Litecoin (LTC) has spent the previous week buying and selling inside a decent value vary, with its worth hovering steadily across the mid-range level of $64. The worth motion for LTC in September has remained primarily bearish, with sellers sustaining management over the market.

Whereas LTC has a historical past of risky value swings, latest occasions have seen it mirroring the sideways motion of the general market, largely influenced by Bitcoin’s fluctuations, which rose from $25,000 to $27,000 earlier than dropping to $26,000.

As of the most recent information from CoinGecko, Litecoin is at present buying and selling at $64.63, with a 24-hour acquire of 0.7%. Nonetheless, over the previous seven days, LTC has skilled a decline of two.9%, reflecting the prevailing bearish sentiment available in the market, in keeping with a latest value report.

Chasing Litecoin Bulls and Avoiding The Bears

For these in search of a bullish revival in Litecoin’s value, a value report notes that the important thing stage to look at is the 23.6% Fibonacci retracement stage, which stands at $69. Breaking above this stage may open the door for additional features, with potential targets mendacity at $78 and $80.

However, if the flat buying and selling quantity persists, bears could exert additional stress, probably resulting in a drop in LTC’s value to the $60 mark.

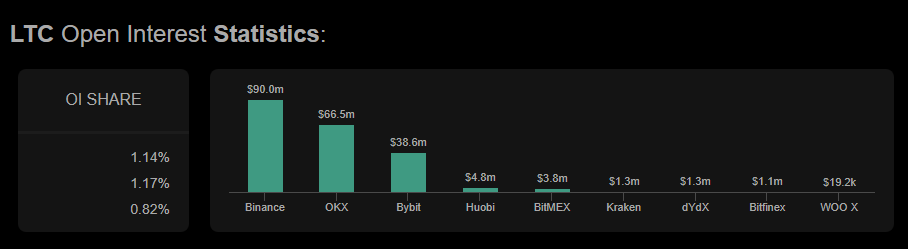

Supply: Coinalyze

Market speculators haven’t been significantly keen about Litecoin’s latest sideways motion. The Open Curiosity (OI) for LTC has continued to say no, with information from Coinalyze indicating a $9 million drop inside the previous 48 hours. This means that merchants and traders have gotten more and more cautious as they monitor the developments within the Litecoin market.

Litecoin’s Funding Attraction in Q3/This autumn

Regardless of the latest lackluster efficiency, some analysts consider that Litecoin stays a lovely funding alternative within the third and fourth quarters of this yr. Litecoin’s established status, stable ecosystem, and upcoming halving occasions are elements that contribute to its enchantment.

LTC market cap at present at $4.7 billion. Chart: TradingView.com

Halving occasions have traditionally had a constructive influence on Litecoin’s value, lowering the speed at which new LTC cash are mined and probably growing shortage.

Market members are carefully watching the 23.6% Fibonacci retracement stage at $69 for indicators of a bullish revival, whereas a continuation of flat buying and selling quantity may see LTC drop to $60.

Regardless of latest market issues, Litecoin’s robust fundamentals and upcoming halving occasions make it an funding alternative value contemplating as we transfer into the later a part of the yr.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Once you make investments, your capital is topic to danger).

Featured picture from Make investments Proper