Bitcoin’s fame as a protected haven asset has lengthy been disputed by the world of conventional finance. Its lack of centralized management, excessive worth volatility, and novelty made it laborious to categorize as inflation-proof or recession-proof.

Nevertheless, prior to now yr we’ve seen that in instances of uncertainty, buyers maintain selecting Bitcoin over fiat.

Inflation results in Bitcoin

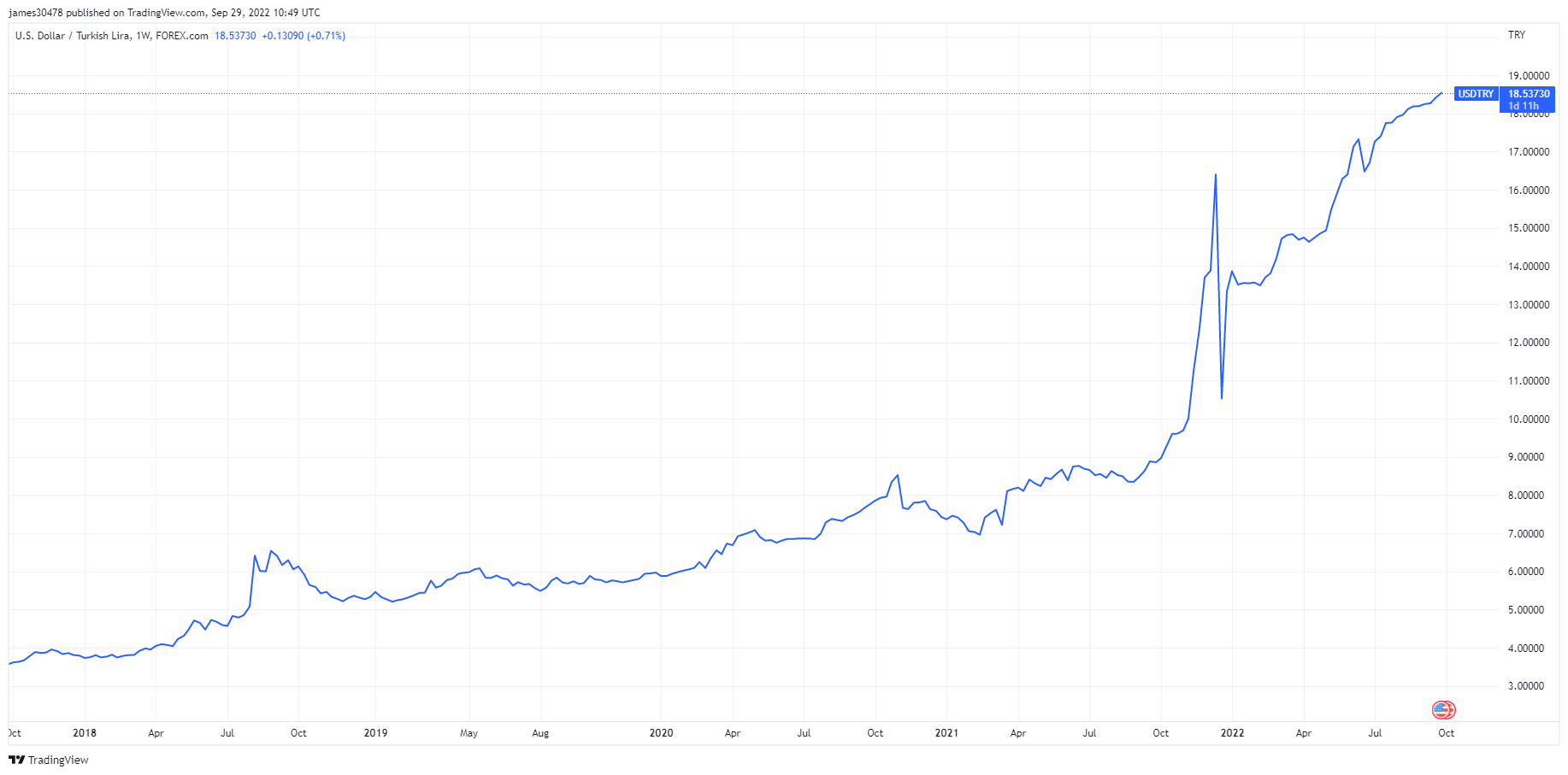

Take, for instance, the Turkish lira (TRY). The foreign money has been on a gentle decline since 2018, with the cumulative inflation over the previous three years surpassing 100%. For the reason that starting of the yr, the lira misplaced 26% of its worth in opposition to the U.S. greenback (USD). PwC categorized Turkey as a hyperinflationary financial system in its September report, saying that deteriorating situations started in 2021 and have worsened in mid-summer 2022.

