1 Q3 2022 Blockchain Safety Overview

A complete of 37 main exploits have been monitored, with a complete lack of roughly $405 million

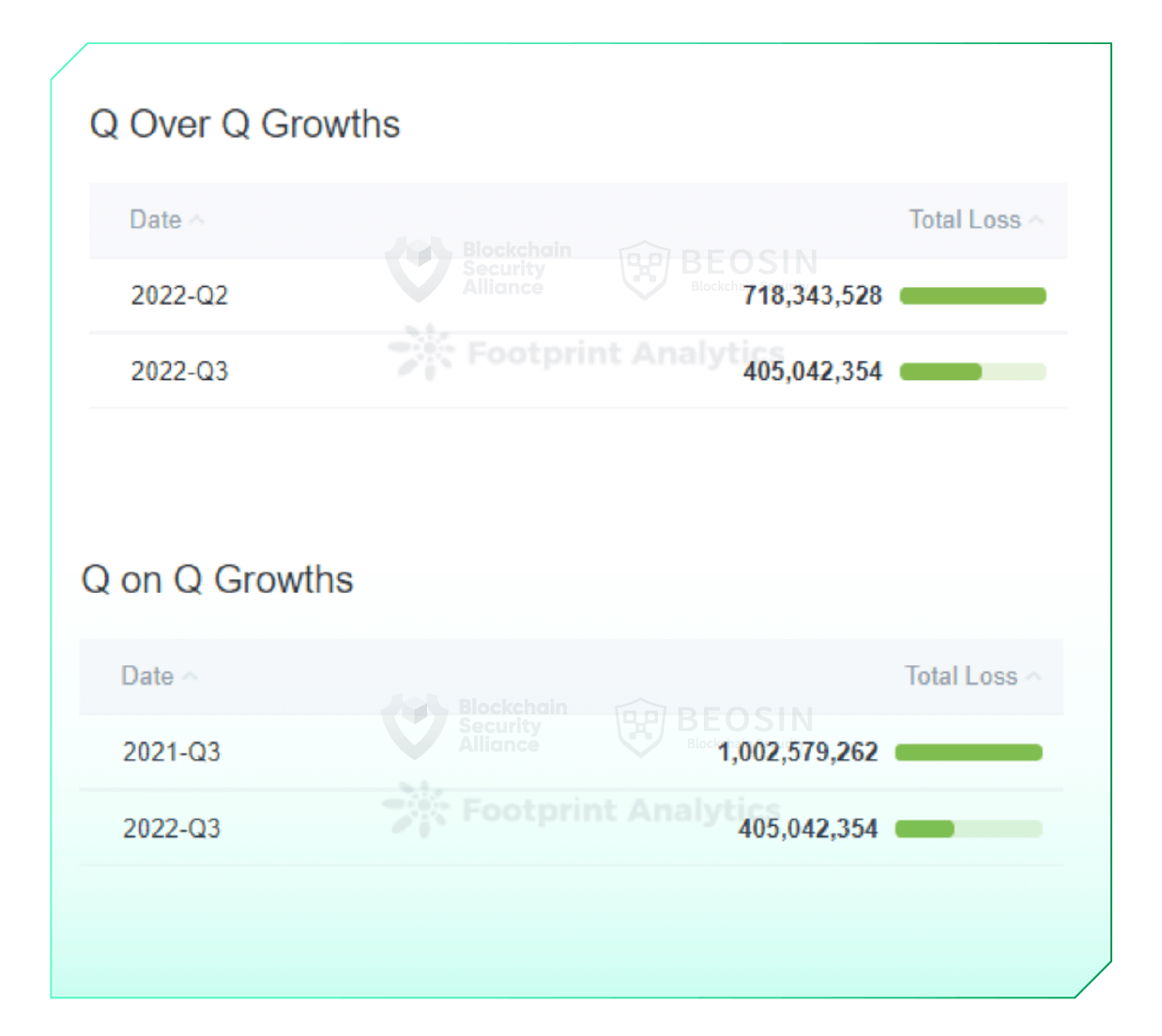

Within the third quarter of 2022, Beosin EagleEye monitored over 37 main assaults within the Web3 house, with whole losses of roughly $405 million, down roughly 43.6% from $718.34 million in Q2 2022 and a lower of 59.6% from the lack of $1,002.58 million in Q3 2021.

From January to September 2022, belongings misplaced within the Web3 house because of assaults totaled $2,317.91 million.

