The collapse of FTX might need wrecked the trade and worn out billions from the market, however it doesn’t appear to have shaken individuals’s convictions in Bitcoin. The truth that BTC has been struggling to interrupt $16,000 over the weekend turned out to be a significant shopping for alternative for a giant chunk of the market.

This constructive sentiment isn’t anecdotal — on-chain knowledge exhibits clear indicators of elevated adoption that defies the bear market.

Addresses holding BTC at an all-time excessive

CryptoSlate evaluation confirmed wholesome community adoption. Characterised by an uptick in each day lively customers, a better transaction throughput, and an elevated demand for block house, rising community adoption has traditionally been a bullish signal.

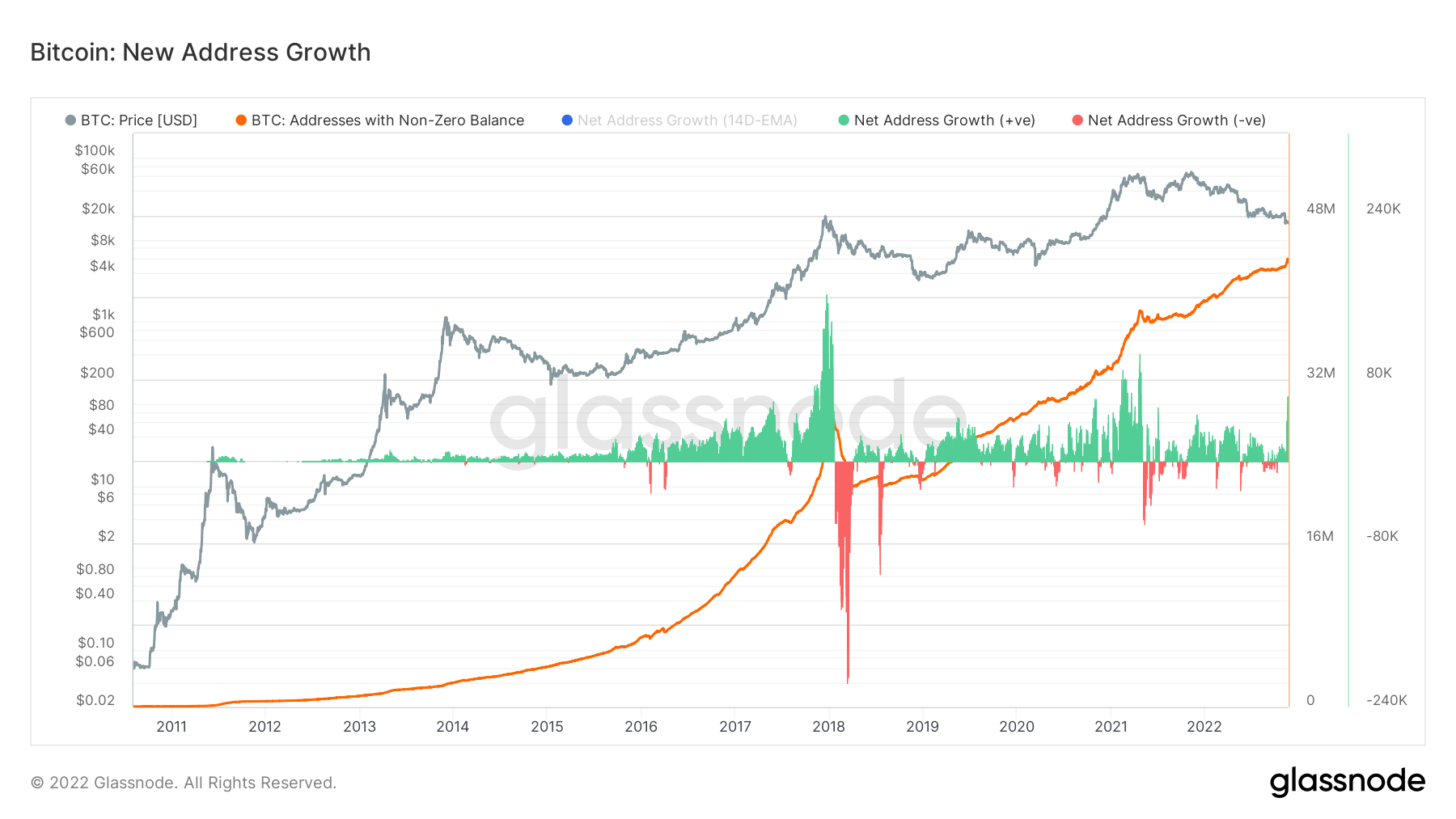

Among the best measurements of community adoption is the variety of non-zero steadiness addresses. Development within the variety of addresses holding BTC signifies a bigger diploma of on-chain exercise happening on the community. A discount within the variety of non-zero steadiness addresses normally signifies consolidation, as wallets start purging their belongings.

