Stablecoins are cryptocurrencies that peg their worth to reference belongings, together with fiat currencies, commodities, or different cryptocurrencies.

They kind an integral a part of the crypto ecosystem by providing value stability in an in any other case risky market. Biking into and out of stablecoins, customers present liquidity and exit positions.

This biking relationship between Bitcoin and stablecoins can present perception into market sentiment and point out durations of shopping for and promoting strain.

Knowledge from Glassnode and analyzed by CryptoSlate reveals an ideal storm of potential shopping for strain constructing. Nevertheless, macro uncertainty continues to weigh closely.

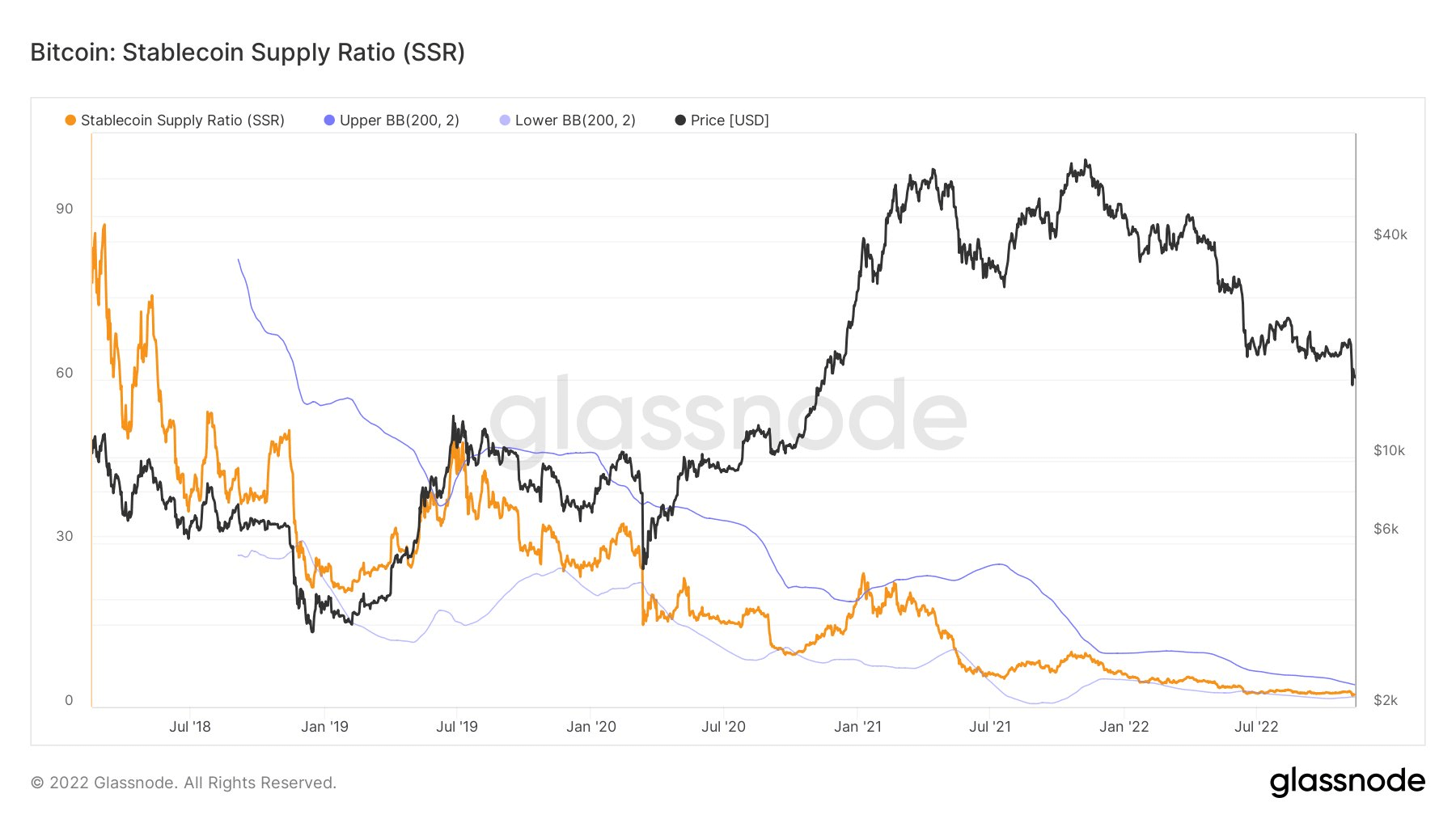

Bitcoin: Stablecoin Provide Ratio

The Stablecoin Provide Ratio (SSR) is calculated by dividing the Bitcoin market cap by the market cap of all stablecoins. By evaluating the market caps of Bitcoin and stablecoins, the SSR may be thought-about a measure of power between the 2.