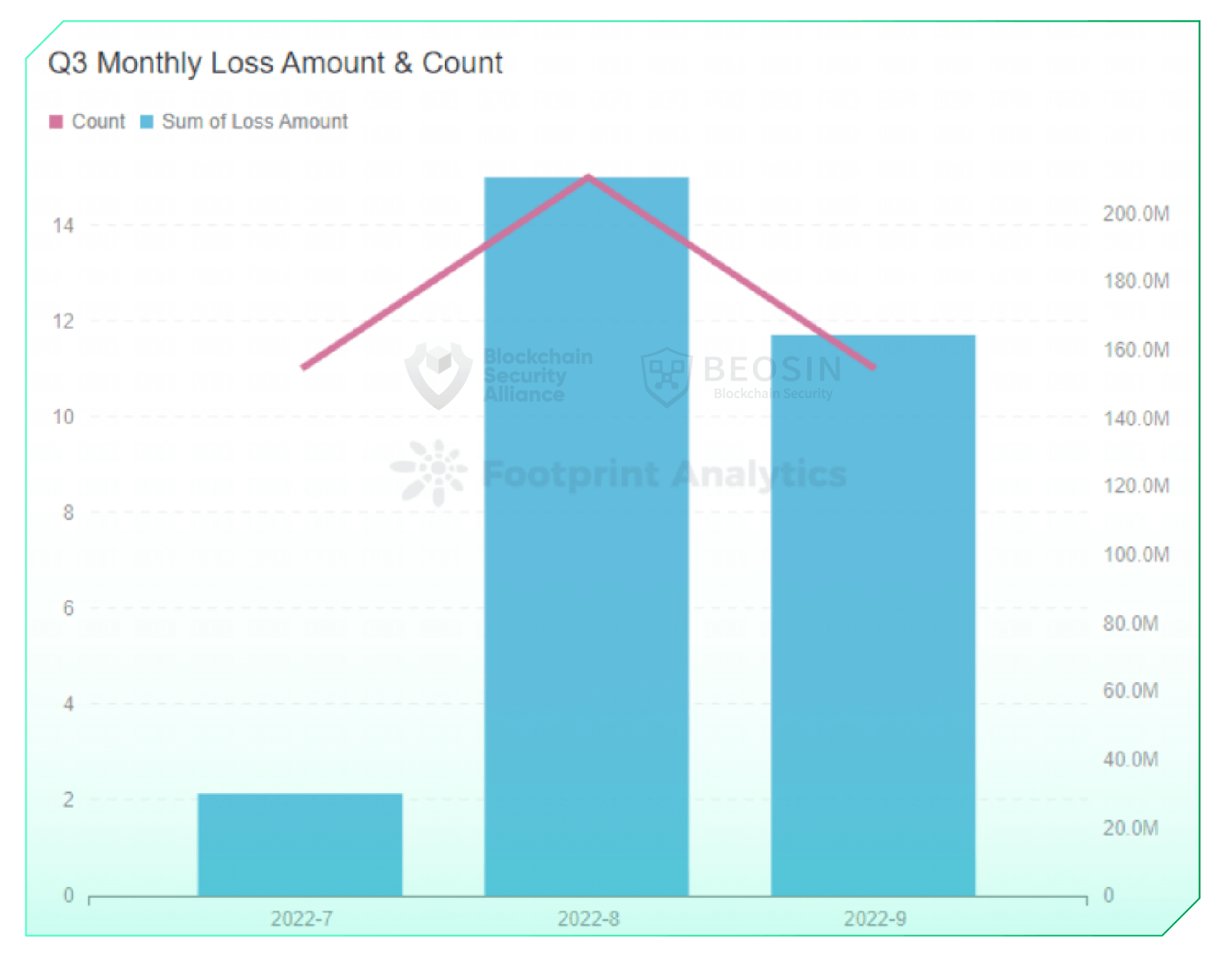

By way of every month, July noticed a big lower in assaults, making it the least loss quantity from assaults since 2022. Hacker exercise elevated considerably in August and September.

