Almost 78% of Bitcoin’s whole circulating provide is illiquid, based on Glassnode on-chain information analyzed by Cryptoslate, leaving lower than 22% of all mined BTC transferring round and exchanging arms.

The metrics present buyers have been pulling their digital property away from exchanges and storing them in custodial wallets, to keep away from promoting them.

Cryptoslate delved into the provision metrics of Bitcoin to guage the long-term perspective of the coin after weeks of market turmoil and unsure macroeconomics. The evaluation revealed extra Bitcoin had develop into illiquid regardless of buying and selling downwards for practically all the of 2022.

Illiquid provide is a crucial crypto information set because it implies only some weak arms (1 / 4 of all BTC provide), can promote their holdings and exert bearish pressures.

However, it additionally implies large-scale consumers are going to accumulate extra BTC from whales, establishments and robust arms.

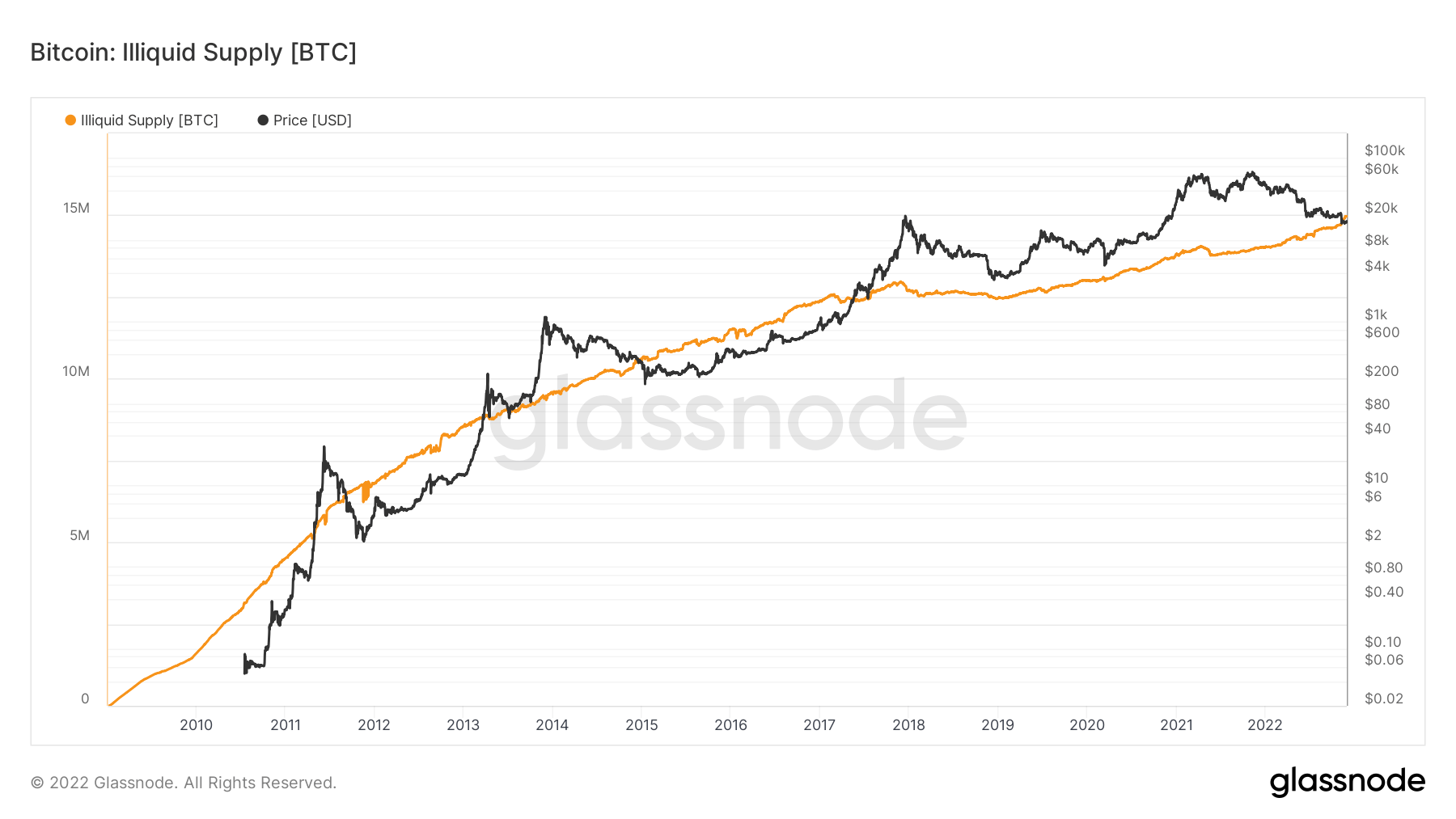

The chart under demonstrates the motion of Bitcoin into illiquid provide since 2010, the quantity of BTC moving into illiquid arms is roughly three-quarters of the entire circulating provide.

