Whereas the variety of new customers getting into GameFi has dropped precipitously, the common variety of transactions per person is growing steadily. Subsequently, with the customers out there right now extra prone to be actively gaming, GameFi knowledge from August may also help us perceive which tasks and ecosystems are sustainable in the long term.

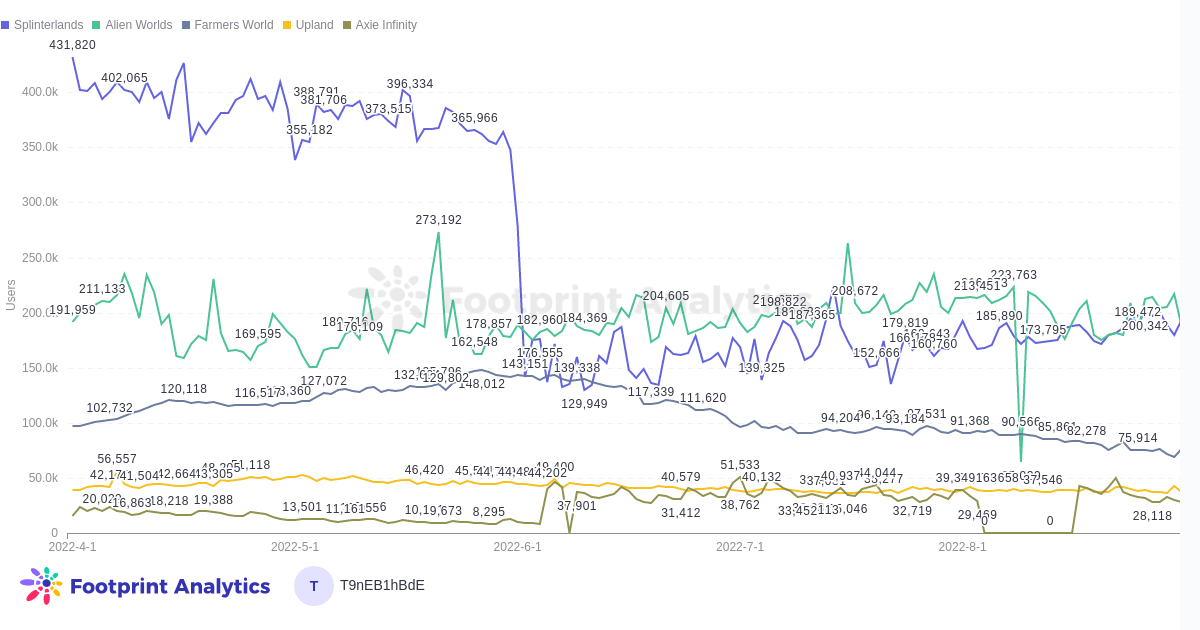

Splinterlands and Alien Worlds proceed to be neck-and-neck as they steadily enhance the variety of customers since June regardless of the market. In distinction, as soon as promising Farmers World continues to bleed customers.

A large $200M funding spherical for stealth mode Web3 gaming studio Restrict Break and huge rounds for different builders like Animoca and Gunzilla Video games present that buyers are banking on studios to hold the torch as soon as the market reverses.

