In response to information from buying and selling agency Webull, round 70% of Grayscale GBTC holders seemingly stay in revenue. The typical shares have been bought at $27.82, some 20% under the present value as of press time.

The Webull information reveals the state of the belief the day earlier than its conversion to a spot Bitcoin ETF and signifies that 70% of traders had a price vary between the $18.84 and $27.24 vary.

When it comes to distributions, the primary focus of shareholders seems to be positioned between $33 and $40. With the worth at $34.9 as of press time, it is going to be attention-grabbing to see whether or not the underside of this vary acts as a help for the worth amid continued outflows.

The second focus is way decrease, between $18 and $21. This group will stay worthwhile till the GBTC value falls one other 39%.

Ought to the worth fall to this stage and its property underneath administration see an equal decline, we’d witness an additional 230,000 BTC hit the OTC desks, value round $8.9 billion as of press time.

Such a drop would go away Grayscale with roughly 350,000 BTC, which at a 1.5% administration payment would nonetheless generate roughly $200 million in income if Bitcoin retained a worth of round $39,000. This underlines the shortage of stress on Grayscale to decrease charges together with the seemingly limitless potential for Grayscale traders to take earnings. With few inflows into the ETF, the proportion of traders in revenue may be very excessive.

Thus, there’s definitely an argument to be made that Grayscale’s stress on Bitcoin’s value via profit-taking could possibly be as extreme as a near-40 % drawdown. For bears within the viewers, a 40% drop for Bitcoin proper now would take it to Could 2023 lows of roughly $23,000.

Doubtlessly 100% of Grayscale traders in revenue at conversion.

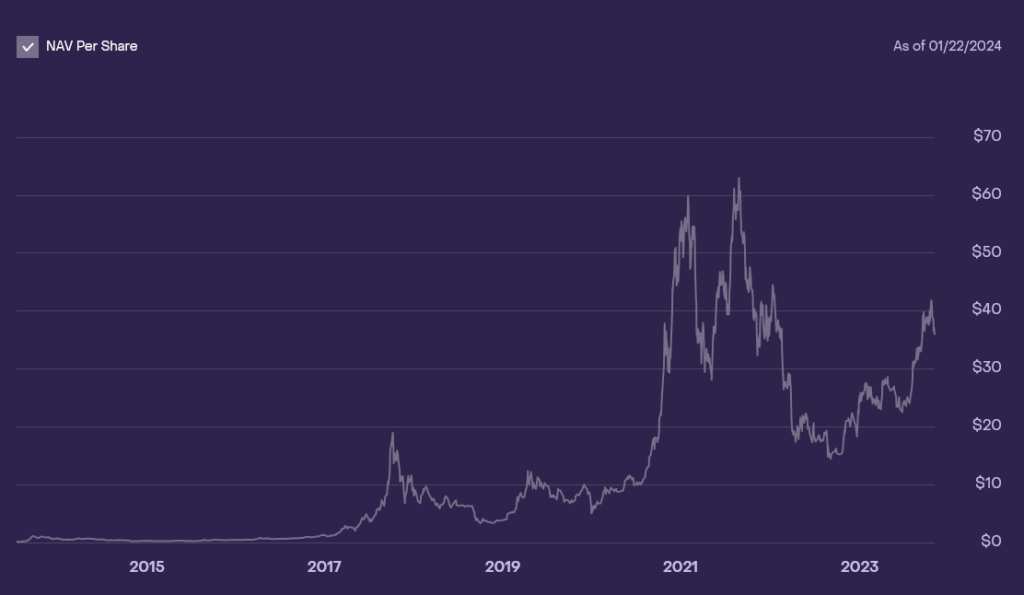

Since its conversion, the ETF has seen appreciable outflows totaling roughly $3.5 billion. Its property underneath administration have additionally fallen to $22.1 billion (552,681 BTC) from a year-to-date excessive of $29 billion (623,390 BTC) on Jan. 10. In greenback phrases, its AUM all-time excessive was really additional again, aligning with the highest of the 2021 bull market at a staggering $44 billion (651k BTC.)

