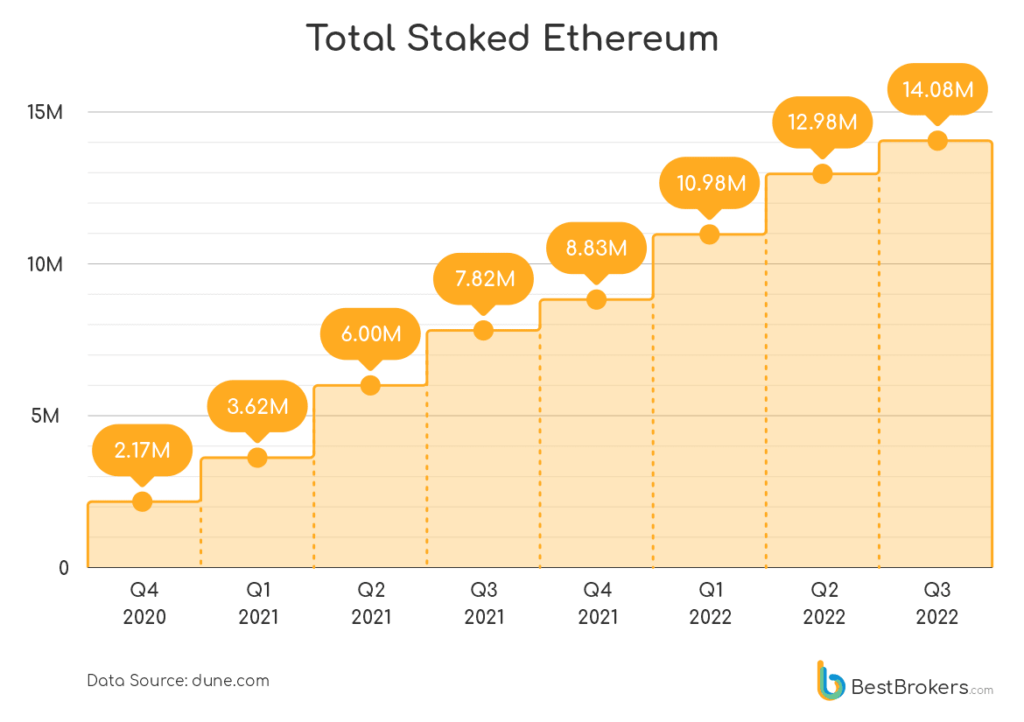

The quantity of staked Ethereum has elevated to simply over $19 billion at about 14 million ETH because the begin of the yr, in keeping with a report by the buying and selling platform Bestbrokers.

Whereas the value of Ethereum has declined round 64% throughout the identical time, different belongings akin to Gold and equities are additionally down about 10-20%.

Alan Goldberg, a market analyst at BestBrokers, commented that

“Whole Ethereum stake at the moment sits at roughly 14.44 million ($19.5 billion). Whole staked ETH in Q3 2022 alone exceeds 1.096 million, which is an indication that merchants discover it a dependable different to the standard markets.”

The Merge lastly accomplished the proof-of-stake improve for the Ethereum community, and thus, it’s unsurprising that this has had a web constructive impact on the quantity of ETH staked. Miners can not mine Ethereum utilizing the proof-of-work consensus technique; subsequently, staking Ethereum is the first method to contribute to the community’s safety.

The present APR for staking Ethereum is round 4-5% however can’t be unstaked till the Shanghai replace is accomplished. Platforms akin to Lido permit traders to trade sETH tokens for ETH, generally known as liquid staking. Nonetheless, the unique Ethereum stays staked within the protocol, and it merely modifications palms to be redeemable by the proprietor of the sETH tokens.

Nonetheless, in relation to the Ethereum straight staked into the community, Goldberg additionally famous;

“Making a deposit for a yr with out entry to your funds is a dangerous transfer, particularly if the funds are in crypto. Nonetheless, merchants proceed to stake. Presently over 11% of the whole circulating provide are staked and the quantity rises day by day. It simply proves that many merchants really feel safe with Ethereum.”