Key Findings

General Market

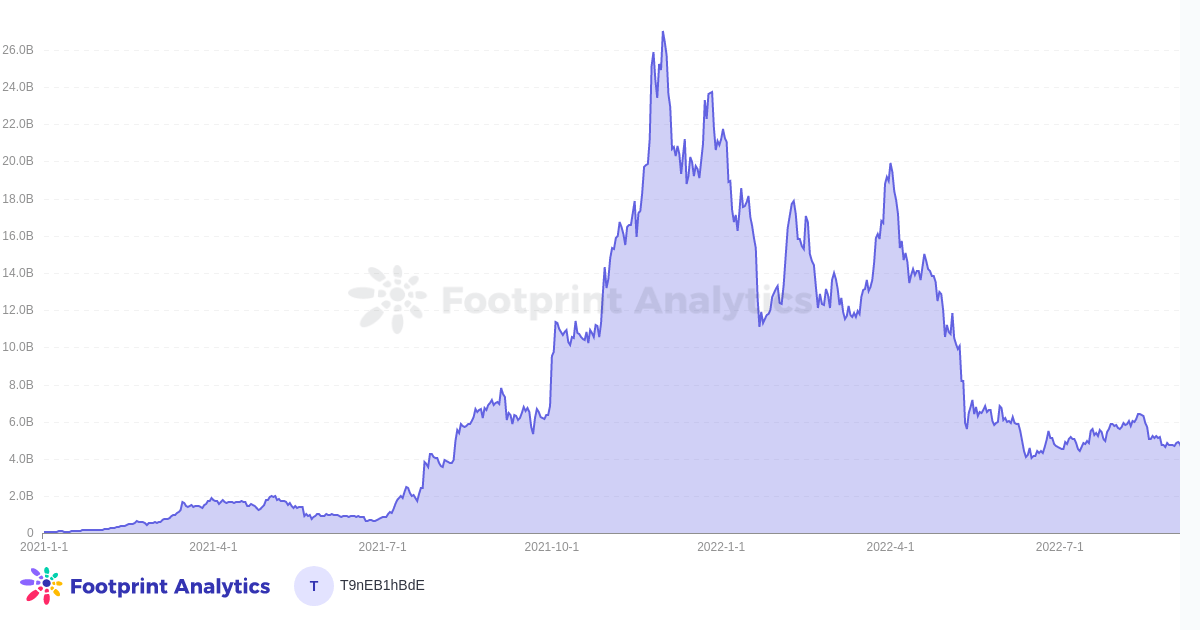

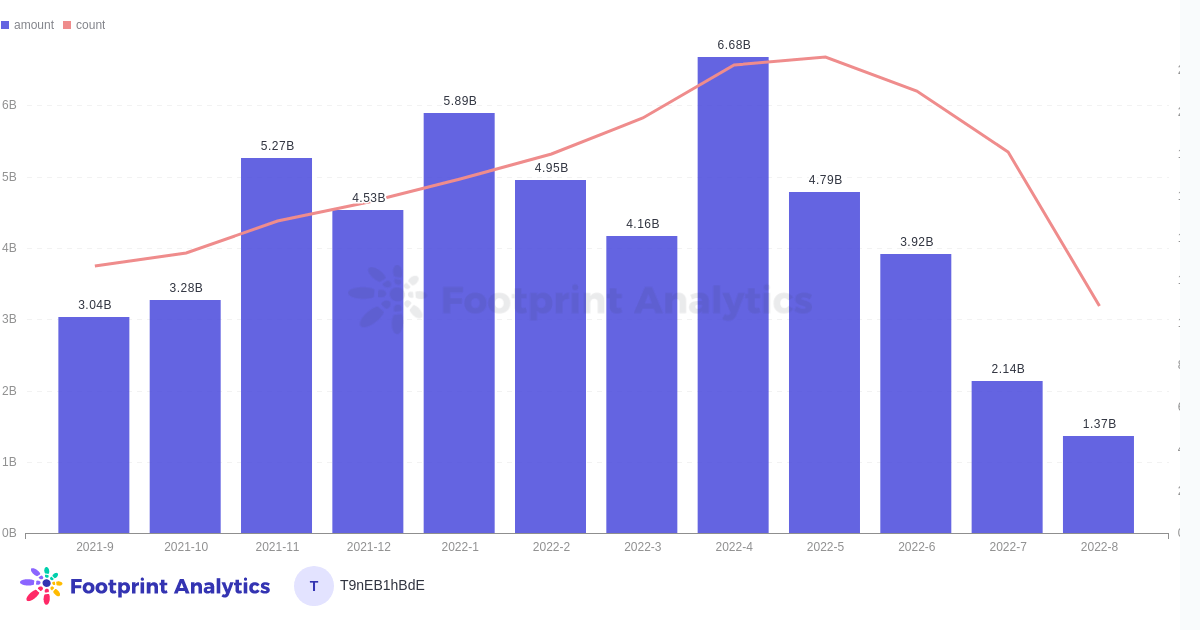

- The entire quantity in GameFi noticed its first MoM respite after 9 months of consecutive declines, rising 28% p.c—not sufficient to interrupt the general downwards pattern or warrant celebration simply but

- For perspective, quantity in August was 93.5% below its December 2021 highs on the peak of the bear market

- Whereas the quantity per person declines, the transactions per person enhance—there is no such thing as a easy conclusion to attract. Nonetheless, it might imply that contributors out there right now usually tend to be actively gaming and having fun with the video games.