A excessive SSR signifies low potential shopping for strain and is taken into account bearish. In distinction, a low SSR means excessive potential shopping for strain making this case bullish.

The chart beneath reveals the SSR on a macro downtrend because the begin of 2018, transferring considerably decrease from July 2021 onwards and sinking additional into 2022.

A present studying of two.28 reveals for each $1 in stablecoins, there are $2.28 of Bitcoin – a state of affairs of excessive potential shopping for strain for Bitcoin.

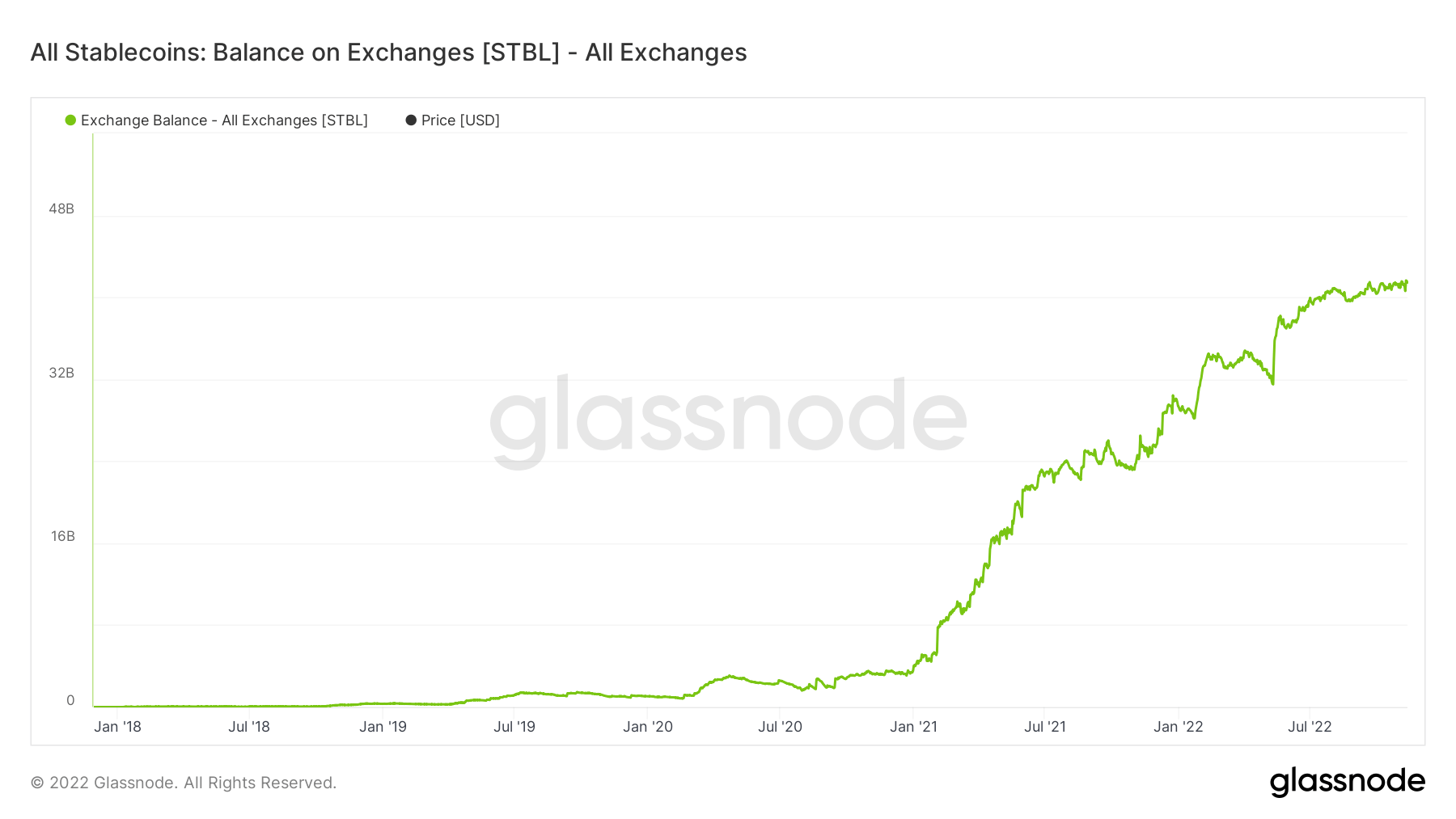

Stablecoin: Steadiness on Exchanges

Stablecoins: Steadiness on Exchanges (SBoE) seems on the whole variety of stablecoins held on exchanges. Rising SBoE is taken into account bullish, indicating a continuous build-up of sidelined liquidity able to pounce.

SBoE started trending greater from January this 12 months to peak at roughly $46 billion at current.

