Core Scientific, one of many world’s largest publicly traded Bitcoin mining corporations, is on the verge of insolvency.

In an Oct. 26 SEC submitting, the corporate mentioned its working efficiency and liquidity had been severely impacted by rising electrical energy prices and falling Bitcoin costs.

The rise in hash price has additionally drastically impaired the corporate’s potential to mine BTC, additional affected by the continuing litigation with Celsius.

As of Oct. 26, the corporate holds simply 24 BTC and roughly $26.6 million in money. This starkly contrasts to September, when it had over 1,000 BTC and $29.5 million in money.

In its 8-Okay submitting, the corporate mentioned its board has determined to not make funds due in late October and early November. The funds embody tools purchases, financings, and two bridge promissory notes.

Core Scientific mentioned it was exploring a number of potential methods to resolve its insolvency points. These methods embody hiring extra strategic advisors, elevating extra capital, and restructuring its current capital construction. It should additionally discover legal responsibility administration transactions, together with exchanging its present debt for fairness. Chapter stays a viable possibility as nicely, the corporate mentioned within the submitting.

“Within the occasion of a chapter continuing or insolvency, or restructuring of our capital construction, holders of the Firm’s widespread inventory may undergo a complete lack of their funding.”

Whereas it mentioned it was troublesome to estimate its whole liquidity necessities, it famous that it anticipates its current money assets might be depleted by the top of 2022 or sooner.

“Given the uncertainty concerning the Firm’s monetary situation, substantial doubt exists concerning the Firm’s potential to proceed as a going concern for an inexpensive time period.”

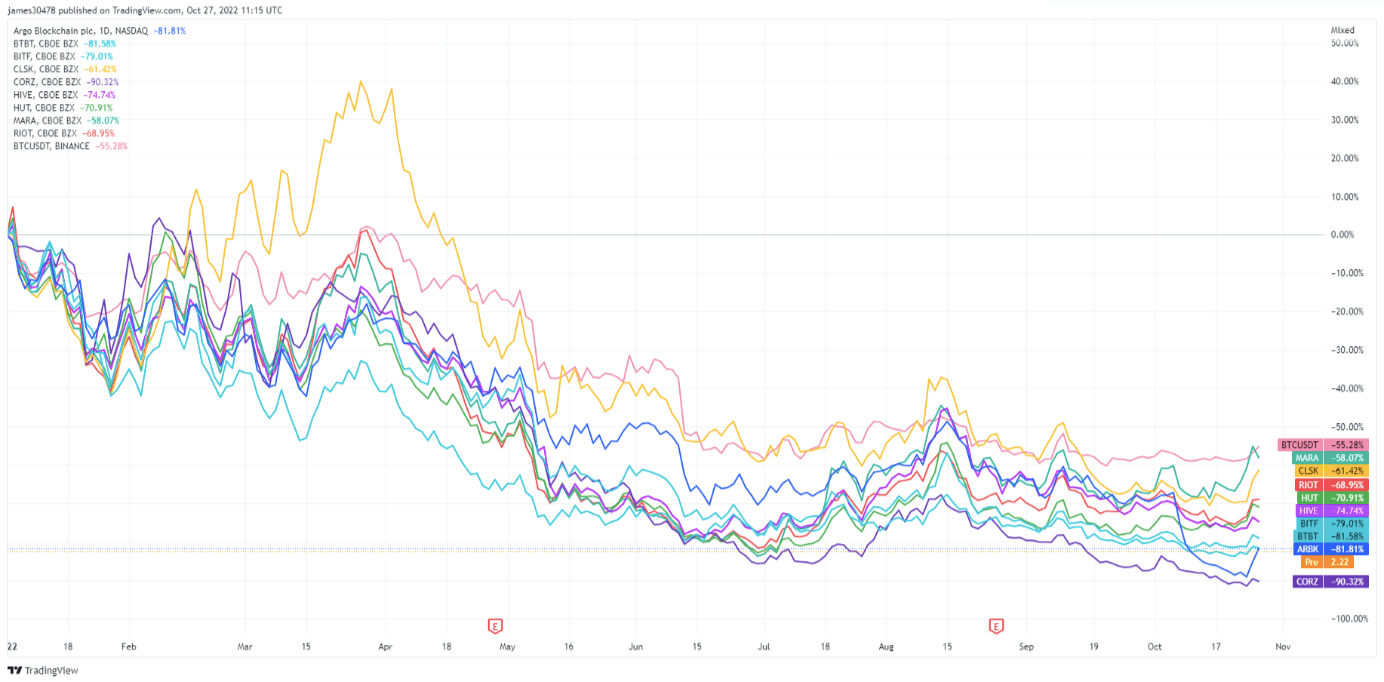

Out of all of the publicly traded Bitcoin mining corporations available on the market, Core Scientific has skilled essentially the most vital drop in inventory value. Information analyzed by CryptoSlate confirmed that CORZ misplaced over 90% of its worth for the reason that starting of the 12 months. Whereas Core Scientific leads the way in which as the most important loser, all the Bitcoin mining market has skilled vital losses because it struggles with rising electrical energy prices and growing hash price.