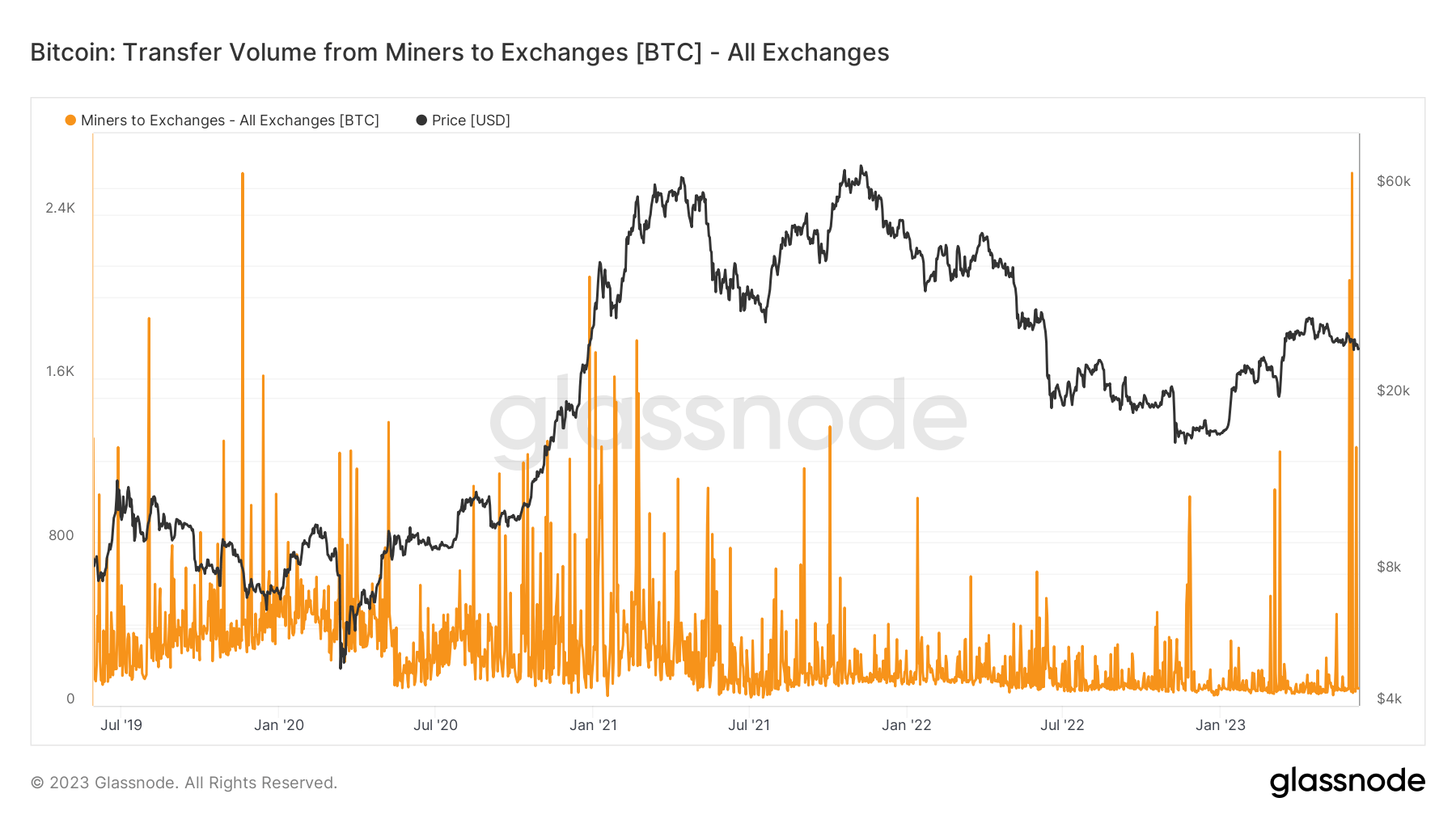

Analyzing miner-to-exchange flows is essential for understanding market sentiment, notably when evaluating whether or not miners are liquidating or accumulating. A surge in Bitcoin inflows to exchanges has traditionally preceded a rise in promote orders, typically main to cost slumps because the promoting strain will increase.

On June 3, miners transferred a substantial quantity of BTC to exchanges, sparking market-wide debate in regards to the supply of those inflows and their potential influence in the marketplace. Information from Glassnode confirmed that simply over 2,606 BTC was transferred on June 3, making it the very best switch since March 26, 2019. On the time, miners despatched over 4,083 BTC to exchanges.

