Within the monetary system, a perpetual futures contract, often known as a perpetual swap, is a transaction representing an settlement to purchase or promote an asset at an unspecified level sooner or later. It additionally permits customers to commerce utilizing margin or leverage (utilizing borrowed funds).

Which means that relatively than having the capital to commerce a big notional worth of the underlying asset (say, 500 ETH), customers can simply deposit a small a part of it, leveraging their capital. Customers can commerce in each instructions by shopping for (lengthy) and promoting (quick) perpetuals. Briefly, customers are utilizing borrowed funds to wager on the longer term value of an asset.

Perpetual futures are an answer to allow derivatives markets for illiquid belongings. They rose in recognition when launched by BitMEX in 2016. Cryptocurrency perpetuals often provide excessive leverage, typically over 100 occasions the margin. In 2022, these devices on centralized exchanges like Binance, Kraken, and BitMEX will generate billions of buying and selling quantity day by day, even beating spot crypto buying and selling. Nevertheless, there at the moment are additionally decentralized platforms for perpetual markets.

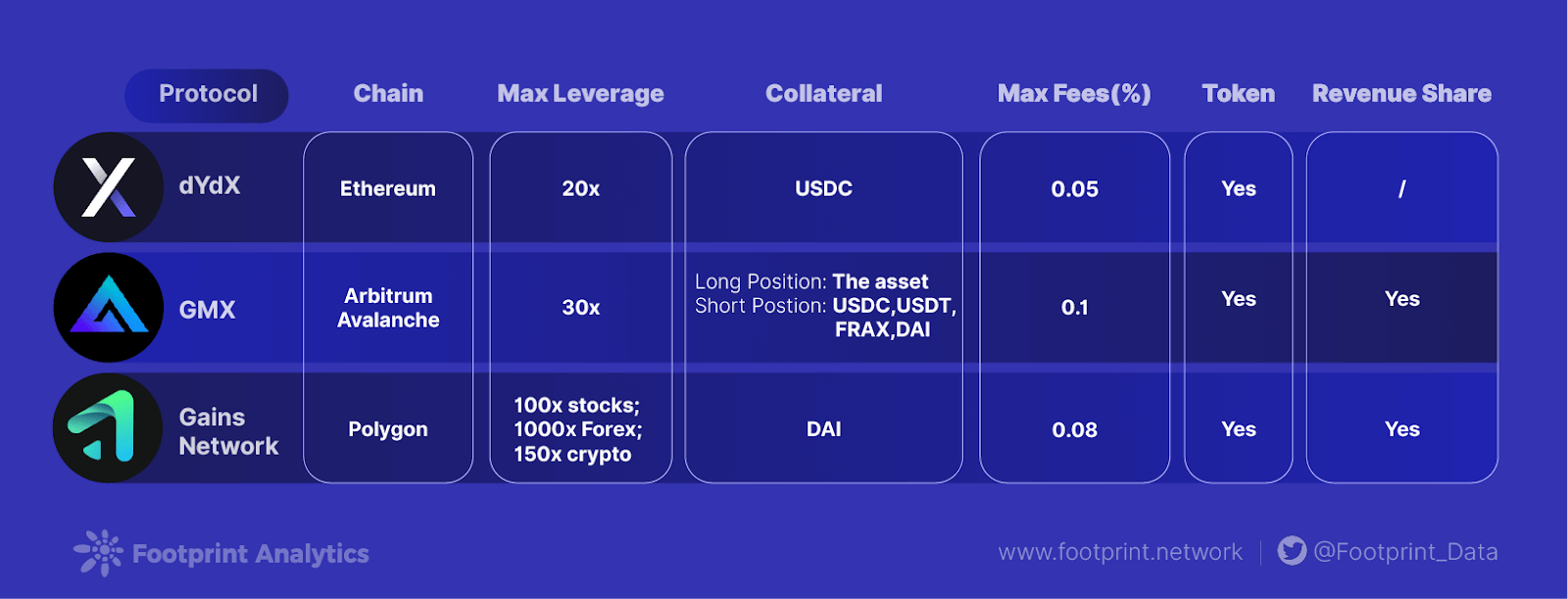

This text will cowl related gamers within the Perpetual DEX sector, evaluating their most important options and key metrics:

dYdX

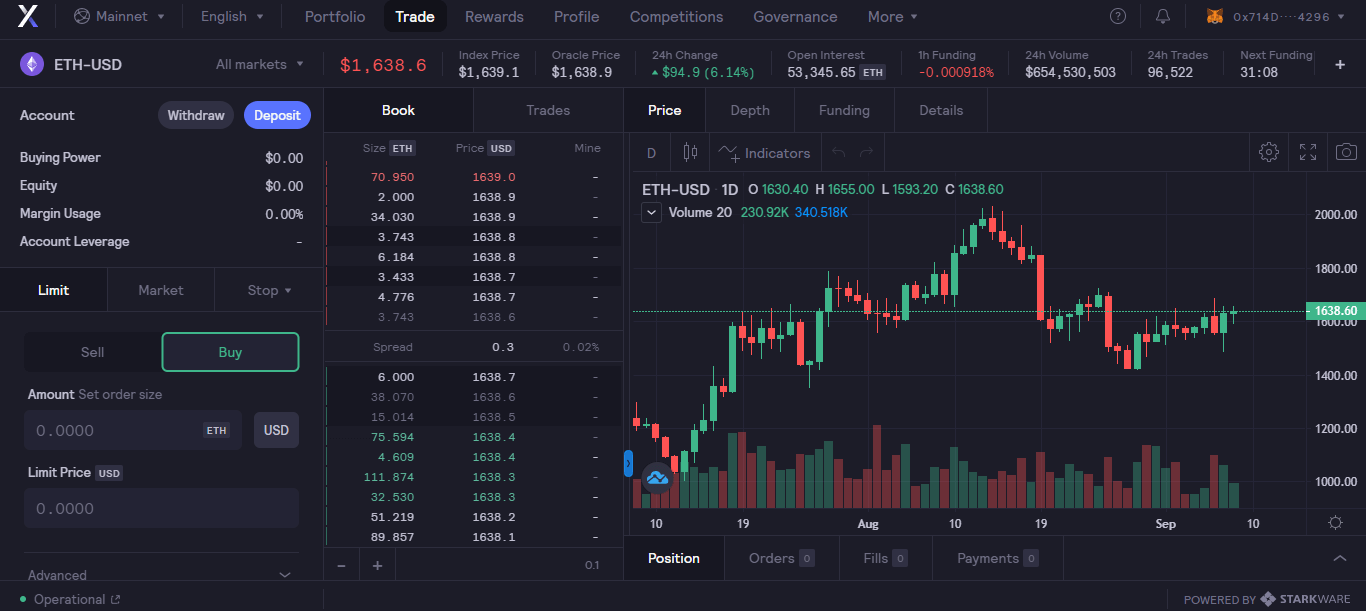

Launched in 2017, dYdX is a DEX that runs good contracts on Ethereum to supply perpetual contract buying and selling, margin buying and selling, spot buying and selling, lending, and borrowing providers.

Customers deposit their collateral on the dYdX alternate and begin buying and selling perpetual contracts.

However that’s not the one method an investor can work together with the alternate. He can deposit USDC to the alternate buying and selling pool (thus changing into a liquidity supplier) and obtain a yield on that capital.

