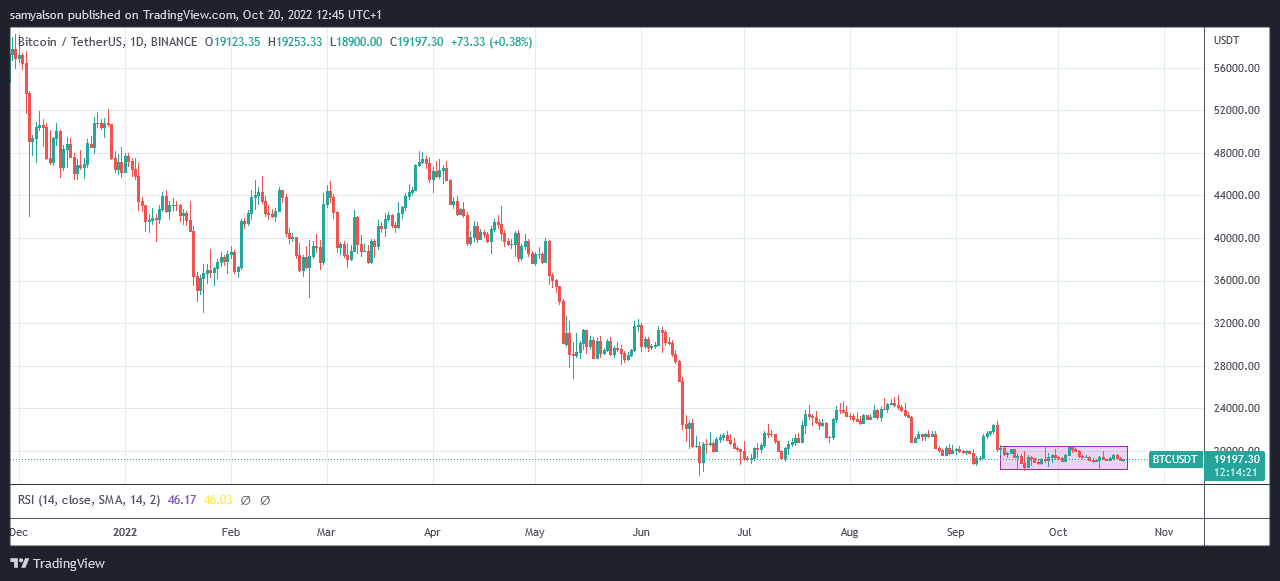

Since mid-September, Bitcoin has been “crabbing,” or shifting sideways, between $18,100 and $20,500.

The noticeably flat worth motion has given rise to remarks resembling BTC is lifeless and foreign currency trading is the brand new crypto buying and selling.

Nevertheless, taking into account the deteriorating macroeconomic setting, a distinct narrative is perhaps that Bitcoin volatility has eased throughout these testing occasions.

What’s extra, that is one thing that Wall Road would have picked up on.

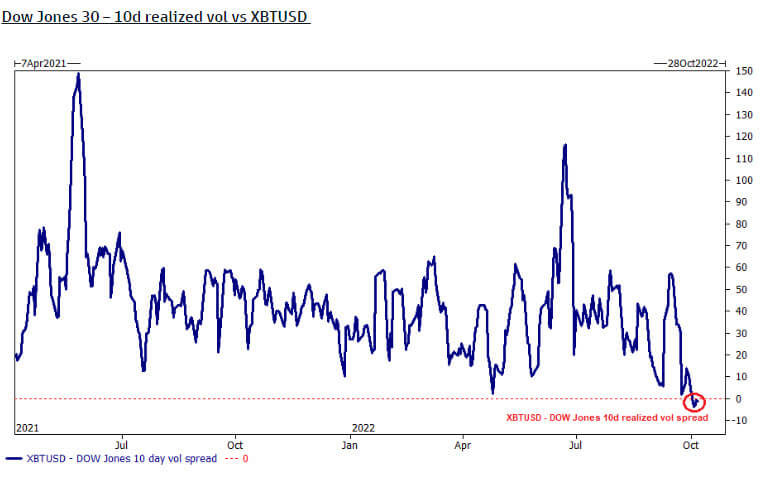

Dow Jones volatility

The chart beneath maps the ten-day realized volatility unfold between the 30 largest industrial shares in opposition to Bitcoin.

