With lower than two days left till Ethereum transitions to a Proof-of-Stake system, all eyes are pointed at the Merge however many are nonetheless frightened whether or not it is going to change the crypto marketplace for the higher.

In accordance with the most recent report from analytics firm Nansen, the issues a PoS Ethereum will face aren’t dismissible. Nonetheless, the corporate believes most considerations are largely unwarranted as Ethereum will climate the storm and emerge as a stronger, extra resilient chain.

Merging right into a extra centralized system?

One of the heated conversations across the Merge has been in regards to the extent of centralization it is going to convey to Ethereum.

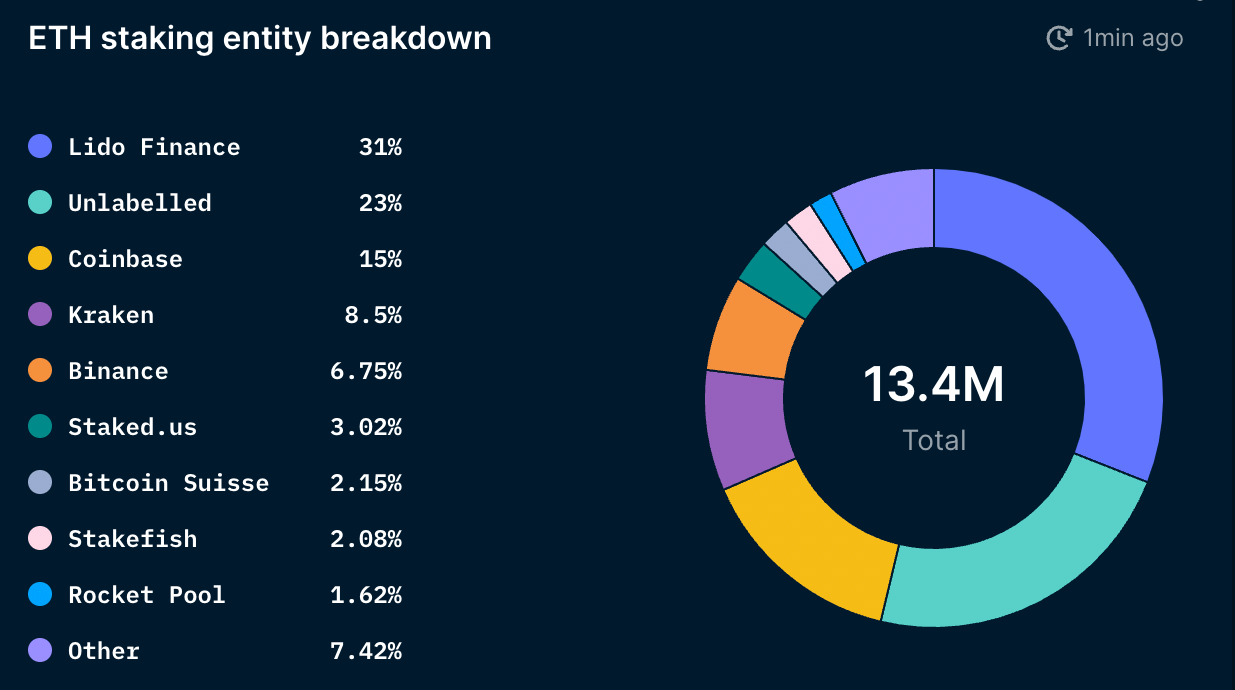

Nansen experiences that round 80,000 distinctive addresses are set to take part in staking on Ethereum. And whereas the quantity seems to be excessive, trying on the panorama of middleman staking suppliers reveals that there’s fairly a little bit of centralization going down.

In complete, 11.3% of the ETH provide has been staked, or 13.5 million ETH. Lido, a decentralized liquid staking protocol, accounts for 31% of the overall staked ETH. Coinbase, Kraken, and Binance have round 30% of the staked ETH.

Exchanges like Coinbase, Kraken, and Binance are required to adjust to laws within the jurisdictions they function in. For this reason the most important a part of the market isn’t targeted on the centralization points that may come up from them, however reasonably on the centralization that may come up from decentralized companies like Lido.

Zooming in on the liquid staking answer market, Lido’s share turns into even greater. In accordance with Nansen, Lido accounts for 47% of liquid-staked ETH, whereas Coinbase, Kraken, and Binance collectively account for 45%. Zooming into liquid staking suppliers excluding centralized exchanges reveals the extent of Lido’s dominance — it accounts for 91% of the liquid staking market.

Lido is a service supplier ruled by the Lido DAO, set as much as permit a number of validator units. The construction of the DAO makes it onerous for regulators to focus on it, however many imagine Lido’s weak point lies in its token. Nansen famous within the report that the centralization of the LDO token possession might depart Lido weak and expose it to centralization dangers. The highest 9 wallets holding the LDO token maintain 46% of the governance energy and will, in concept, exert vital affect on Ethereum validators.

“If Lido’s market share continues to rise, it’s attainable that the Lido DAO might maintain nearly all of the Ethereum validator set. This might permit Lido to benefit from alternatives like multi-block MEV, perform worthwhile block re-orgs, and within the worst-case situation censor sure transactions by imposing or rewarding validators to function in accordance with Lido’s needs (through governance). This might pose issues for the Ethereum community,” Nansen mentioned within the report.

It’s essential to notice that Lido is actively engaged on mitigating these centralization dangers. The platform is contemplating introducing a dual-governance mannequin with LDO and stETH. However, reasonably than making stETH a governance token, it might solely be used to vote towards a Lido proposal that would adversely have an effect on stETH holders.

No hazard of sell-offs and destabilization after the Merge

One other main concern in regards to the Merge was the potential of it triggering a big sell-off. In its report, Nansen notes that stakers won’t be able to dump their ETH in the marketplace. All the staked ETH will likely be locked till the Shanghai improve, which is scheduled to happen between 6 and 12 months after the Merge.

Staking rewards will even be onerous to promote. In accordance with the report, there’s an exit queue in place for validators of round 6 validators per epoch. With an epoch lasting round 6.4 minutes, it might take round 300 days for the 13 million ETH staked to be withdrawn.

When stakers are lastly in a position to withdraw, Nansen believes that it’ll most certainly be illiquid stakers that promote. The report additionally notes that the majority promoting will likely be to take earnings. If the market stays impartial or barely bullish, a lot of the unstaked ETH will most certainly stay off the market. Even when nearly all of illiquid stakers resolve to promote, they solely make up 18% of the overall staked ETH — and most certainly gained’t have the facility to maneuver the market considerably.

In accordance with the report, one other good signal of stability to come back is the buildup spree seen amongst good cash wallets and wallets belonging to ETH millionaires and billionaires. Total, ETH millionaires and billionaires have persistently been stacking Ethereum for the reason that starting of the 12 months. Sensible cash wallets, traditionally extra targeted on buying and selling than straight accumulation, additionally appear to be rising their holdings since dropping to a yearly low in June. This implies that they’re anticipating optimistic worth motion following the Merge.

Nansen concludes that a lot of the issues at present troubling Ethereum gained’t have a damaging impact on the community following the Merge. The corporate notes that regardless of the problems with the liquid staking market, the Ethereum community is ready to come back out of the Merge with out main hiccups.

“The liquid staking market seems to be trending in the direction of a ‘winner-takes-all’ situation. Nonetheless, this final result mustn’t harm Ethereum’s core worth proposition if the incumbent gamers are satisfactorily decentralized and correctly aligned with the Ethereum neighborhood.”