The largest information within the cryptoverse for Nov. 8 contains Binance’s plans to amass FTX, Coinbase and Kraken’s downtime after the market plummeted, and FTX’s insolvency being questioned with transactions halted for 2 hours.

CryptoSlate Prime Tales

Binance intends to completely purchase FTX

Binance CEO Changpeng Zhao tweeted that FTX approached the alternate on the lookout for assist because it was battling liquidity on its platform.

CZ mentioned that Binance signed a non-binding letter of intent to amass FTX.

Coinbase, Kraken down as Bitcoin breaks beneath June low

Bitcoin retreated to its lowest worth since June and precipitated Coinbase and Kraken to interrupt down. Each exchanges reported that they’ve been experiencing connectivity points round 19:00 UTC.

These stories led the group to conspire if the exchanges had been down as a result of a financial institution run.

Bitcoin stability on FTX Change goes destructive – Coinglass

Over 20,000 Bitcoins had been faraway from the in FTX reserves prior to now 24 hours, which left FTX with destructive -197.95 Bitcoins.

This put FTX on the backside of the listing of exchanges with the bottom Bitcoin balances. The second lowest is Poloniex with 127.14 BTC, whereas alternate big Binance holds 573.452 Bitcoins.

Two hours with out withdrawals places FTX’s liquidity in query

FTX stopped processing any transactions on the Ethereum (ETH) blockchain for 2 hours on Nov. 8. The final transaction was recorded at round 6:18 AM EST. Contemplating the liquidity disaster FTX has been experiencing currently, the halt in transactions sparked rumors of insolvency.

A complete of $1.2 billion in crypto has been withdrawn from FTX prior to now 24 hours, whereas solely $540 million was deposited. This brings FTX to a destructive web circulation of -$653 million.

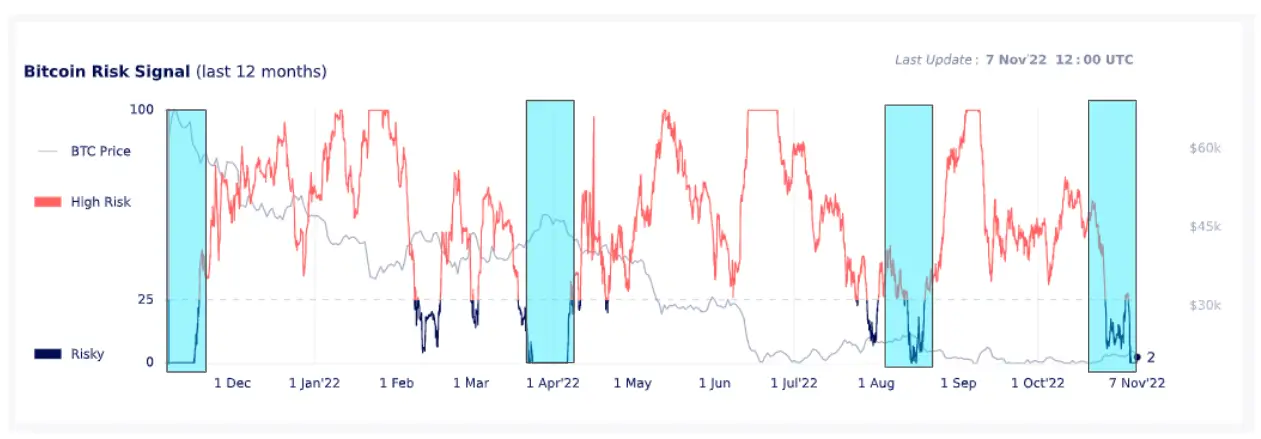

Danger Sign flashes purple as Bitcoin loses $20K amid Binance-FTX feud

Bitcoin, together with the remainder of the market, additionally fell following the FTT plummet. Responding to the autumn, Bitcoin’s danger sign sank to a low of two.

The chance sign had solely hit two on three different events since November 2021, and a significant worth fall was recorded every time.

Practically 20K Bitcoins moved to Binance from FTX over 48 hours

FTX’s Bitcoin holdings have been shrinking because the starting of November. It solely accelerated after Nov. 6, and over 20,000 Bitcoins moved from FTX to Binance since then. This motion elevated Binance’s Bitcoin holdings to over 640,000 Bitcoins.

FTX treasury misplaced over $3B in per week, whereas Binance treasury is up $2B

FTX’s Ethereum and Bitcoin reserves misplaced over $3 billion because the starting of November. Whereas FTX has been shedding funds at an accelerated fee, Binance’s reserves have been rising.

Throughout the week the place FTX misplaced $3 billion, Binance’s treasury elevated to $43 billion versus $41 billion on the finish of October.

BitDAO suspects Alameda of dumping BIT tokens, asks for proof of funds

BitDAO (BIT) and Alameda agreed to swap tokens with one another in Nov. 2021 and made a public dedication to not promote their tokens till Nov. 2024. In accordance with the deal, BitDAO obtained 3,362.315 FTT tokens whereas Alameda received 100 million BIT.

On Nov. 8, each BIT and FTT plummeted by 20%, which led BitDAO to suspect that Alameda breached its promise and liquidated its BIT holdings. The BitDAO group requested for proof of funds, and Alameda responded by shifting over 100 million BIT tokens from an FTX pockets to an Alameda deal with.

BUSD provide dominance grows as USDT’s provide drops 4%

Binance USD (BUSD) emerges because the best-performing stablecoin as its dominance elevated by 6% on the year-to-date metrics to 16%.

Within the meantime, Tether’s (USDT) dominance retreated to 50% from 54%. However, USD Coin (USDC) remained the second-largest stablecoin by market cap.

SEC victory over LBRY has ramifications for Ripple and wider crypto market

The U.S. District Court docket of New Hampshire allowed SEC’s movement for abstract judgment towards LBRY on Nov. 7. The movement confirmed LBRY had acquired a complete of $12.2 million in money and in crypto from the sale of LBRY Credit.

The character of the case has implications for the continuing Ripple (XRP) vs. SEC lawsuit. In accordance with the founding father of Crypto-Legislation. U.S, the SEC is more likely to level on the LBRY resolution to strengthen its hand towards Ripple’s claims.

Analysis Spotlight

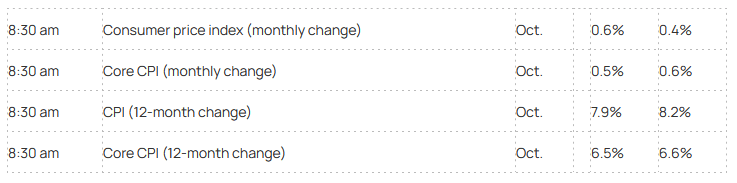

Crypto, shares brace for Thursday’s CPI announcement

Though buyers anticipate the Fed to go straightforward with the speed hikes as soon as the inflation reveals indicators of declining, metrics point out that the U.S. economic system is way from cooling.

In accordance with information, total CPI is anticipated to document a rise of 0.6% in October, which shall be a 7.9% change year-over-year.

On account of this, buyers are involved that the equities are susceptible to falling additional. Whereas they might be right, Bitcoin had proven indicators of decoupling from shares and changing into a secure haven. Nonetheless, it’s nonetheless unknown the way it will reply to the rising total CPI.

Information from across the Cryptoverse

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased by -11.81% to fall $18,364, whereas Ethereum (ETH) additionally fell by -17.15% to commerce at $1,326.