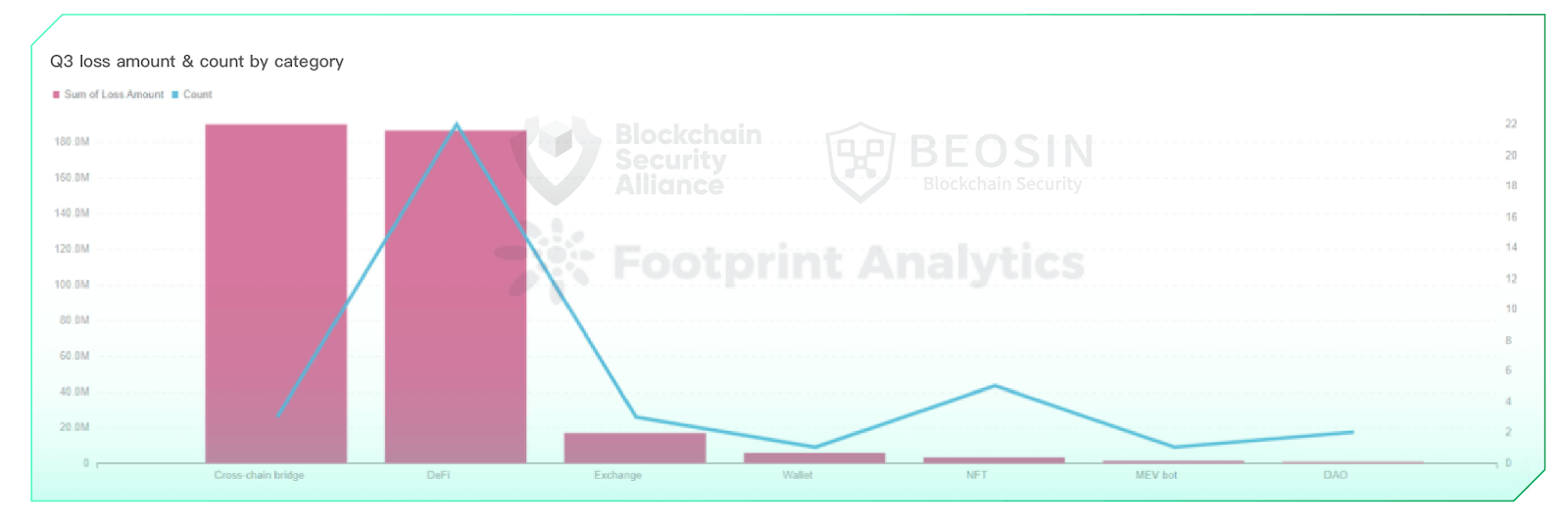

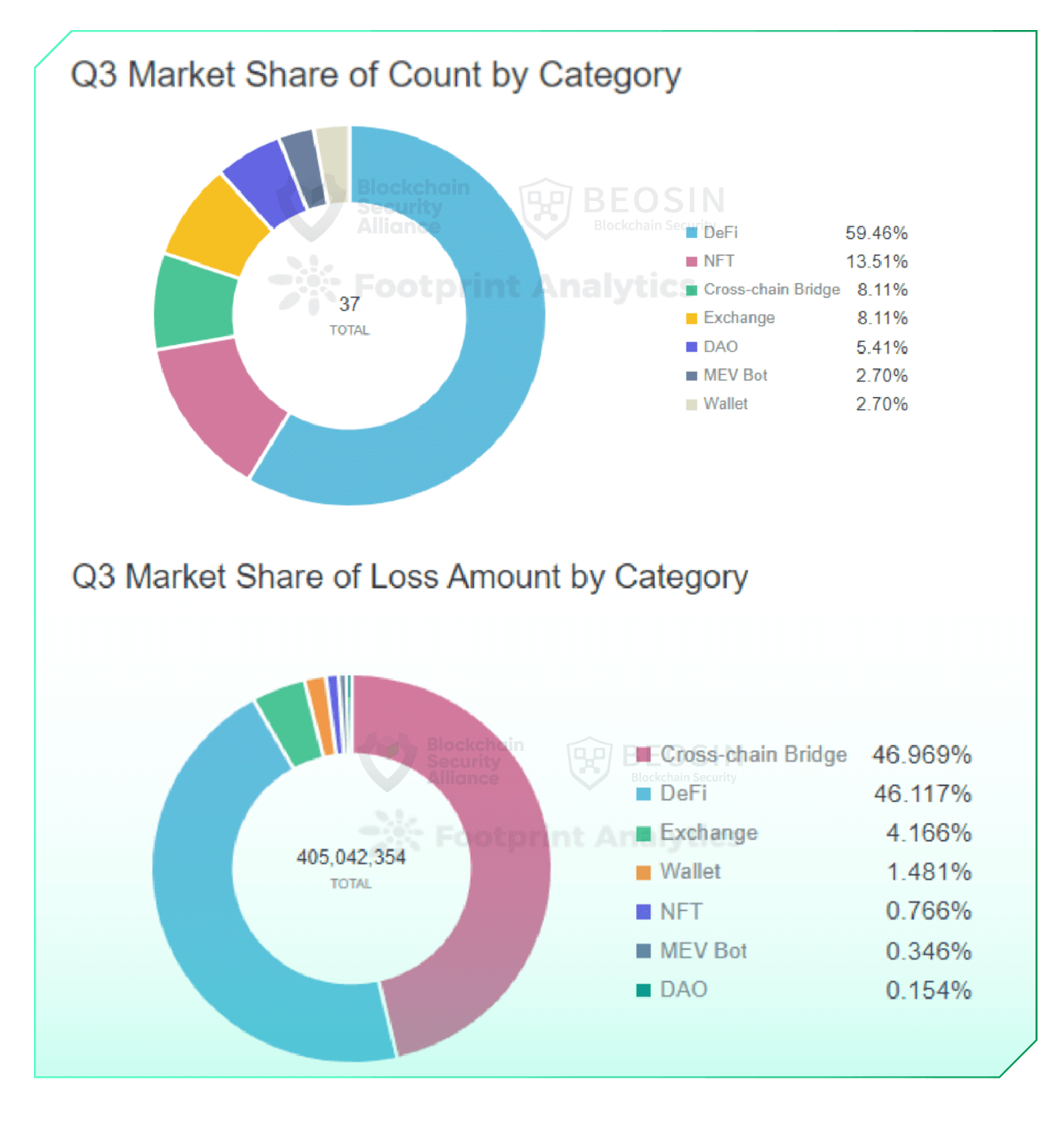

By way of the venture varieties, 92% of the quantity misplaced got here from cross-chain bridges and DeFi protocols. 22 of the 37 assaults occurred within the DeFi house.

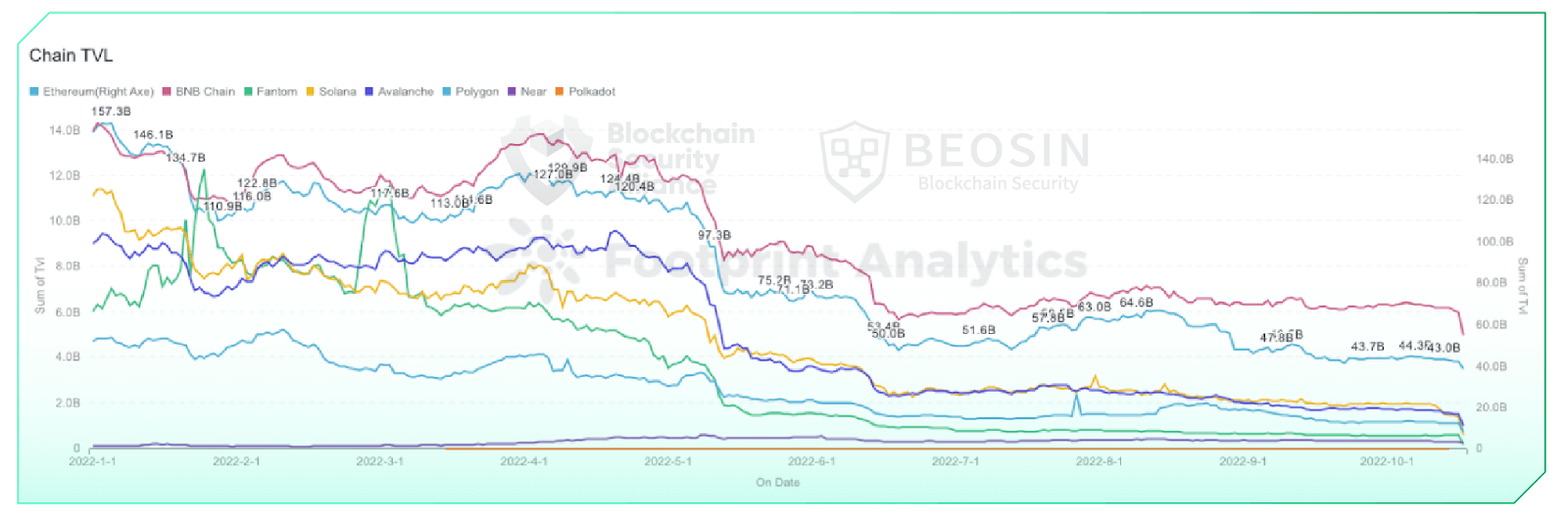

By way of TVL, after a pointy drop in TVL from Could to June, the development of TVL of every chain tended to be secure this quarter. Late July to early August confirmed a slight upward development in TVL, which was additionally the interval with the best variety of assaults and loss quantity on this quarter.

