The countdown to Bitcoin’s extremely anticipated halving occasion is on, with fewer than 10,000 blocks left as of Feb. 12.

In keeping with the Bitcoin Halving Clock, roughly 9,843 blocks stay earlier than the occasion, which is estimated to happen by April 17.

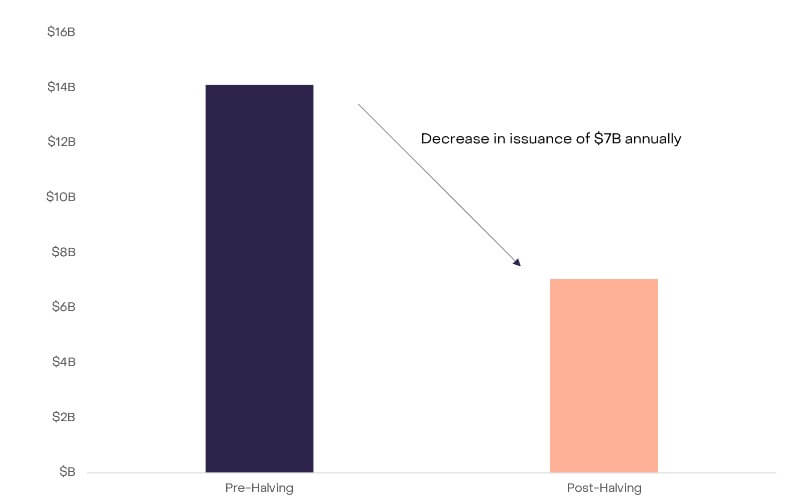

The halving occasion is critical for the crypto business as a result of it enhances Bitcoin’s shortage by lowering miner rewards. CryptoSlate Perception reported that the occasion would slash the variety of BTC produced each day by miners to 450 BTC from 900 BTC.

Traditionally, BTC halving has normally been adopted by an elevated issue in mining the highest crypto asset and a bullish worth motion.

Bitcoin upcoming halving is ‘totally different’

Crypto asset administration agency Grayscale mentioned the upcoming halving occasion carries distinct implications in comparison with its predecessors as a result of notable surge in BTC’s utility over the previous yr.

“Regardless of miner income challenges within the brief time period, basic onchain exercise and constructive market construction updates make this halving totally different on a basic degree,” Grayscale wrote.

In keeping with the agency, the latest introduction of Bitcoin Trade-Traded Funds (ETFs) presents a secure demand outlet that might counteract the downward strain from mining issuance.

It mentioned:

“ETFs, usually, create entry to Bitcoin publicity to a better community of buyers, monetary advisors, and capital market allocators, which in time might result in a rise in mainstream adoption.”

Moreover, Grayscale highlighted the importance of Non-Fungible tokens (NFTs)-like ordinal inscriptions within the BTC ecosystem. The agency mentioned these belongings “current a brand new path towards sustaining community safety via elevated transaction charges.”

Past that, the emergence of ordinal inscriptions has invigorated on-chain exercise, yielding over $200 million in transaction charges for miners as of February 2024. This development is anticipated to endure, buoyed by renewed developer engagement and ongoing improvements throughout the blockchain.

As well as, Grayscale famous that miners have been proactively making ready for the halving’s monetary implications by liquidating their BTC since late 2023. This proactive stance positions them favorably forward of the halving occasion.

Even when some miners had been to exit the community, Grayscale mentioned the next lower in hash charge would immediate an adjustment in mining issue, safeguarding community stability.

“Whereas [BTC] has lengthy been heralded as digital gold, latest developments recommend that [it] is evolving into one thing much more important,” Grayscale concluded.

On the time of press, Bitcoin is ranked #1 by market cap and the BTC worth is up 3.52% over the previous 24 hours. BTC has a market capitalization of $980.27 billion with a 24-hour buying and selling quantity of $30.81 billion. Study extra about BTC ›

Market abstract

On the time of press, the worldwide cryptocurrency market is valued at at $1.86 trillion with a 24-hour quantity of $62.28 billion. Bitcoin dominance is at present at 52.66%. Study extra ›