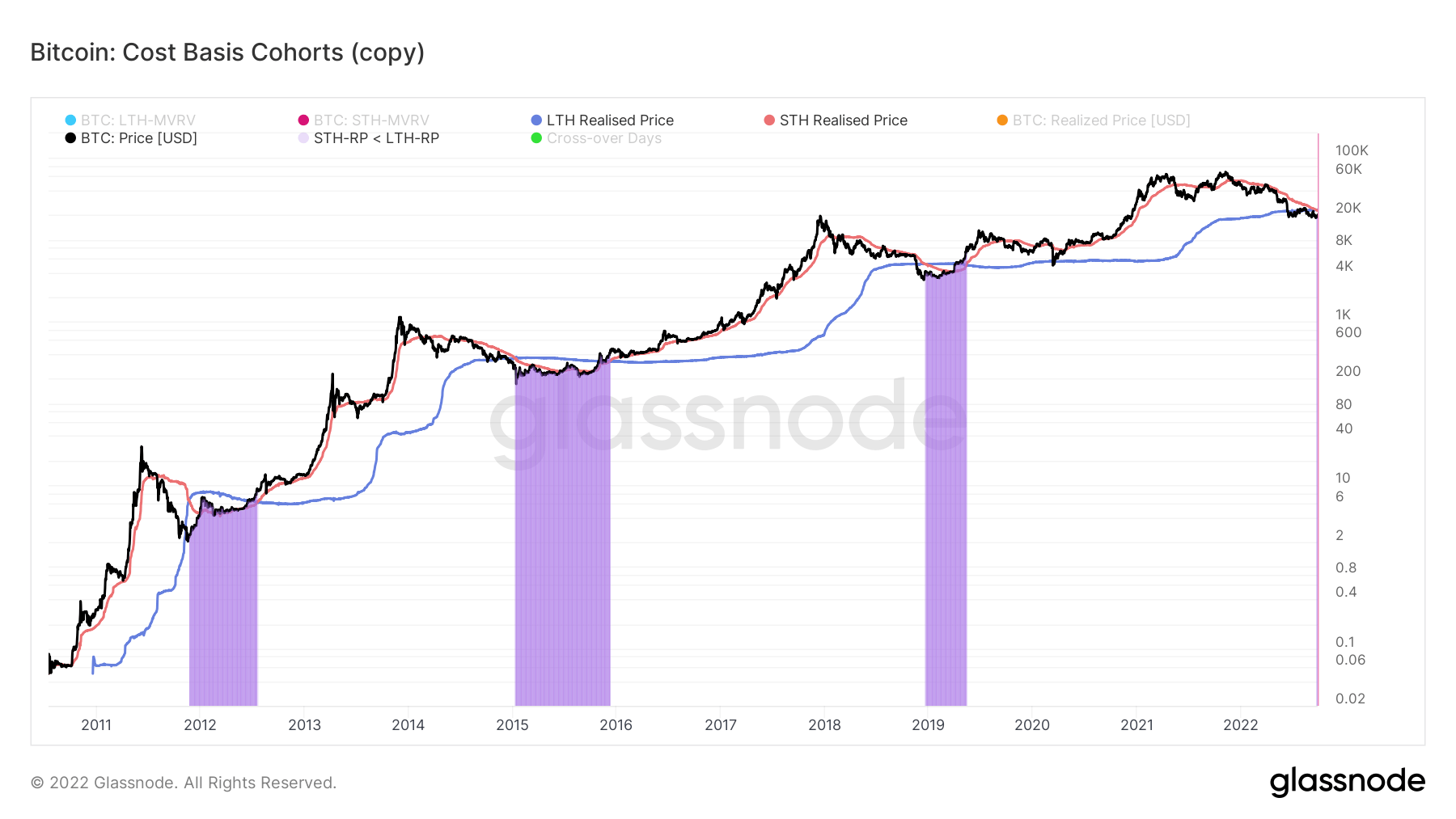

The Bitcoin: Price Foundation metric, also called the realized value, is break up into the long-term holder (LTH) and short-term holder (STH) cohorts.

Price foundation refers to the amassed truthful market worth of the cryptocurrency token acquired, plus the earnings on the time bought. It’s usually used to calculate tax legal responsibility by figuring out whether or not a revenue or loss was made in the course of the holding interval.

LTHs are outlined as tokens held for longer than 155 days, and STHs as tokens held for 154 days and under.

Bitcoin: Price Foundation metric

Analysts use the LTH/STH ratio to find out bull and bear cycles, thus market bottoms and tops. When the ratio is:

- Uptrending: STHs understand losses at a better price in comparison with LTHs. This case is related to bear market accumulation.

- Downtrending: LTHs are spending tokens and transferring them to STHs. This usually happens throughout bull market distribution.

- Buying and selling > 1.0: The fee foundation for LTHs is larger than that of STHs, typifying the late phases of bear market capitulation.

Traditionally, when the ratio is lower than 1, a market backside has been reached. At the moment, that is the case because the STH realized value is beginning to dip under the LTH realized value, signifying a interval of lack of religion by short-term holders.

Nevertheless, market bottoms can span many months earlier than an uptrend in value is mirrored. This case has occurred on solely three different events prior to now.

With the DXY up 6% because the begin of September, persevering with greenback energy places additional strain on risk-on markets within the close to time period.