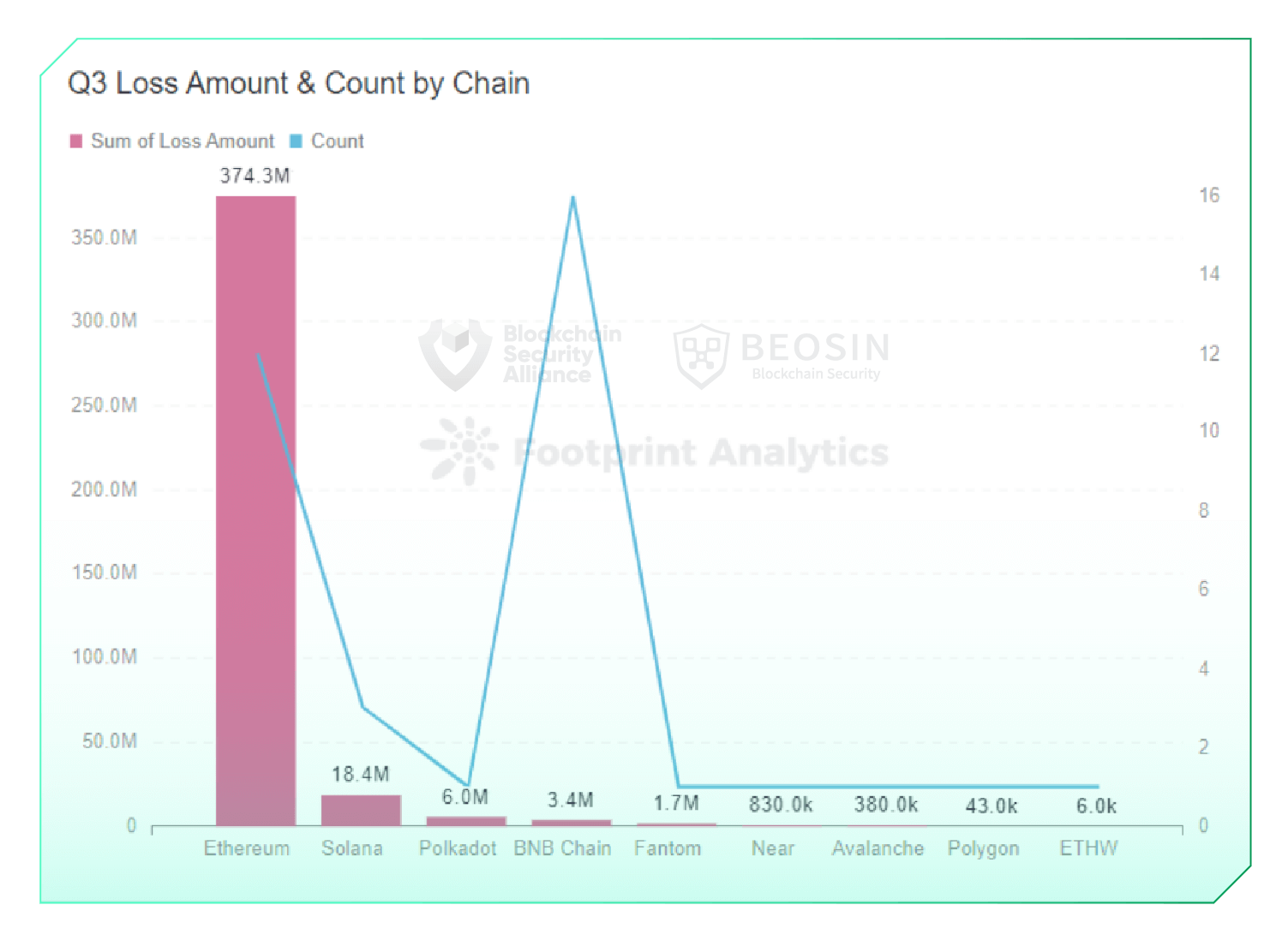

By way of chains, the quantity of losses on Ethereum reached $374.28 million this quarter, accounting for 92% of the full losses. Probably the most incessantly attacked chain was BNB Chain, which reached 16 occasions.

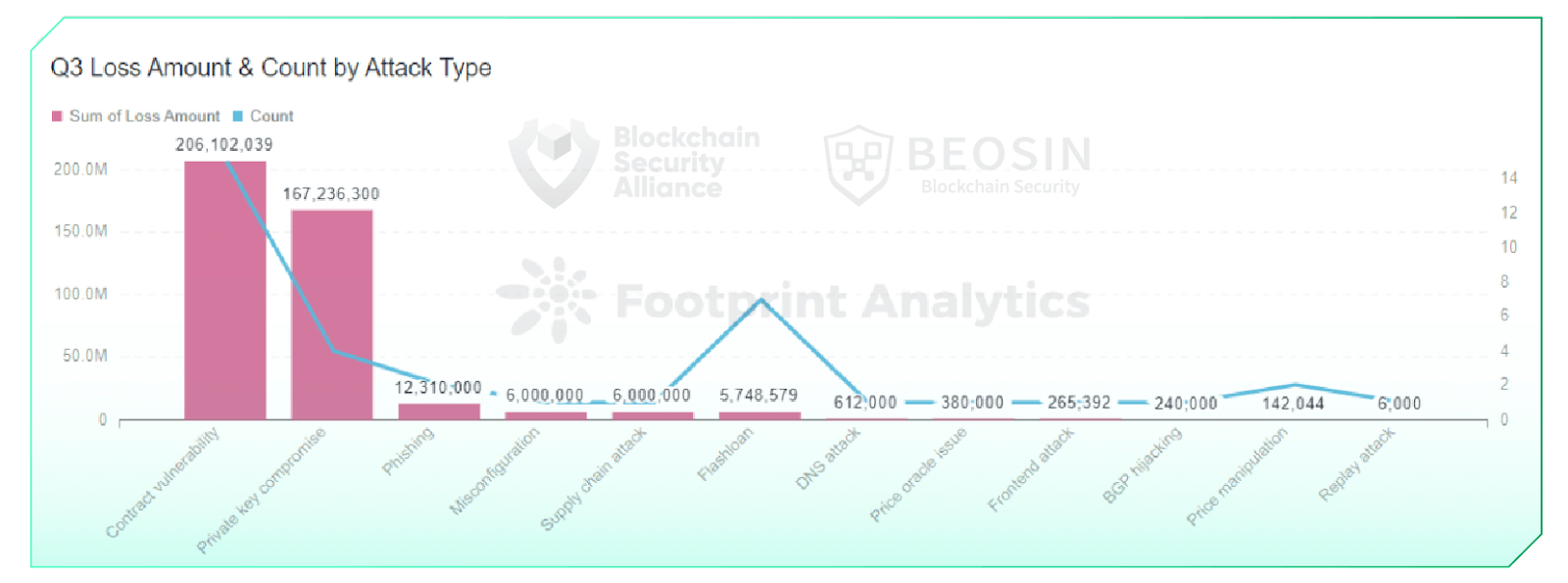

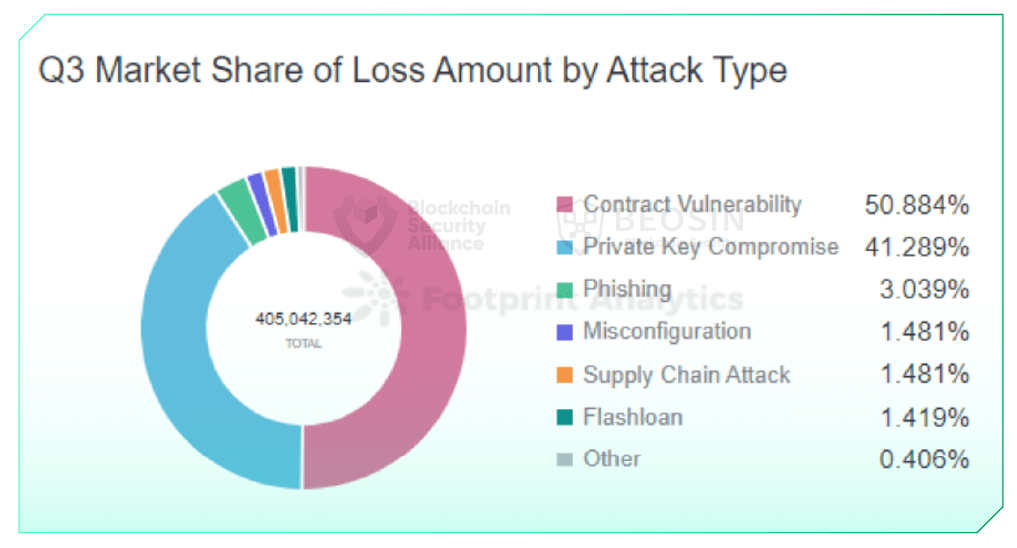

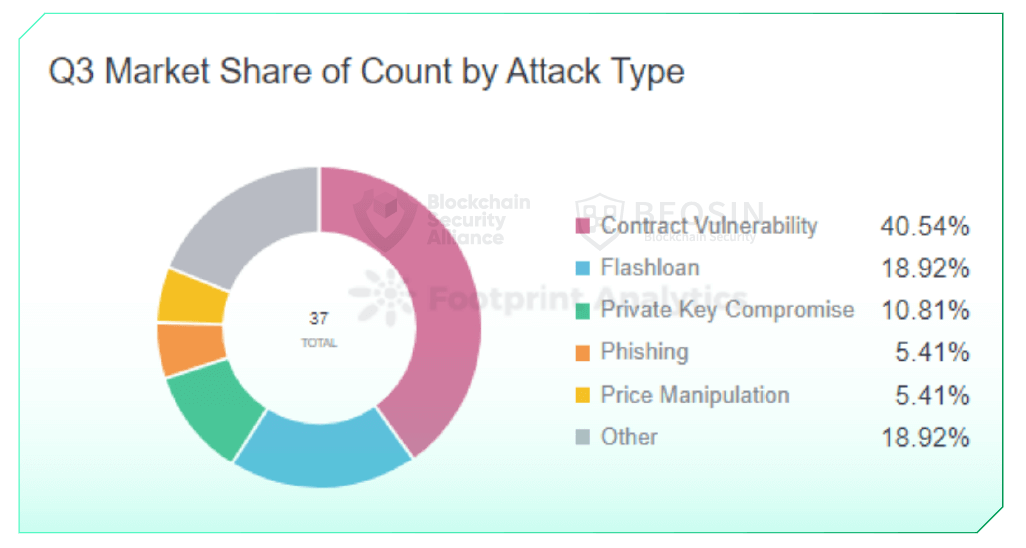

By way of assault varieties, 92% of the loss quantity was attributable to contract vulnerability exploits and personal key compromises.

