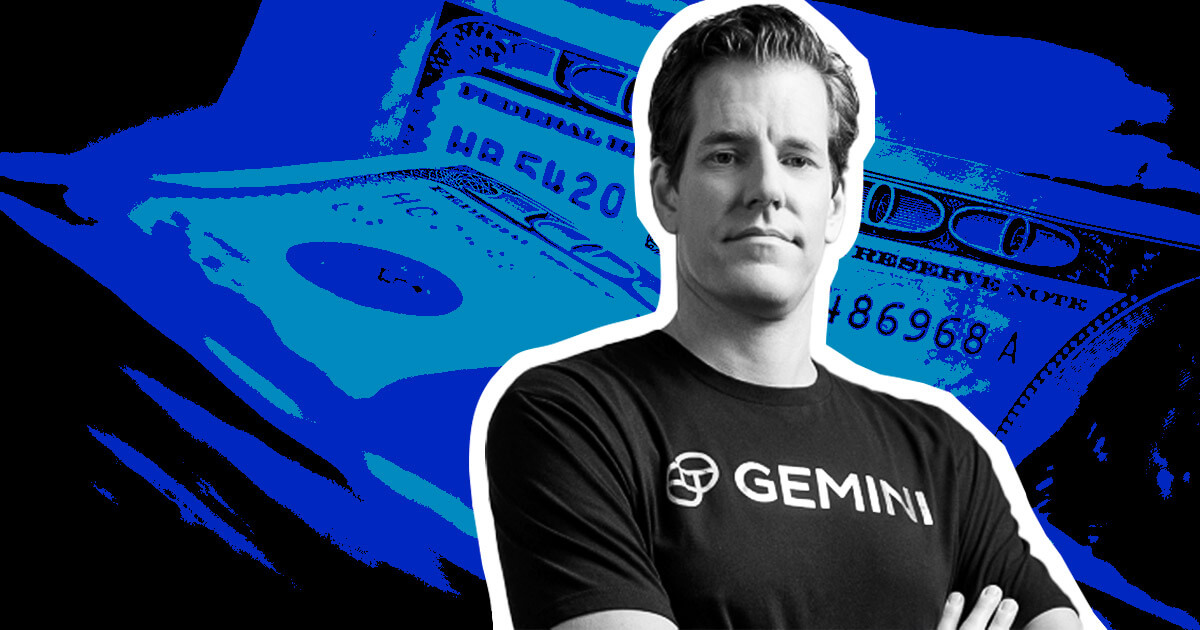

The co-founder of the Gemini cryptocurrency change, Cameron Winklevoss, publicly issued an ultimatum to Barry Silbert, the CEO of the Digital Forex Group (DCG), on July 4.

In an open letter, he introduced Gemini’s “finest and remaining supply” for debt restructuring, giving Silbert a good deadline of simply two days to reply.

The tiff between Winklevoss and Silbert began practically eight months in the past when DCG holding firm Genesis halted withdrawals and subsequently filed for chapter.

Based on Winklevoss, Genesis owes $1.2 billion to 232,000 customers of the defunct Gemini Earn program. It’s price noting, nevertheless, that Genesis’ chapter submitting pegged the worth of its debt to Gemini Earn customers at $765.9 million.

In his remaining supply for the continuing debt restructuring negotiations, Winklevoss proposed a complete fee plan of $1.465 billion spanning 5 years. The structured fee plan features a forbearance fee of $275 million due by July 21, adopted by a $355 million fee in 2 years and a remaining $835 million fee in 5 years. The plan additionally specifies that the funds needs to be made as 40% in USD, 40% in Bitcoin (BTC), and the remaining 20% in Ethereum(ETH).

Winklevoss famous within the letter:

“This proposal is truthful and cheap for everybody and represents the ground that collectors, who’re required to assist a deal, will settle for.”

‘Video games are over.’

Winklevoss’ ultimatum comes though he claimed Gemini had reached an “settlement in precept” with Genesis in February.

Winklevoss lashed out at Silbert for always delaying a decision on the compensation of Gemini Earn customers. Winklevoss, who had referred to as for the dismissal of Silbert as DCG chief in January, reiterated allegations of fraud in opposition to the agency and Silbert.

The Gemini co-founder famous that Silbert’s 4000-word letter to shareholders in January was a “piece of fastidiously crafted stupidity” that shirked all duty. Winklevoss claimed Silbert’s letter was one other ploy to purchase time and play “dumb” to “screw” over Gemini Earn customers.

Winklevoss additional criticized Silbert, accusing him of delaying and avoiding a consensual decision with collectors. He wrote,

“As a substitute, you’ve got devoted the final 8 months to purchasing time so you’ll be able to elevate cash and stiff collectors and Earn customers once more,”

Winklevoss once more accused DCG and Genesis of mendacity to collectors and Earn customers. Within the months after Three Arrows Capital collapsed, DCG assured collectors it had absorbed Genesis’ lack of $1.2 billion. Winklevoss claimed it was a “fraudulent transaction” involving a “bogus long-dated promissory word,” which was uncovered with the collapse of FTX in November.

The previous Olympic rower additional alleged that Silbert has “pretended” to barter a deal solely to “rope-a-dope collectors.” He claimed that Silbert is utilizing the negotiations to purchase time whereas DCG has litigated the validity of the promissory word for years.

DCG has been scrambling to elevate funds over the previous a number of months however, seemingly, to no avail. DCG missed its fee of $630 million to Genesis in Might and entered into mediation. Nevertheless, after eight weeks of mediation, no deal has been reached as a result of the mediation has allowed DCG to delay its compensation indefinitely, Winklevoss claims.

Winklevoss has had sufficient of DCG’s delaying techniques and shenanigans and declared that the “video games are over.”

Authorized penalties

If DCG doesn’t settle for Gemini’s supply by July 6, Winklevoss has warned of potential authorized penalties, a step he has threatened to take previously as properly.

Winklevoss stated that if the supply is unaccepted, Gemini will file a lawsuit on July 7 in opposition to DCG and Silbert. The go well with will define Silbert’s private “legal responsibility in hiding Genesis’ insolvency,” he famous.

Moreover, Gemini will demand the Genesis Particular Committee file a turnover movement on July 7 to drive DCG to repay the $630 million it owes instantly. Winklevoss additionally stated that Gemini would work with the committee to advance a “non-consensual” plan with strict deadlines prioritizing speedy compensation to Earn customers and different Genesis collectors.

Gemini may even ask the unsecured creditor committee (UCC) to file a lawsuit detailing investigations into the intercompany loans between Genesis and DCG.

In response to the ultimatum, Ram Ahluwalia, CEO of Lumida Wealth Administration, instructed that it might be yet one more missed deadline for DCG. He believes Silbert has little to achieve from Gemini’s plan, which may probably amplify DCG’s authorized liabilities.

“… collectors can’t assess whether or not Barry is taking part in hardball or if his again is up in opposition to a wall.

The absence of any fairness injection, no debt refinancings, and the Might missed debt funds recommend the latter.”