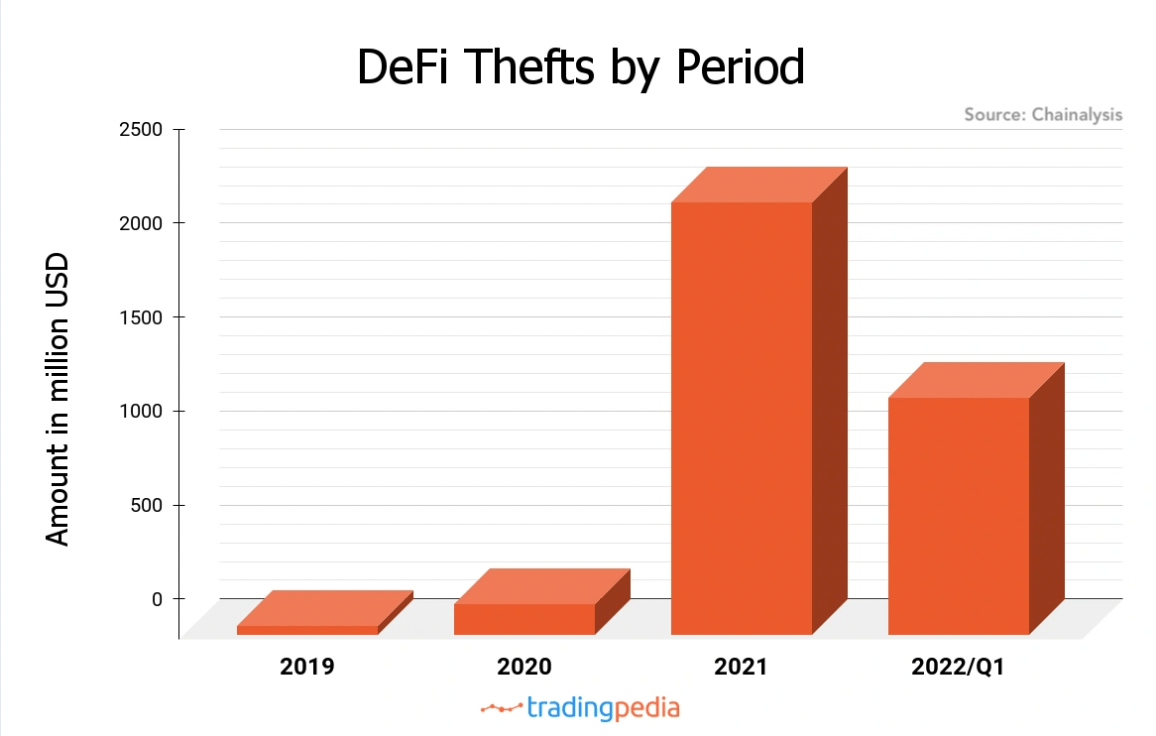

The U.S. Federal Bureau of Investigation (FBI) recently issued a warning against DeFi protocols after finding that 97% of the $1.3 billion was stolen via DeFi protocols during the first three months of the year.

The FBI said it observed cybercriminals taking advantage of the complexities of cross-chain transactions more and more each year. The warning article cited data from crypto analytics company Chainalysis and noted that the amount DeFi accounted for the total stolen funds has increased by 72% annually.

Exploited functionalities

The warning pointed to a handful of DeFi functionalities being the most prone to attacks. According to the bureau, the first and most vulnerable are smart contracts. The warning article stated that the attacks on smart contracts caused investors and developers to lose around $3 million worth of crypto during the first three months of 2022.

Signature verification mechanisms come second in line. When appropriately manipulated, they can allow for the withdrawal of all the funds within the protocol, which caused approximately $320 million to be stolen between January and March.

The FBI also warned about possible manipulations of price pairs, price oracles, bypassing slippage checks during leveraged trading, and taking advantage of price calculation malfunctions. The bureau said these attacks also cost the DeFi sphere around $35 million worth of crypto.

Recommendations

The warning was concluded with a list of recommendations for the investors and DeFi protocols separately. The bureau suggested investors learn about DeFi protocols and their functionalities, investigate the protocols before depositing funds, and look for potential risks and audit reports.

For the DeFi protocols, the FBI advised holding real-time analytics, monitoring, and periodical tests. It also added that developing and practicing a response to possible emergencies could be beneficial.

DeFi Hacks

CryptoSlate held an exclusive interview with TradingPedia technical analysis expert Brian McColl in May 2022 on the increasing attacks on DeFi protocols.

McColl said the increasing number of attacks is the growing interest in DeFi. However, it also led to FUD in the field, gradually decreasing the number of new users joining the DeFi sphere.

TrustPedia analysts said that the supporters of Central Bank Digital Currencies (CBDC) have been growing gradually due to this negative sentiment toward the DeFi projects. As opposed to the unregulated DeFi protocols, CBDCs appear safe and less prone to attacks as governmental entities host them.