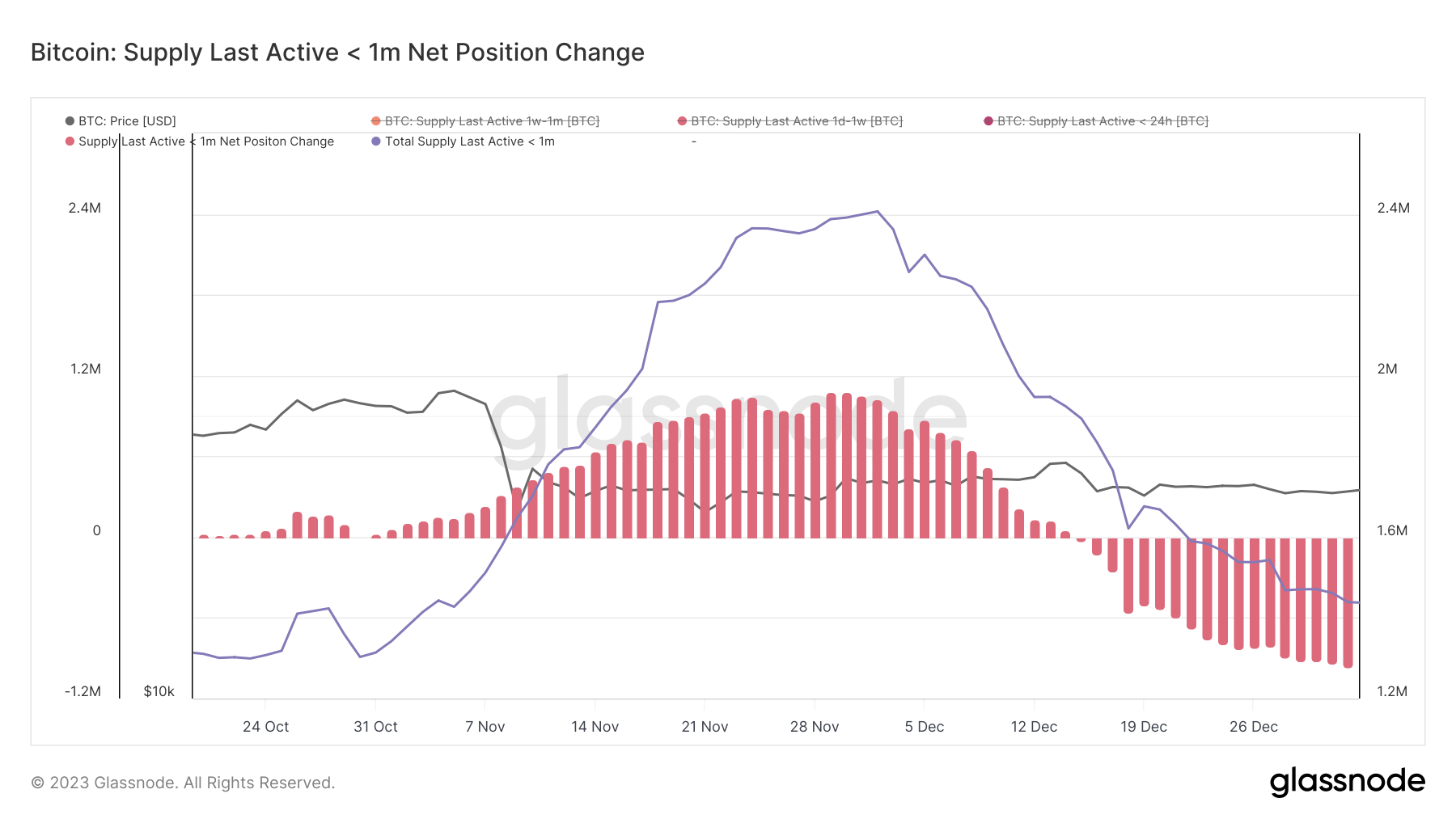

Bitcoin’s provide final lively lower than a month in the past has plummeted to an 8-year low. This typically ignored metric offers important insights into the market’s present dynamics and is beneficial when analyzing historic developments.

Bitcoin’s provide dynamics are useful when analyzing the market, as they supply a window into the buying and selling conduct of its huge consumer base. Bitcoin’s provide final lively lower than a month in the past has traditionally been probably the most risky a part of its provide, representing the vast majority of day-to-day transaction exercise. Its motion, or lack thereof, may be an indicator of broader market developments.

