CryptoSlate’s evaluation of Bitcoin’s (BTC) realized value and value foundation cohorts revealed that the transition from the present bear market may doubtlessly transition to a bull market by the tip of the primary quarter of 2023.

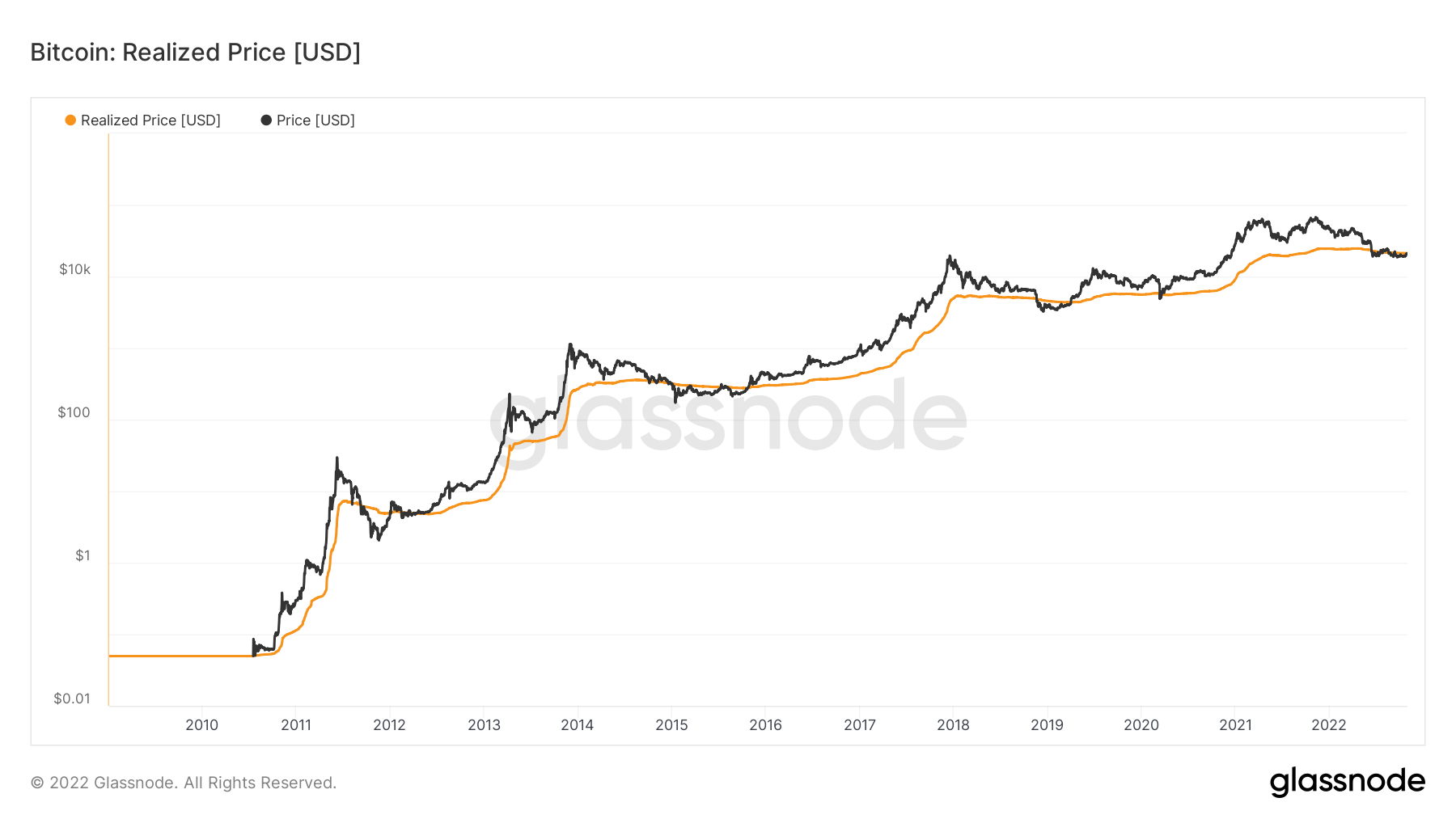

Realized Worth

The realized value is calculated by dividing Realized Cap by the present provide.

The realized cap metric is barely totally different than the market cap. Whereas the market cap makes use of the present value of an asset, the realized cap makes use of the worth on the time it final moved. It considers totally different components of the provides at totally different costs as a substitute of taking the every day closing value.

Particularly, it’s computed by valuing every unspent transaction output (UTXO) based mostly on the worth when it final moved.

When Bitcoin’s actual value fell beneath $20,000, it additionally fell beneath the realized value and has been battling to beat it. On the time of writing, Bitcoin is buying and selling round $20,430, which brings the realized value simply above $21,000.

