On October 3, the Bitcoin hash price soared to a brand new all-time excessive of 244.25 EH/s. Commenting on this, Binance CEO Changpeng Zhao stated, “miners know one thing we don’t.”

Two days later, the hash price surged but once more, smashing the earlier report to print a brand new all-time excessive of 314.58 EH/s, additional signaling miner confidence regardless of rising value uncertainty amid crypto winter.

In the meantime, because the November 2021 market high, mining problem has additionally elevated however to not the identical magnitude seen in hash price will increase – all of which squeezes the miners’ backside line.

The state of affairs is additional compounded by Bitcoin persevering with to commerce at comparatively low costs.

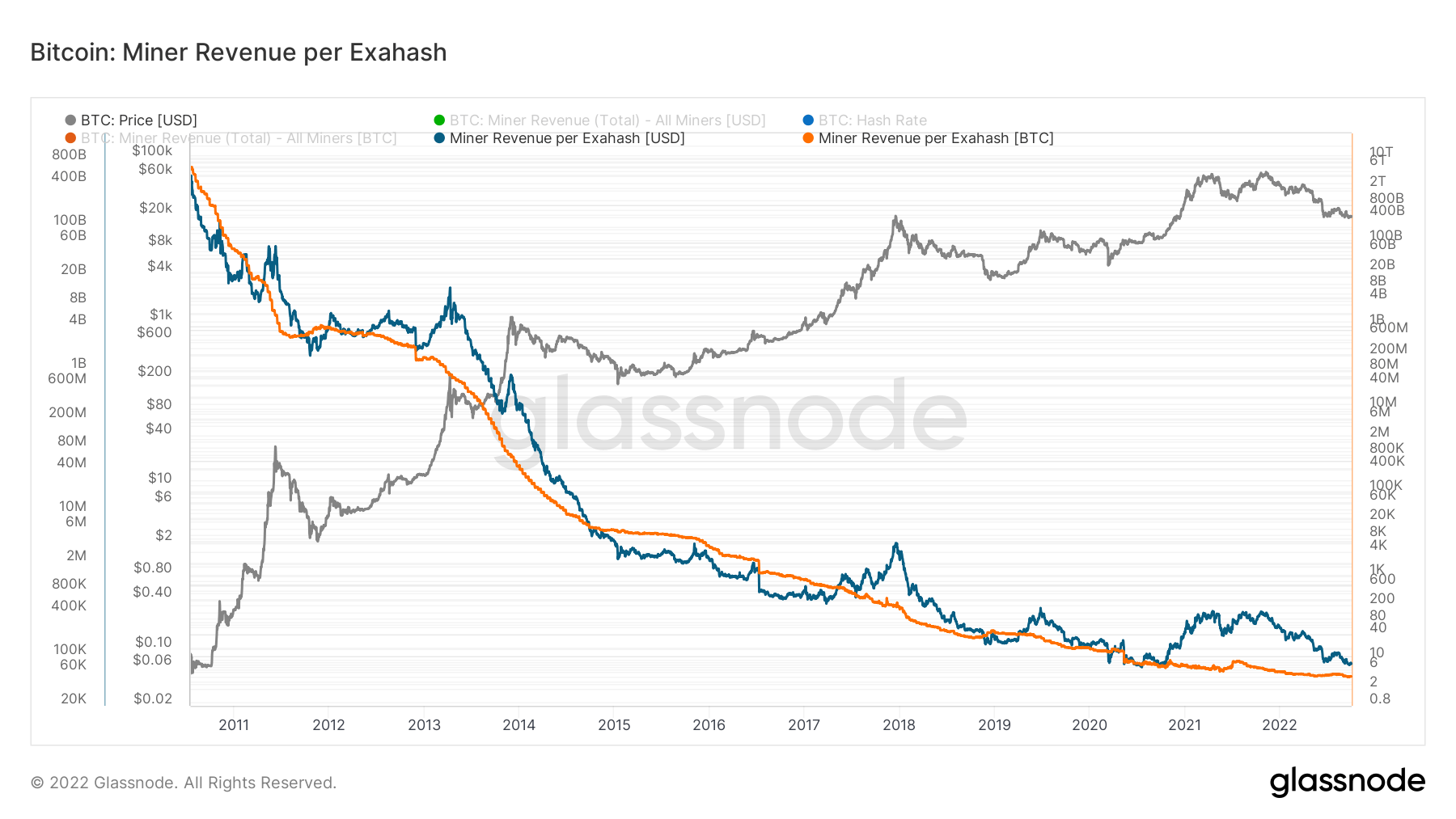

Bitcoin Mining Income slumps

The Miner Income per Exahash chart under exhibits a gentle long-term downtrend in income in each greenback and BTC phrases.