The 2017 trade price of 1 USD per 3.5 TRY now stands at 1 USD er 18 TRY. This has created big quantities of USD/TRY buying and selling quantity, which has been on a parabolic rise for the reason that starting of the yr.

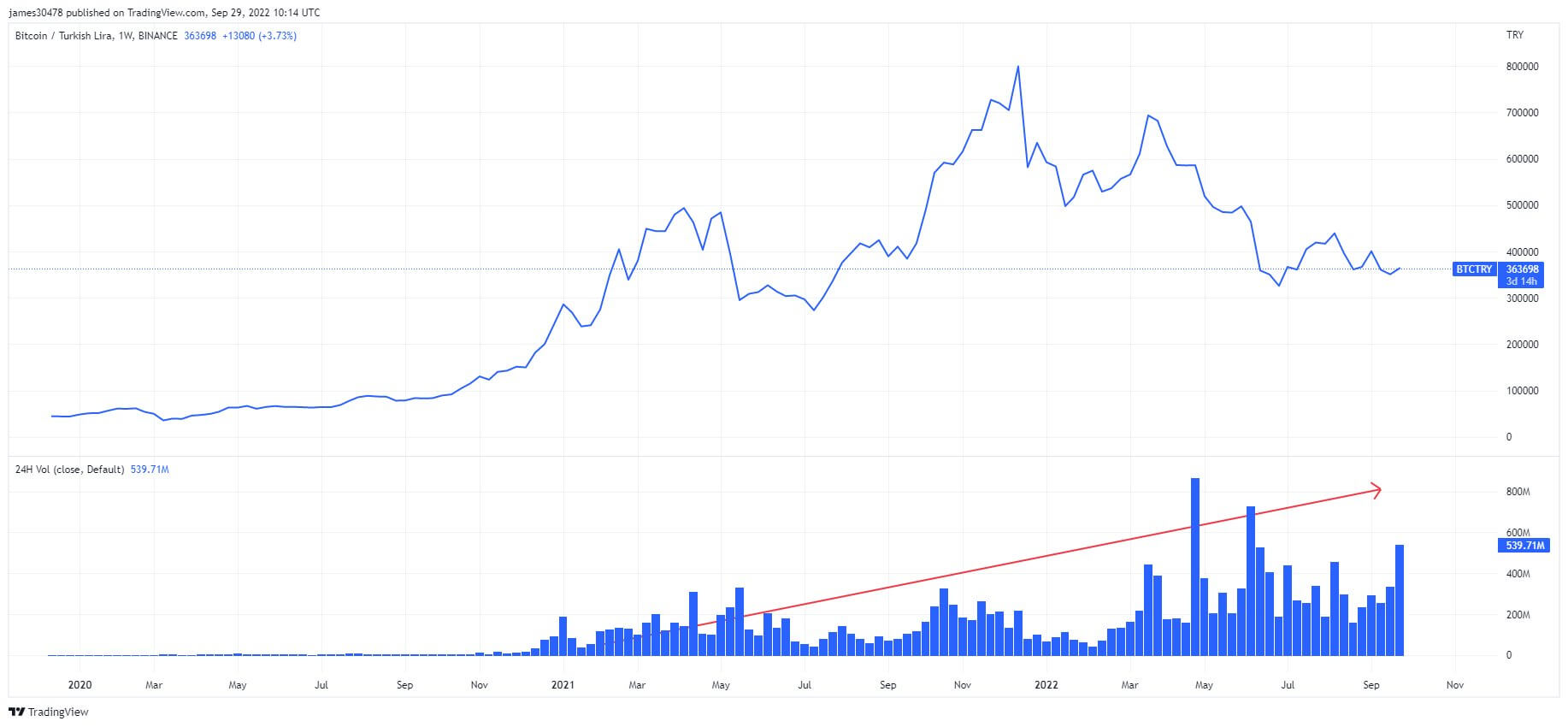

The U.S. greenback isn’t the one foreign money Turkish individuals have flocked to.

There was a gentle improve in BTC/TRY buying and selling quantity on centralized exchanges. Knowledge from Binance has proven that the value of Bitcoin in TRY jumped to its ATH firstly of 2022, whereas the 24-hour buying and selling quantity for the pair reached its peak in Might this yr.