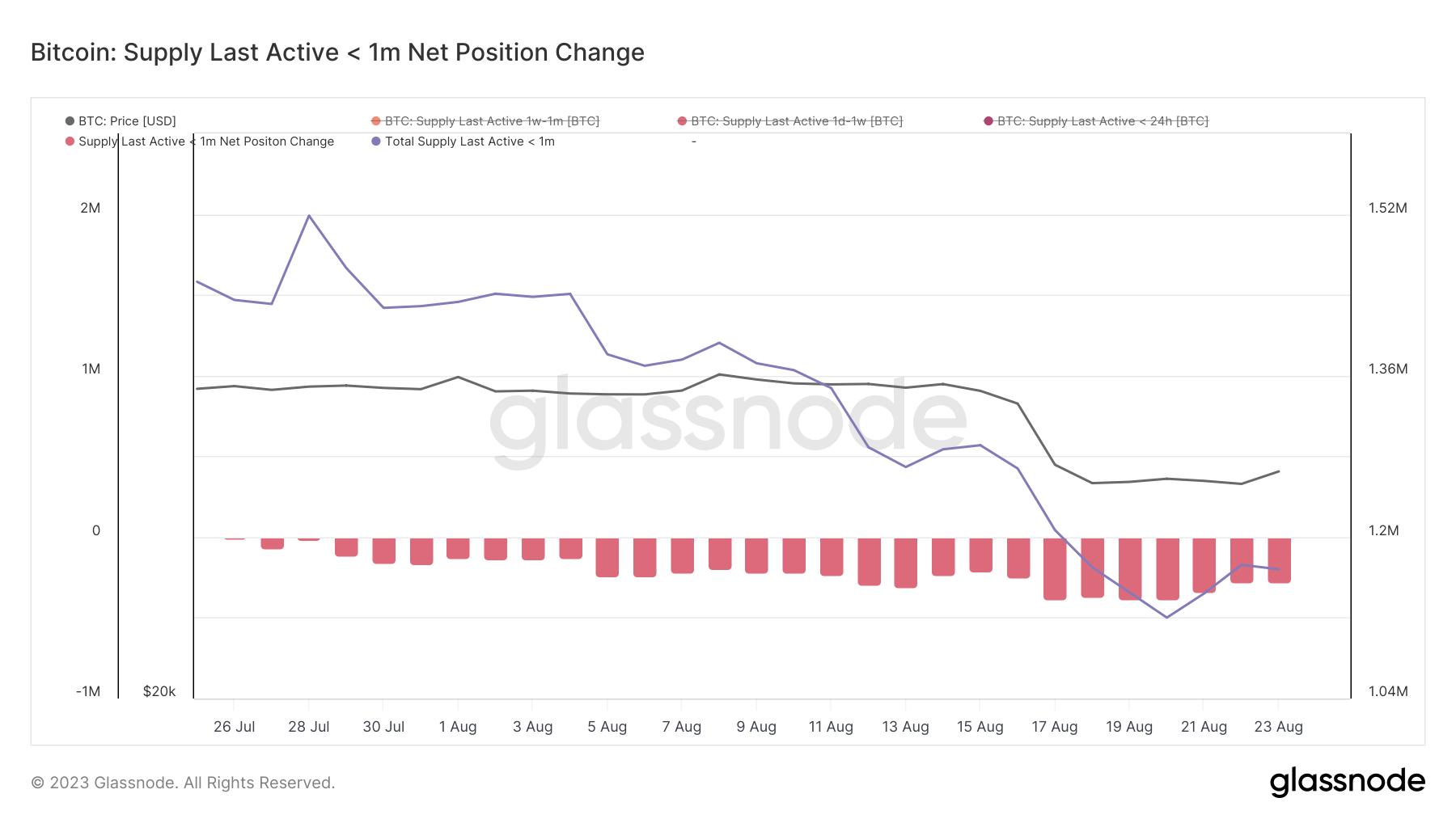

On Aug. 20, the whole provide of Bitcoin final lively lower than a month in the past dropped to 1.12 million BTC. This represents a notable decline from the 1.28 million BTC it recorded on Aug. 14. Throughout that point, Bitcoin’s value dropped from $29,400 to $26,200.

The fast decline culminated within the provide reaching its lowest level in 8 years.