Consider illiquidity as the purpose when Bitcoin strikes to a pockets that reveals no spending historical past, whereas liquidity is when BTC strikes to wallets which have a historical past of spending comparable to sizzling wallets and exchanges.

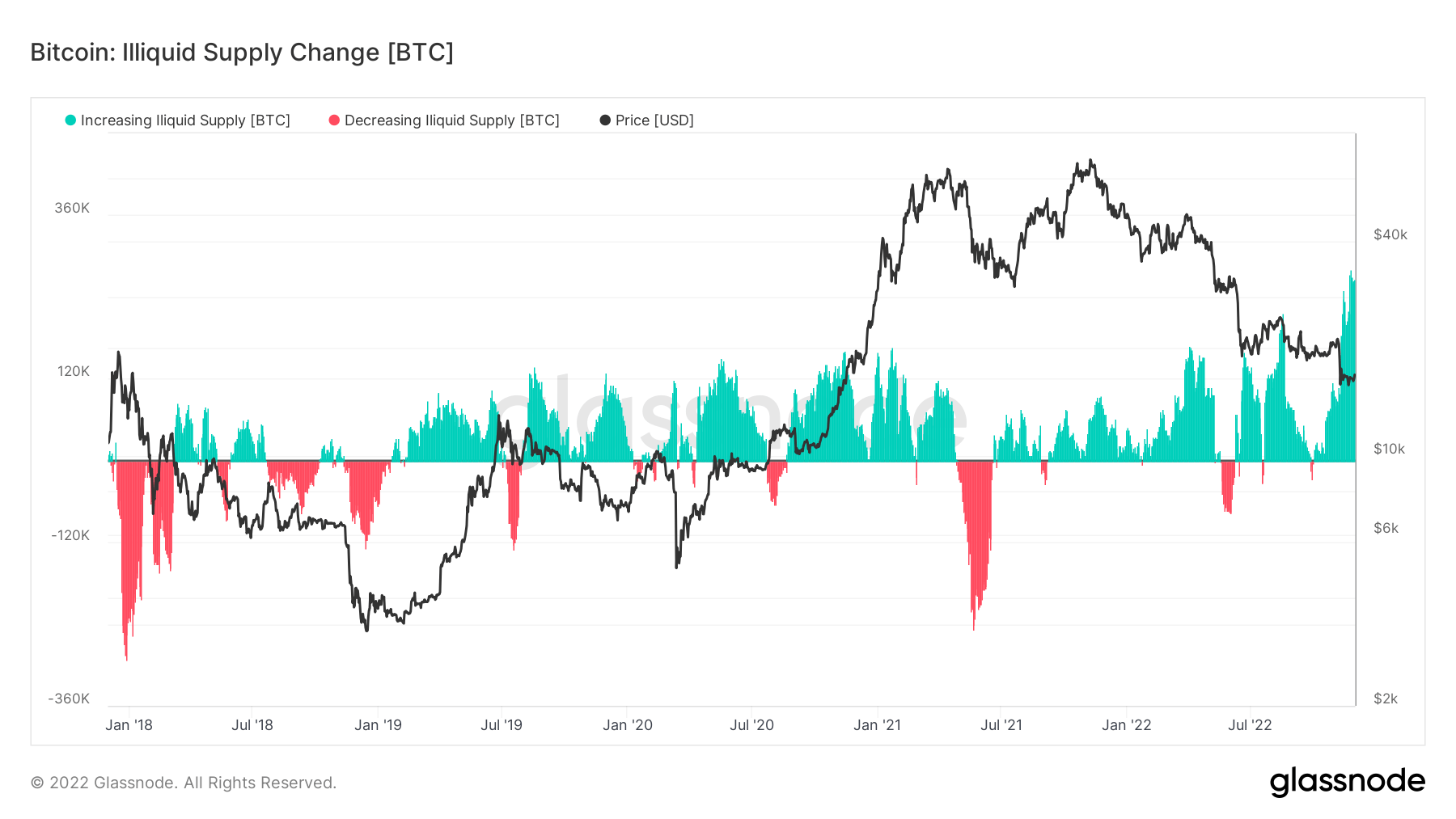

The above metrics recommend extra BTC is transferring into chilly storage and implies a prevalence of hodling and accumulation. Higher but, falling liquid provide as proven within the chart under is a sign of subsiding main sell-offs and capitulation. The identical Glassnode information signifies Bitcoin has recorded the quickest charge of change

The identical information by Glassnode recorded the quickest charge of change of BTC transferring into long-term holders over the past 5-years, additionally known as illiquid provide change. Subsequently suggesting long-term holders have stopped spending their Bitcoins and at the moment are within the accumulation stage.