At present, BTC-denominated rewards are available as little as 4 BTC per day. This equates to round $80,000 a day in income per exahash, which is on par with revenues seen in late 2020 when Bitcoin was round $10,000.

In the meantime, mining problem has elevated alongside the hash price, which means it’s now extra demanding and aggressive to mine BTC profitably than ever earlier than.

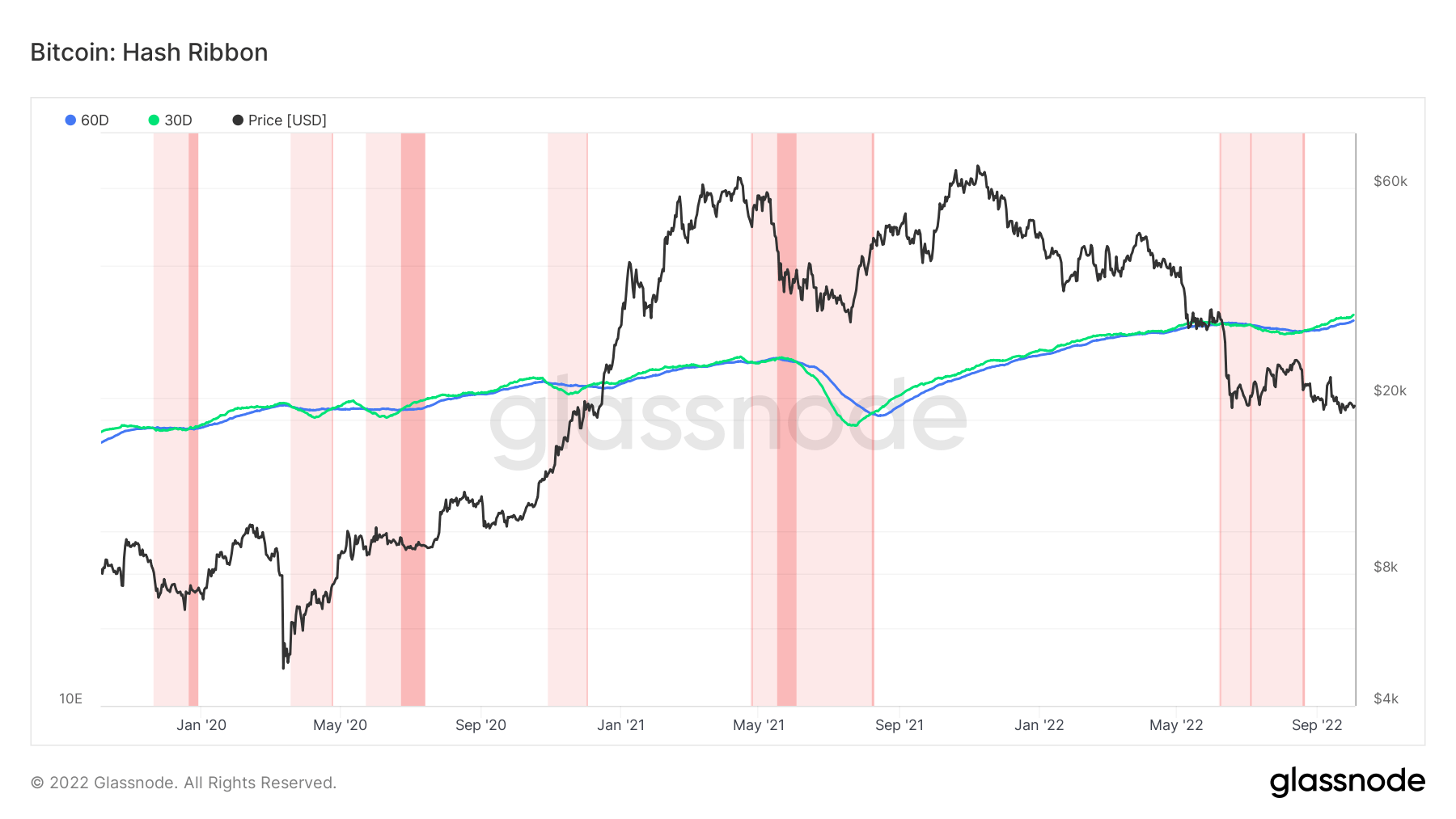

Hash Ribbons

Hash Ribbons are calculated from the 30-day and 60-day Easy Shifting Averages (SMA) of the Bitcoin hash price. Analysts use this metric to find out intervals of miners’ misery and thus can be utilized to foretell capitulation.

The chart under exhibits the market has left a two-month-long capitulation interval that ended round September. The capitulation interval might have been a consider Bitcoin’s continuous drop under and subsequent recapture of the $20,000 degree on quite a few events in current weeks.