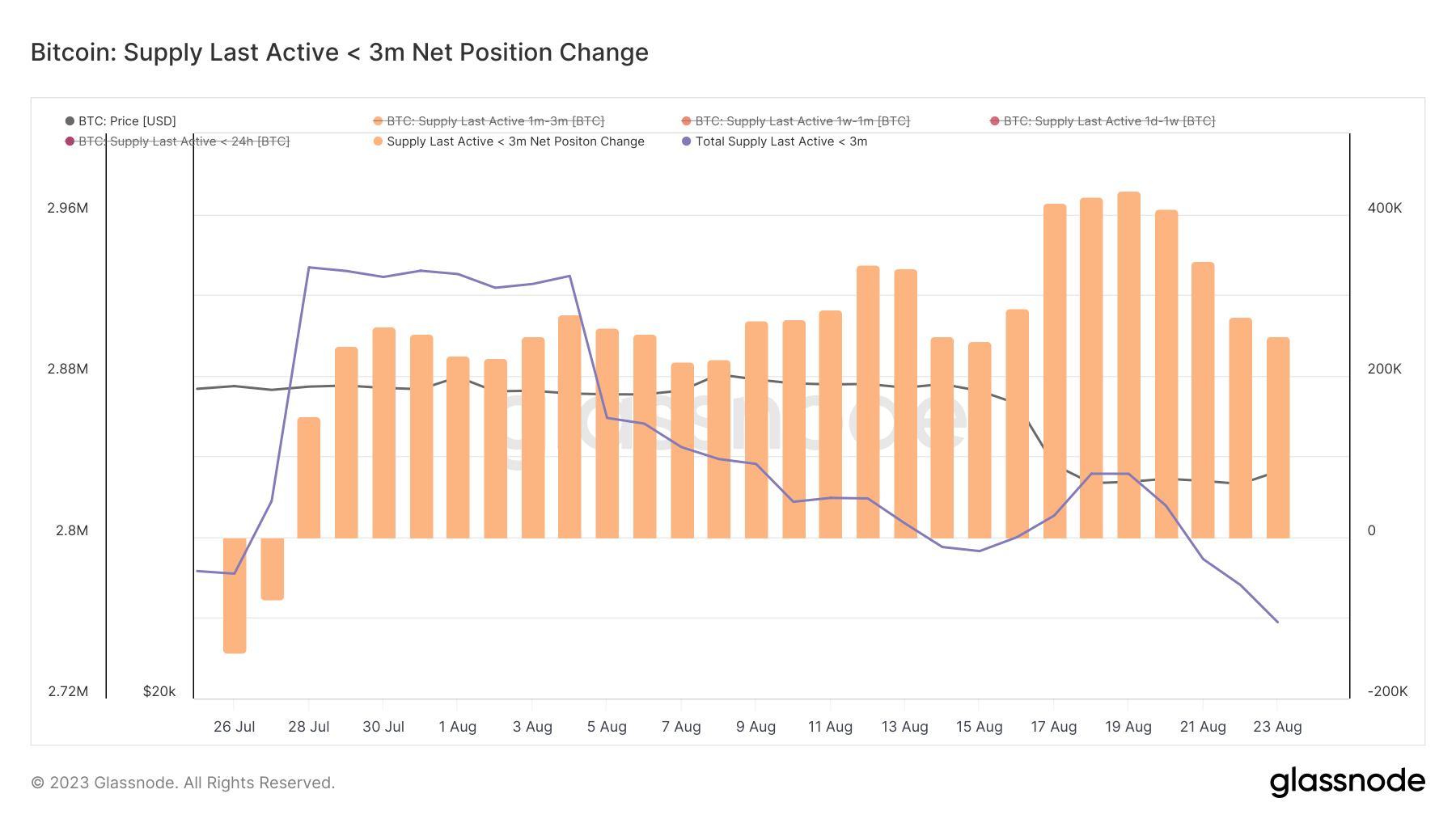

Information from Glassnode additional revealed that the provision final lively lower than 3 months in the past additionally skilled a slight dip, transferring from 2.79 million BTC on August 14th to 2.75 million BTC by August twenty third.