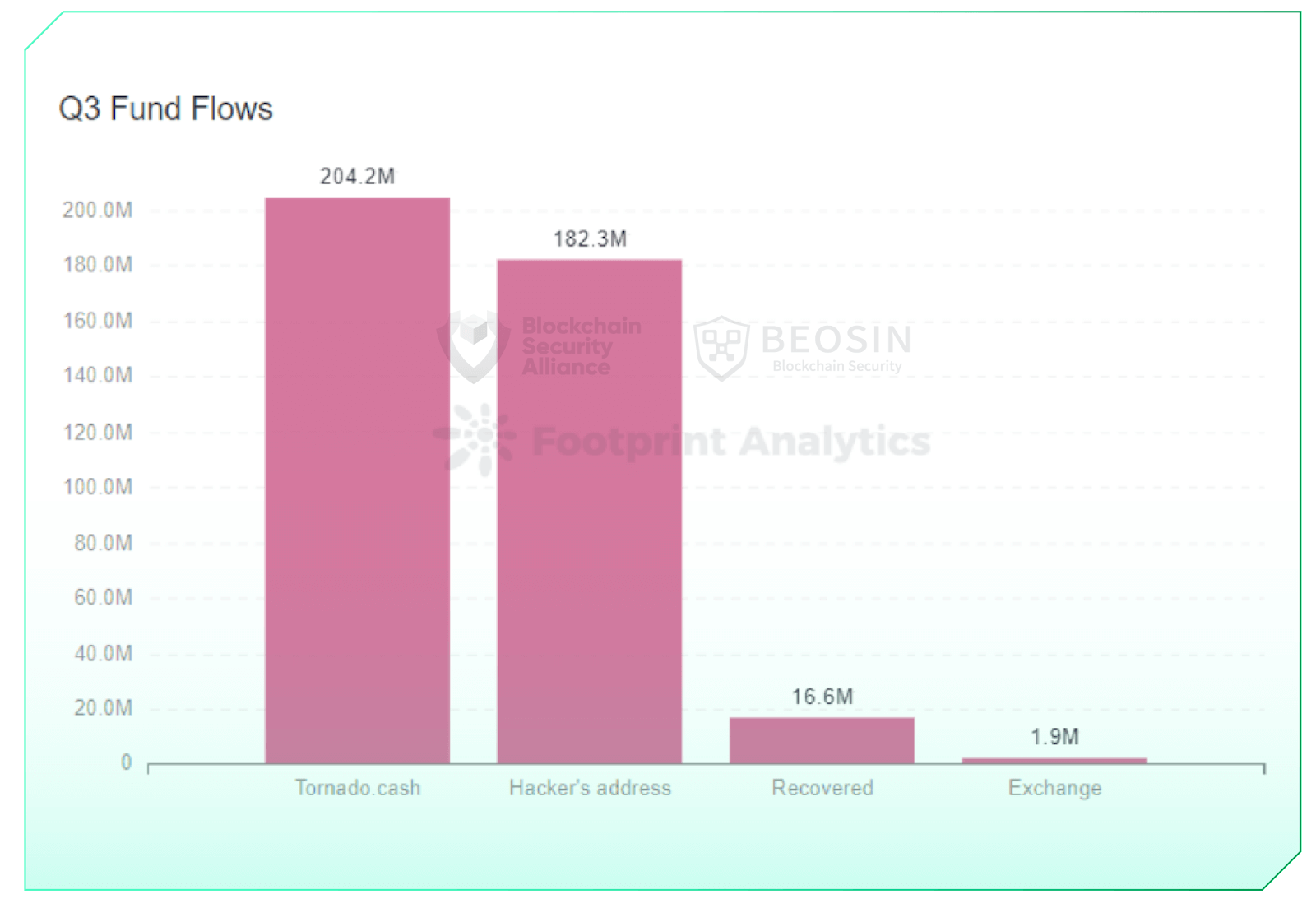

By way of fund flows, about $204.2 million of the stolen funds flowed into Twister Money, accounting for about 50.4% of the funds stolen within the quarter. Solely about 4% of the stolen funds have been recovered through the quarter.