- BNB has a comparatively tiny portion of quantity (10.6%) and of gaming transactions (below 5%) regardless of having probably the most tasks—lending credence to the argument that the chain is stuffed with vaporware video games no person needs to play.

Financing & Funding

- The quantity of funding raised within the GameFi house dropped 36% MoM from $2.14B to $1.37B. The variety of rounds continues to break down precipitously.

- Recreation builders and studios closed 4 of the highest 10 largest funding rounds in August.

- This displays an ongoing pattern on this bear market the place buyers are betting massive on Web3 sport studios and conventional builders and searching for to enter GameFi.

- Among the many rounds in August was one other $45M for Animoca Manufacturers, which has dozens of blockchain video games in its portfolio, together with The Sandbox, Loopy Protection Heroes, and the upcoming Phantom Galaxies. The spherical brings the corporate’s whole funding funding to $775.3M.

GameFi Customers

- MAU continued for the sixth month of decline (by 9.4%), whereas the variety of new customers/contributors in GameFi elevated by 19.8% MoM.

- There have been no important shifts within the distribution of customers among the many main chains; nonetheless, ThunderCore rapidly emerged to take up 4.5% of customers. The most important sport on ThunderCore is JellySquish, which averaged round 400-600 customers per day in August.

Initiatives Overview

- Since Splinterlands’ collapse in person numbers in June, the sport has been steadily rebuilding, rising by 54% from its low on June 6 to its excessive on August 26.

- Alien Worlds continued to be neck-and-neck with Splinterlands, vying for the most well-liked blockchain sport spot.

- Apparently, each Splinterlands and Alien Worlds are comparatively fundamental card and text-based video games with no skill for the person to regulate characters or work together with a 3D world—demonstrating the primitiveness of the present GameFi business.

- Farmers World continued to bleed customers, reaching an August low of 66,228 lively every day customers on the thirtieth, a 55% decline from its ATH in Might.

