The largest information within the cryptoverse for Nov. 9 contains Binance’s choice to not transfer ahead with the potential acquisition of FTX, Bitcoin’s retrace to $ 15,000 ranges, and a number of stablecoins dropping under $1.

CryptoSlate Prime Tales

Binance walks away from FTX deal, citing ‘mishandled buyer funds,’ regulatory scrutiny

Binance revealed its intent to buy FTX on Nov.8, whereas noting it wanted to run due diligence earlier than doing so. On Nov. 9, Binance introduced that it determined to not proceed with the acquisition.

The change stated {that a} U.S. company opened an investigation on FTX, which was what modified Binance’s thoughts.

On account of company due diligence, in addition to the newest information stories relating to mishandled buyer funds and alleged US company investigations, we’ve got determined that we are going to not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

Massive brief positions push Bitcoin towards $17k amid $861M in crypto liquidations

The market noticed $861 million in crypto liquidations over the previous 24 hours. Of this, $259 million was made up of Bitcoin (BTC) shorts, which assisted in sending Bitcoin to $17.000.

Bitcoin choices merchants swing bearish as FTX fallout takes maintain

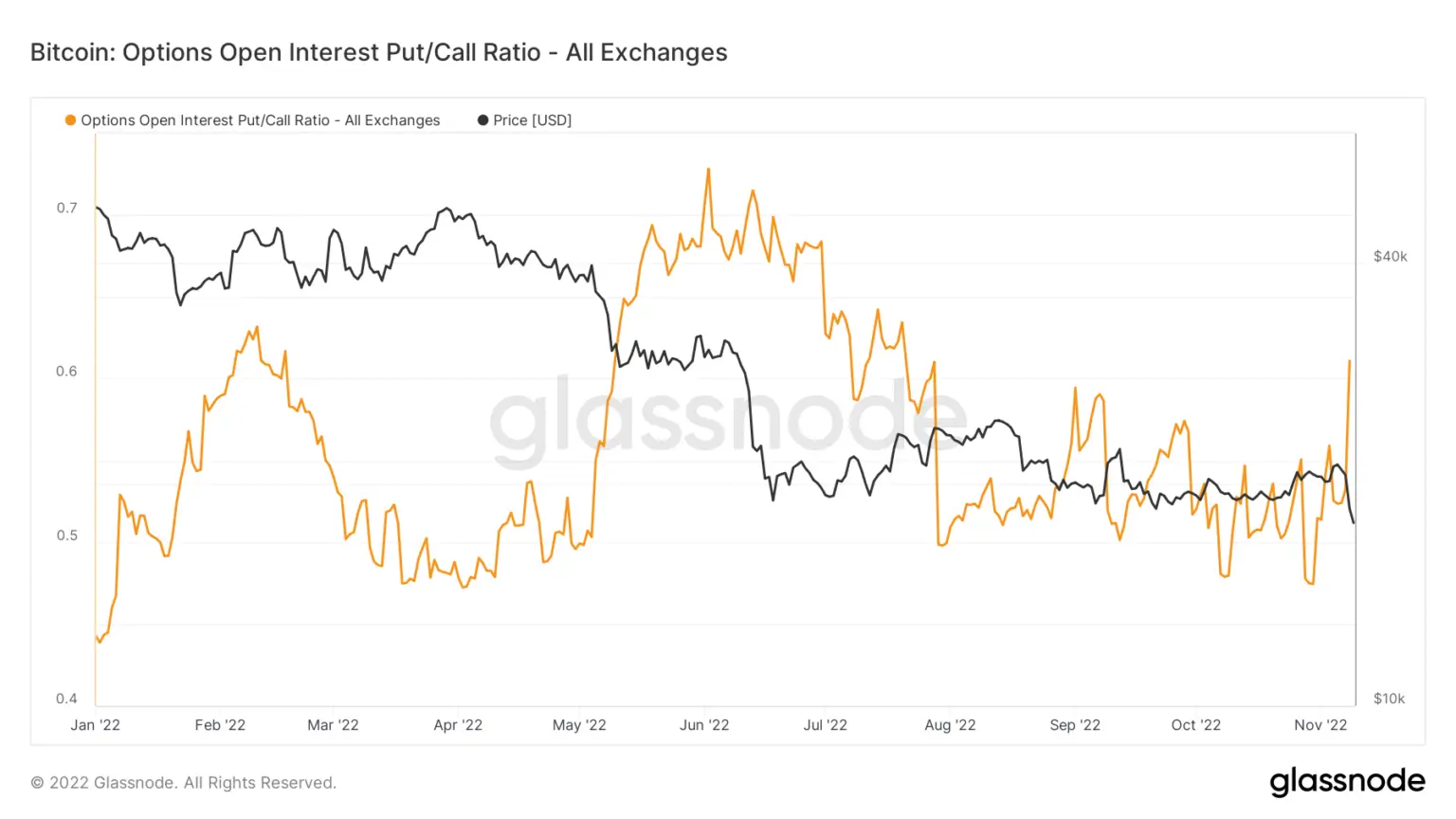

The Choices Open Curiosity Put/Name Ratio (OIPCR), buyers are leaning towards shopping for, which suggests a bearish market sentiment.

The OIPCR is calculated by dividing the full variety of places open curiosity by the full variety of calls open curiosity on a given day. It has been spiking excessive for the reason that FTX disaster began to unveil, whereas it didn’t see its extremes but, because it did in the course of the Luna collapse.

Crypto exchanges to publish ‘proof-of-reserves’ following FTX’s implosion

After the market implosion as a result of FTX disaster, Binance’s CEO Changpeng Zhao stated that exchanges ought to share a Merkle-tree proof-of-reserves to show that they’re not bancrupt.

All crypto exchanges ought to do merkle-tree proof-of-reserves.

Banks run on fractional reserves.

Crypto exchanges shouldn’t.@Binance will begin to do proof-of-reserves quickly. Full transparency.— CZ 🔶 Binance (@cz_binance) November 8, 2022

Following Zhao’s lead, a number of main exchanges together with OKX, Huobi, and KuCoin said that they meant to publish their fund reserves to handle the present contagion fears out there.

Gate.io turned the primary change that revealed its Merkle-tree proof-of-reserves.