Throughout late August, the 30-day SMA crossed above the 60-day SMA, which noticed an uptick in hash price. When this phenomenon happens, the value often tends to rise, as seen throughout BTC’s run to $69,000 in November 2021.

Nevertheless, apart from a rally between September 7-11, the BTC value didn’t maintain an uptrend this time spherical.

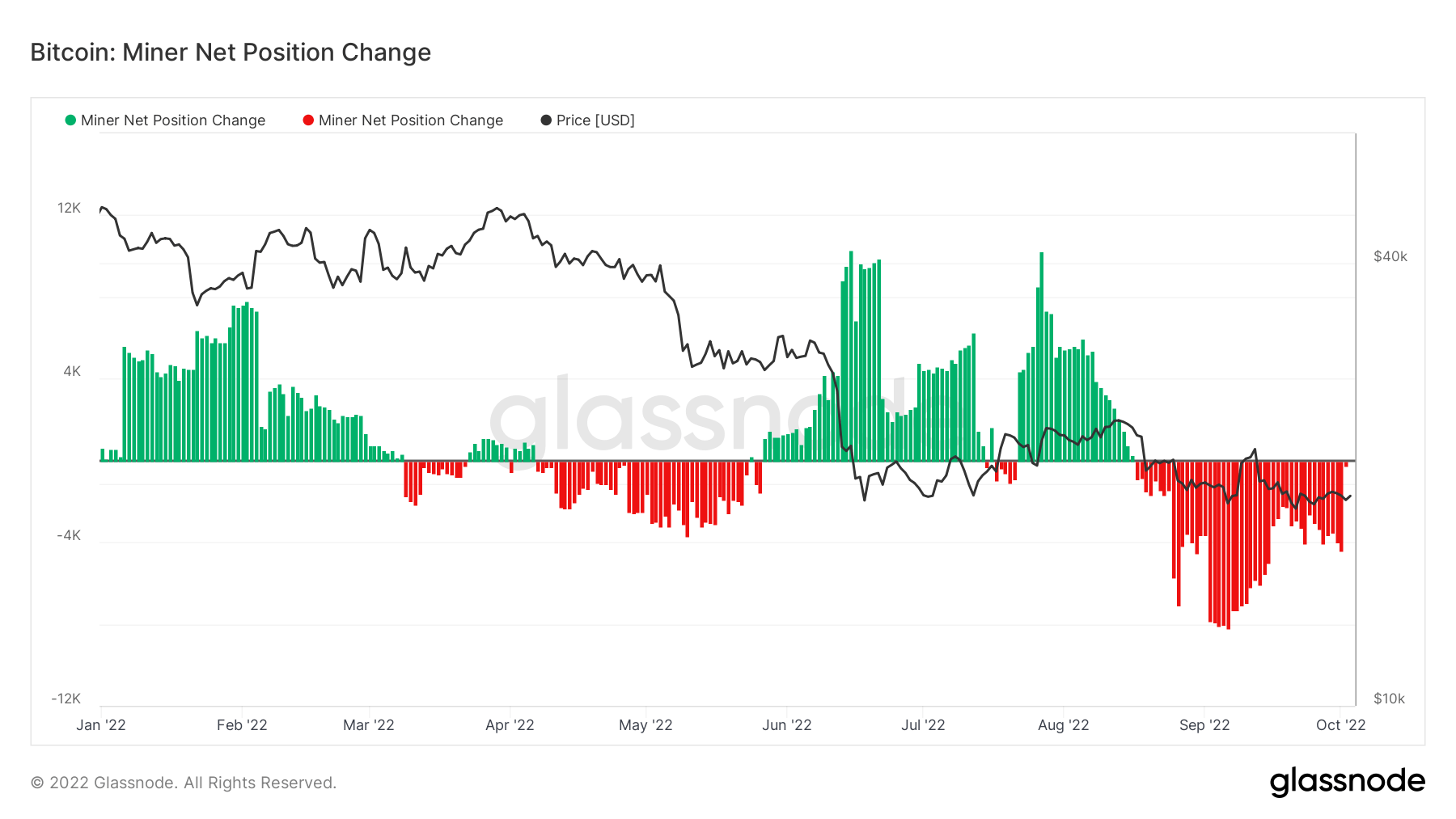

Miner Web Place Change

Miner Web Place change refers back to the 30-day price of change in Bitcoin miners’ unspent provide. Web optimistic readings equate to miners holding onto tokens, whereas web detrimental is when miners promote into the market.

The chart under exhibits a web detrimental distribution of tokens since mid-August. Throughout September peaks, promoting hit as excessive as -9,000.

Since then, there was a noticeable drop-off in distribution with a present web place change of -4,500.