Fast Take

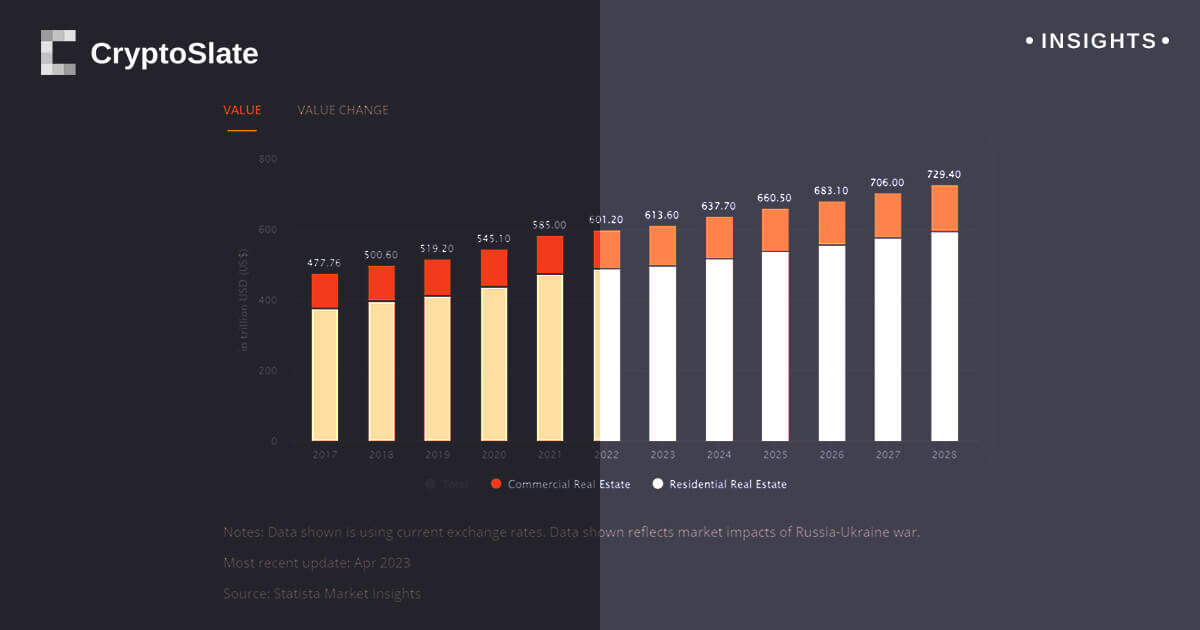

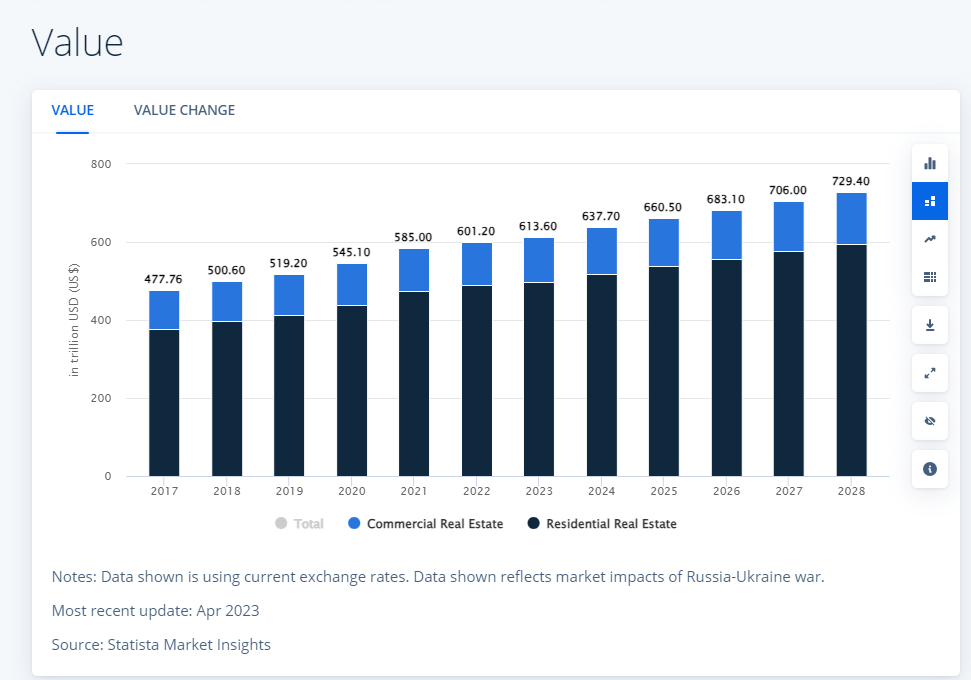

As one of many largest international wealth sources, the actual property sector continues to reveal large progress. In response to Statista, it’s projected to hit a whopping $613 trillion in 2023 and probably attain $700 trillion by 2027. A lot of this wealth is concentrated in China, the world’s largest actual property asset class, with an estimated worth of $131 trillion in 2023, in accordance with Statista. But, a monetary storm brews on the horizon for China, as mentioned beforehand by CryptoSlate, with the nation grappling with deflation and foreign money points.

Concurrently, a dramatic shift is happening within the Western markets. As reported by The Kobessi Letter, the charges and yields are on a gentle upward climb, with the 30-year mortgage charges touching a 21-year excessive of seven.5%. This rise signifies extra capital being funneled into servicing housing loans, leaving much less for financial circulation. Moreover, as properties usually characterize a good portion of individuals’s web price, the ensuing lower in property values on account of rising charges may set off a reverse wealth impact.

The submit China’s actual property wealth meets monetary storm whereas Western markets see mortgage fee spike appeared first on CryptoSlate.