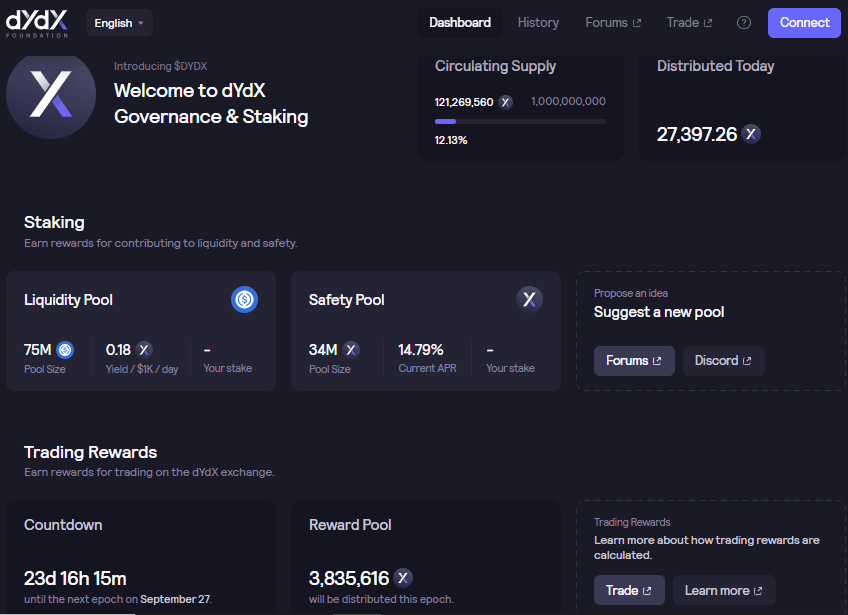

dYdX rewards

The alternate has a token (dYdX) that’s acquired as a reward when you find yourself a liquidity supplier on their Liquidity Pool and might be staked to be a part of the protocol’s security pool. At present, the latter has a yield of 14.79% APR.

GMX

GMX is a decentralized platform for spot and perpetual contract buying and selling that helps customers to leverage as much as 30x on their trades. The protocol launched on Arbitrum in September 2021 after which went into Avalanche at first of 2022.

Equally to dYdX, an investor may also present liquidity to GMX’s buying and selling pool to obtain rewards. One distinction is that he can ship UDSC and different tokens (BTC, USDT, DAI, and many others) to the pool; one other distinction is that the platform has two tokens: GMX and GLP.

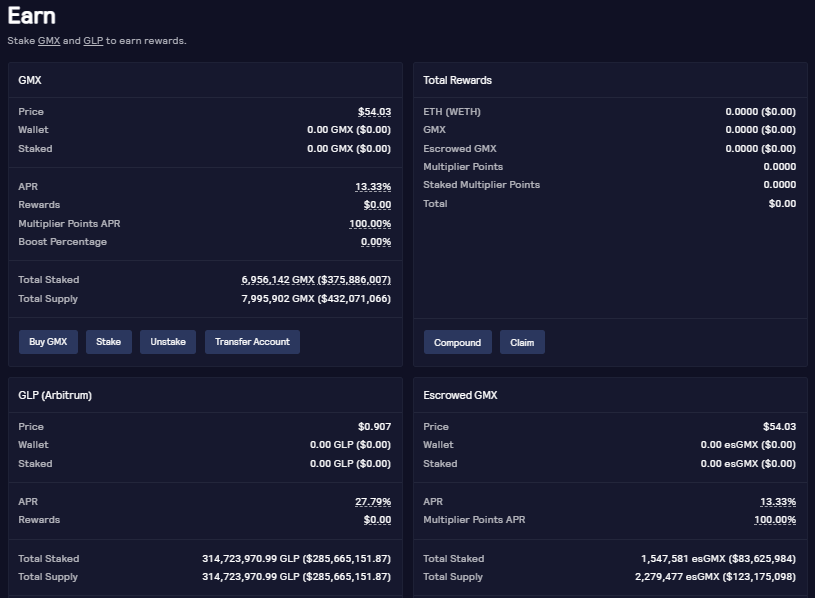

GMX rewards

Traders should purchase GMX and stake it to gather shared revenues from the protocol. GMX is the token used for Governance. GLP is given to traders that present liquidity to the protocol and in addition might be staked. Charges are break up between GMX (30%) and GLP (70%).

