In distinction to Sam Bankman Fried’s current claims that he wasn’t conscious of Alameda’s place, Forbes just lately launched its communication with SBF when drafting their billionaires’ listing, indicating that he was properly versed in Alameda’s funds.

Throughout his current interview with the New York Occasions, the ex-CEO stated Alameda made dangerous investments on the FTX platform as a result of it had an excessive amount of leverage and that he didn’t perceive what the corporate was doing.

“It’s not an organization I run. It’s not an organization I’ve run for the final couple of years. And Alameda’s funds I used to be not deeply conscious of. I used to be solely surface-level conscious of Alameda’s funds,” SBF said through the interview.

Amid these developments, curiously, just a few billionaires got here to Bankman-Fried’s protection.

Name me loopy, however I believe @sbf is telling the reality.

— Invoice Ackman (@BillAckman) November 30, 2022

Together with Invoice Ackman, FTX investor O’Leary, additionally a spokesperson for the change, expressed his assist for Bankman-Fried.

I misplaced tens of millions as an investor in @FTX and bought sandblasted as a paid spokesperson for the agency however after listening to that interview I’m within the @billAckman camp in regards to the child! https://t.co/5lWzTT7JEv

— Kevin O’Leary aka Mr. Great (@kevinolearytv) December 1, 2022

Forbes’ current revelations about SBF inform a distinct story

Bankman-Fried despatched Forbes paperwork exhibiting his possession stakes in Alameda (90%) and FTX (about 50%) and screenshots of wallets holding cryptocurrencies in January 2021.

SBF says he was “not deeply conscious of” Alameda’s funds

Forbes says he despatched them particulars of Alameda’s holdings as just lately as Augusthttps://t.co/SVR3XJuvc5 pic.twitter.com/PHek7Tx7qv

— db (@tier10k) December 2, 2022

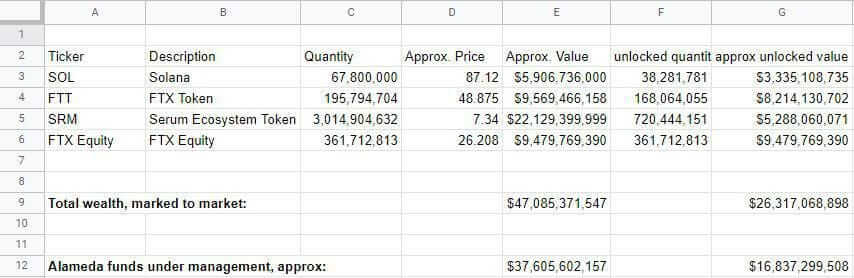

In response to the revelations, he despatched a Google Sheet itemizing his property, together with FTX fairness, 67.8 million Solana tokens, 193.2 million FTT tokens, and three billion Serum tokens.

Following that, Forbes additionally caught periodic modifications to the Google sheet when calculating the annual World’s Billionaires listing.

As crypto costs rose, Alameda elevated its share of FTT tokens to 195.8 million. In consequence, the “Alameda funds underneath administration, approx.” row learn $37,605,602,157.

“A separate column, itemizing solely tokens that have been unlocked–which means in a position to be transacted–pegs Alameda’s whole funds at a extra modest $14.7 billion. Updates like this arrived periodically–virtually every time Forbes requested for them,” Forbes said

The Google Sheet was then modified in September 2021 to incorporate an up to date tab, “Alameda’s funds underneath administration,” which had grown to $37.6 billion, $16.8 billion, counting solely unlocked tokens.

It was in March 2022 that Bankman-Fried up to date the spreadsheet once more with further particulars about Alameda’s possession share. FTT holdings have been all the way down to 176 million tokens; Solana was all the way down to 53 million.

SBF once more guided Forbes by his web price two months earlier than FTX collapsed, offering a desk of FTX and FTX U.S.’ largest shareholders. On a brand new tab within the spreadsheet, Alameda’s holdings have been additionally proven, with 53 million, 3 billion, and 176 million shares of Solana, Serum, and FTT, respectively.

On the time, Bankman-Fried’s administration share of Alameda’s funds totaled $8.6 billion, or $6.4 billion, counting solely unlocked tokens.

Some Twitter customers have taken pictures on the former CEO of FTX following the current revelations:

Serving to Forbes develop image of web price is a large pink flag. Most billionaires wish to preserve their wealth as stealthy as potential.

— Ben Davenport (@bendavenport) December 2, 2022

Forbes said.

“The extent of element Bankman-Fried offered to Forbes through the years exhibits that he had detailed data of a few of Alameda’s holdings and not less than some data of the transactions it was making, particularly in 2021, regardless of stepping again from operating the hedge fund after cofounding FTX in 2019.”