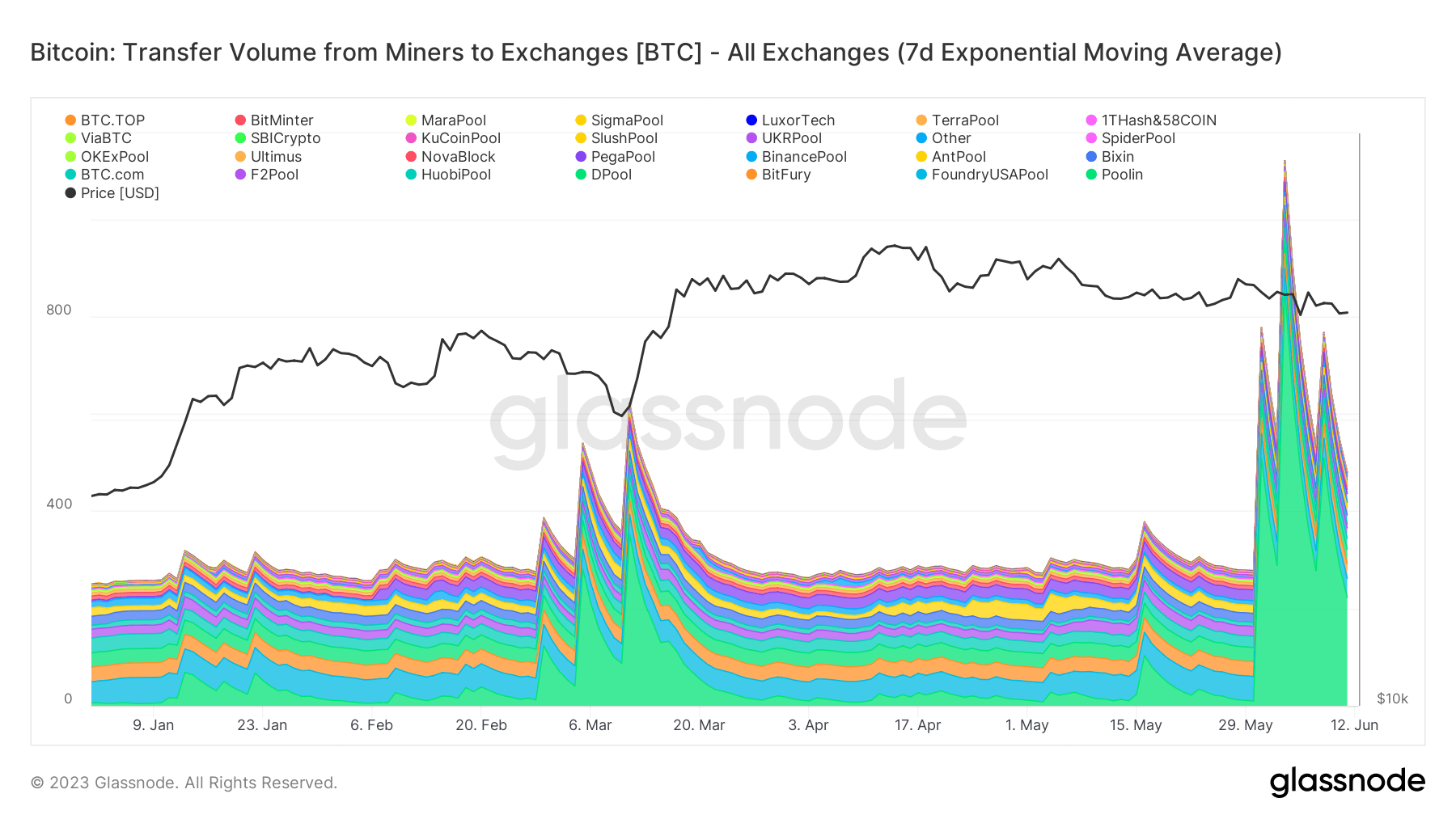

CryptoSlate evaluation discovered that the primary driver of the large outflow was Poolin, one of many largest mining swimming pools in the marketplace. Roughly a 3rd of all Bitcoin transferred from miners to exchanges on June 3 may be attributed to Poolin, because the pool transferred 853.4 BTC.

The switch is just not an remoted occasion — it’s a continuation of a development from Poolin that started in late Might.

Since Might 31, Poolin has despatched a mean of 433.5 BTC to exchanges every day, peaking with the big outflow on June 3. For comparability, the following largest contributor, Foundry USA, transferred 45.5 BTC on the identical day and maintained a every day switch quantity between 40 and 50 BTC because the finish of Might.