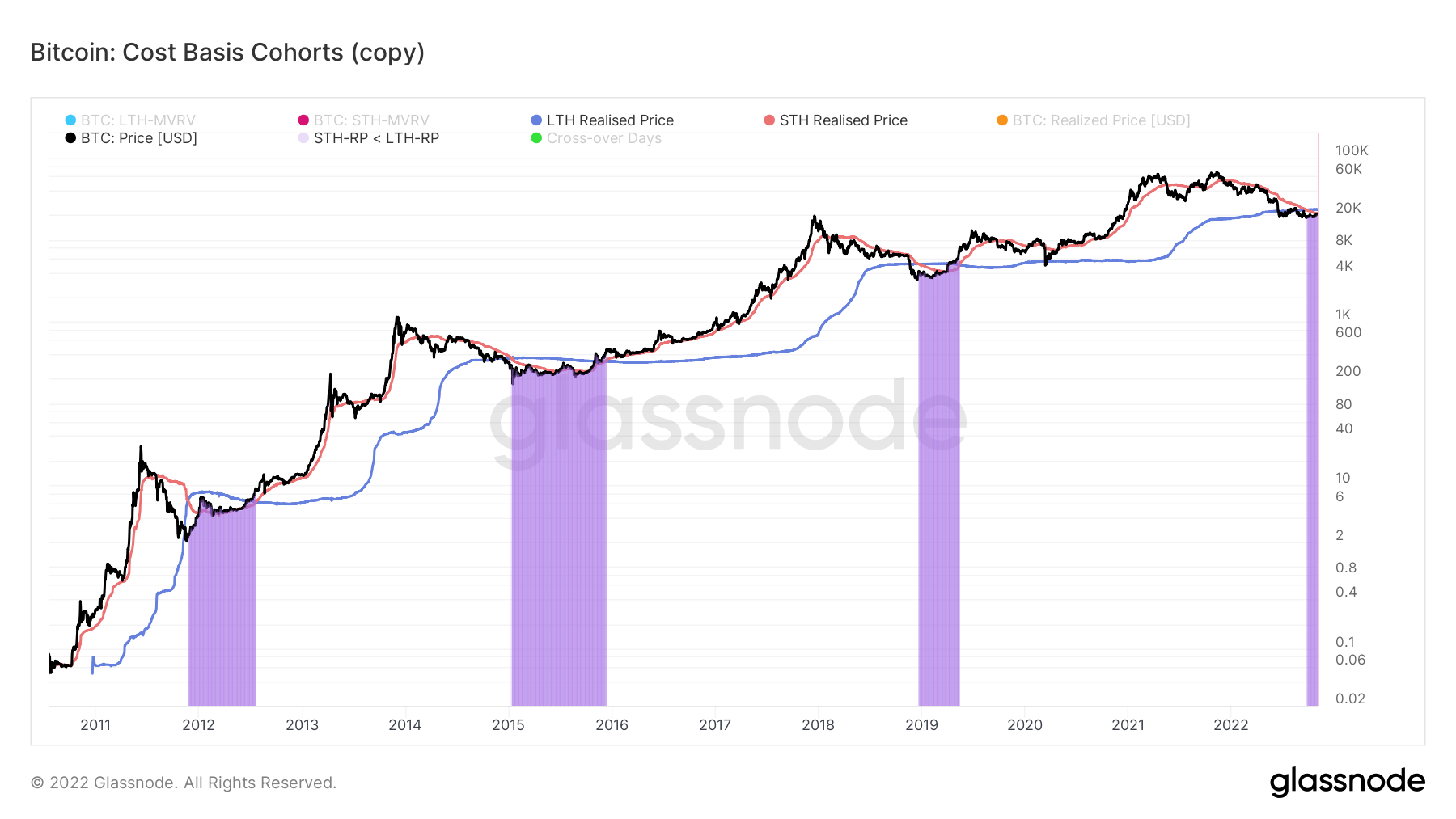

Price Foundation Cohorts

The realized value mirrored the combination value when every coin was final spent on-chain. Due to this fact, the realized value for short-term holders (STH) and long-term holders’ (LTH) cohorts may be calculated to replicate the combination value foundation for each teams.

When calculated, LTH and STH value foundation ratios replicate the ratio between the realized value of LTH and STH. If this metric seems as an uptrend, it signifies a bear market setting the place the STHs are dropping at a higher price compared to LTHs. If it attracts a downtrend line, it displays a bull market sentiment the place LTHs spend their holdings and switch them to STHs.

The price foundation ratio displays commerce to be higher than 1.0 when the LTH value foundation level is greater than STH. This metric has beforehand signaled that the market has reached the ultimate stage of bear market capitulations.

Bitcoin’s value foundation cohorts chart reveals that the present value has fallen beneath the STH and LTH realized costs on Sept. 23 and stays beneath them as of Nov. 3.

Such a sign has solely occurred thrice earlier than — mirrored within the chart beneath with the purple areas.

In every incident, Bitcoin value surged to new all-time-high (ATH) ranges.

Bitcoin value appears to be like like it’s going to break its present resistance starting from six months to a yr — with probably the most optimistic evaluation placing it on the finish of the primary quarter of 2023.