The eagerly anticipated Ethereum Merge is predicted to happen on Sept. 15. It will consolidate the present Proof-of-Work (PoW) execution layer to the concurrently working Proof-of-Stake (PoS) Beacon chain. Proponents anticipate this to convey scaling and environmental advantages.

Though the run-up to the Merge has seen a major leap in value, rising 90% since bottoming on June 18, shopping for exercise appeared to have peaked over the weekend.

Evaluation of ETH derivatives metrics confirmed merchants anticipate a value dip to happen post-Merge.

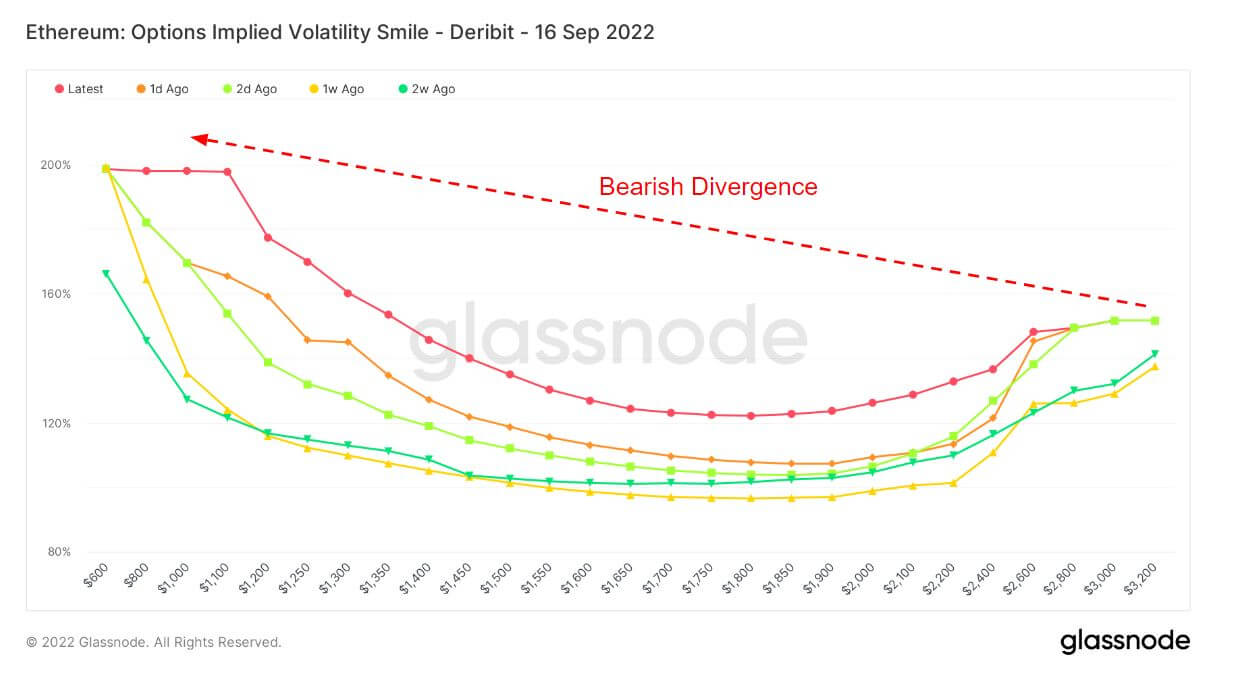

The Volatility Smile

The Volatility Smile chart reveals implied volatility by plotting choices’ strike value with the identical underlying asset and expiration date. Implied volatility rises when the underlying asset of an possibility is additional out-of-the-money (OTM), or in-the-money (ITM), in comparison with at-the-money (ATM).

Choices additional OTM normally have increased implied volatilities; therefore Volatility Smile charts usually present a “smile” form. The steepness and form of this smile can be utilized to evaluate the relative expensiveness of choices and gauge what sort of tail dangers the market is pricing in.