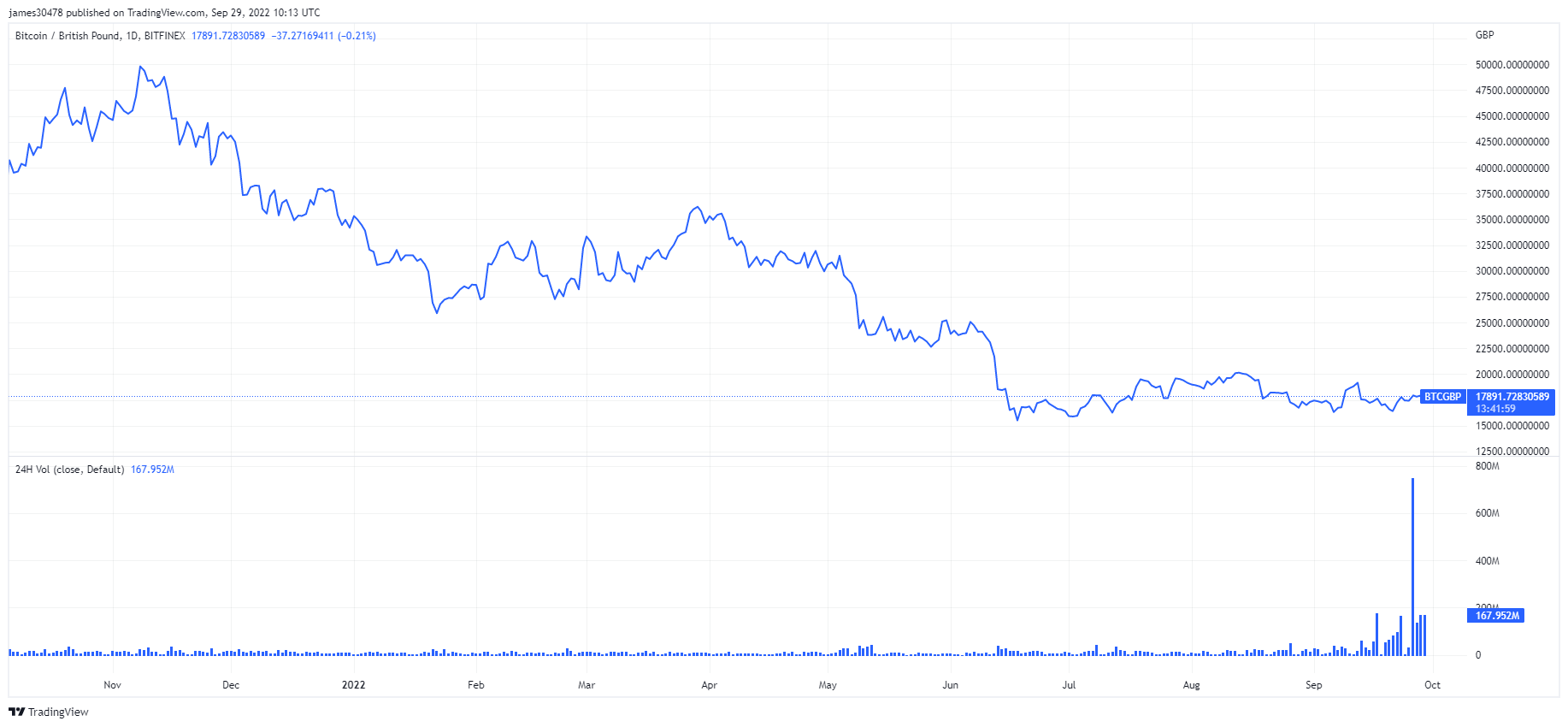

On Sept. 26, 2022, the British pound skilled a flash crash as giant because the one recorded on Black Wednesday 1992, shedding 4.3% of its worth in opposition to the U.S. greenback in a single day. As beforehand lined by CryptoSlate, the drop was a results of the Financial institution of England’s emergency intervention within the bond market.

The identical day the pound skilled its worst drop in 30 years, the BTC/GBP buying and selling quantity reached its ATH, hovering over 1,200% in 24 hours.

