Final week, digital asset funding merchandise noticed $2.2 billion in inflows, reflecting a broader market uptrend pushed by Donald Trump’s current victory on the just-concluded US presidential election.

Within the first half of the week, inflows peaked at $3 billion, lifting whole property beneath administration (AUM) to an all-time excessive of $138 billion. Nevertheless, Bitcoin’s document worth efficiency through the interval prompted an outflow of round $866 million, leading to a internet influx of $2.2 billion.

In accordance with CoinShares, this influx pushed the totals for the reason that September rate of interest reduce to $11.7 billion, bringing the year-to-date whole to $33.5 billion.

James Butterfill, Head of Analysis at CoinShares, defined that:

“This current surge in exercise seems to be pushed by a mix of looser financial coverage and the Republican get together’s clear sweep within the current US elections.”

US-Bitcoin ETFs proceed to dominate

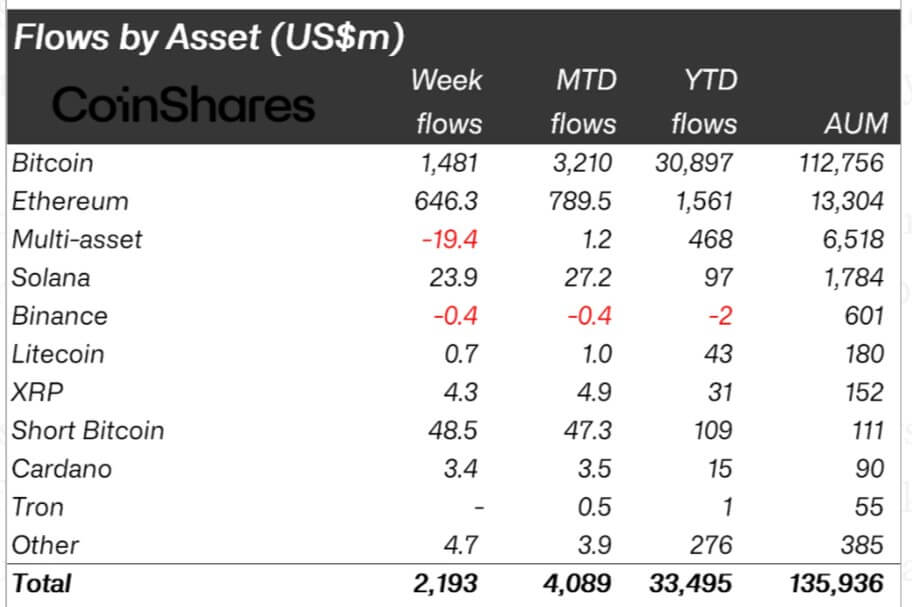

Bitcoin’s dominance remained sturdy, with $1.48 billion in inflows. The substantial flows might be linked to the spectacular efficiency of the US-based spot exchange-traded fund (ETF) merchandise, which proceed to draw important consideration from retail and institutional merchants.

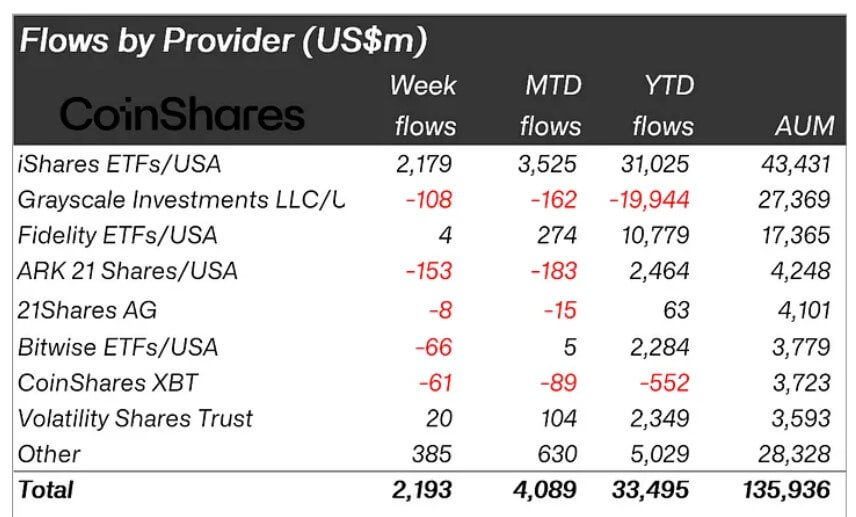

In accordance with CoinShares knowledge, BlackRock’s IBIT and Constancy’s FBTC noticed inflows of $2.1 billion and $4 million, respectively. However, outflows of $153 million from the Ark 21 Shares fund outstripped these of Grayscale, which stood at $108 million for the week.

In the meantime, Bitcoin’s record-breaking worth efficiency above the $90,000 mark has attracted bearish merchants, who invested $49 million in brief Bitcoin merchandise.

Furthermore, the bullish market sentiment appeared to affect curiosity in Ethereum, which additionally attracted important inflows of $646 million (equal to five% of its AUM). Butterfill linked this influx to election outcomes and a proposed Beam Chain community improve.

Different property, together with Solana, XRP, and Cardano, noticed extra modest inflows of $24 million, $4.3 million, and $3.4 million, respectively.