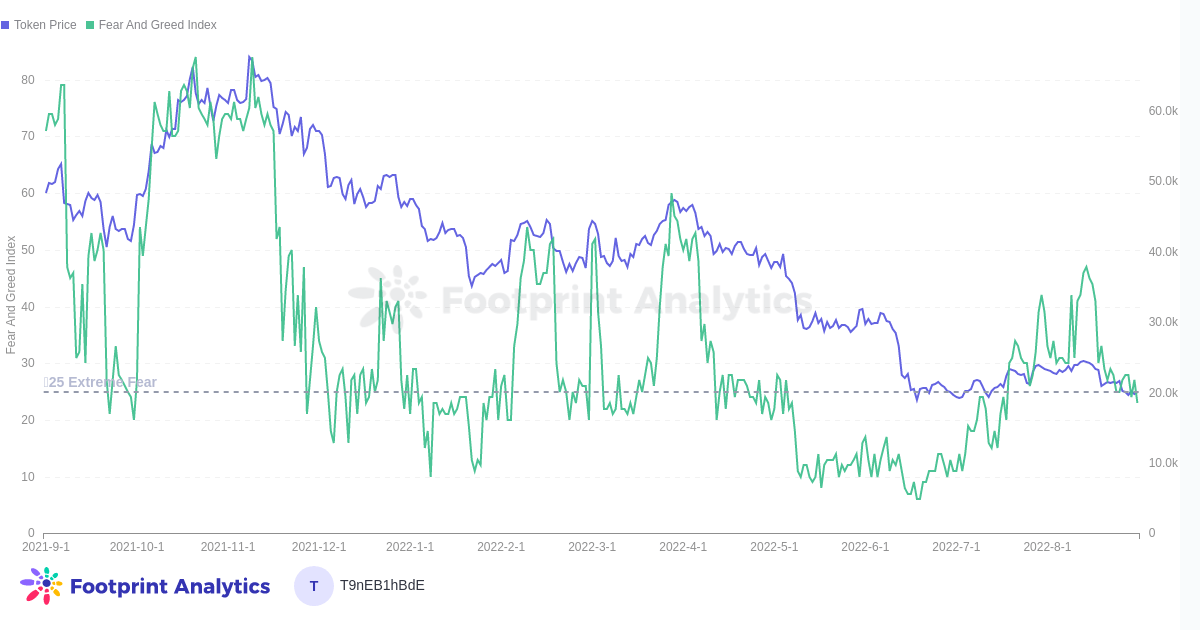

Crypto Macro Overview

The crypto market noticed its most substantial rally in half a 12 months from mid-July to August, spearheaded by Ethereum’s leap above $2,000 in mid-August.

Explanations embrace:

- Anticipation for The Merge will see Ethereum transfer to Proof of Stake (and ultimately burn provide).

- The doable starting of much less aggressive financial tightening by the Federal Reserve.

- Only a useless cat bounce on the best way to decrease lows.

GameFi doesn’t rapidly get better on macro information

Both means, the pattern didn’t translate to a major enhance in market cap or customers for many video games. The entire GameFi token market cap rallied precariously in mid-August to $6.43 billion however then declined by 26% by the tip of the month.

Most concerningly, the variety of new GameFi customers continues to sit down at excessive lows. It’s because the GameFi sector takes extra sources and time funding to re-enter than others, requires lively participation to generate yield, and remains to be extremely speculative.

Splinterlands and Alien Worlds present a sustainable participant base

In addition to a collapse for Splinterlands person numbers in June, Splinterlands and Alien Worlds have proven regular development of their person numbers.

Apparently, each Splinterlands and Alien Worlds are comparatively fundamental card and text-based video games with no skill for the person to regulate characters in an immersive world. Nonetheless, they contain technique on the participant’s half to win and obtain profitability.

Each are removed from what individuals think about gaming to seem like in 2022 (the subsequent main cohort of video games, which incorporates Illuvium and Phantom Galaxies, goals to redress this.)

Traders wager massive on sport builders and studios

Whereas general funding has tanked, buyers nonetheless shut rounds for confirmed groups with a document of viable merchandise in both Web3 or Web2.

The highest financing rounds in August mirror a pattern that’s been lengthy constructing—buyers are closing funding for Web3 sport studios, and conventional builders are actually searching for to enter GameFi. Studios and builders have had considerably extra success on this bear market than GameFi infrastructure tasks or particular person video games.

Among the many rounds in August was $45 million for Animoca Manufacturers, which has dozens of blockchain video games in its portfolio, together with The Sandbox, Loopy Protection Heroes, and the upcoming Phantom Galaxies. The spherical brings the corporate’s whole funding funding to $775.3 million.

The highest spherical for the month went to Restrict Break, the studio behind the DigiDaiku NFT assortment with plans to launch free-to-play blockchain video games.

Abstract

By the numbers, the GameFi business has had a foul month in August as its rut continues, with little reduction from the month’s Ethereum-driven rally.

General quantity, the variety of new tasks, and funding keep close to July ranges or drop additional.

Nonetheless, now is a good time to construct—confirmed builders and studios with concepts for future blockchain video games and metaverse tasks proceed to obtain document funding rounds. With the healthiest video games proper now being the comparatively fundamental Splinterlands and Alien Worlds, there’s a variety of room for enchancment.

The Footprint Analytics neighborhood contributed to this piece.

The Footprint Neighborhood is a spot the place knowledge and crypto lovers worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or some other space of the fledgling world of blockchain. Right here you’ll discover lively, numerous voices supporting one another and driving the neighborhood ahead.