Information from Glassnode has proven a big improve within the variety of non-zero steadiness addresses on the Bitcoin community. The online deal with development started in mid-October after which skyrocketed as November started. This development was adopted by an equally sharp improve within the variety of non-zero steadiness addresses, as indicated within the graph under.

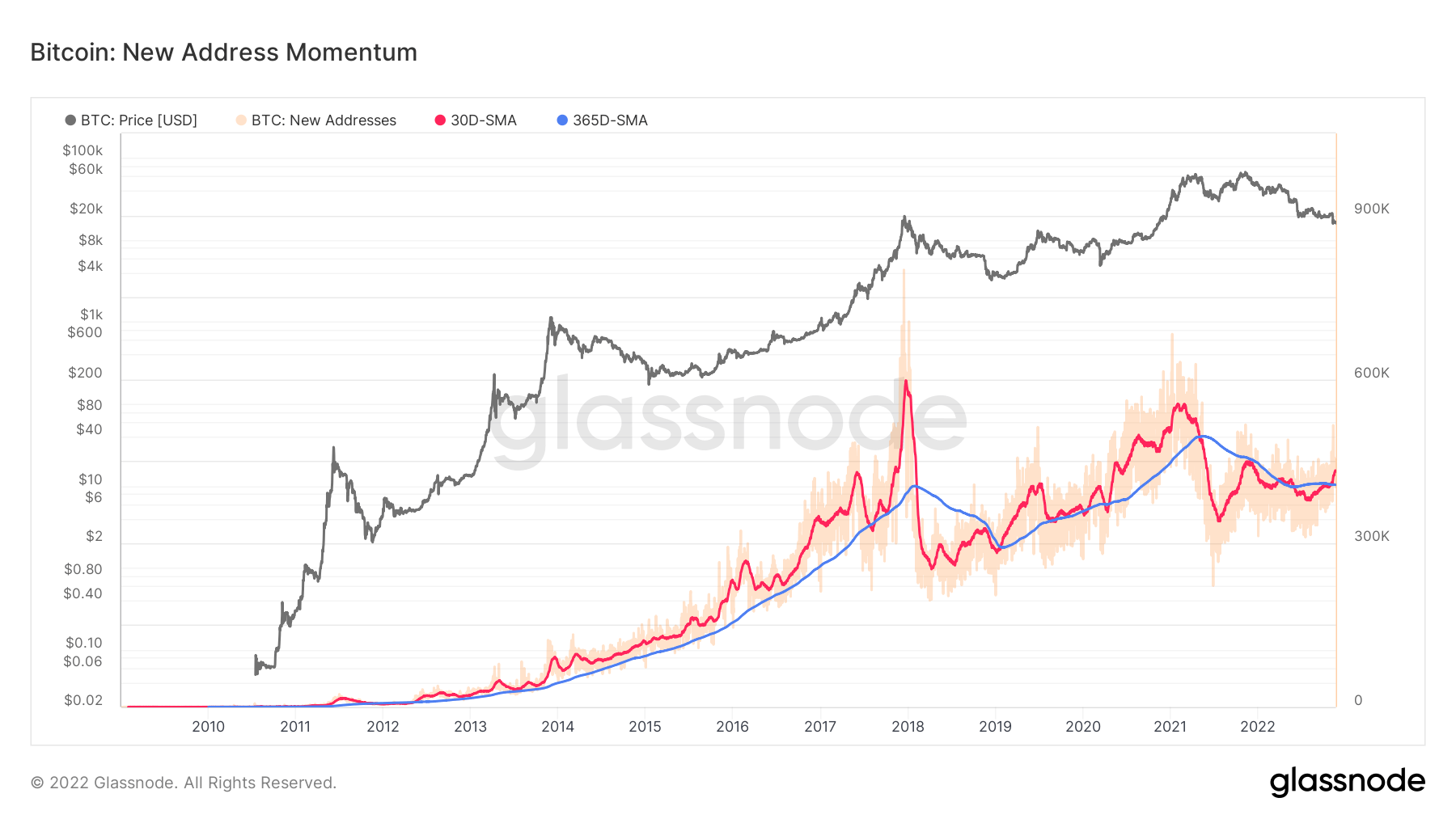

Digging deeper into on-chain knowledge exhibits that almost all of non-zero addresses have been created prior to now month. The 30-day easy transferring common (SMA) of recent addresses surpassed the 365-day SMA, which has been flatlining for the higher a part of 2022.