The accompanying legend refers to historic overlays and reveals the form of the smile 1 day, 2 days, 1 week, and a pair of weeks in the past, respectively. For instance, when ATM implied volatility values for excessive strikes are decrease right now in comparison with historic overlays, it might point out a decreased tail danger being priced in by the market. In such instances, the market’s view has a decrease likelihood for excessive strikes in comparison with medium strikes.

Earlier analysis from a month in the past examined the habits of choices merchants utilizing the Smile Volatility chart. The general conclusion was that choices merchants anticipate a value run-up, main right into a dump post-Merge. However has something modified between then and now?

The Volatility Smile chart under reveals a bearish divergence for every of the historic overlays and the present smile. Usually, at decrease strike costs, the implied volatility is decrease. However the left tail in every occasion is at round 100% or extra, signaling the potential for swings in implied volatility post-Merge.

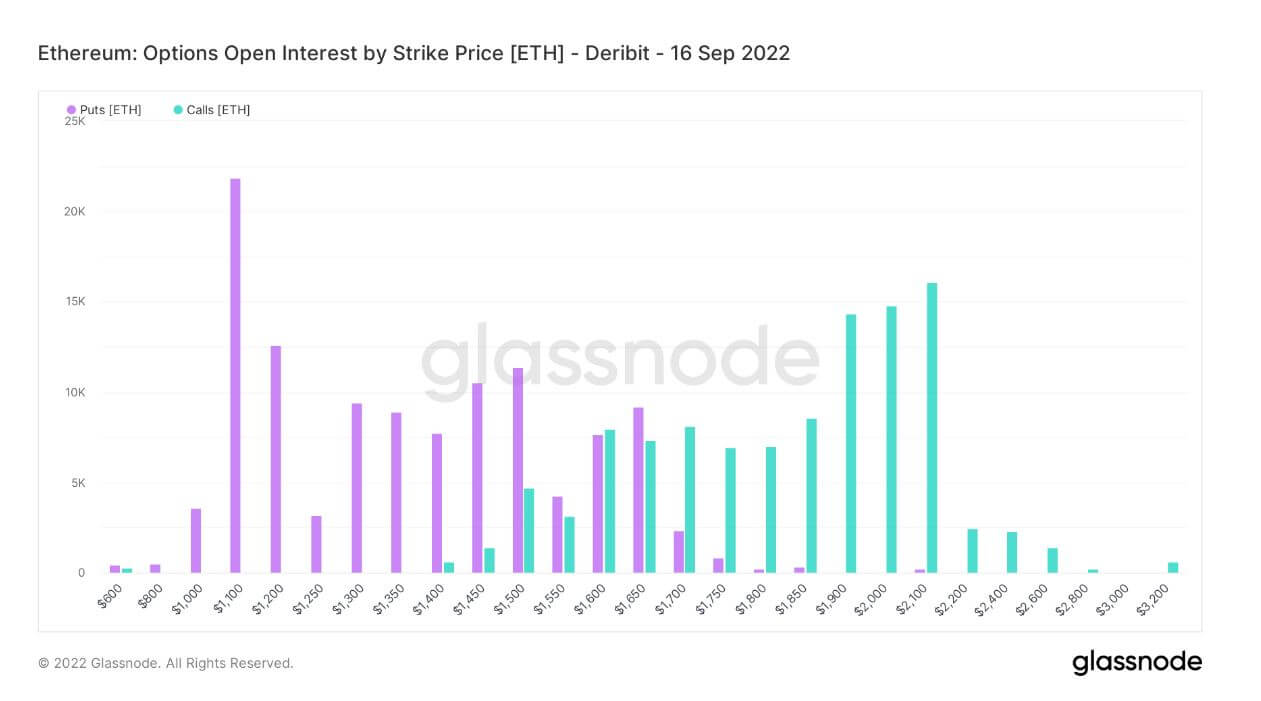

Choices Open Curiosity

Choices Open Curiosity refers back to the variety of lively choices contracts. These are contracts which have been traded however not but liquidated by an offsetting commerce or project.

There isn’t any data on when the choices had been purchased or bought. Nevertheless, this metric can be utilized to gauge quantity at varied strike costs and decide liquidity.

