CryptoSlate’s evaluation of gasoline consumption on the Ethereum (ETH) community based mostly on transactions interacting with non-fungible tokens contracts confirmed that OpenSea’s gasoline utilization has declined to nearly zero.

The evaluation included token contract requirements (ERC721 and ERC1155) and different NFT marketplaces like LooksRare, Rarible, and SuperRare.

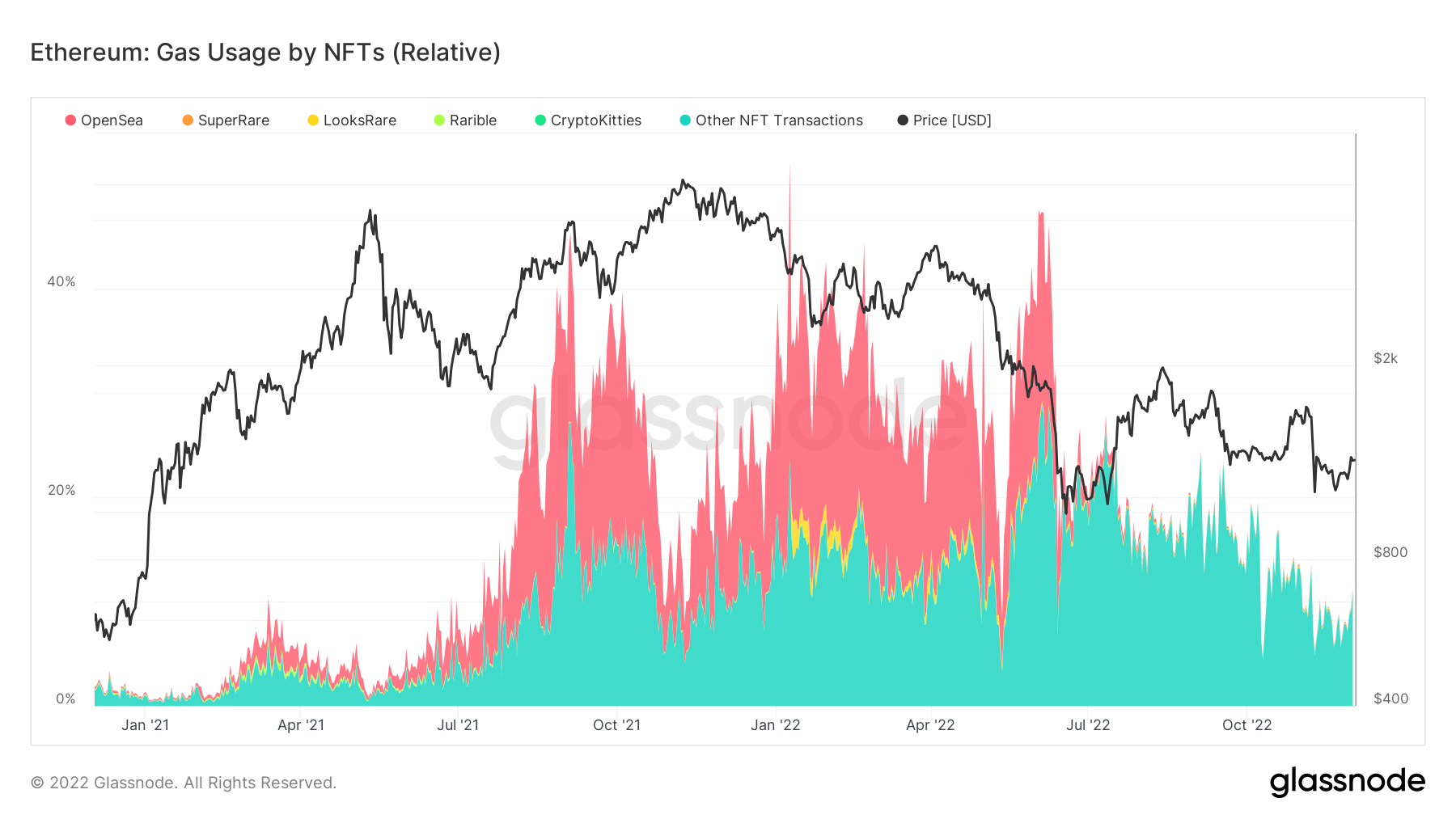

In accordance with the above chart, general gasoline charges in transactions associated to NFTs peaked between October 2021 and January 2022. Throughout this era, OpenSea accounted for roughly 20% of NFT gasoline consumption on Ethereum.

The most important NFT market was nonetheless capable of keep its dominance in gasoline consumption till July, when it started to say no quickly –this coincided with when the bear market was negatively impacting NFT gross sales.

OpenSea’s Ethereum NFTs buying and selling quantity has declined for 5 consecutive months, in accordance with dune analytics information.

Layer2 networks’ gasoline consumption crosses $100 billion

In the meantime, Ethereum layer2 networks spent over $100 billion in gasoline charges to validate transactions and function their bridges on the mainnet in November, in accordance with information shared by Paolo Rebuffo.

In November 2022 for the primary time, L2 techniques consumed greater than 100b gasoline to validate transactions and function their bridges on L1. 6 months in the past in Might 2022 the 50b gasoline threshold was exceeded for the primary time.

A doubling time of the gasoline consumed by the l2 techniques of 6 months. pic.twitter.com/hgUmKrx9pl— funnyking.eth zkHODLER 🦦🐛🦈 (@PaoloRebuffo) November 28, 2022

This represented an over 100% progress from the beginning of the yr when the gasoline charges was $33.2 billion.

In accordance with the info, Optimism was chargeable for nearly 50% of the gasoline charges, whereas Arbitrum took 30% of the charges. Different networks like dYdX, Loopring, and Starkware accounted for the remainder.