Double dip anticipated as flood of unlocked Solana to hit the market

Being part of FTX, Solana (SOL) took its share of the latest FTX disaster and misplaced 51% of its worth for the reason that begin of the week. Nonetheless, it might need not discovered its dip.

Solana’s staking lock-in interval on the present epoch will finish inside 24 hours and round 18 million SOL tokens can be unlocked. Buyers are prone to exit their positions and trigger a “second wave of promoting.”

‘Don’t view it as a ‘win’ for us’: Binance’s CZ says on FTX acquisition

Binance’s CZ shared his opinion on the change’s intention to buy FTX and stated that it’s not a very nice state of affairs for the crypto neighborhood, and due to this fact, not a “win” for Binance.

He said:

“Don’t view it as a “win for us. Person confidence is severely shaken. Regulators will scrutinize exchanges much more. Licenses across the globe can be tougher to get,”

Stablecoins fall under Greenback parity as turbulence impacts complete market

The market turmoil precipitated stablecoins to drop under $1. Tether (USDT), USD Coin (USDC), Dai (DAI), and Binance USD (BUSD) all dropped to round $0.998.

Despite the fact that the drop doesn’t appear like it would result in a Luna-like spiral, it signifies that the sentiment is extremely fearful.

Alameda Analysis web site goes non-public following FTX collapse

FTX’s founder Sam Bankman-Fried‘s enterprise capital Alameda Analysis took its justifiable share of the FTX tremble. As of Nov. 9, Alameda’s official web site is inaccessible, together with FTX Ventures’ web site.

Tether, Circle deny publicity to FTX, Alameda

Crypto reporter Wu Blockchain shouted out to Circle and Tether and requested them to reveal their monetary relationship with Alameda and FTX.

Tether’s CTO Paolo Ardoino quoted this Tweet and stated that Tether has zero publicity to FTX or Alameda. Circle‘s CEO, Jeremy Allaire, then again, revealed a thread to make sure the neighborhood that Circle is protected. He stated:

“Circle has by no means made loans to FTX or Alameda, has by no means obtained FTT as collateral, and has by no means held a place in or traded FTT. In any case, Circle doesn’t commerce by itself account.

Coinbase CEO calls out “dangerous enterprise practices” in FTX saga, sympathizes with these concerned

Coinbase‘s CEO Brian Armstrong posted a thread on Twitter to affix Tether and Circle in saying that Coinbase doesn’t have any materials publicity to FTX, FTT, or Alameda.

