The worth of Bitcoin sank following the discharge of Client Worth Index (CPI) knowledge by the U.S. Bureau of Labor Statistics (BLS), displaying a 0.1% enhance in August, taking the unadjusted worth to eight.3%.

In response to final month’s BLS CPI report, launched on August 10, Bitcoin closed the day up 5% to $24,050. BTC has since been trending decrease to type an area backside at $18,700 on September 7.

Since then, BTC has printed six consecutive day by day inexperienced closes, with right this moment’s worth additionally trending increased forward of the BLS announcement.

Nonetheless, on the discharge of CPI knowledge at 13:30 UTC, BTC’s rapid response was a 5% draw back swing to bounce at $21,600.

Consideration turns to the September FOMC assembly

Following the earlier Federal Open Market Committee (FOMC) on July 27, the Fed enacted a 75 foundation level rate of interest hike in a bid to handle mounting inflationary pressures.

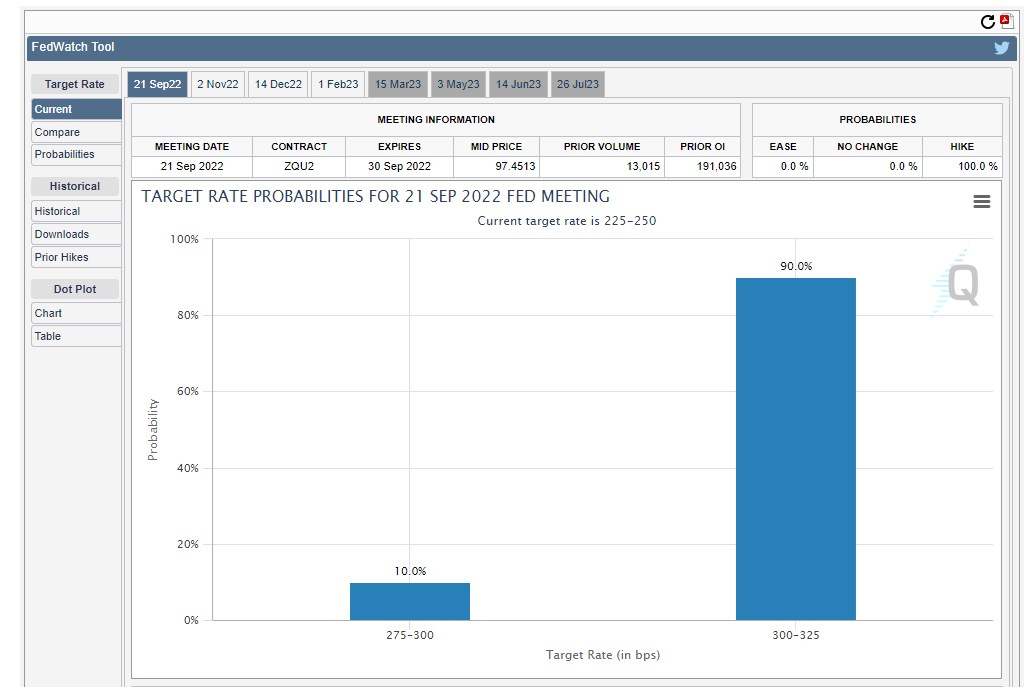

The following FOMC assembly is scheduled to happen between September 20-21, with 90% of specialists now focusing on a 75 foundation level hike. If carried out, it might make a 3rd consecutive 75 foundation level hike.

With no signal of the Fed slowing down its hawkish place, the outlook for risk-on property stays close to time period bearish.