Given macro uncertainty, it’s possible that sidelined liquidity is ready for a backside in legacy markets earlier than biking into Bitcoin and different cryptocurrencies.

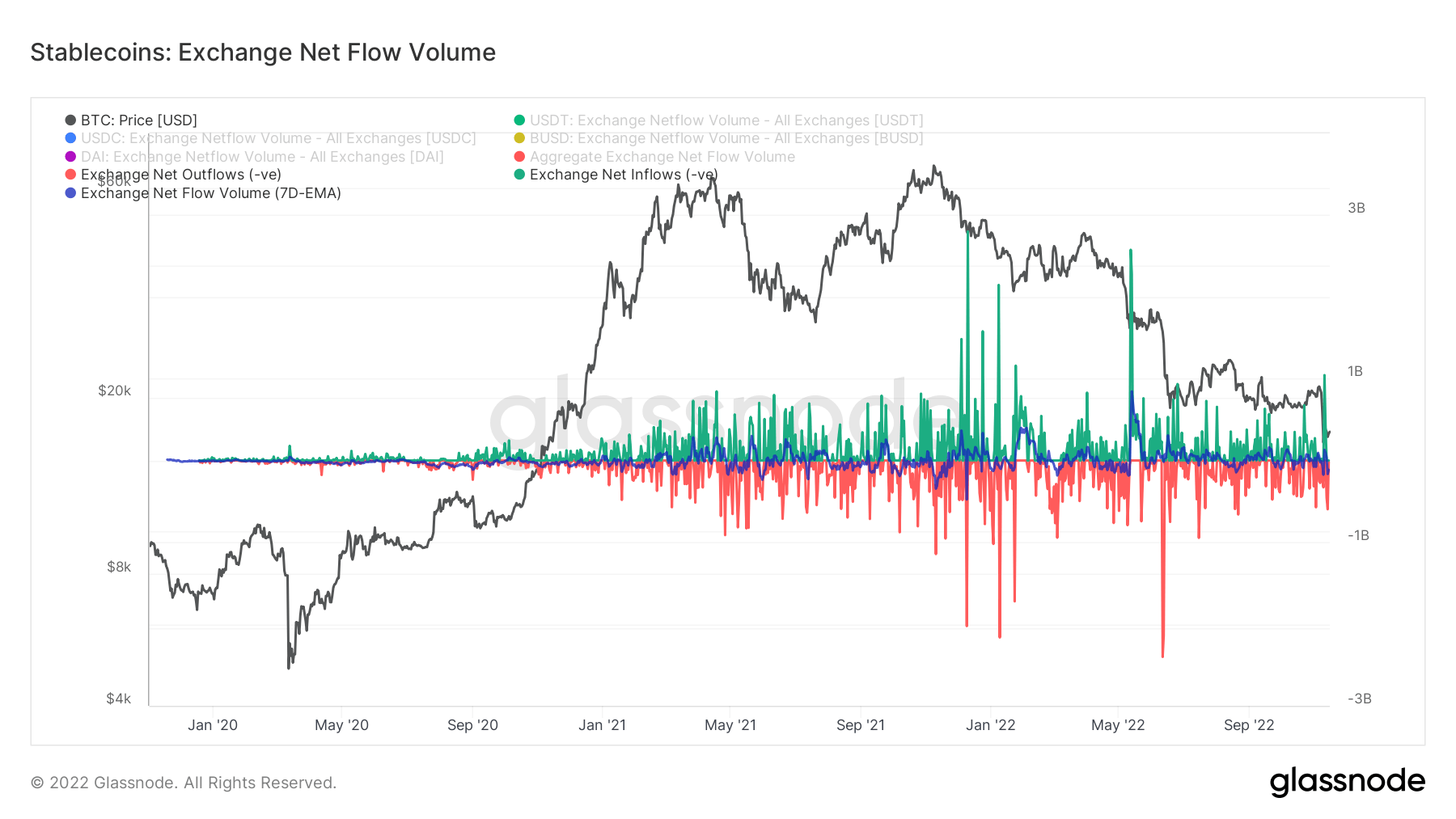

Stablecoin: Change Web Movement Quantity

The Stablecoin: Change Web Movement Quantity reveals the each day web motion of stablecoins into and out of exchanges for the highest 4 stablecoins. These are USDT, USDC, BUSD, and DAI, however the knowledge solely contains actions by way of the Ethereum blockchain.

Constructive web stream (inexperienced) refers to inflows of stablecoins into exchanges, rising the availability held. Destructive web stream (crimson) is when exchanges expertise total outflows.

The chart beneath reveals present inflows are available in at over $1 billion, marking the seventh-highest inflows thus far – offering additional affirmation of merchants readying to pounce as soon as favorable market situations current.