The chart under reveals the overall Open Curiosity of places and calls by strike value. A slight bias in direction of places (or the fitting to promote a contract) signifies a bearish sentiment. On the identical time, probably the most vital knowledge level reveals over 22,000 places at a value of $1,100.

Annualized perpetual funding

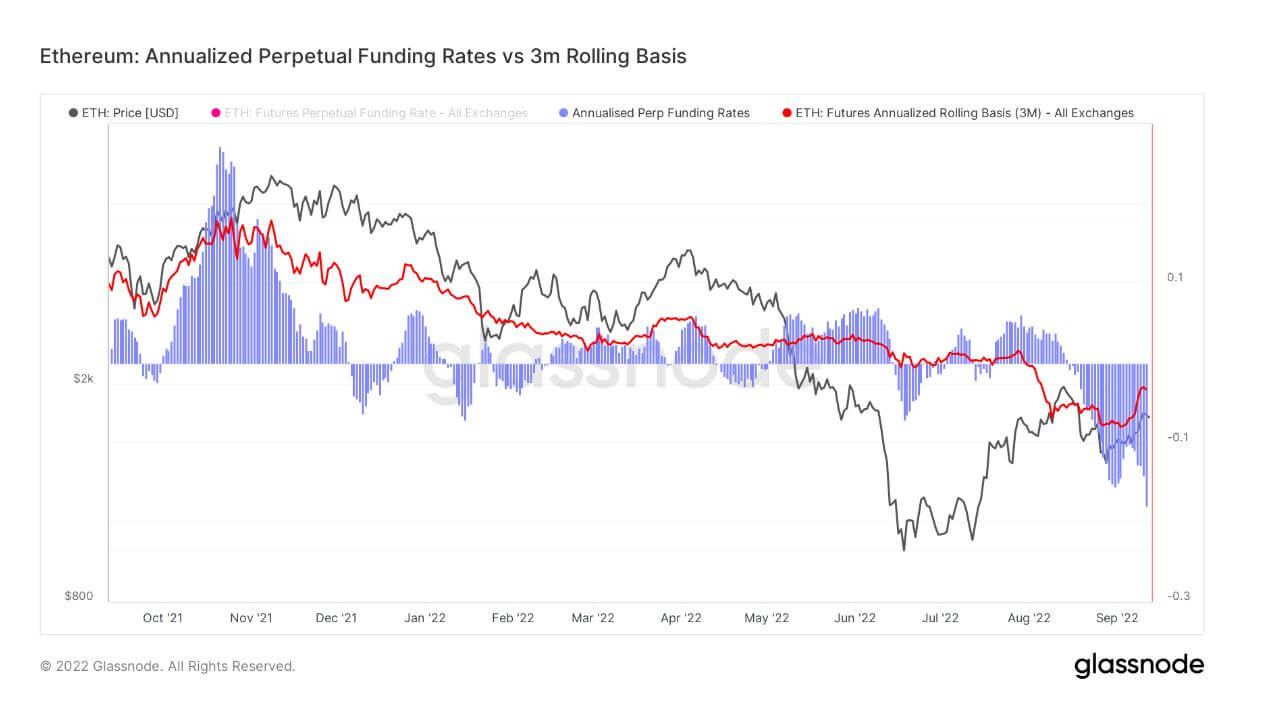

This metric compares the annualized charges of return accessible in a cash-and-carry commerce between 3-month expiring futures (3-mth rolling foundation) and perpetual funding charges.

On condition that digital belongings have low storage, dealing with, and supply value overheads (in contrast to bodily commodities), perpetual futures have develop into a most popular instrument for market hypothesis, danger hedging, and capturing funding price premiums.

