Because the starting of the yr, the normal monetary market has been on a gradual downward spiral. Russia’s invasion of Ukraine appears to have acted as a spark that ignited the issues which have been piling up because the starting of the pandemic, devastating most belongings in its manner.

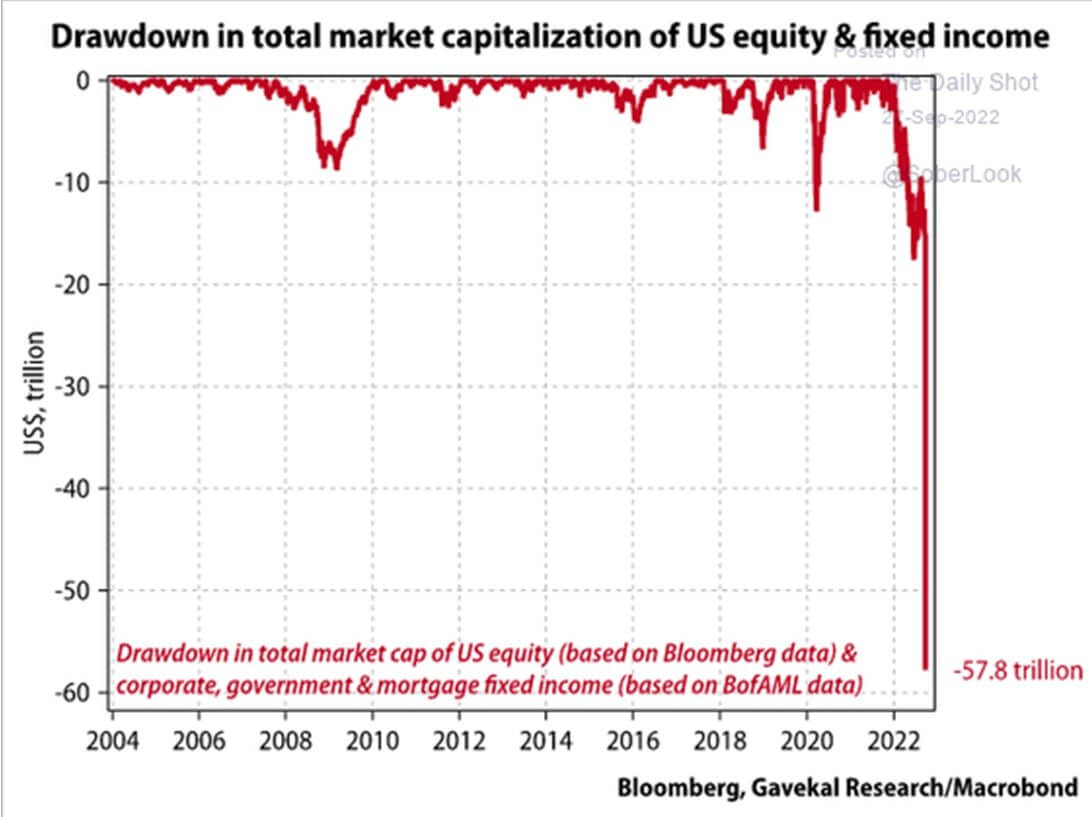

In response to information from Bloomberg, nearly $60 trillion has been worn out from the entire market cap of U.S. fairness and stuck earnings since February. The present drawdown exceeds the market downturns seen originally of the pandemic in 2020 and through the Nice Monetary Disaster in 2008.

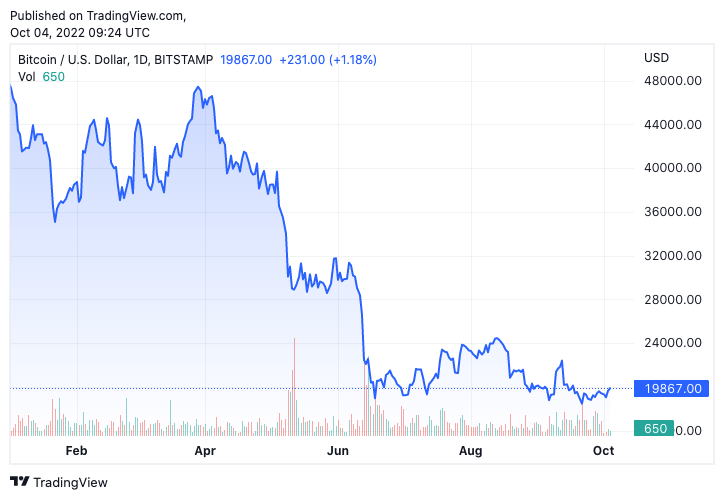

Bitcoin hasn’t been resistant to the macro elements which have been devastating the tradfi markets. After the collapse of Terra (LUNA) in June, Bitcoin did not get better and has been on a turbulent path of transient upswings and sharp corrections.

