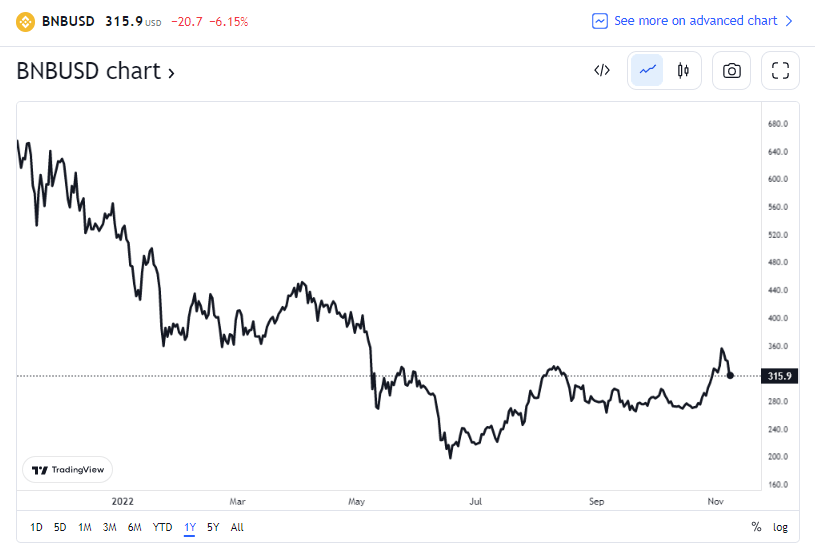

BNB, issued by the biggest trade by quantity, Binance, surged by greater than 20% in two hours after Binance CEO. Changpeng Zhao (CZ) introduced plans to amass FTX.

Later, nevertheless, the BNB value dropped by greater than 20% to its present value of $315.9.

This afternoon, FTX requested for our assist. There’s a vital liquidity crunch. To guard customers, we signed a non-binding LOI, intending to completely purchase https://t.co/BGtFlCmLXB and assist cowl the liquidity crunch. We might be conducting a full DD within the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

The Binance CEO described the present FTX state of affairs as “dynamic” and predicted that FTT could be extremely unstable within the coming days. Zhao additionally affirmed that Binance may withdraw from the deal at any time.

Moreover, FTX CEO confirmed that full due diligence is predicted to be accomplished within the close to future.

2) Our groups are engaged on clearing out the withdrawal backlog as is. This may filter out liquidity crunches; all belongings might be lined 1:1. This is without doubt one of the important causes we’ve requested Binance to come back in. It might take a bit to settle and so forth. — we apologize for that.

— SBF (@SBF_FTX) November 8, 2022

Along with the rise in BNB worth, FTX native token FTT additionally surged by 40% in a couple of hours however later fell by greater than 75% to its present worth of $5.412.

The sequence of occasions has been uncovered with large withdrawals of belongings from FTX within the final two days after CZ introduced Binance would promote its shares in FTT reserves. In consequence, FTX treasuries have been drying up whereas Binance’s quantity soared as belongings flowed to the distinguished cryptocurrency trade. Consequently, some feared FTX would collapse just like the Luna debacle and face insolvency.

Nevertheless, Binance ended up being the primary and final investor to amass FTX. Following that, there have been large speculations that led to large investments in BNB inside a couple of hours, growing its market cap from $2.76 billion to $3.68 billion. Thus contributing to its large value enhance.

At the moment, BNB is buying and selling at $317.2, up 5.85% in 24 hours.