Since October, as BTC has remained comparatively flat in greenback phrases, this metric has dipped beneath zero, indicating that the Dow Jones is now extra unstable than Bitcoin.

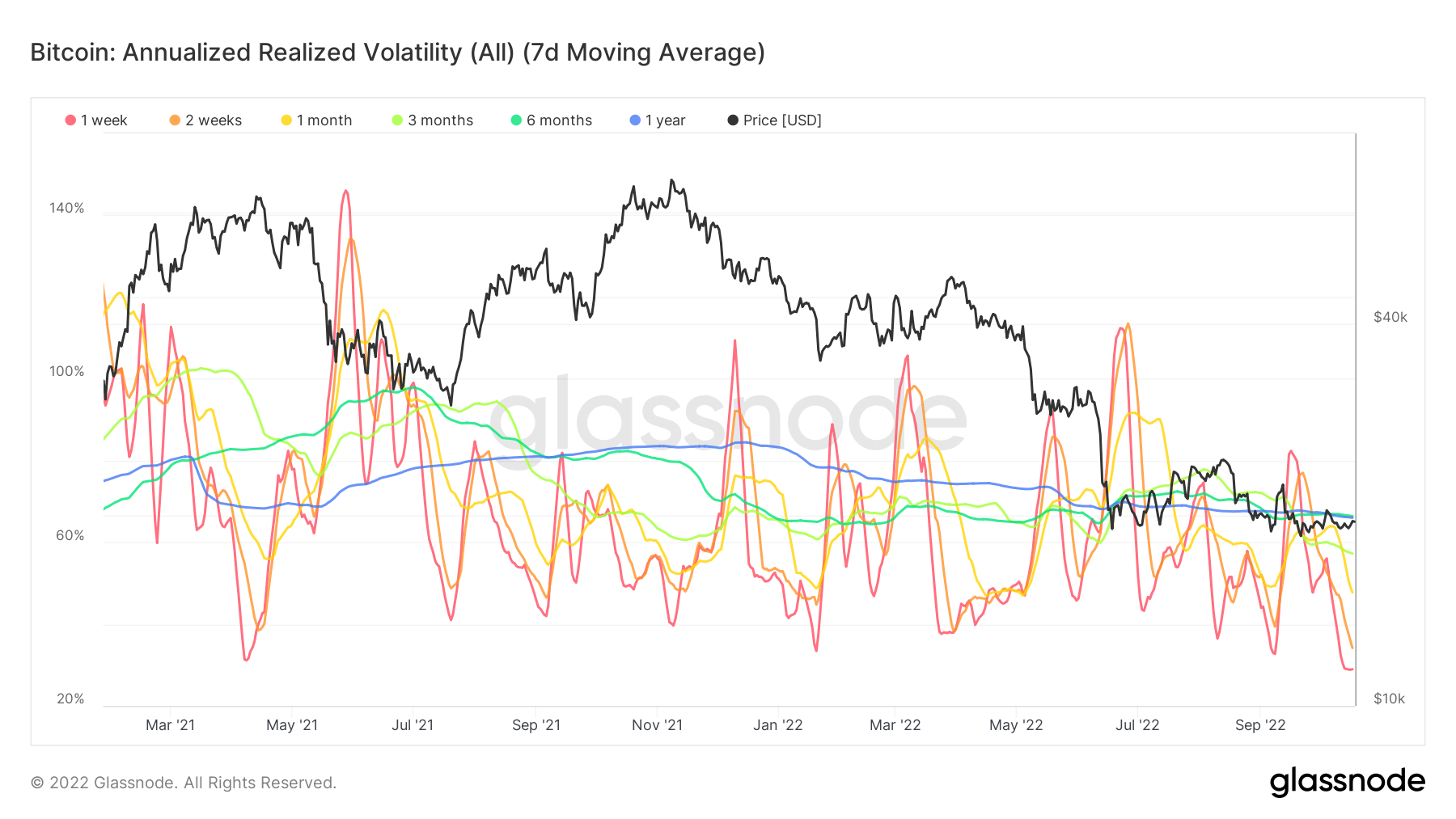

Bitcoin Annualized Realized Volatility

Bitcoin Annualized Realized Volatility refers to precise volatility actions within the BTC choices market based mostly on outlined previous intervals.

Annualizing the info assumes observations remodeled a selected time-frame, on this case, over one week, two weeks, one month, three months, and 6 months, will proceed over the course of a yr.

