Lido (LDO) staked Ethereum (stETH) traded at a reduction to Ethereum (ETH) on Curve after a whale eliminated 84,131 ETH ($101 million) from the protocol, permitting arbitrageurs to revenue from the scenario.

Peckshield additionally reported {that a} whale withdrew 42,400 stETH from Aave.

#PeckShieldAlert A Whale has withdrawn ~42.4k $stETH (~$50M) from Aave Protocol V2 pic.twitter.com/d0lcbf0cFC

— PeckShieldAlert (@PeckShieldAlert) November 24, 2022

Lookonchain reported that an MEV bot arbitraged 104 ETH ($124,800) from this example. In accordance with the on-chain analytics, the bot transactions took this format:

“MEV Bot makes use of flash mortgage to acquire 8,000 WETH from 0x2718. His alternate path is 8,000 ETH → 8,272 stETH → 7,537 wstETH → 8,104 WETH.”

An hour in the past, a whale eliminated 84,131 $ETH ($101M) from #Curve. Which prompted the stETH/ETH pool out of stability, and stETH/ETH depegged to 0.9682.https://t.co/0jdd8VeYCg

SmartMoneys have already made cash on the momentary depegging of stETH/ETH.

1.🧵

Share with you. pic.twitter.com/G1UDBqYK91— Lookonchain (@lookonchain) November 24, 2022

One other dealer, Mandalacapital.eth, has longed stETH on Aave with a plan to take revenue after stETH/ETH returns to peg. The dealer deposited 4,513.70 stETH on Aave to borrow 3,193 ETH. He then exchanged the borrowed ETH for 3,258.46 stETH and borrowed once more to extend the lengthy leverage.

3.

mandalacapital.eth longs stETH on #AAVE and takes revenue when stETH/ETH returns to the peg.

He deposited 4,513.70 stETH to #AAVE and borrowed 3,193 ETH.

Alternate 3,193 ETH for 3,258.46 stETH.

Then borrow once more to extend the leverage of lengthy.https://t.co/nUTSbJKZH3 pic.twitter.com/KkTTwMaNCv

— Lookonchain (@lookonchain) November 24, 2022

In one other case, an tackle exchanged 2000 ETH for two,053.48 stETH at a fee of 0.974. Because of this they will later redeem it for ETH. That may imply a revenue of 53.4 ETH.

4.

Handle “0x9026” swaped 2,000 $ETH for two,053.48 stETH at a fee of 0.974.

When stETH is redeemable, he can redeem 2,053.48 $ETH at a ratio of 1:1 and make a revenue of 53.48 $ETH ($64,176).https://t.co/dYKj3qjhpd pic.twitter.com/fYleOT8cK9

— Lookonchain (@lookonchain) November 24, 2022

Following Terra’s implosion in Might, stETH/ETH depeg prompted large market volatility and liquidity points that affected bankrupt crypto corporations like Celsius and Three Arrows Capital.

In accordance with CryptoSlate knowledge, ETH is presently up by 2.8% and buying and selling at $1,196, whereas stETH is up by 2.4% and price $1,172. The stETH-ETH peg is at 0.9817.

