Bitcoin’s (BTC) buying and selling quantity with the British Pound Sterling surged by 233% in September, in response to CryptoCompare knowledge.

In September, the British Pound fell to a file low towards the US Greenback. Reuters reported that the buying and selling quantity between the Pound and Bitcoin peaked at £846 million ($955 million) on Sept. 26.

Former UK prime minister Liz Truss launched a mini-budget on Sept. 23, which despatched many buyers scrambling for Bitcoin as an inflation hedge.

Whereas stroll backs on the funds proposals and Truss’ resignation have quickly steadied the Pound, extra buyers are starting to see Bitcoin as a go-to asset towards under-pressure fiat currencies.

Troubled economies flip to Bitcoin.

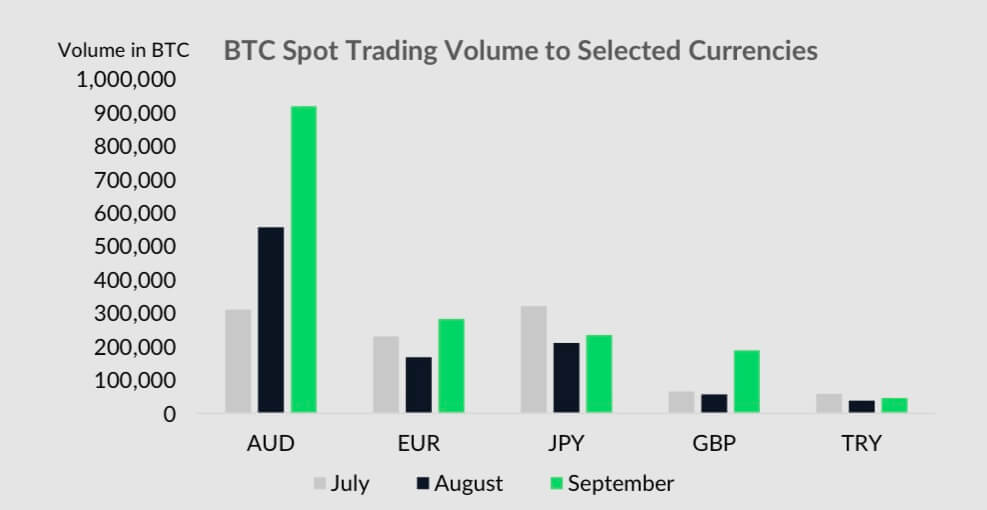

The CryptoCompare report continued that BTC noticed a rise towards different weakening currencies. Based on the report, Bitcoin’s buying and selling quantity has spiked towards the Australian {Dollars} (AUD), Japanese Yen (JPY), Turkish Lira (TRY), and Euro (EUR) throughout the final three months.

Through the early days of the Russian-Ukraine disaster, their residents adopted BTC in droves as each international locations’ currencies fell considerably.

A latest Chainalysis report additionally recognized how Latin Individuals had been more and more utilizing crypto to fight the excessive inflation of their area. Nonetheless, the report famous that folks within the area most popular stablecoin to Bitcoin due to their relative stability.

Consultants have argued that the simple accessibility of Bitcoin and the broader crypto market, as towards different doable inflation hedges like gold, makes the digital asset enticing for economies in disaster.

Nonetheless, this doesn’t imply Bitcoin has been with out blemish. Whereas its volatility is at present very low, its value efficiency has not been encouraging, because it has traded in a spread for the previous three months.

CryptoSlate analysis revealed that Bitcoin had been down by greater than 50% within the final 12 months. By comparability, no main fiat foreign money or conventional monetary product has misplaced greater than 20% of its worth on the year-to-date metric.

Coinbase falls behind rivals

CryptoCompare report famous that spot buying and selling quantity on US-based alternate Coinbase fell to its lowest since January 2021. Based on the report, the alternate’s buying and selling quantity declined 17.6% to $48.1 billion.

As compared, rivals like Binance, OKX, and FTX all noticed their volumes rise by 23.5%, 8.26%, and 5.49% to $541 billion, $58.1 billion, and $51.8 billion, respectively.

The report additionally famous that Bitcoin spot buying and selling elevated amongst these exchanges regardless of the broader market sell-off skilled in September.