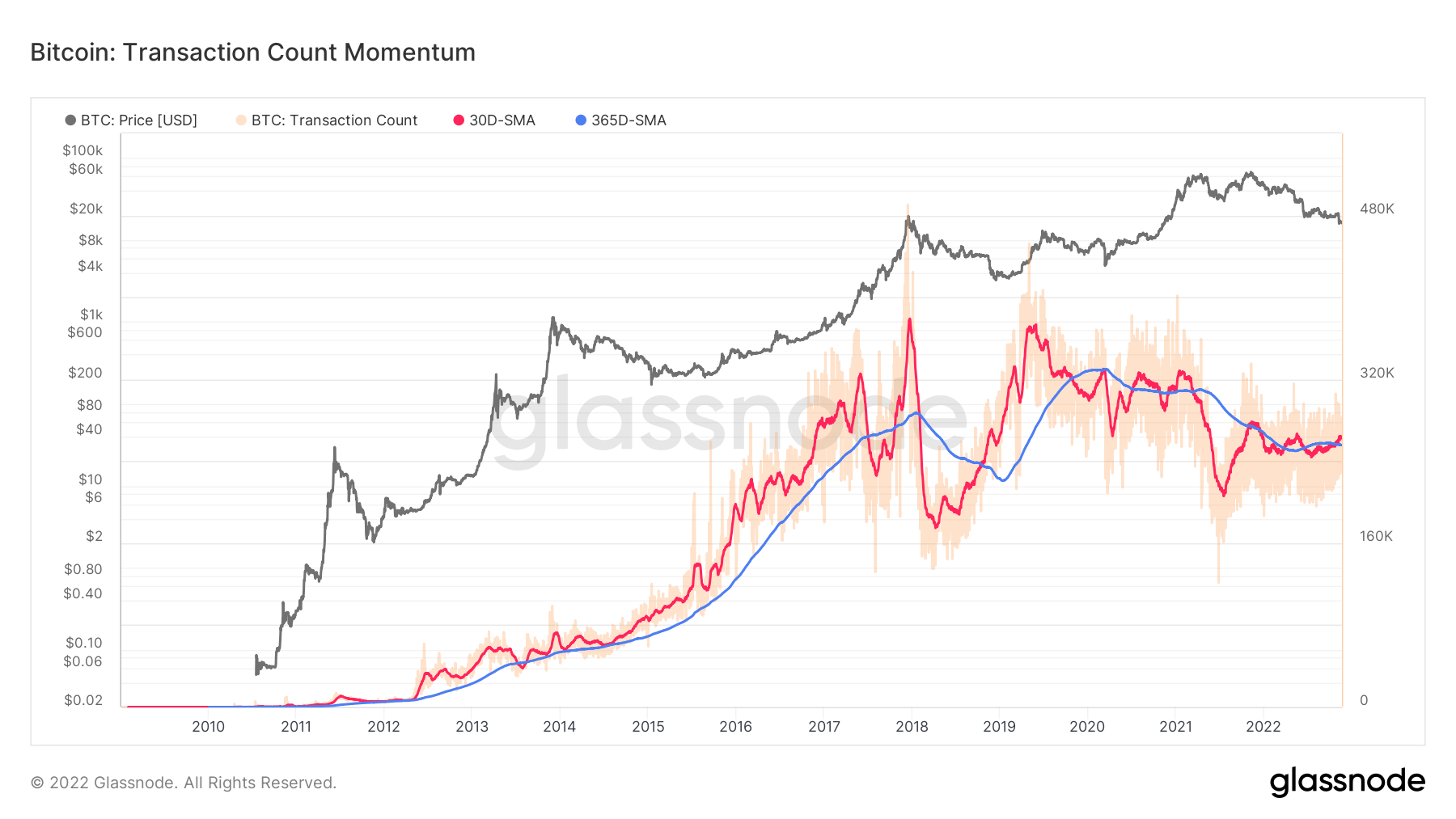

The expansion within the variety of new addresses interprets into a better transaction rely. The entire new non-zero steadiness addresses needed to purchase that steadiness prior to now month, drastically rising the transaction rely recorded on the community.