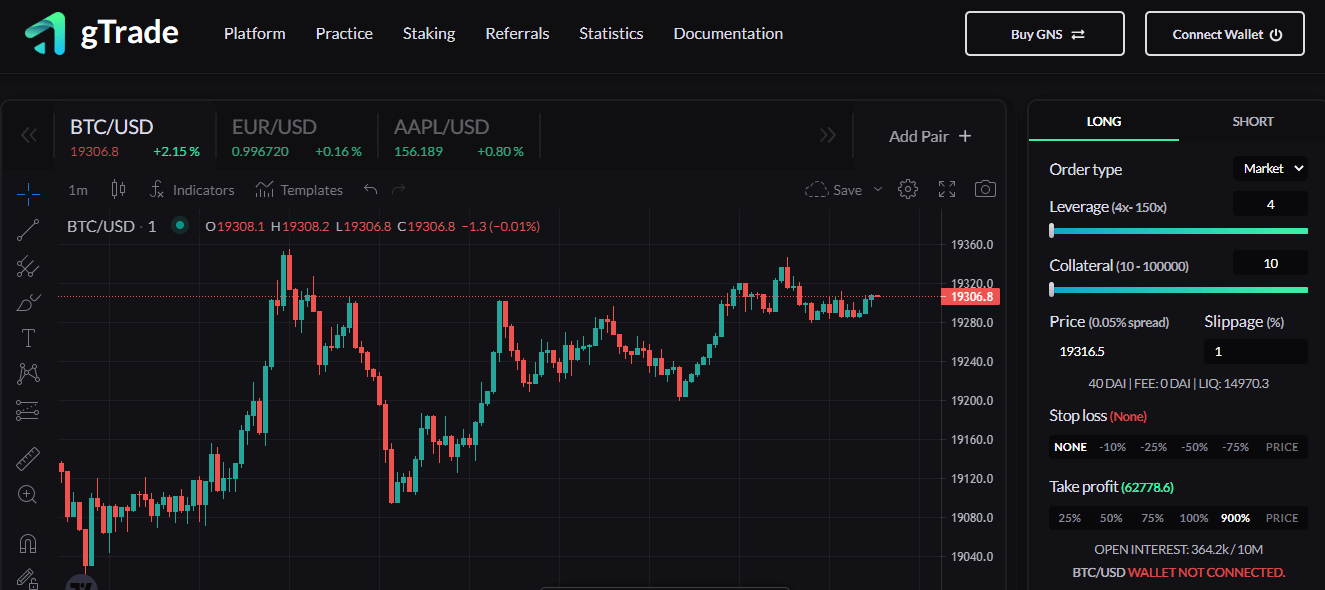

Positive aspects Community

Positive aspects Community is a decentralized perpetual alternate on Polygon. It launched gTrade, a decentralized leveraged buying and selling platform with artificial belongings. Not like the dYdX and GMX, these artificial belongings allow it to supply a variety of leverages and pairs (as much as 150x on cryptos, 1000x on foreign exchange, and 100x on shares).

On Positive aspects Community the investor can also present liquidity to the vault (DAI on this case) used as counterpart to the buying and selling exercise, and obtain rewards/income from the platform.

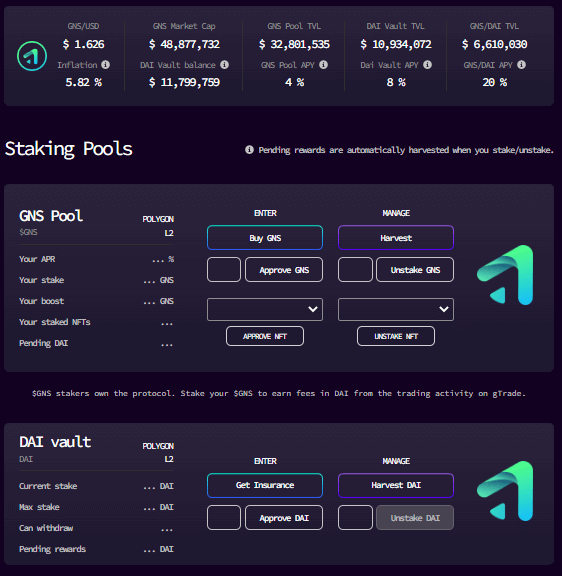

Positive aspects Community rewards

The protocol has two tokens: an ERC-20 token (GNS) and ERC721 utility token (NFTs). GNS and the NFTs had been created to be actively used throughout the platform. GNS holders obtain platform charges when staking by Single Sided Staking, paid in DAI. NFT holders get decreased unfold and boosted rewards, on prime of the common ones.

