The worth of Bitcoin tanked by 3% following the discharge of September’s Client Worth Index (CPI) knowledge displaying inflation at 8.2% year-over-year.

This got here in worse than the 8.1% anticipated charge, extending fears of a drawn-out bear market whereas including stress for additional charge hikes.

The stress is on

On October 7, the U.S. Bureau of Labor Statistics (BLS) posted non-farm payroll knowledge for September, displaying a 263,000 enhance in jobs throughout September.

Bitcoin reacted with an instantaneous 1% swing to the draw back swing to shut the day at $19,400.

The sturdy U.S. jobs report highlighted efforts to chill the economic system will not be filtering by means of. At the moment’s CPI knowledge places additional stress on the Fed to press forward with its hawkish agenda.

Whereas CPI inflation was worse than anticipated, JPMorgan mentioned any enhance above 8.3% can be “huge hassle for the inventory market.” By extension, this could additionally seek advice from different risk-on belongings, together with cryptocurrencies.

Bitcoin slumps on hotter-than-expected CPI

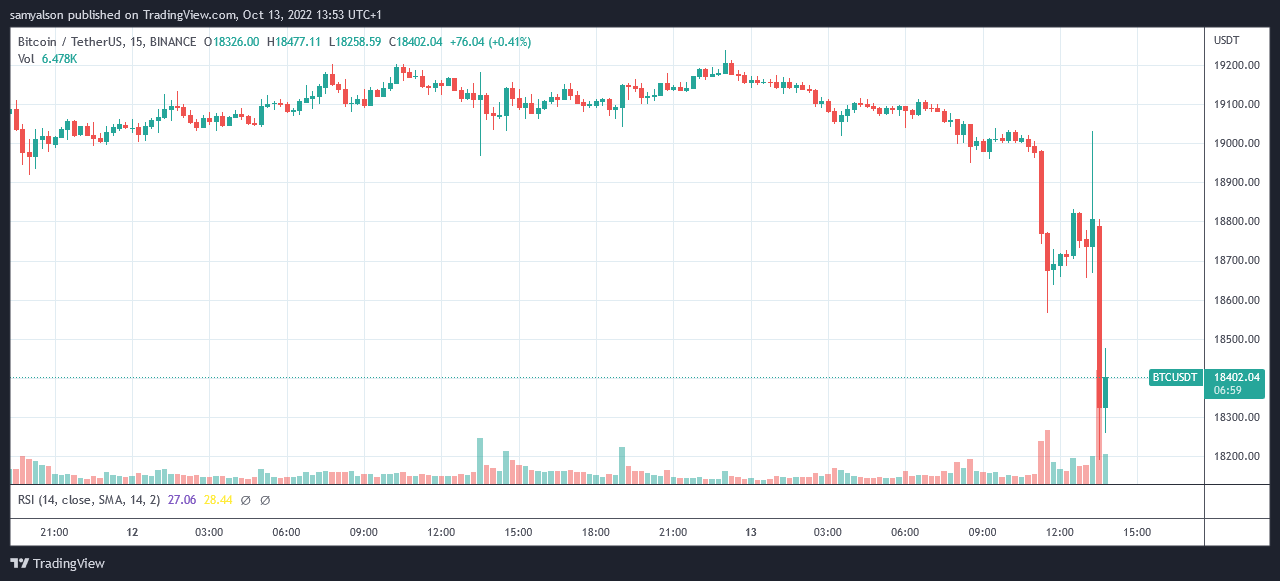

Since final month’s CPI announcement, the market chief has been ranging between $18,300 and $20,500 with out printing a definitive value sample in both route.

Nevertheless, having peaked at $19,200 throughout the late night (UTC) of October 12, Bitcoin has been trending down. The gradual downtrend become a unstable spill at 11:15 (UTC), resulting in a 2% swing to the draw back that bottomed at $18,600.

The following bounce later led to a robust rally, recovering the earlier losses. This transfer topped out at $19,000 on the eve of the CPI announcement earlier than bears took management resulting in an instantaneous drop to $18,200.

The Federal Open Market Committee (FOMC) assembly concludes on November 3. The likelihood of a fourth 75 foundation level hike has elevated from 81% final week to 98%.