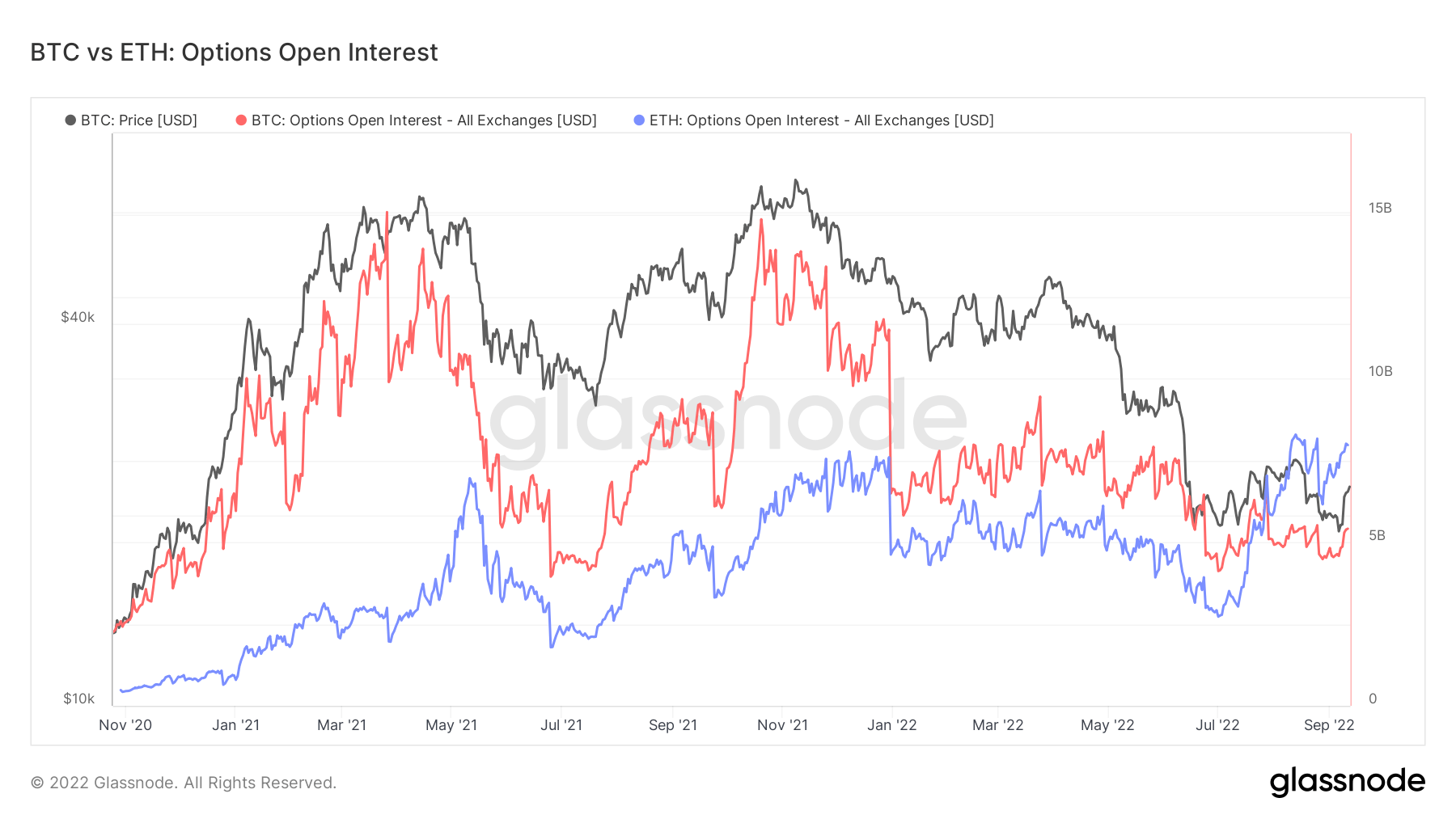

Bitcoin vs. Ethereum Choices Open Curiosity

Evaluating the Bitcoin and Ethereum Choices Open Curiosity reveals ETH is $8 billion – a brand new all-time excessive. In the meantime, BTC’s present open curiosity is round $5 billion, which is properly under its $15 billion peak.

In July, ETH open curiosity moved BTC for the primary time, indicating speculative curiosity is powerful and that derivatives merchants are gearing up for the Merge.