Key Metrics and Options

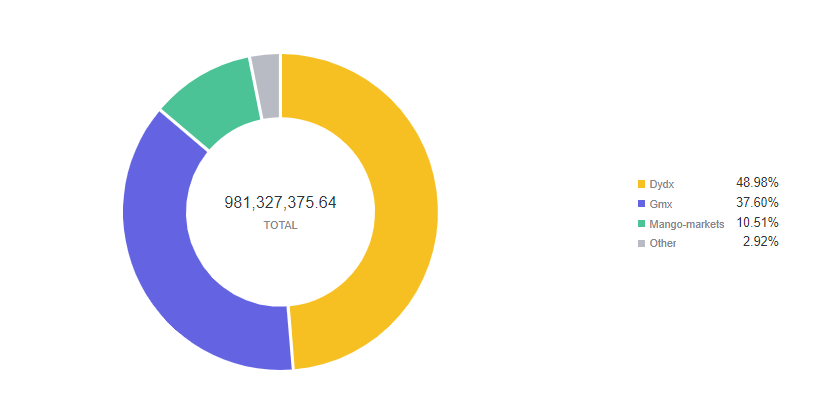

TVL

dYdX (USD 468 million) and GMX (USD 360 million) dominate the DEX Perpetual panorama in TVL, accounting for nearly 87% of the market. One consolidated its place by being the primary mover (dYdX), and the opposite is the brand new entrant that was in a position to higher seize new customers by utilizing the “sharing the income” technique, laso applied by different exchanges like Positive aspects Community.

Each day Customers

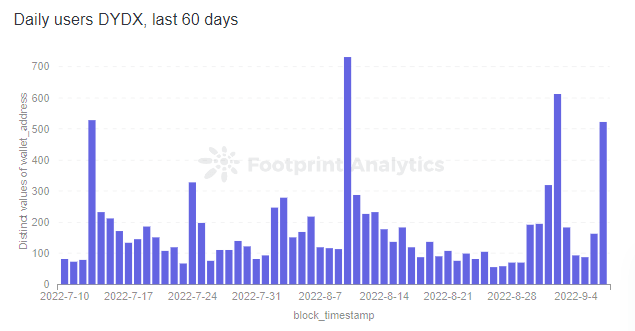

dYdX

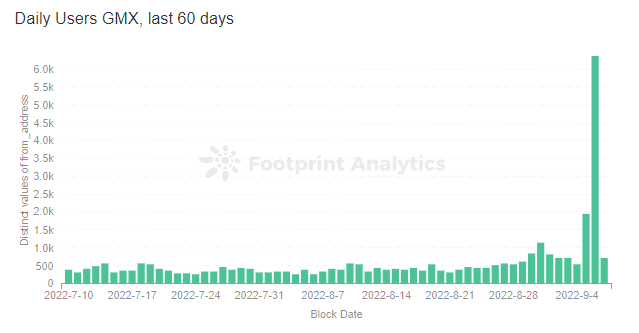

GMX

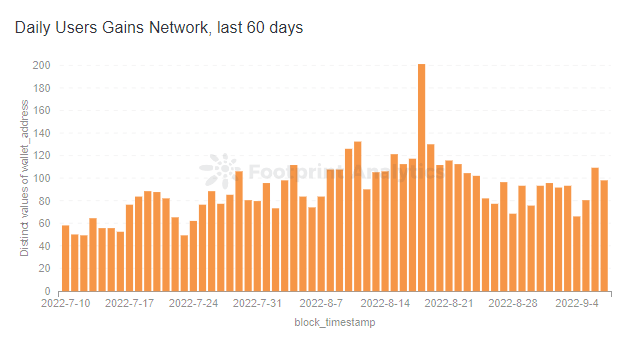

Positive aspects Community

GMX had extra day by day customers (common of 500) than dYdX (common of 200) during the last 60 days, and Positive aspects Community (common of 80) is getting near dYdX numbers. All platforms incentivize buying and selling. DYdX does that by a buying and selling rewards program, the place the customers obtain dYdX tokens based mostly on their buying and selling exercise. GMX makes use of a referral program to incentivize the brand new customers’ onboarding, producing reductions for the brand new customers and rebates for the referral code proprietor. Positive aspects Community additionally makes use of a referral program to spice up its day by day common variety of customers.

Key Takeaways

dYdX and GMX are probably the most distinguished gamers within the DEX perpetual markets vertical, as seen within the charts above. Nevertheless, new entrants like Positive aspects Community have new options (extra leverage, extra buying and selling pairs) and are attempting to extend their TVL. The flexibility to make use of extra leverage, and the help of extra collateral sorts, are good steps towards main adoption, when mixed with the income sharing to the token holders, one thing dYdX doesn’t do.

This piece is contributed by Footprint Analytics neighborhood.

Sept. 2022, Thiago Freitas

Information Supply: dYdX & GMX $ Positive aspects Community Comparability

The Footprint Group is a spot the place information and crypto lovers worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or another space of the fledgling world of blockchain. Right here you’ll discover lively, various voices supporting one another and driving the neighborhood ahead.

Footprint Web site: https://www.footprint.community

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data