Bitcoin on exchanges reaches a promising low

The buildup development can also be evident in trade knowledge.

The collapse of FTX has briefly ignited Bitcoin spot volumes throughout exchanges. Nevertheless, Bitcoin steadiness on exchanges started dropping alongside the rising quantity, displaying that customers have been shopping for cash en masse and taking them off centralized exchanges and into chilly wallets.

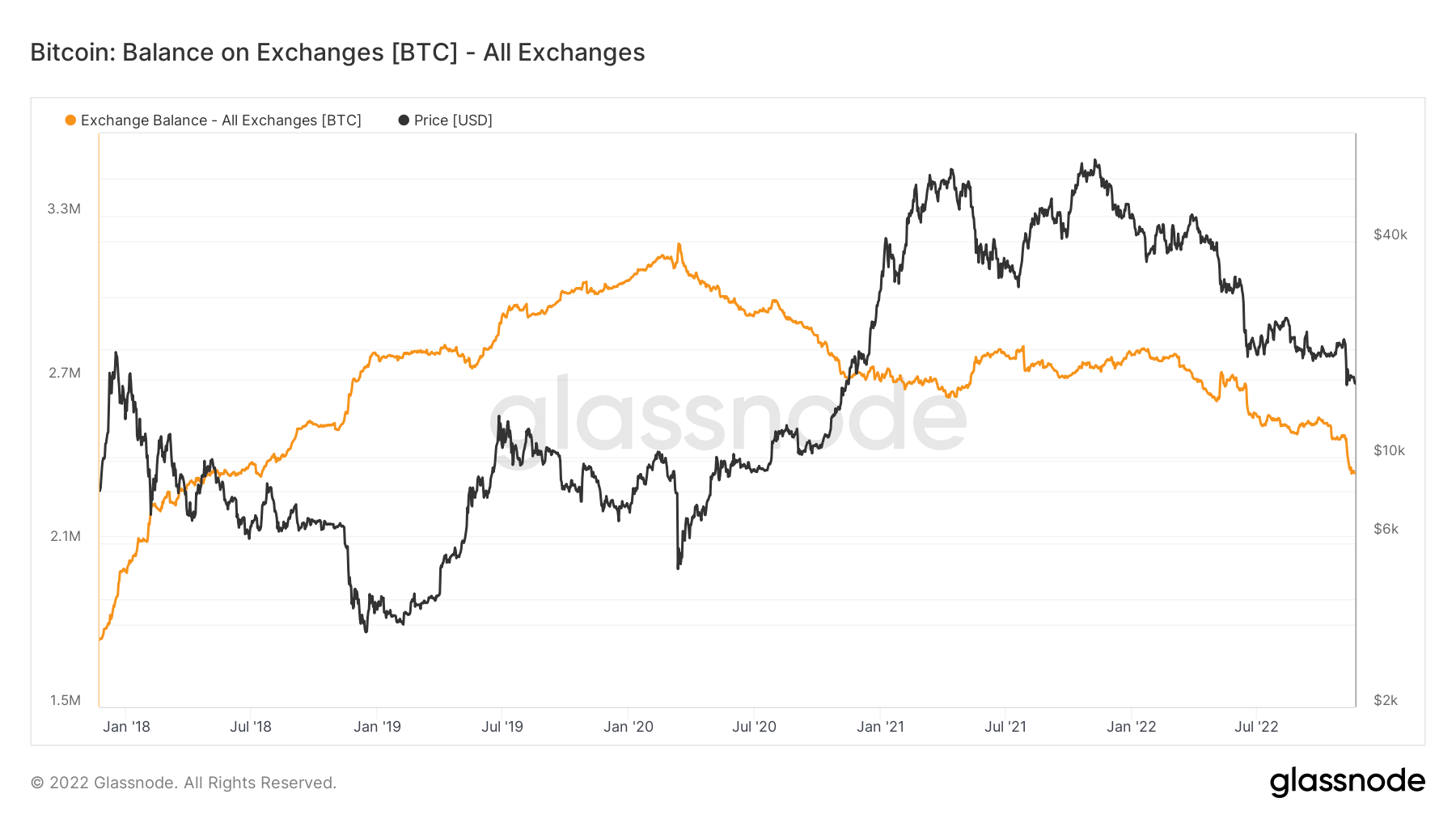

Round 2.3 million BTC is presently held on centralized exchanges, just like the degrees recorded in mid-2018. It’s a pointy drop from the all-time excessive of three.1 million BTC recorded in 2020.