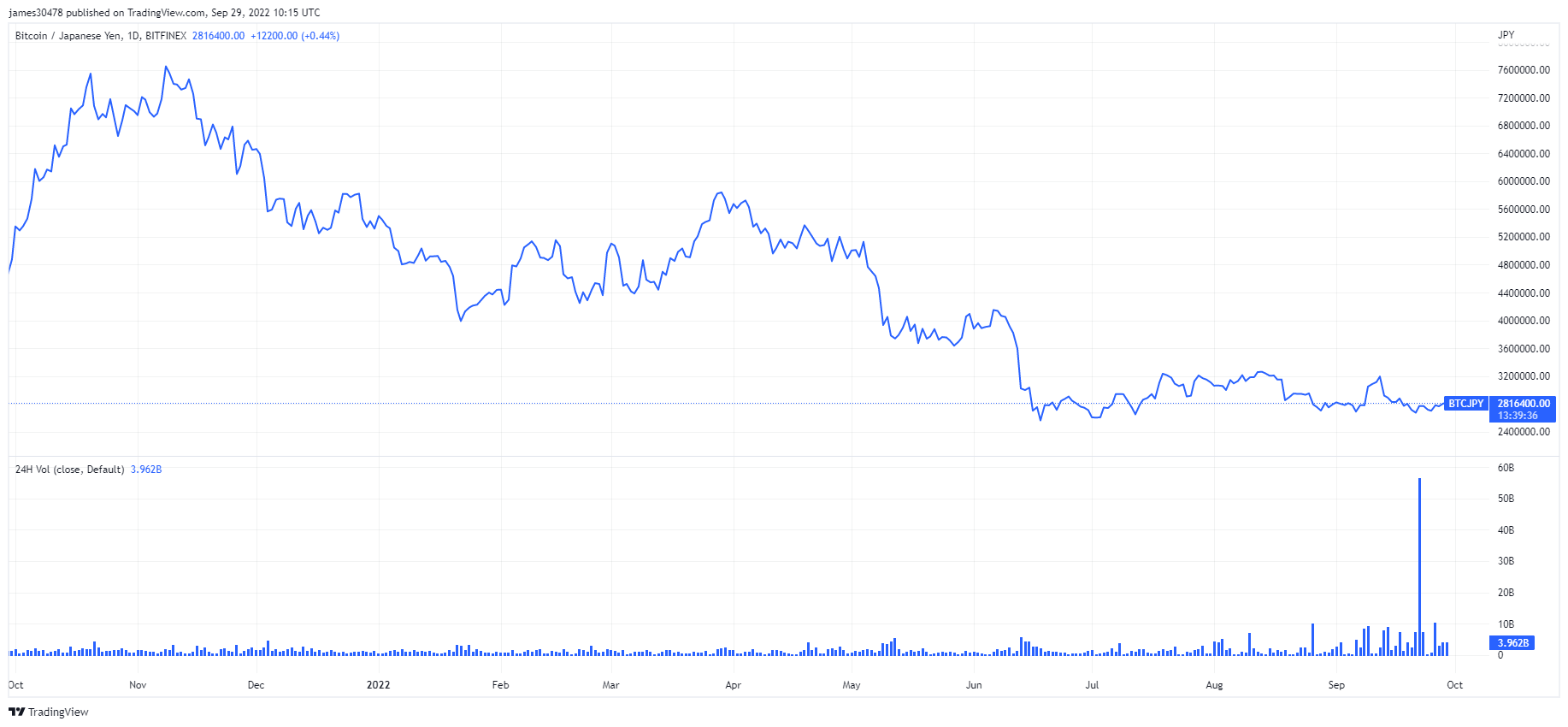

The scenario was no higher in Japan, the place the central financial institution spent nearly $20 billion, or 3.6 trillion yen, intervening within the international trade market to prop up the quickly declining yen. Whereas the determine signifies the federal government’s complete spending on foreign money intervention in the complete month of September, it’s extensively believed that all the $20 billion have been utilized in a single intervention on Sept. 22.

That is now the Financial institution of Japan’s largest and most important dollar-selling, yen-buying intervention, surpassing the two.6 trillion yen document it set in 1998. The intervention was alleged to heal the struggling yen, which misplaced a fifth of its worth in opposition to the U.S. greenback this yr.

Nevertheless, the treatment was short-lived — the yen traded at 144 in opposition to the greenback earlier than the intervention, after which it briefly reached 140. The next day the yen dropped to 145 in opposition to the greenback the next day, erasing the results of the intervention.

Because the yen tumbled, Japanese buyers additionally flocked to Bitcoin. The BTC/JPY buying and selling quantity peaked proper on the time of the intervention.