Wrapped Bitcoin depeg

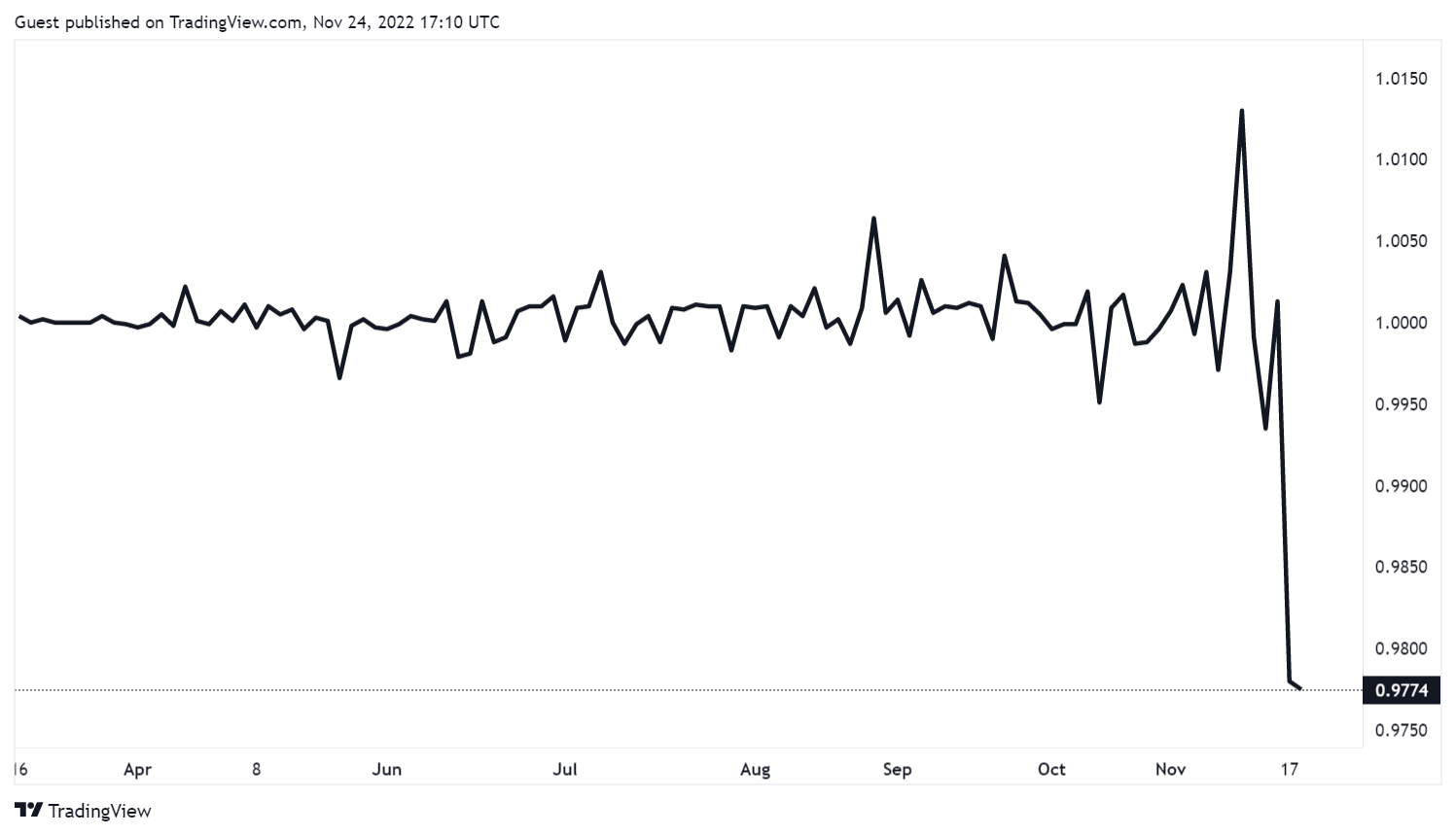

Tradingview knowledge reveals that Wrapped Bitcoin (WBTC) has depegged for over every week. In accordance with the graph beneath, WBTC misplaced its parity with Bitcoin (BTC) on Nov. 13, when it fell to 0.9990.

Since then, the chasm has widened and fallen to 0.9774. Wrapped Bitcoin is an ERC-20 token. It’s a 1:1 illustration of BTC on the Ethereum blockchain community.

The depeg locations 235,000 WBTC in danger as arbitrageurs might reap the benefits of the scenario.