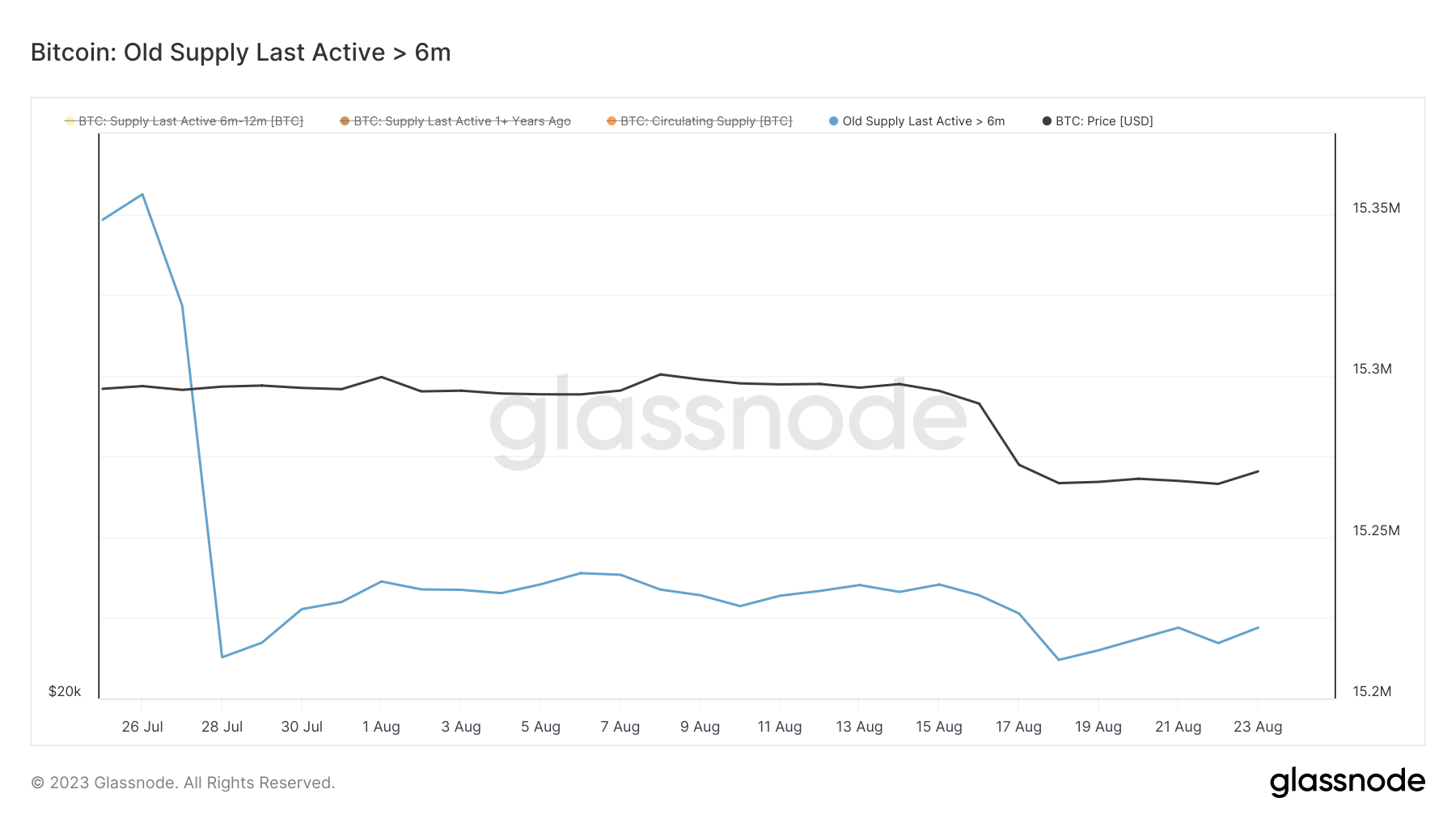

Curiously, the provision final lively greater than 6 months in the past remained comparatively secure, whilst Bitcoin’s value confronted a stoop. This stability within the longer-term lively provide means that whereas short-term merchants could be adjusting their positions, long-term holders stay unfazed by the value fluctuations.

The numerous lower in “scorching cash” factors to a lower in day-to-day buying and selling exercise. Fewer cash transferring means that merchants and buyers are transferring from actively transacting with BTC to holding the cash.