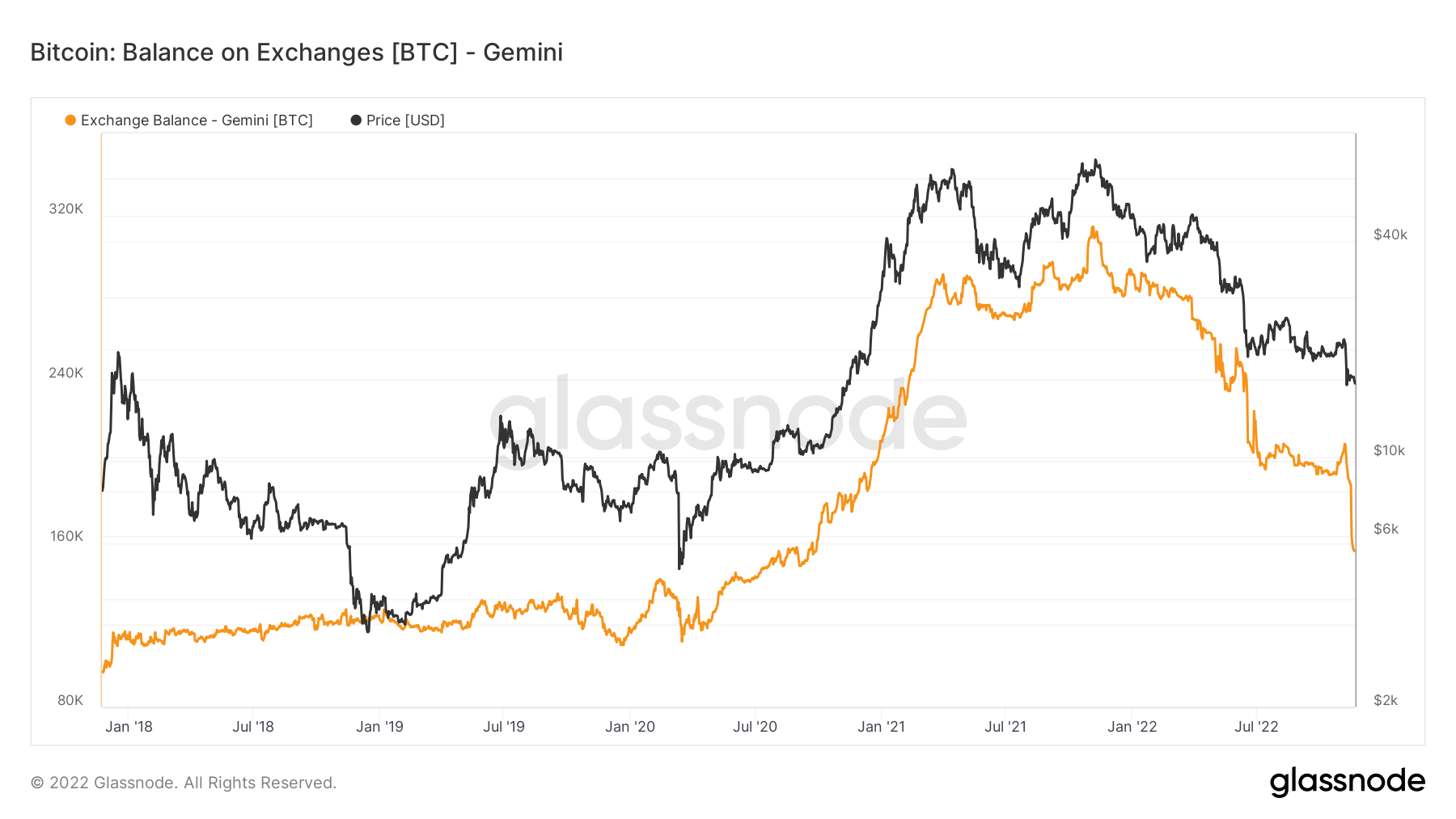

Gemini noticed essentially the most aggressive Bitcoin outflow, shedding round 47,000 BTC in per week. The Bitcoin steadiness held on the trade dropped from 210,000 BTC final week to round 163,000 BTC.

Information exhibits that solely round 12% of Bitcoin’s circulating provide is presently held on exchanges. This share additional confirms the buildup development different on-chain knowledge counsel. And whereas it’d take some time earlier than we see a bullish momentum, the continued accumulation exhibits that the conviction in Bitcoin stays excessive.