The above chart showcases the regular improve in staked Ethereum since This fall 2020. When in comparison with the value chart for Ethereum, the info means that value motion just isn’t main the staking revolution occurring on Ethereum Mainnet.

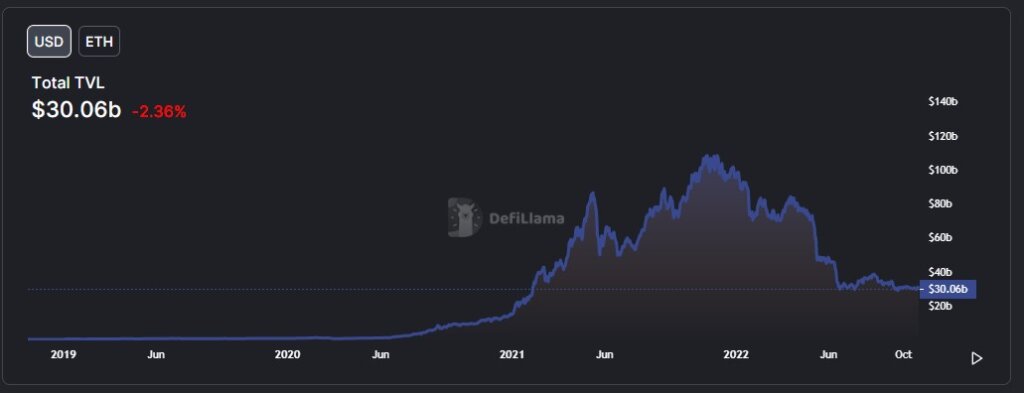

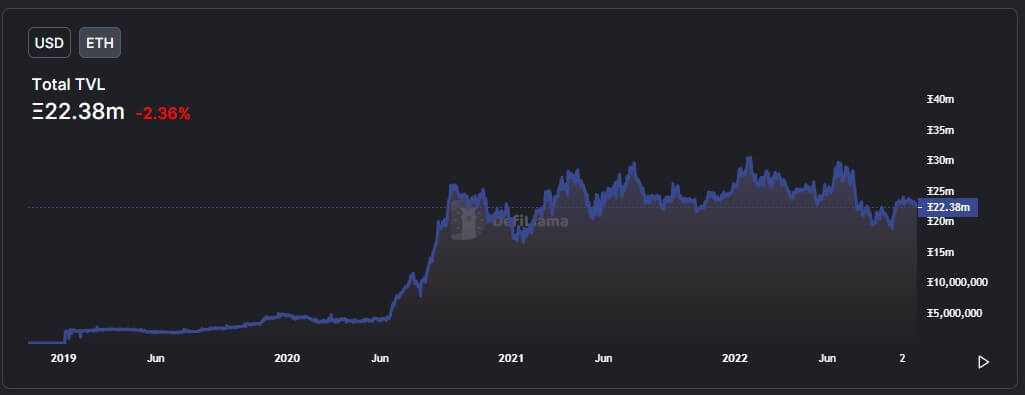

The charts beneath showcase the whole quantity of Ethereum staked throughout all DeFi protocols denominated in each ETH and USD. Whereas the TVL topped at round $105 billion in November 2021, the TVL denominated in ETH neared its all-time excessive as lately as June 2022.

When all of DeFi is taken into account, together with liquid staking, the whole worth staked Ethereum tallies as much as 22.38 ETH, down 26% from its all-time excessive in November 2021. When reviewing the TVL denominated in USD of any crypto asset, it’s important to know the underlying asset’s value all through time.

In June 2022, the USD worth of the Ethereum TVL was in decline, however the quantity of ETH being staked was growing. This discrepancy pertains to the drop within the value of ETH throughout that point. Ethereum opened in June at $1,942 and closed the month down 43% at $1,099.