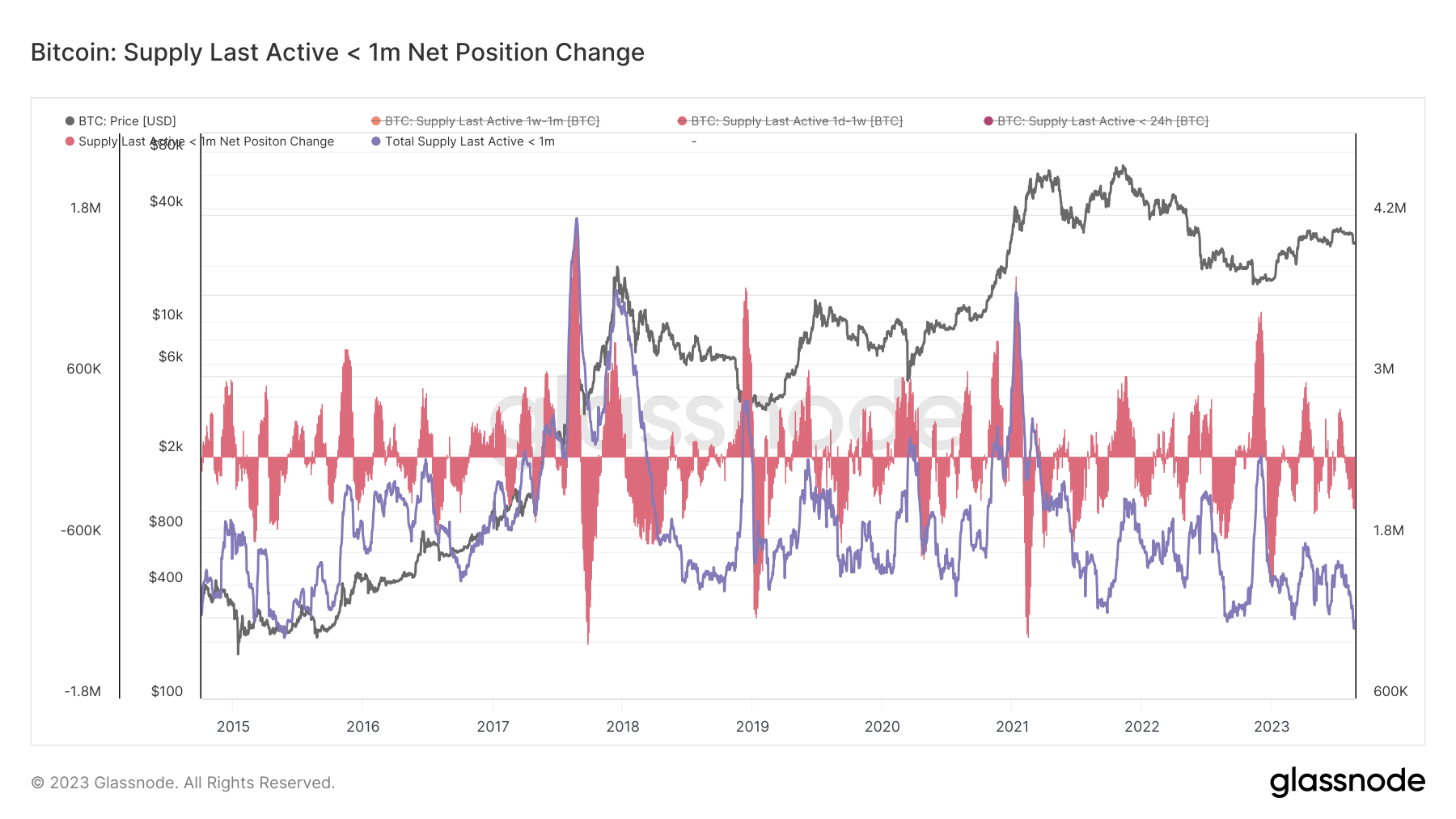

In 2023, the market has seen a transparent correlation between the lower within the provide of those scorching cash and drops in Bitcoin’s value. Conversely, a rise on this provide typically correlated with a rise in Bitcoin’s value.

The present pattern of decreased Bitcoin exercise might be interpreted in a number of methods. It would counsel a stabilization available in the market, with fewer contributors actively buying and selling BTC. It might additionally counsel market stagnation, with potential merchants sitting on their BTC awaiting clearer alerts earlier than making strikes.

Nonetheless, there have been some anomalies on this pattern.

November 2022 noticed a break on this correlation throughout the collapse of FTX. On the time, a pointy surge in scorching cash occurred whereas Bitcoin’s value noticed a big downturn.

The truth that scorching cash surged throughout this time might point out panic promoting and a rush to maneuver funds out of FTX and associated platforms, resulting in a pointy spike in exercise. As the value continued dropping regardless of the rise in provide motion, it might point out a prevailing unfavourable sentiment and insecurity available in the market on the time.

The submit Bitcoin’s most lively provide hits 8-year low appeared first on CryptoSlate.