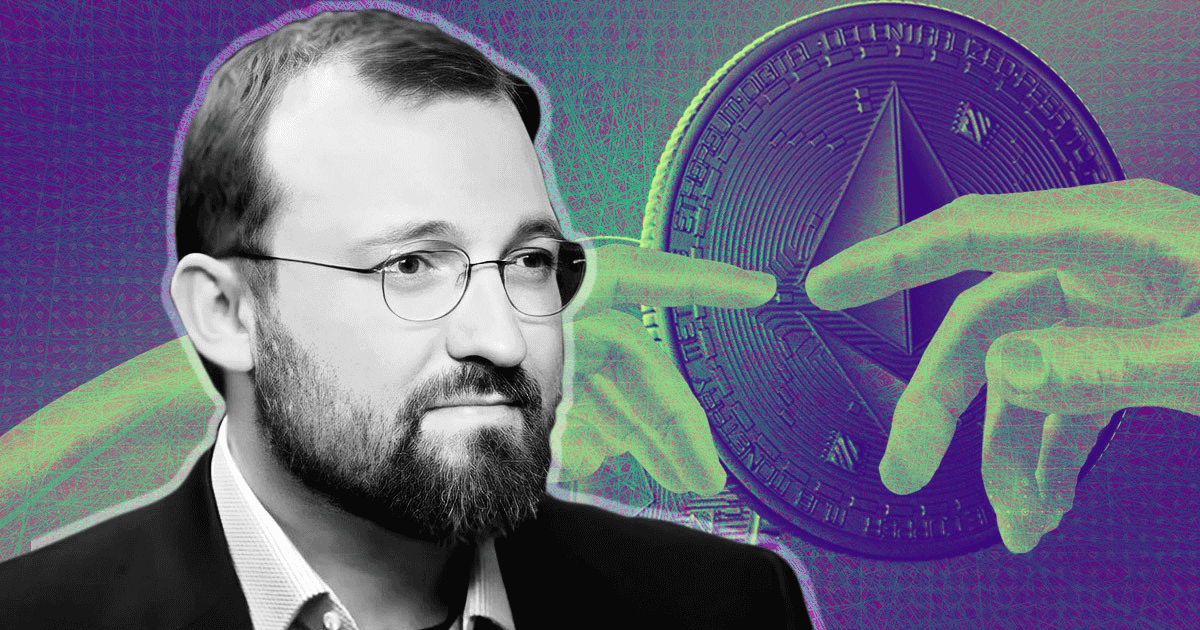

Enter Output CEO Charles Hoskinson stated the Merge modifications nothing by way of efficiency, working value, and liquidity.

Eth 2.0 requires Shanghai which is subsequent yr minimal by their very own launch schedule. My prediction remains to be on the right track. You do perceive that nothing has modified by way of efficiency, working value, nor liquidity?

— Charles Hoskinson (@IOHK_Charles) September 15, 2022

After months of build-up, the Ethereum Merge occurred on September 15 at round 08:00 UTC. Vitalik Buterin commented that the occasion was a milestone second for Ethereum and that he’s pleased with the efforts of all concerned that made it occur.

The Merge refers to becoming a member of the Proof-of-Work(PoW) execution layer to the concurrently operating Proof-of-Stake (PoS) Beacon chain consensus layer, thus rendering the PoW chain out of date. Proponents say the swap to PoS will make Ethereum safer, scalable, and eco-friendly.

The Merge isn’t Ethereum 2.0

Hoskinson’s feedback got here in response to a Twitter consumer mocking him for saying Ethereum 2.0 will doubtless happen in 2024.

In response, the IO boss stated ETH 2.0 refers back to the closing product and that the Merge is only one step in getting there. As such, a 2024 launch date “remains to be on the right track.”

To hammer dwelling his level, Hoskinson stated the Merge won’t enhance Ethereum’s “efficiency, working value, nor liquidity.”

Staked ETH is presently locked into the contract and can’t be withdrawn. The Shanghai fork will allow validators to withdraw their staked tokens.

Different milestones are the surge, which can add sharding for higher scaling by way of decrease working prices. The verge, or the implementation of “Verkle bushes” (a mathematical proof) to reduce knowledge storage necessities. The purge to additional lower the protocol’s retailer historical past for higher knowledge effectivity. And the splurge for no matter is deemed “enjoyable” sufficient to implement.

Proof-of-Stake below fireplace

PoS depends on validators quite than miners to validate transactions and safe the community. The present requirement to turn into a validator on Ethereum is to stake 32 ETH, which prices roughly $51,200 at in the present day’s value – a hefty capital outlay.

Critics argue that solely suitably financed entities can act as validators. Due to this fact, the swap to PoS will make the Ethereum community extra centralized.

In accordance with knowledge from Nansen, simply 5 entities, Lido, an unknown entity, Coinbase, Kraken, and Binance, management 64% of the staked ETH.

Then again, turning into a Cardano validator, also referred to as a Stake Pool Operator (SPO,) has a a lot decrease barrier to entry. There may be no required ADA pledge quantity, and the {hardware} wanted is attainable for many – which inspires even small gamers to turn into community validators.

Some SPOs favor to run digital machines on cloud companies, resembling Amazon Internet Service, as a result of reliability of cloud service networks. Nevertheless, this technique will improve operating prices in comparison with a non-public community.

With the Merge now full, Hoskinson voiced his concern that PoS will now be seen as a extremely centralized consensus mechanism – which isn’t true within the case of Cardano.

Now begins the Period of everybody assuming that every one Proof of Stake works like Ethereum’s Proof of Stake. The maxis will assault Cardano for slashing and label all of the ethereum issues as ours. Thanks Jack https://t.co/XpL4OynoeM

— Charles Hoskinson (@IOHK_Charles) September 15, 2022