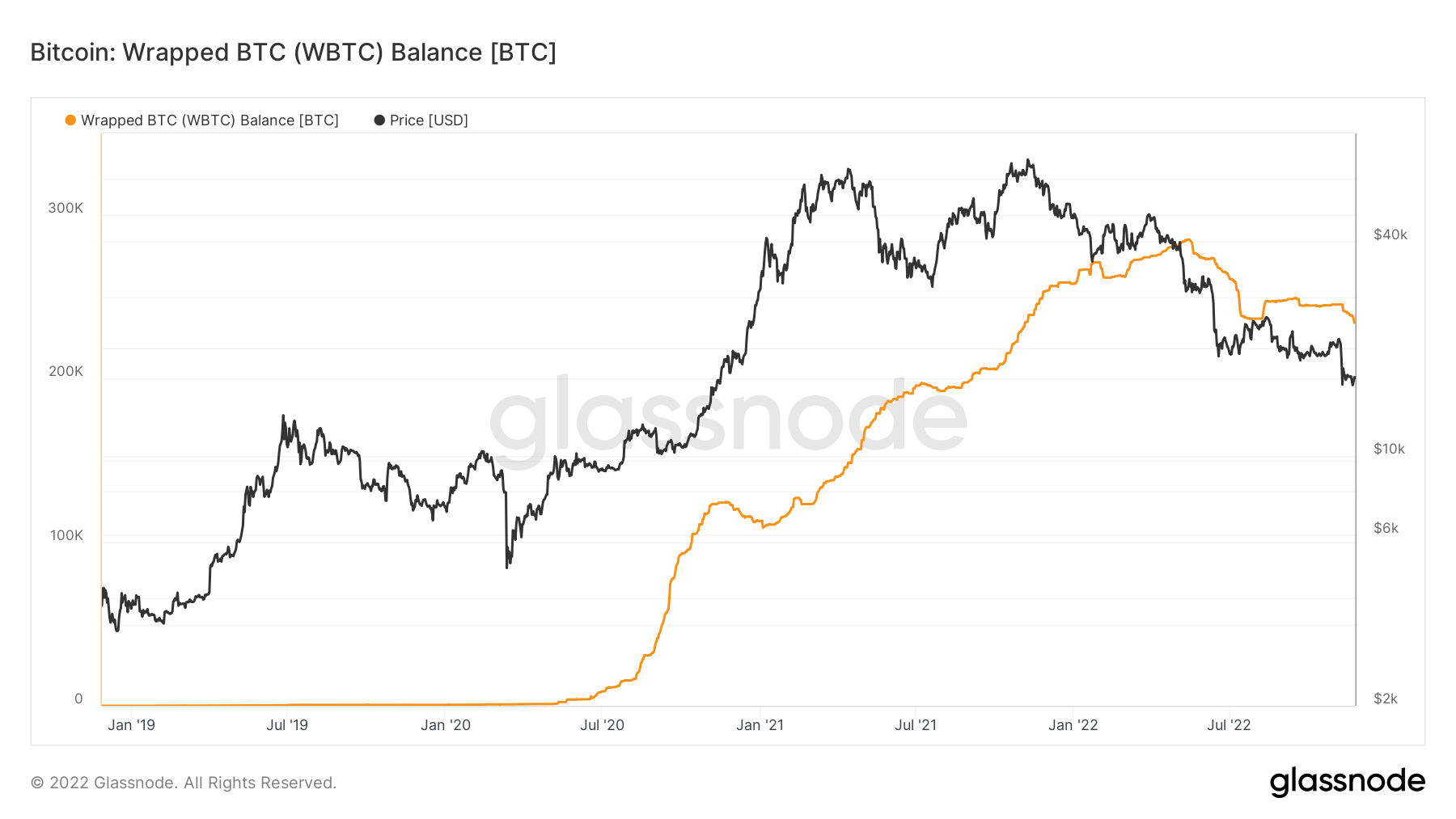

In the meantime, Glassnode knowledge reveals that WBTC provide has decreased by 50,000 since Might 2022 when the business was reeling from Terra LUNA’s crash.

WBTC is buying and selling for $16,573, whereas BTC is exchanging palms for $16,634, in accordance with CryptoSlate knowledge.