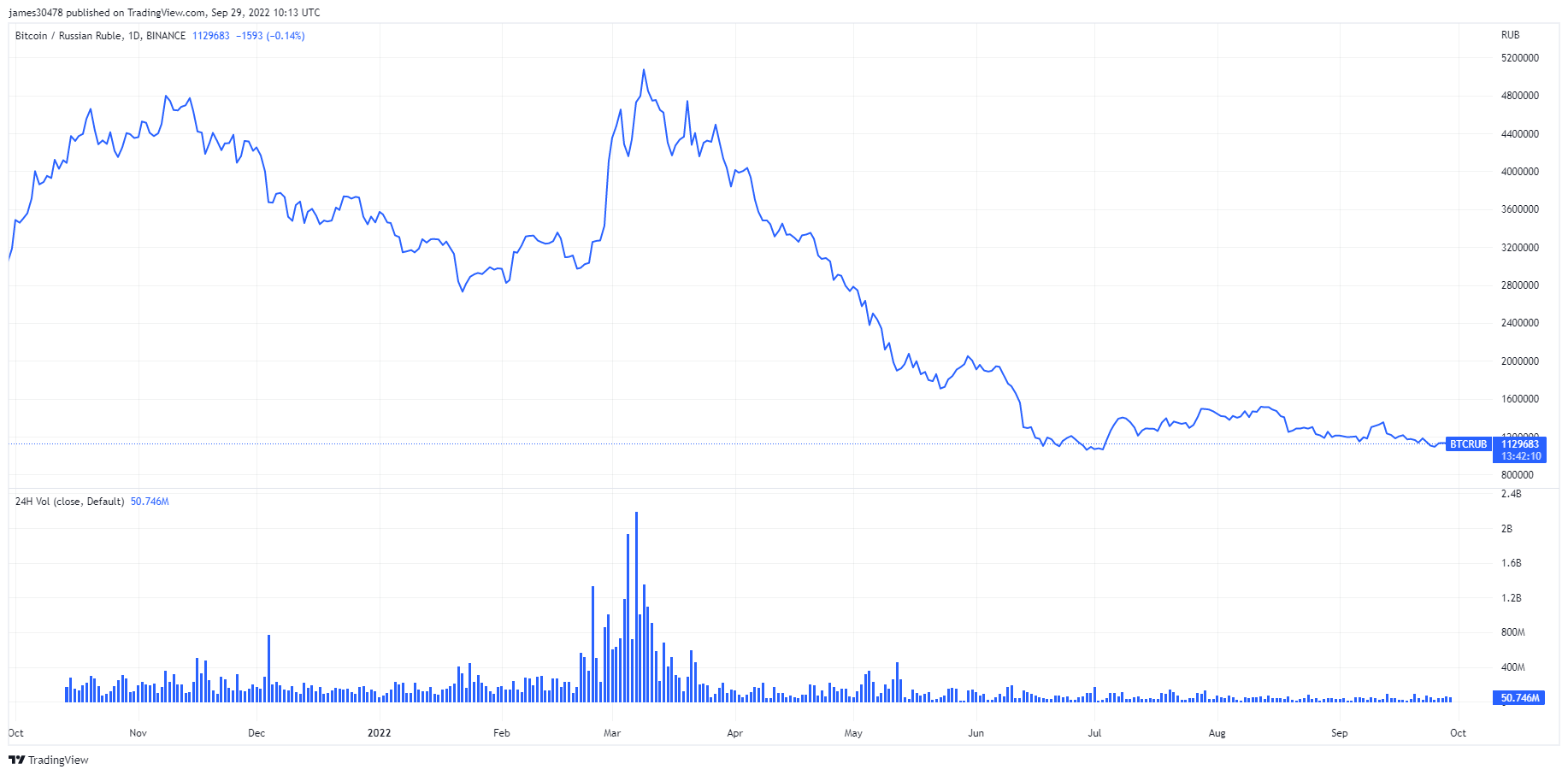

In Russia, because the ruble fell to its historic lows, the BTC/RUB buying and selling quantity soared. Buyers within the nation turned to the toughest asset accessible as Russia started its invasion of Ukraine, pouring their cash into Bitcoin.

Whereas the spikes we’ve seen in Bitcoin buying and selling quantity won’t signify that mass adoption is close to, they present that it’s starting to behave as a protected haven asset. Confronted with macro uncertainty, inflation, and debasing currencies, buyers are flocking to Bitcoin en masse.