Throughout Mainnet 2022, in New York, Hoskinson talked about issues individuals get improper with Cardano.

The subjects of debate ranged from the advantages of beginning with a Bitcoin base (UTXO), sluggish, methodical ideas which have thought-about upgradeability paths earlier than wanted, and the nuances of good contract design.

“Can we do the arduous, heavy lifting now so I can plug a easy answer in? In the meantime, all these different persons are making an attempt to take older techniques and retrofit them to have capabilities they had been by no means supposed to do.”

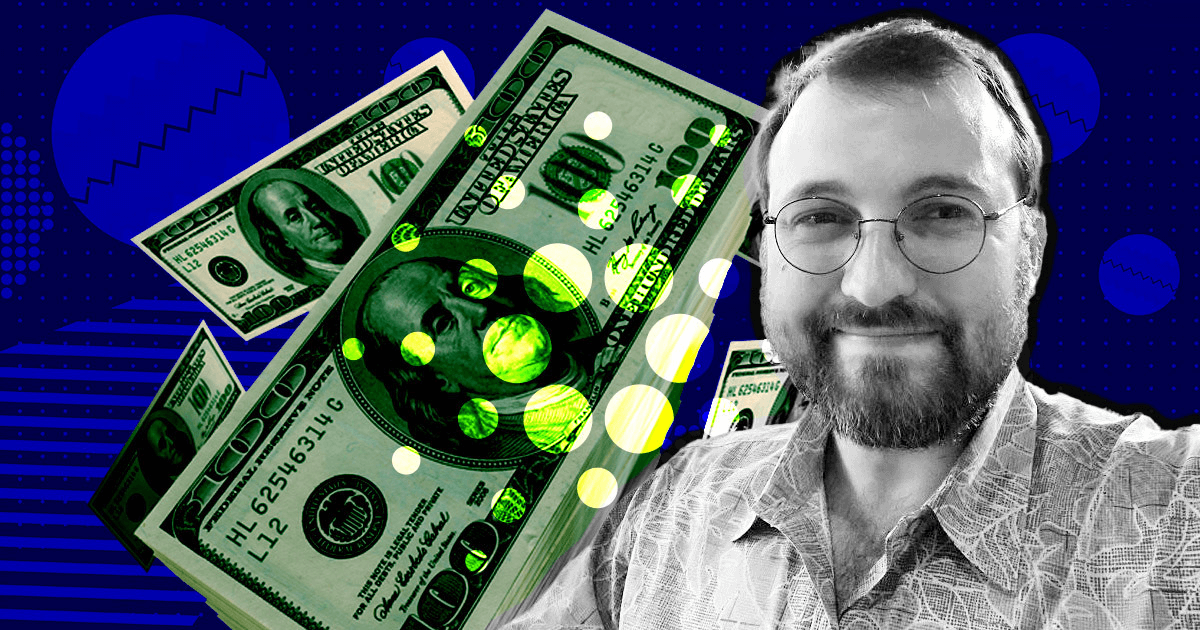

Nevertheless, of explicit curiosity was Hoskinson’s tackle enterprise capitalist cash.

VCs aren’t serious about Cardano

Talking to a passive-aggressive Ryan Selkis, who co-founded analysis platform Messari, Hoskinson defined why some VCs overlook the Cardano ecosystem.

The Enter Output (IO) CEO stated, “the issue is we didn’t have any ponzinomics for them,” earlier than elaborating that VCs chase short-term earnings by way of unfair early distributions to dump on retail bag holders.

Supporting his level, Hokinson gave an unnamed instance that launched to market at a excessive valuation. This was quickly adopted by insiders who dumped their tokens, triggering a fall in value, leaving the early traders to stroll away wealthy(er).

What occurred to EOS mirrored Hoskinson’s account. Its 2018 year-long $4.4 billion preliminary coin providing stays the most important increase thus far.

Given Cardano’s “egalitarian [token] distribution,” no such alternatives exist, resulting in the challenge being ignored by VCs.

“It was a good distribution of Cardano, it has an awesome gini coefficient, it’s some of the distributed currencies… So there was no insider distribution to go and promote.”

The Gini coefficient refers to a measure of wealth distribution. In cryptocurrency, it’s used to quantify a sequence’s diploma of centralization, with a studying of 1 denoting absolute inequality; conversely, on the different finish of the spectrum, a studying of 0 refers to excellent distribution.

Issues are set to vary

Nevertheless, issues are set to vary “as a result of greed is their factor,” and getting cash is a “fiduciary obligation” to their LPs, stated Hoskinson.

The spark for this transfer is when the Cardano dApp ecosystem takes off, and initiatives are valued at billions of {dollars}. Hoskinson predicts this can occur inside the subsequent two years.

“The place they get entangled is if you see a number of Cardano dApps begin getting a number of billion greenback valuations. As a result of there’s something to spend money on, there’s something to hook up with. So in all probability 2023, 2024.”

In any case, the IO CEO identified that the ecosystem already has its personal VC within the community-run Catalyst fund, which presently holds $500 million of ADA accessible to again startup initiatives intending to construct on Cardano.