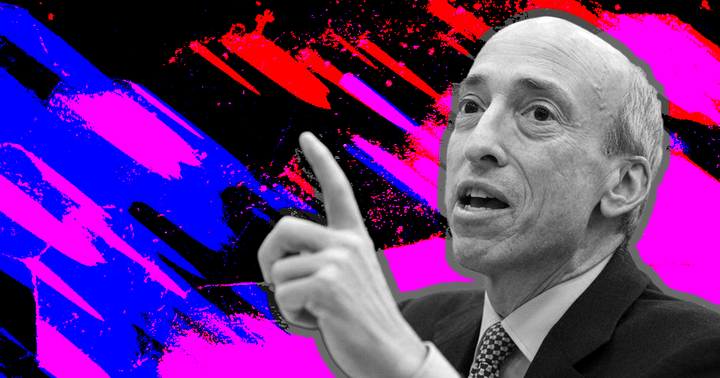

The U.S. SEC’s enforcement employees are reportedly sad with Chairman Gary Gensler over his “publicity stunt” regarding the current settlement superb paid by Kim Kardashian, Fox Enterprise Community’s Charles Gasparino reported on Oct. 5.

SCOOP (1/3): @SEC_Enforcement staffers are complaining @GaryGensler violated protocol by hyping @KimKardashian settlement, showing on @CNBC inside minutes of the case being introduced, individuals w direct information inform @FoxBusiness. They’re calling it a “publicity stunt”

— Charles Gasparino (@CGasparino) October 5, 2022

In keeping with Gasparino, the regulator’s employees complained that Gensler violated protocol through the use of media consideration to prop his popularity for the Treasury Secretary place.

The employees allegedly mentioned:

“Gensler stealthily approached CNBC for his look and created a video on the settlement… [an] uncommon transfer for chairs which often permit employees to take credit score for actions and pursue broader points.”

Gensler’s media look

SEC chairman Gary Gensler launched a video on Oct. 3 when information emerged that the fee had fined Kim Kardashian over her promotion of Ethereum Max. Within the video, Gensler mentioned superstar endorsements of funding alternatives don’t imply “these funding merchandise are proper for all traders.”

As we speak @SECGov, we charged Kim Kardashian for unlawfully touting a crypto safety.

This case is a reminder that, when celebrities / influencers endorse funding opps, together with crypto asset securities, it doesn’t imply these funding merchandise are proper for all traders.

— Gary Gensler (@GaryGensler) October 3, 2022

The SEC chair additional appeared on CNBC the identical day to debate the enforcement case.

Earlier than the current case, the SEC chair had granted media interviews the place he known as most crypto belongings securities. Moreover, Gensler had beforehand launched social media movies the place he urged crypto companies to return in and speak to the fee.

SEC faces backlash

The crypto group has lashed the SEC’s inconsistent enforcement towards the business.

Vocal Bitcoin critic Peter Schiff criticized the SEC for failing to superb MicroStrategy Chairman Michael Saylor whereas fining Kardashian. Saylor, in his protection, acknowledged that Bitcoin isn’t a safety.

#Bitcoin is a commodity, not a safety. Advocating a commodity is just like selling metal, aluminum, concrete, glass, or granite. The BTC community is an open protocol, providing utilitarian advantages just like roads, rails, radio, phone, tv, web, or english.

— Michael Saylor⚡️ (@saylor) October 3, 2022

One other group member identified that the fee had didn’t go after politicians like Nancy Pelosi, who’s confronted with allegations of insider buying and selling.

The SEC will go after Kim Kardashian for shilling a crypto however not Nancy Pelosi for insider buying and selling her approach to 100 million {dollars} https://t.co/i0bZKjaxjJ

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 3, 2022

In the meantime, some puzzled why Kardaishan was singled out amongst all of Ethereum Max’s promoters. The pump and dump challenge had different superstar promoters like Floyd Mayweather, Jr., and Paul Pierce. The three are at present going through a category motion lawsuit over their promotion of the token.