Crypto influencer Ben Armstrong (BitBoy Crypto) alleged that former SEC Director William Hinman accepted bribes to declare Ethereum (ETH) a commodity in an Oct. 9 tweet.

Gotta say when #ETHGate dropped I used to be about on the identical place @IOHK_Charles is. He makes many legitimate factors in thread.

Nevertheless, William Hinman definitely accepted bribes. It’s CLEAR.

My 3 largest holdings are $XRP, $ADA, & $ETH and I refuse to take sides. All of them win.

— Ben Armstrong (@Bitboy_Crypto) October 9, 2022

Armstrong made his assertion in response to Cardano’s (ADA) founder Charles Hoskinson’s ideas on the difficulty of corruption amongst SEC officers.

Hoskinson urges Ripple attorneys to argue in opposition to XRP being safety

In response to Hoskinson, Ripple’s attorneys needs to be arguing that an impartial and decentralized token like XRP shouldn’t be declared safety as a substitute of implying that the SEC gave ETH a free move due to corruption.

Analyzing the allegations of corruption appears to indicate that Ethereum must also be sued by the SEC however wasn’t due to relationships. However how does this in any manner clear up the bigger difficulty of cryptocurrencies being pressured right into a framework that is unnecessary? (9/16)

— Charles Hoskinson (@IOHK_Charles) October 8, 2022

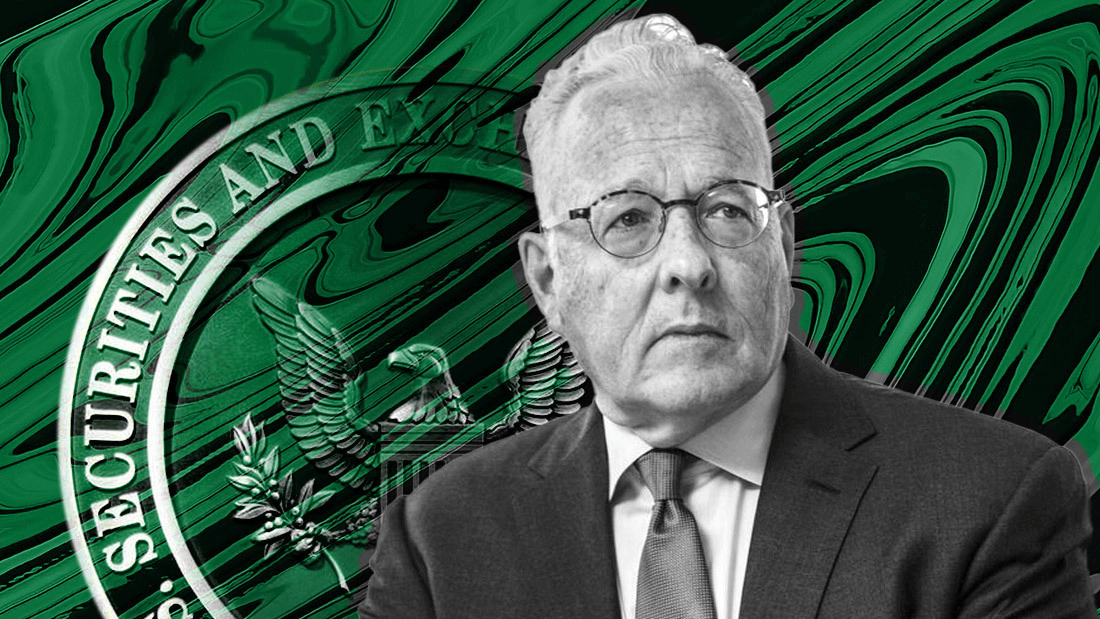

Ripple’s neighborhood had recommended that SEC’s former director William Hinman accepted bribes from companies with a monetary curiosity in ETH. In response to them, this was why the previous director declared that Bitcoin (BTC) and Ethereum weren’t securities in a 2018 speech.

In the meantime, some inside the XRP neighborhood didn’t agree with Hoskinson’s views, arguing that his description of the allegations as a conspiracy concept derailed the case.

Professional-XRP lawyer John Deaton insists that allegations in opposition to Hinman matter considerably and are based mostly on details, not conspiracy.

BitBoy acknowledged that he believes Hoskinson has legitimate factors. Nevertheless, he declared:

“William Hinman definitely accepted bribes. It’s CLEAR.”

SEC has refused to launch Hinman’s speech

U.S. SEC has refused to launch the controversial Hinman’s 2018 speech, arguing that the speech is irrelevant to the case.

U.S. District Decide Analise Torres not too long ago ordered the fee to launch the speech to Ripple — the second time a decide ordered the SEC handy over the paperwork.

Ripple not too long ago criticized the SEC for opposing the amicus briefs filed by two companies utilizing its blockchain expertise. In response to the crypto agency, the filings had been meant to assist the court docket.

Hoskinson and Ripple’s co-founder requires regulation

Hoskinson additional reiterated his opinion, saying, “your complete XRP affair shouldn’t have occurred.”

I agree with @IOHK_Charles on the bigger level at hand – there isn’t a regulatory readability on classify and use crypto within the US, which is why the SEC is utilizing regulation by enforcement to deliver all crypto beneath their remit. This impacts all of us.

— Chris Larsen (@chrislarsensf) October 9, 2022

Ripple co-founder Chris Larsen agreed that the extra crucial difficulty is the shortage of regulatory readability on the classification and use of crypto.

He additional counseled Hoskinson’s work on creating a code for Proof of Helpful Work, an try and make Bitcoin carbon-negative.