The Ronin bridge, an Ethereum sidechain designed to facilitate the expansion of the Axie Infinity universe, has had a mountain to climb following its main exploit in April, which led to lots of of thousands and thousands of {dollars} being stolen by hackers.

A report from Nansen Alpha completely shared with CryptoSlate recognized the state of the ecosystem and whether or not the makes an attempt to revive funds to the bridge have been profitable in permitting Axie to thrive as soon as extra.

Ronin was designed to be a gaming-first layer-1 blockchain centered on rapid transactions with low gasoline charges. It connects to Ethereum by means of the Ronin Bridge however in any other case acts independently to permit for essentially the most optimum gaming efficiency.

Nevertheless, the devastating impact of the Ronin hack has crippled the ecosystem because the Nansen report revealed that the overall worth locked declined to only $55.11 million of $RON in Q2 from $318.71 million in Q1. The 82.7% drop in locked $RON surpasses the general TVL of the Ethereum ecosystem, which declined to $55.15 billion on the finish of June from $159.83 billion on the finish of March.

Validators uninterested

As a part of its try to rebuild confidence within the Ronin Bridge, there was an try in Q2 to accumulate extra impartial validators to take the overall to 21 complete nodes from 9 lively validators throughout the assault. Becomng extra decentralized may also help scale back the chance of the same assault sooner or later.

Nevertheless, Nansen has revealed that on the finish of the second quarter, solely 14 validator nodes had been lively on the community, indicating that Ronin fell wanting its 21-node objective.

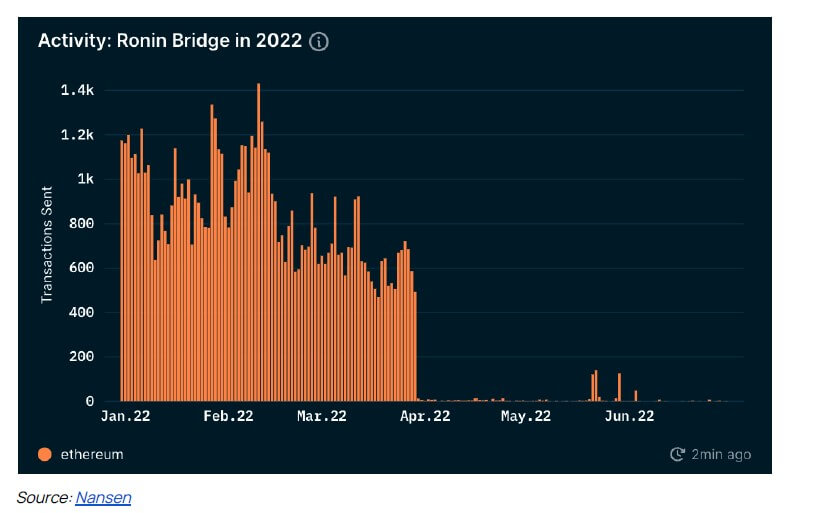

Additional, information from Nansen signifies that even after the Ronin Bridge was reopened on June 28, exercise on the community has remained at all-time lows.

Way forward for Axie Infinity

Nevertheless, because of Ronin-based DEX Katana, transactions on the community remained comparatively secure all through Q2. Minting of native Axie token $SLP held on to a median of 20 million day by day all through the second quarter. Nonetheless, based on Nansen, the burning of $SLP was diminished to nearly zero.

Nonetheless, co-founder of Axie, Jeff Zirlin, tweeted again in June that “nature is therapeutic,” and Nansen ended its report with a equally bullish sentiment.

22,000 Axies bought within the final 24 hours. Was at 7,000 just a few weeks in the past.

Origin rising rapidly with the brand new Alpha Season. 4,600 downloads yesterday.

Bridge is up. Land (90% staked) is emitting AXS.

Nature is therapeutic. pic.twitter.com/AdNzi8x4cb

— The Jiho.eth 🦇🔊 (@Jihoz_Axie) July 7, 2022

In line with Nansen, land staking, Origin downloads, reopening of the bridge, and an obvious enhance in gamers returning to the sport are constructive indicators for the Axie Infinity universe.

Additional, the report highlighted Axiecon, the Axie Infinity conference, and the Lunacia SDK Alpha, which permits builders to construct video games on high of Axie Land, as being two core options that might current a bullish future for the sport.

Knowledge from DefiLama signifies that Q3 is but to recommend a bullish reversal for the Ronin ecosystem. The TVL has declined 22% since August, presently at $54.98 million. But Nansen stays bullish, with Mega Septiandara, a Analysis Analyst at Nansen, stating.

“Regardless of the bear market circumstances impacting all the crypto ecosystem, each the Fantom and Ronin networks confirmed thrilling indicators of dynamic development that bode effectively for his or her Q3 efficiency.”

The present state of the Ronin community will be seen utilizing Nansen’s evaluation instruments, as proven within the graphs beneath.

The total report can be obtainable by way of the Nansen web site.