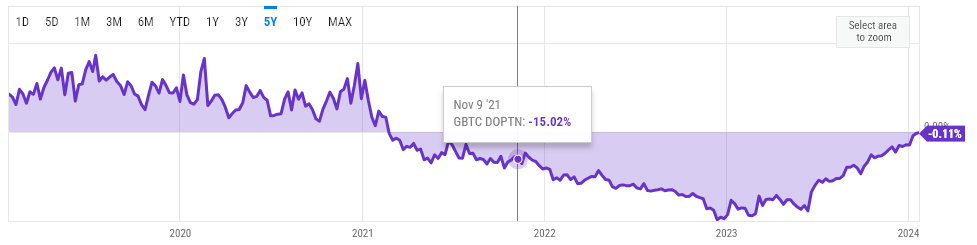

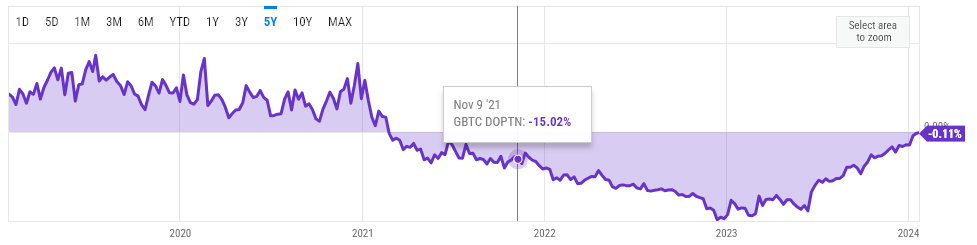

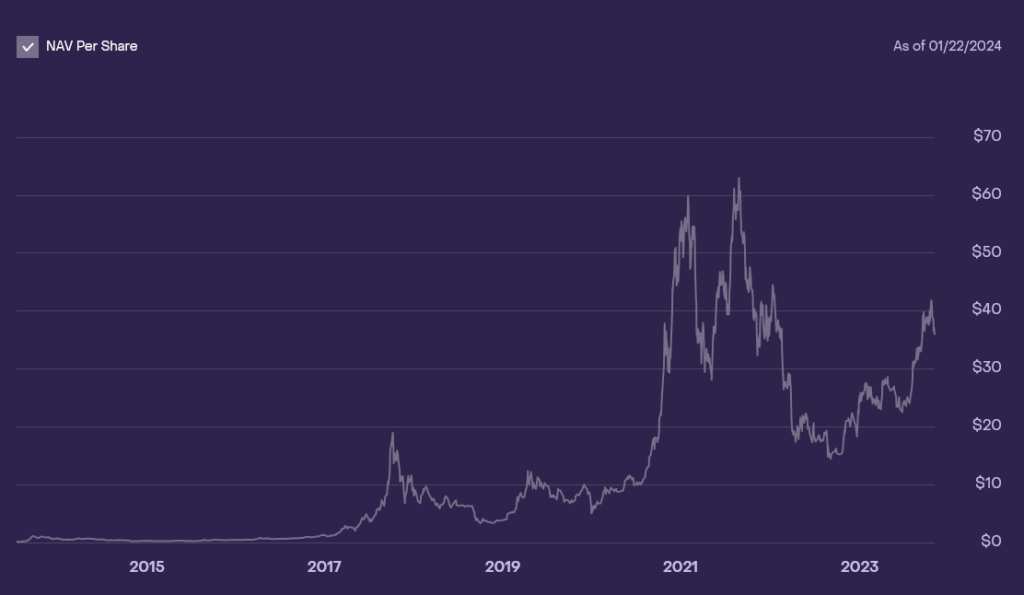

Apparently, even on the prime of the market, issues concerning the belief’s make-up resulted in it buying and selling at a 15% low cost to its web asset worth (NAV), representing a value prime of round $58,000 as a substitute of the spot value of $69,000. This low cost continued to extend till the beginning of 2023, reaching -47% at its lowest.

By the applying and eventual success of its conversion to a spot Bitcoin ETF, the low cost has all however disappeared to a mere -0.11% as of Jan. 23.

Apparently, the place value distribution chart from Webull above signifies that every one traders who purchased about $40.53 exited the belief earlier than its conversion. In contrast with the chart under of the historic NAV value, GBTC principally traded above $40.53 for round 12 months between Could 2021 and Jan. 2022. Nevertheless, Webull information counsel that when the belief closed on Jan. 10, its final day earlier than its conversion to an ETF, 100% of shares have been worthwhile.

The TradingView chart under helps this declare, because it closed out at its highest value in 17 months. What’s extra shocking is the variety of traders who had already exited the fund after having entered at larger costs all through 2021.

Following the revelation that a lot of the outflows from GBTC have been a results of FTX liquidations, many within the Bitcoin group have been buoyed by the prospect of the ETF outflows slowing down. Nevertheless, an additional 17,000 BTC was despatched to Coinbase Prime in the present day, Jan. 23, with web outflows of round 15,000 BTC, valued at roughly $600 million.

The excessive variety of traders in worthwhile positions places the ETF in a precarious place for additional outflows. But, the influence it will have on the spot Bitcoin value will solely be seen with time. Trades between the ETF issuers and its buying and selling counterparty, Coinbase, occur over-the-counter (OTC), thus having a restricted impact on the underlying Bitcoin value immediately.

Nonetheless, that is solely true so long as there are patrons prepared to accumulate Bitcoin. Ought to the OTC liquidity dry out, the worth influence could possibly be monumental. Nevertheless, given the institutional demand for Bitcoin, I can not think about traders like Michael Saylor turning down the prospect to accumulate some low-cost Bitcoin.

Bloomberg analysts similar to James Seyffart estimated solely round 33% of GBTC outflows had been flowing into different ETFs. Nevertheless, if the FTX liquidations at the moment are over, it is going to be attention-grabbing to see if flows finally shallow and the bulk merely change to lower-fee funds similar to Constancy and BlackRock, that are presently main the New child 9.