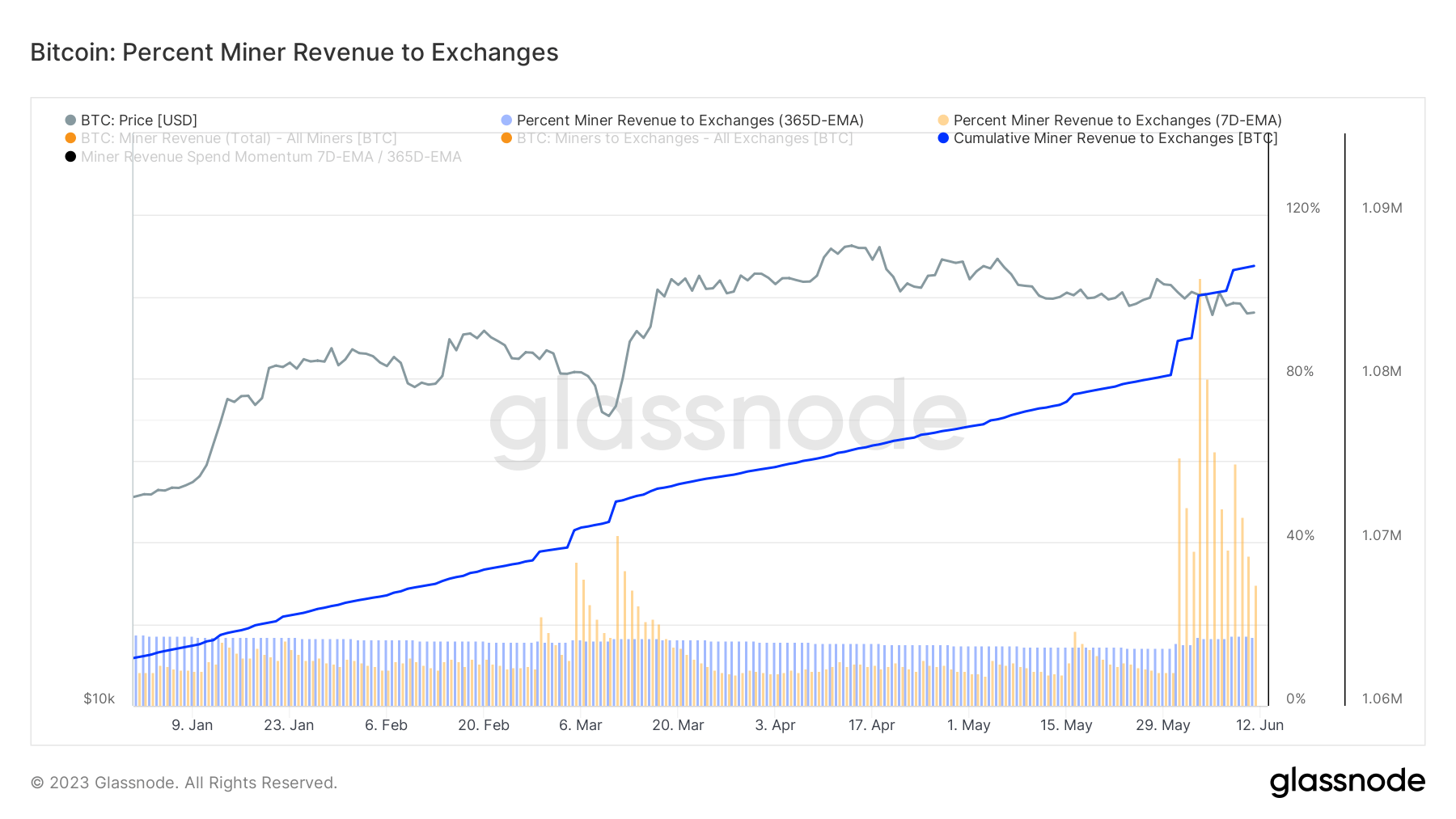

The rise in miner transfers led to an abrupt rise within the proportion of miner income despatched to exchanges. CryptoSlate evaluation discovered that the 7-day exponential shifting common (EMA) of miner income to exchanges reached 104.5% on June 3.

An EMA is an important monetary metric that gives extra weight to current information, smoothing out the information line and revealing development shifts extra successfully. This EMA worth is the very best recorded since November 17, 2014, when it reached 131.7%.

Bitcoin’s value remained comparatively secure, hovering between $26,800 and $27,300 from Might 31 to June 4. The sharp downturn on June 5 was extra possible a response to information in regards to the SEC’s lawsuit towards Binance and Coinbase slightly than a rise in alternate promoting strain from miners, as the worth rebounded inside 24 hours.

This means that miners could also be opting to liquidate their cash by way of over-the-counter (OTC) strategies or retain them on exchanges in anticipation of extra favorable market circumstances.

The put up What’s happening behind the scenes of June’s large miner outflow? appeared first on CryptoSlate.