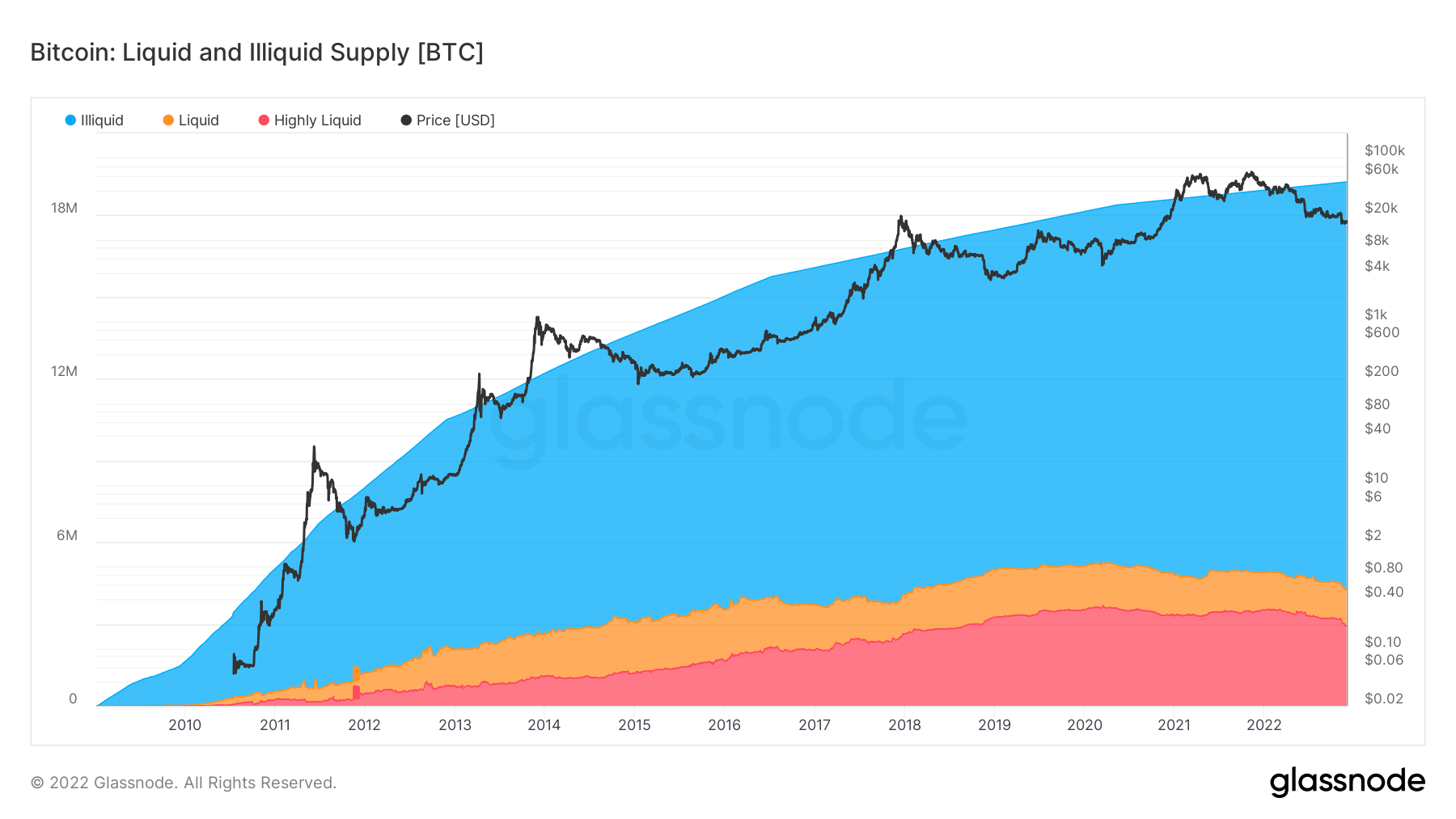

Whereas a whopping 15 million BTC cash should not accessible on the market, solely 4.3 million BTC cash will probably be in fixed circulation and within the liquid/extremely liquid class. A big majority of those cash are held both by short-term buyers or merchants. Thus positioning Bitcoin’s provide shock on the similar stage as when it was priced at $53K, which suggests short-term holders have misplaced to long-term holders.

In truth, the speed of development for liquid provide has been slowing down over the previous months, a state of affairs that may be attributed to a extra bullish long-term overview, and elevated issues across the security of funds saved throughout exchanges and sizzling wallets.

The chart above demonstrates the quantity of extremely liquid and liquid BTC property and reveals the figures are at the moment 3 million and 1.3 million cash respectively. The info is evident that each liquid and extremely liquid provide have been trending downwards amidst the present market turmoil.