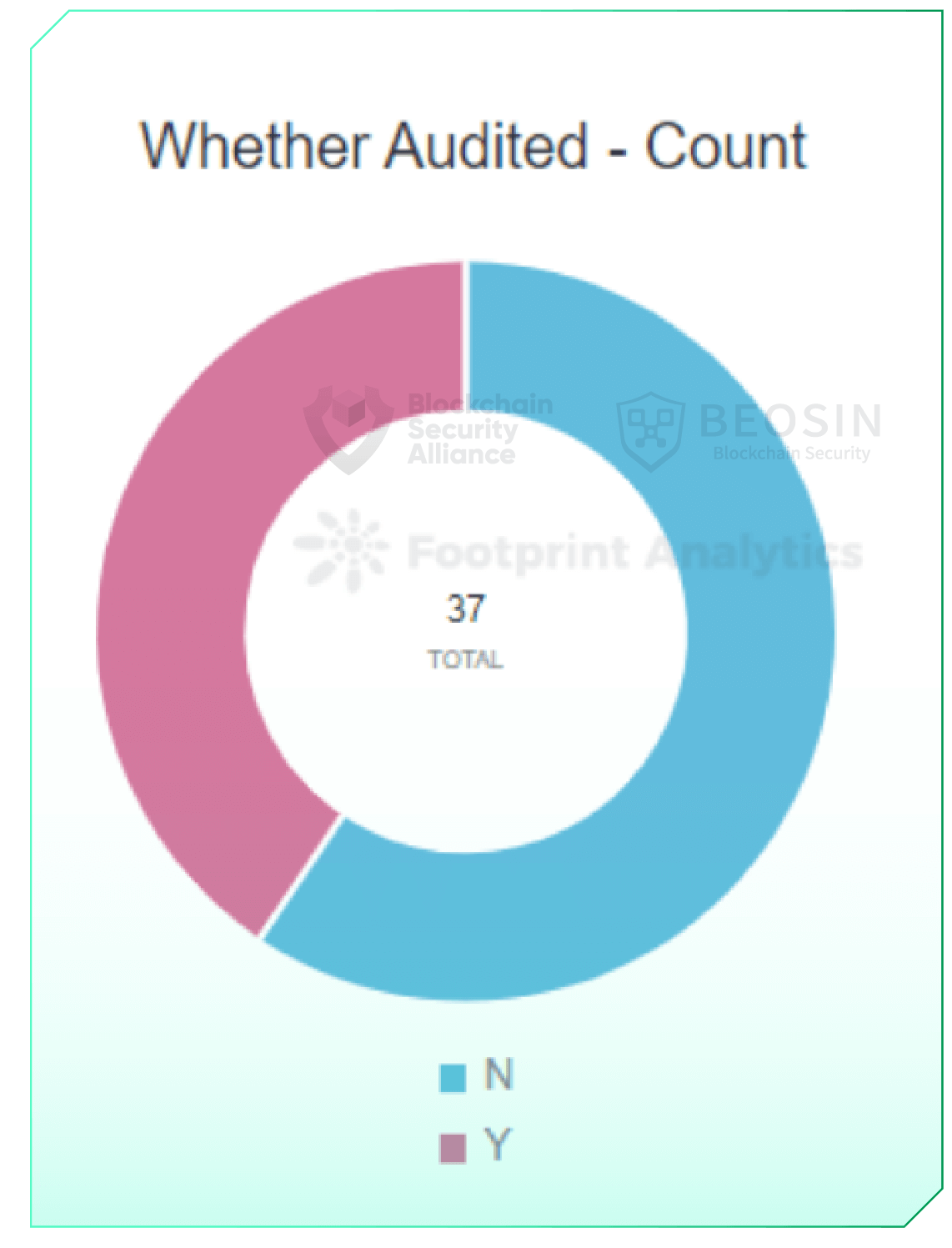

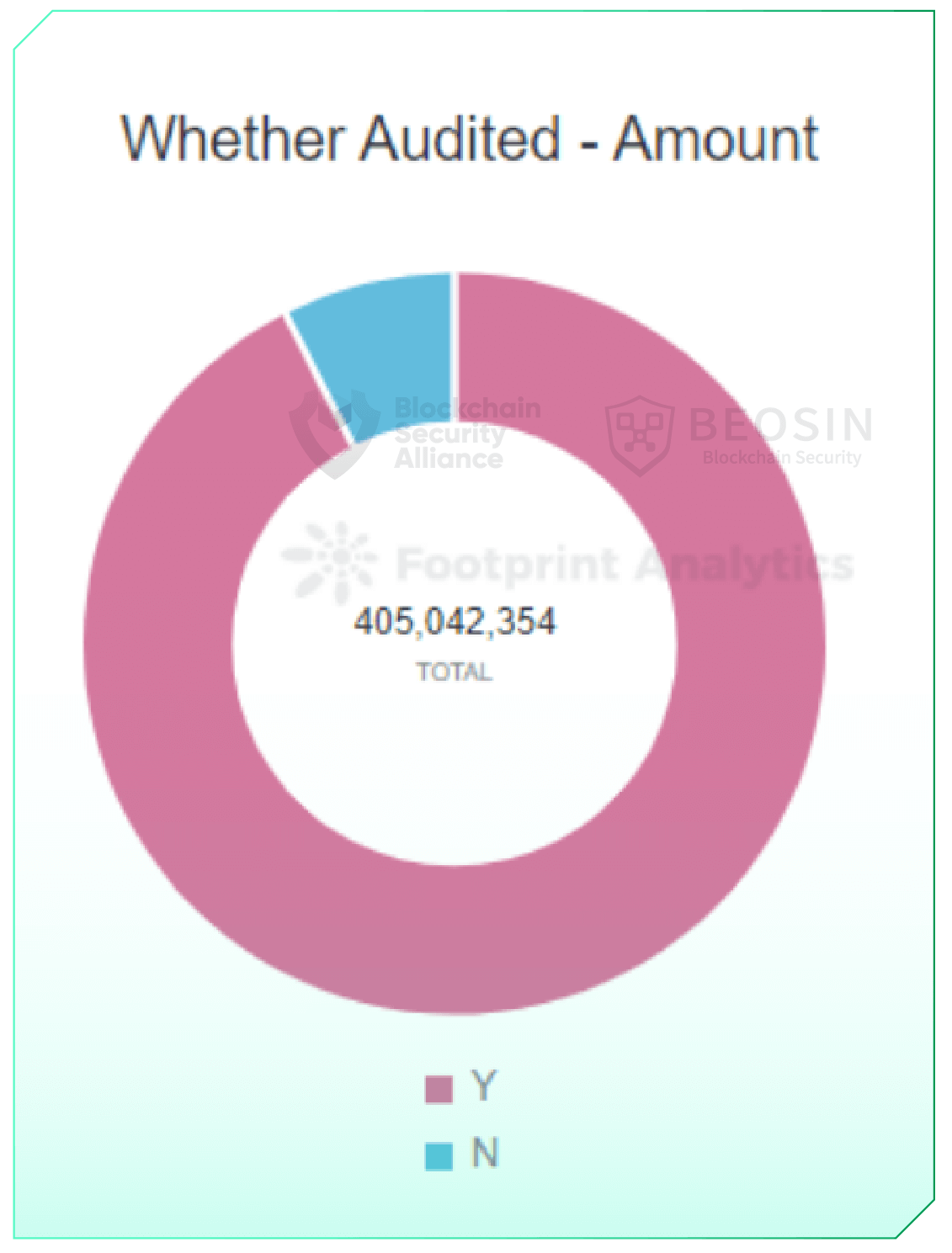

By way of audits, solely 40% of the rekt tasks have been audited.