1/ First off, I’ve lots of sympathy for everybody concerned within the present state of affairs with FTX – it is hectic any time there may be potential for buyer loss.

— Brian Armstrong (@brian_armstrong) November 8, 2022

He referred to the present state of affairs as “the results of dangerous enterprise practices”, and shared his sympathies for those who’re affected by the present disaster.

Galaxy Digital stories $76.8M publicity to FTX

Galaxy Digital’s 2022 Q3 report reveals that the corporate has round $76.8 million in publicity to FTX. The corporate stated that $47.5 million out of the $76.8 million is at present “within the withdrawal course of.” Galaxy Digital didn’t disclose any info for the remaining $29.3 million.

Canada’s third-largest pension fund invested in FTX at $32B valuation

Canada’s third largest pension fund, the Ontario Academics’ Pension Plan participated in FTX’s $400 million Collection C funding spherical in January alongside organizations like with SoftBank, Lightspeed Enterprise Companions, and Paradigm.

A spokesperson for the fund revealed that the group had invested $200 million in FTX, and added that they’d no additional feedback proper now “given the fluidity of the state of affairs.”

Wintermute CEO tells 3AC co-founder to ‘keep worn out’ amid ‘redemption’ try

Wintermute‘s CEO Evgeny Gaevoy shouted out to the Three Arrows Capital founder Su Zhu and stated that he shouldn’t try to make use of the present market disaster to filter his title.

Man actually, SBF being an even bigger villain than you, doesn’t robotically begin your redemption ark. Keep worn out https://t.co/7AuvsPstp6

— wishful cynic (@EvgenyGaevoy) November 9, 2022

Gaevoy stated these as a response to Zhu’s Tweet from Nov. 9 which Zhu stated part of him wished to “rebuild with contemporary objective.” Together with Gaevoy, nearly all of the neighborhood additionally reacted very negatively to Zhu’s Tweet.

CryptoSlate Unique

Strengthening ties in a multi-chain ecosystem by way of message pigeons w/ Paloma Protocol – SlateCast #28

Paloma Protocol’s designer Quantity’s founder Taariq Lewis spoke to CryptoSlate about Paloma’s imaginative and prescient.

Paloma is a Cosmos (ATOM) primarily based SDK blockchain that focuses on growing transaction quantity on all blockchains. The corporate believes in a multi-chain future and goals to strengthen it by growing the quantity of shared transaction quantity throughout chains.

Paloma collects and validates any form of knowledge from one blockchain and might share them with one other one. This permits chains to observe one other blockchain with out dedicating a set of validators whereas enhancing shared safety.