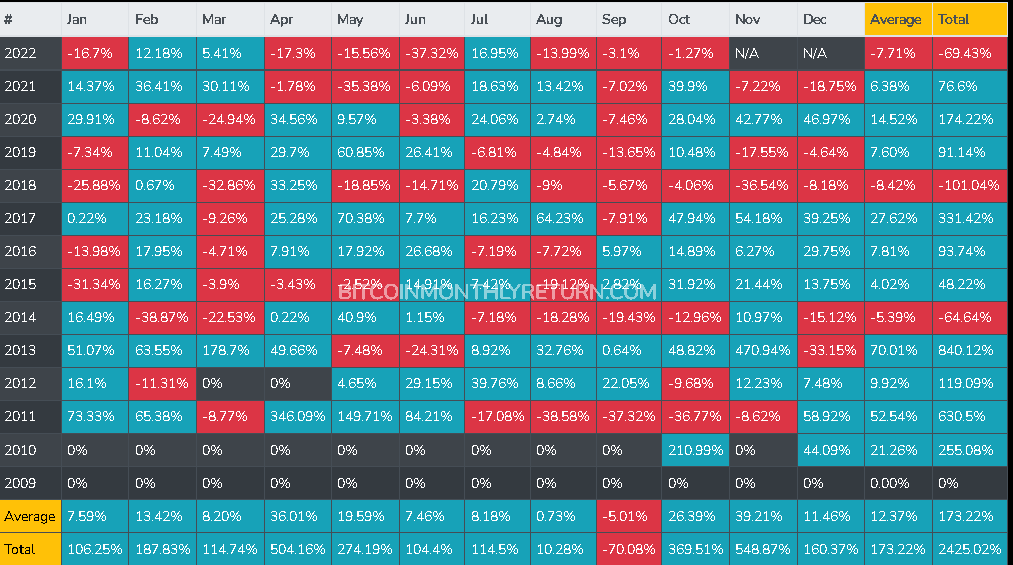

Nevertheless, Bitcoin’s lack of upward momentum could possibly be short-lived. September has traditionally been the worst month for Bitcoin — it failed to shut the month within the inexperienced since 2016. Final month, Bitcoin closed the month at -3.1%, properly under its month-to-month common of -5.01%.

October, then again, has traditionally marked the start of a bullish quarter for the cryptocurrency, with Bitcoin’s month-to-month common shut standing at 26.39%. It has additionally traditionally been the second-best month for Bitcoin, because it posted an gathered complete enhance of 369.5% since 2009. Your entire fourth quarter additionally noticed traditionally constructive closes.

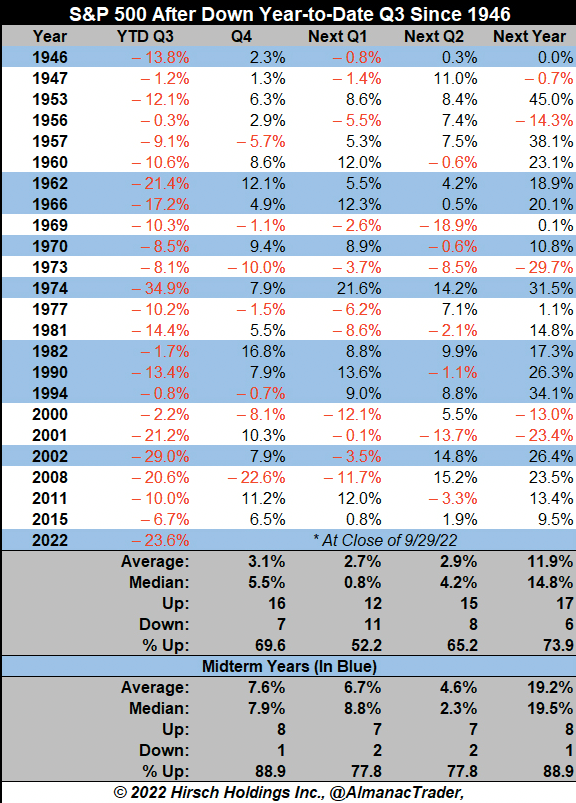

A September massacre is a recurring theme on this planet of conventional finance as properly. Since 1946, the S&P 500 posted unfavorable year-to-date returns within the third quarter 23 occasions. Out of the 23 unfavorable third quarters the S&P 500 noticed, round 70% had been adopted by a fourth quarter with constructive returns. Throughout a yr with midterm elections, this quantity rose to 89%.

If each markets proceed their historic patterns, we might see the strain lower as October closes and a comeback of constructive returns. Nevertheless, with international macroeconomic elements persevering with to worsen and placing extra strain on each markets, there’s an equally excessive likelihood that these patterns might break.