The chart beneath exhibits that realized volatility is at an all-time low, with all time frames presently beneath the one-year line.

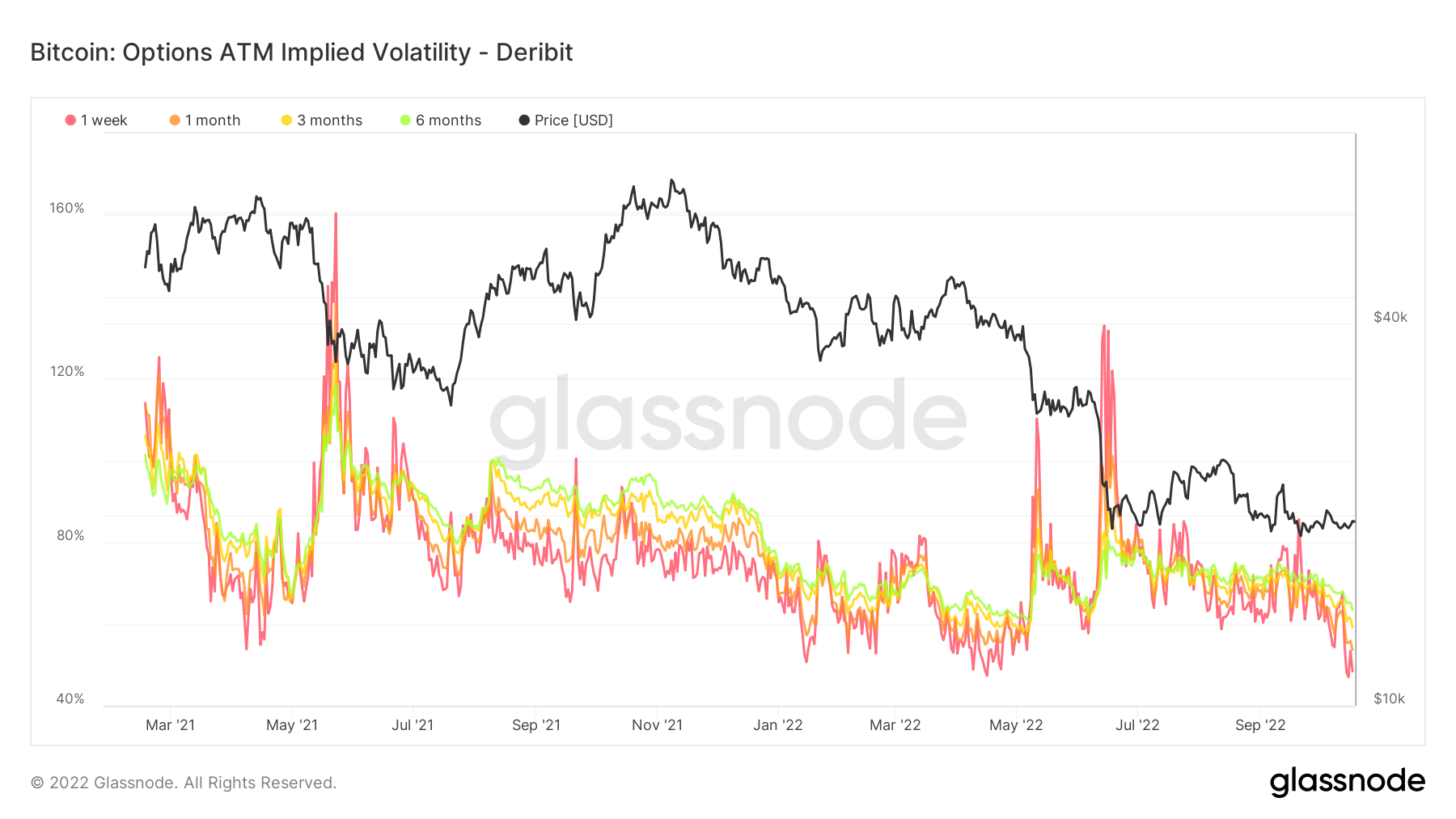

BTC Choices ATM Implied Volatility

Realized volatility refers back to the market’s evaluation of previous volatility measures, whereas Implied volatility is in relation to future volatility. Implied volatility typically will increase throughout bearish markets and reduces when the market is bullish.

The chart beneath exhibits all time frames for implied volatility trending downwards since late July. Presently, every of the 4 intervals has sunk beneath 55%, which is encouraging for bulls.