2 Overview of exploits

Total assaults fell in Q3 in comparison with Q2

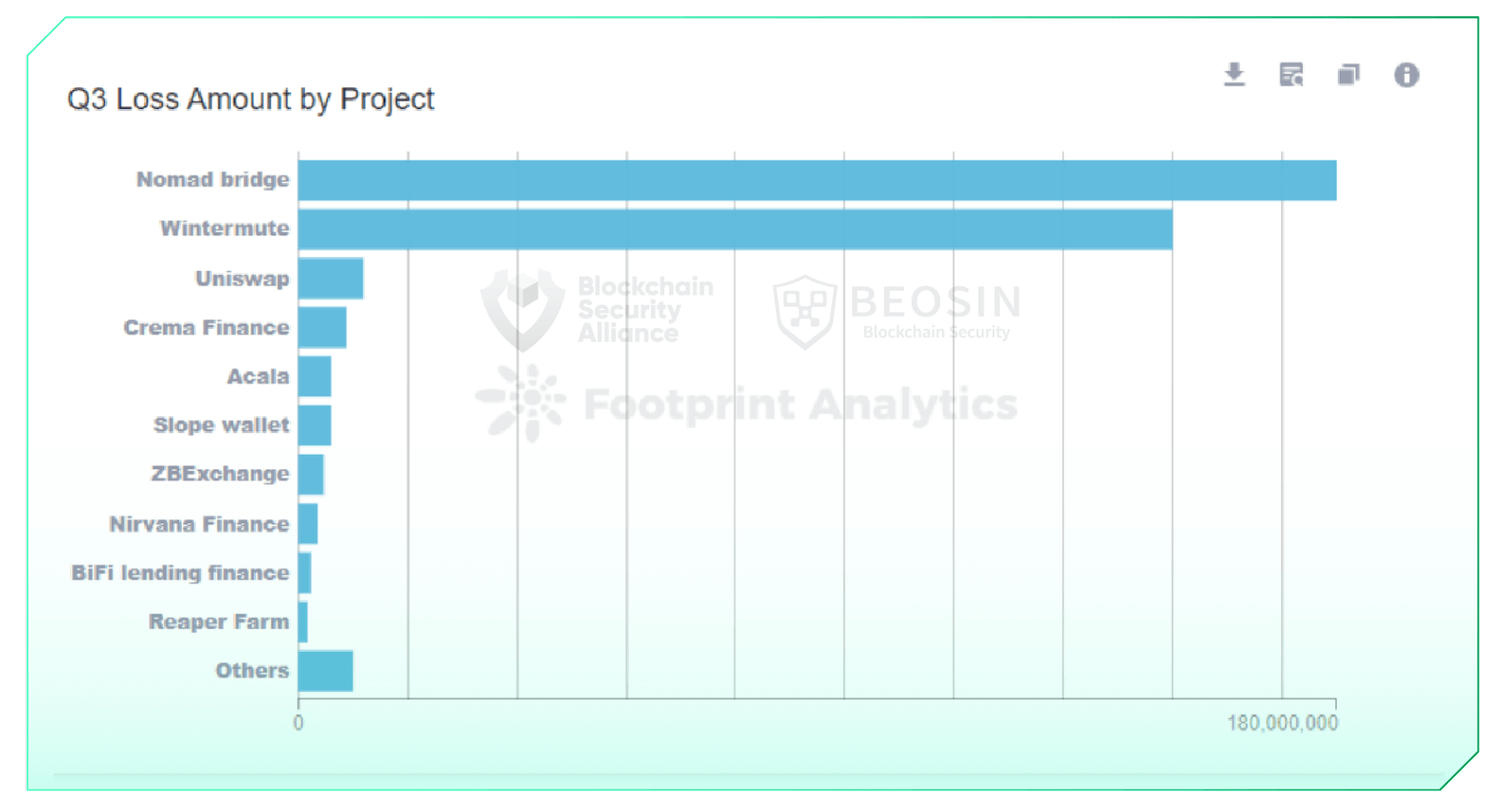

In Q3 2022, 37 main assaults have been monitored within the Web3 house, with a complete lack of roughly $405 million. There have been two assaults with losses of $100 million or extra, three assaults with losses of $10 million or extra, and 14 assaults with losses of $1 million or extra. The safety incidents with over $100 million in losses have been Nomad Bridge ($190 million) and Wintermute ($160 million).

August 2022 was probably the most energetic month for hackers within the quarter, with losses of round $210.62 million. Complete losses from assaults in July have been $30.05 million, making it the bottom quantity of losses in a month since 2022.

3 Forms of rekt tasks

Cross-chain bridges and DeFi tasks account for 92% of the loss quantity

Within the third quarter of 2022, three cross-chain bridge assaults resulted in a complete lack of roughly $190.25 million; 22 assaults within the DeFi house resulted in a complete lack of $186.79 million. Roughly 92% of the assault loss quantity got here from the cross-chain bridge and DeFi protocols.

As of September 2022, there have been 10 main cross-chain bridge safety incidents in 2022, with over $1.4 billion in losses. Cross-chain bridges have been probably the most affected space by assaults in 2022.

Along with cross-chain bridges and DeFi protocols, different forms of tasks attacked this quarter included NFTs, exchanges, DAOs, wallets, and MEV bots, making their general varieties extra various than within the earlier quarter.

4 Loss quantity by chain

Losses on Ethereum quantity to $374.3 million

12 main assaults occurred on Ethereum this quarter, with a complete lack of $374.28 million, rating first amongst all chains. Solana misplaced $18.37 million from 3 exploits.

Chains with main assaults in two consecutive quarters embrace Ethereum, BNB Chain, Fantom, and Avalanche.

BNB Chain noticed probably the most assaults, with 16 exploits, and their corresponding tasks are all unaudited. The amount of cash concerned in these 16 exploits is comparatively small, with 14 incidents involving a single lack of lower than $500,000.

After experiencing a pointy drop in TVL from Could to June, the development of TVL throughout chains stabilized this quarter. TVL confirmed a slight upward development within the interval from late July to early August, which was additionally the interval with probably the most assaults and loss quantity this quarter. The crypto market typically moved barely downward in September. After the Ethereum merge on September 15, the Ethereum TVL noticed a steady slight decline.

5 Evaluation of Assault Varieties

92% of the misplaced quantity was attributable to contract vulnerability exploits and personal key compromise

Within the third quarter, contract exploits continued to be the most typical assault sort. About 15 assaults are contract vulnerability exploits, accounting for 40.5 % of the full quantity. Complete losses from contract vulnerabilities amounted to $201.6 million, or 50.9 % of whole losses.

The 4 personal key compromises this quarter resulted in roughly $167.24 million in losses, the second largest quantity of losses after contract vulnerability exploits.

In contrast with the earlier quarter, the forms of assaults on this quarter have been extra various. New assault varieties that emerged this quarter embrace BGP hijacking, misconfiguration, and provide chain assaults.