Analysis Spotlight

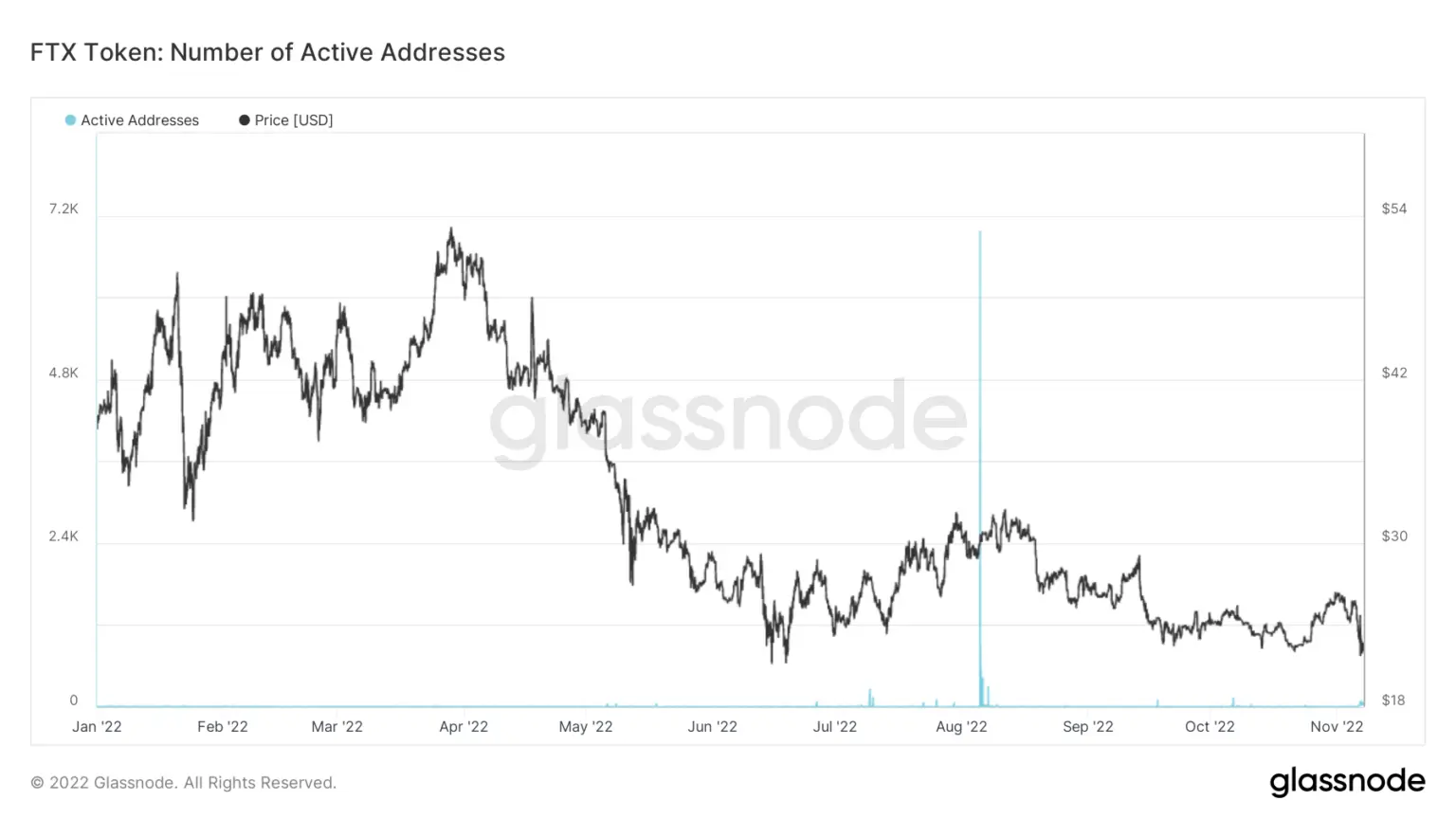

Analysis: FTT token energetic addresses near 0 for the whole thing of 2022

In keeping with knowledge analyzed by CryptoSlate analysts, the variety of energetic addresses that maintain FTX Tokens (FTT) has been near zero for the reason that starting of the 12 months. It looks as if FTT holders have been inactive on-chain lengthy earlier than the FTX disaster began.

Since most transactions on exchanges occur off-chain, and FTT is FTX’s native token, it’s seemingly that FTT holders use custodial wallets on FTX as a substitute of chilly ones.

Crash of the Titans: LUNA dwarves FTX by way of losses however the worst is but to return

At present, the Terra-Luna crash that occurred in Might was far worse than the present FTT disaster. With that being stated, it’s value mentioning that we’re just a few days into the FTX’s collapse, and it could not reveal its true scope simply but.

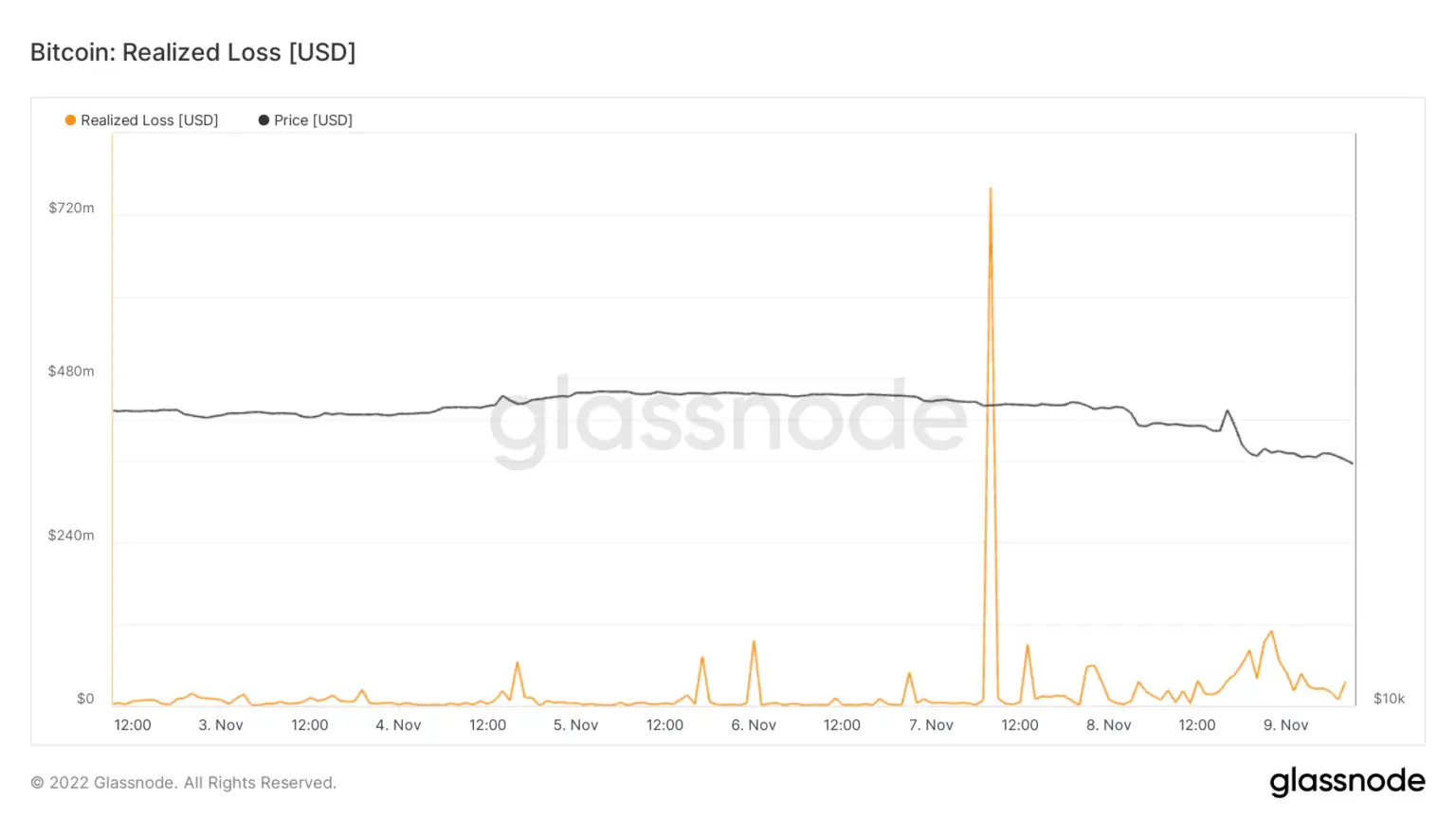

CryptoSlate analysts appeared into Bitcoin’s realized loss metric to find that it signifies extreme stress out there.

The metric reveals that there have been a number of spikes of realized loss, ranging between $50 million to $100 million from Nov. 4 to Nov. 6.

The identical metric indicated a number of billion worths of realized loss in the course of the Luna collapse. Nonetheless, the total results of the Luna collapse had been solely seen after the ripple impact it began reached its full extension. Due to this fact, it may be nonetheless early to say that it was far worse than the FTX disaster.

Information from across the Cryptoverse

Did FTX present a bailout for Alameda in Q2?

Coinmetrics’ Head of Analysis and Growth, Lucas Nuzzi, Tweeted on Nov. 9 and claimed that he discovered proof indicating that FTX might need offered an enormous bailout for Alameda within the second quarter of 2022. Nuzzi stated that the present state of affairs of FTX is just the results of that bailout.

Twitter takes a step to enter the funds subject

In keeping with New York Instances, Twitter filed the mandatory paperwork to register with the authorized authorities so it will possibly begin processing funds.

Japenese Telecom large companions with Accenture

Accenture introduced that it has inked a cope with the Japanese Telecom large NTT DOCOMO to speed up Web3 adoption. The duo will give attention to addressing social points, establishing a safe know-how for Web3, and creating expertise.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased by over 13% to $15,900, whereas Ethereum (ETH) additionally fell by almost 15% to commerce at $1,117.