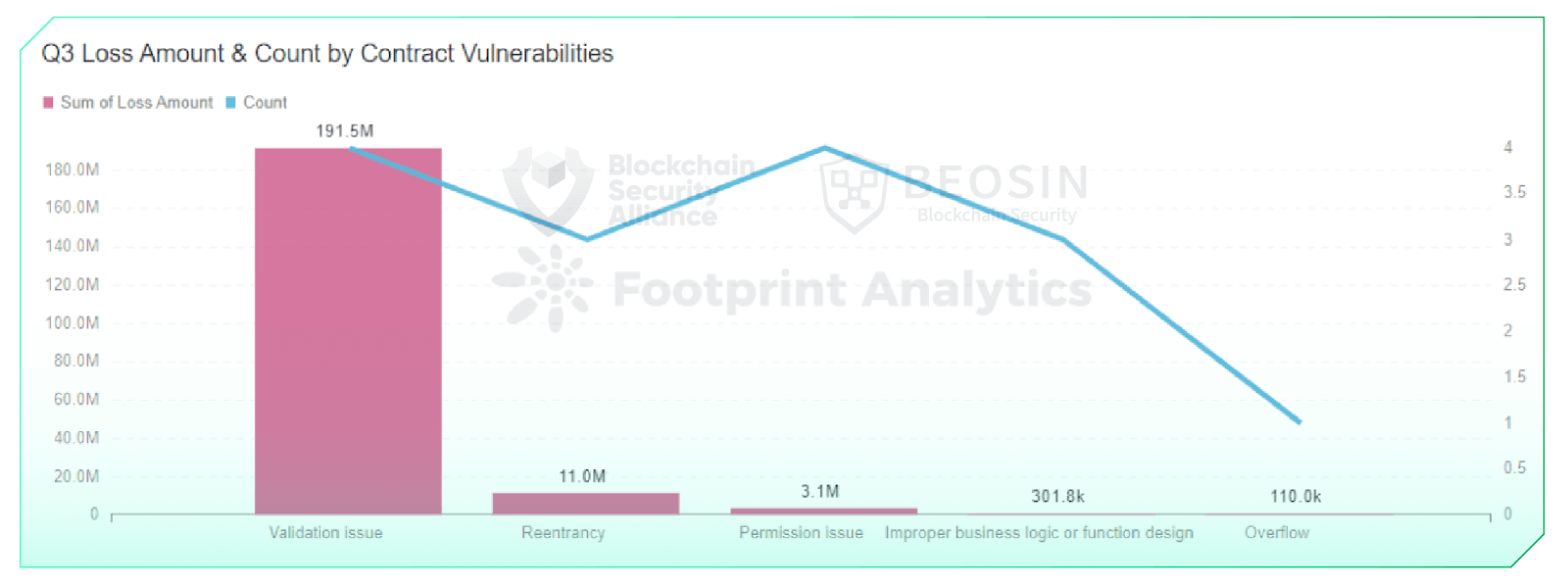

By contract vulnerabilities, the primary vulnerabilities exploited this quarter embrace: validation points, reentrancy, permission points, improperly designed enterprise logic or features, and overflow vulnerabilities. These vulnerabilities are all discoverable and fixable through the audit section.

6 Typical Safety Incident Recap

6.1 Nomad Bridge $190 Million Incident

On August 2, Nomad Bridge, a cross-chain platform that helps asset transfers throughout Ethereum, Moonbeam, Avalanche, Evmos and Milkomeda, suffered a large hack that value the venture $190 million.

6.2 Slope Pockets Incident on Solana

On August 3, a large-scale Slope pockets theft incident occurred on Solana, with losses estimated at round $6 million.

6.3 Wintermute Non-public Key Compromise Incident

On September 20, crypto market maker Wintermute was attacked with a lack of $160 million because of a personal key compromise.

7 Fund Movement Evaluation

Roughly $204.2 million in stolen funds flowed into Twister Money

On August 8, the US Division of the Treasury’s Workplace of International Belongings Management (OFAC) sanctioned Twister Money, prohibiting U.S. people or organizations from interacting with it. Within the third quarter of 2022, roughly $204.2 million in stolen funds nonetheless flowed into Twister Money, representing 50.4 % of the funds stolen in that quarter, which is decrease than within the second quarter.

Roughly $182.3 million of the stolen funds remained within the hacker’s tackle because the stability. Some stolen funds have been bridged to addresses on different chains, and this portion remains to be counted because the hacker’s tackle stability.

About $16.6 million of belongings have been recovered by on-chain negotiations and unsolicited returns from white hat hackers. Within the third quarter of 2022, solely about 4% of the stolen funds have been recovered, a a lot decrease share than within the second quarter.

Round $1.92 million of stolen belongings flowed into exchanges similar to Binance and FixedFloat. Such incidents typically concerned a small variety of belongings (normally round $10K to $100K), and the hackers transferred the stolen funds to the exchanges instantly after the assault, ensuing within the tasks failing to contact the exchanges in time to freeze the funds.

8 Challenge Audit Evaluation

Solely 40% of the tasks have been audited

In 2022, the share of rekt tasks that have been audited have been: 70% within the first quarter, 52% within the second quarter, and 40% within the third quarter. The share of unaudited rekt tasks reveals an growing development quarter by quarter.

Of all of the rekt tasks, the audited tasks misplaced a complete of $ 375.48 million, and the unaudited tasks misplaced about $ 29.56 million in assaults. At first look, it might sound that audits didn’t serve to guard the secure operation of the tasks. Nonetheless, a deeper evaluation reveals that almost all of those audited tasks have been attacked by non-contractual degree points similar to personal key compromise, provide chain assaults, DNS assaults, BGP hijacking, and misconfiguration. Among the many unaudited tasks, 85% have been attributable to contract vulnerabilities or flashloan assaults.

It may be seen that skilled audits are nonetheless efficient in securing the venture on the contract degree to some extent. Nonetheless, the secure operation of a protocol additionally requires job of offline threat management, safekeeping of the personal key, being alert to conventional community safety assaults, and utilizing third-party parts fastidiously. In fact, on this quarter, there are additionally some vulnerabilities that ought to have been found within the audit section however weren’t introduced within the audit report, so it is strongly recommended that the venture search knowledgeable safety firm to conduct the audit.

Obtain the complete report:

About Blockchain Safety Alliance

The Blockchain Safety Alliance was launched by a number of models with various trade backgrounds, together with college establishments, blockchain safety corporations, trade associations, fintech service suppliers, and many others. The primary batch of the alliance council consists of Beosin, SUSS NiFT, NUS AIDF, BAS, FOMO Pay, Onchain Custodian, Semisand, Coinhako, ParityBit, and Huawei Cloud. The present members embrace: Huobi College, Moledao, Least Authority, PlanckX, Coding Ladies, Coinlive, Footprint Analytics, Web3Drive, and Digital Treasures Middle. The members of the Safety Alliance will work and cooperate collectively to constantly safe the worldwide blockchain ecosystem with their very own technical strengths. The Alliance Council additionally welcomes extra folks in blockchain-related fields to affix and collectively defend the safety of the blockchain ecosystem.

Alliance Registration

https://kinds.gle/pb3NaUgS3a2Sswnc8

Contact

Telegram:@kristenbeosin, @Web3Donny

Electronic mail: [email protected]

Alliance Member – Beosin

Beosin is a Singapore-based main international blockchain safety firm with 100+ safety specialists in formal verification and blockchain safety. With the mission of “Securing Web3.0 Ecosystem”, Beosin offers built-in blockchain safety services, together with code safety audit, threat monitoring, alerting & blocking for tasks, safety compliance KYT & KYC, and stolen asset restoration. Beosin has at present offered safety companies to greater than 2,000 blockchain enterprises worldwide, audited over 2,500 sensible contracts, and guarded over $500 billion of belongings for shoppers.

Alliance Member – Footprint Analytics

Footprint Analytics is a software to uncover and visualize knowledge throughout the blockchain, together with NFT and GameFi knowledge. It at present collects, parses, and cleans knowledge from 18 chains and lets customers construct charts and dashboards with out code utilizing a drag-and-drop interface in addition to with SQL or Python.