Litecoin has been climbing the crypto market cap rating and at present stands at rank 15 with a market cap of as of press time.

In the meantime, the shake-up sees Solana transfer within the different route, sliding from its high 10 place on the finish of October to position behind Litecoin at sixteenth.

On Oct 30, Litecoin was languishing within the twenty first spot, sandwiched between Cosmos and Chainlink. Nevertheless, latest occasions have turned the crypto trade the wrong way up, with some commentators warning that the FTX contagion is but to run its course.

Crypto market meltdown

On Nov 17, newly appointed FTX CEO John Ray made the primary Chapter 11 chapter submitting, saying by no means in his profession has he encountered “such a whole failure of company controls and such a whole absence of reliable financial data.”

Ray painted a grim image for collectors, saying he had no confidence within the monetary statements because of the lack of money administration methods and poor reporting mechanisms.

Since Nov 7, the entire crypto market cap has seen $248.6 billion of capital outflows, leaving token costs reeling from the catastrophe. FTX-related tokens have seen essentially the most vital drawdowns, with the native FTT token sinking 93% in worth to drop out of the highest 200.

The worth of Solana has additionally suffered as a consequence of fears over its publicity to the FTX collapse. Messari identified that the improve keys for Serum, a major factor of the SOL ecosystem, had been held by FTX. Equally, doubts emerged that Sollet BTC (wrapped Bitcoin issued by FTX) was 1-to-1 backed.

On a extra intangible be aware, with FTX caput, SOL buyers are additionally involved {that a} vital backer is now not supporting the challenge.

The market in search of stability in Litecoin

The chaos of latest weeks has uncovered an trade hellbent on unacceptable dangers, particularly concerning the collateralization of alternate tokens.

Litecoin was launched in October 2011, making it one of many OG cryptocurrencies alongside Bitcoin. Whereas the likes of Namecoin, Feathercoin, and Peercoin, to call just a few, have pale into obscurity, Litecoin has caught round.

This longevity has not gone unnoticed; LTC’s resurgence is probably going a symptom of crypto customers in search of stability in a chaotic market. The Managing Director of the Litecoin Basis, Alan Austin, thinks so, final week he tweeted:

To these over time who’ve referred to as #Litecoin too boring:

Have you ever guys had sufficient pleasure but?

— Alan Austin (@alangaustin) November 17, 2022

Equally, because the SEC securities controversy continues to play out, Bitcoin maximalist Michael Saylor lately said that Litecoin is probably going a commodity.

“Somebody would possibly file an utility to get Litecoin designated as a digital commodity.”

LTC wallets are on monitor to outnumber Ethereum wallets

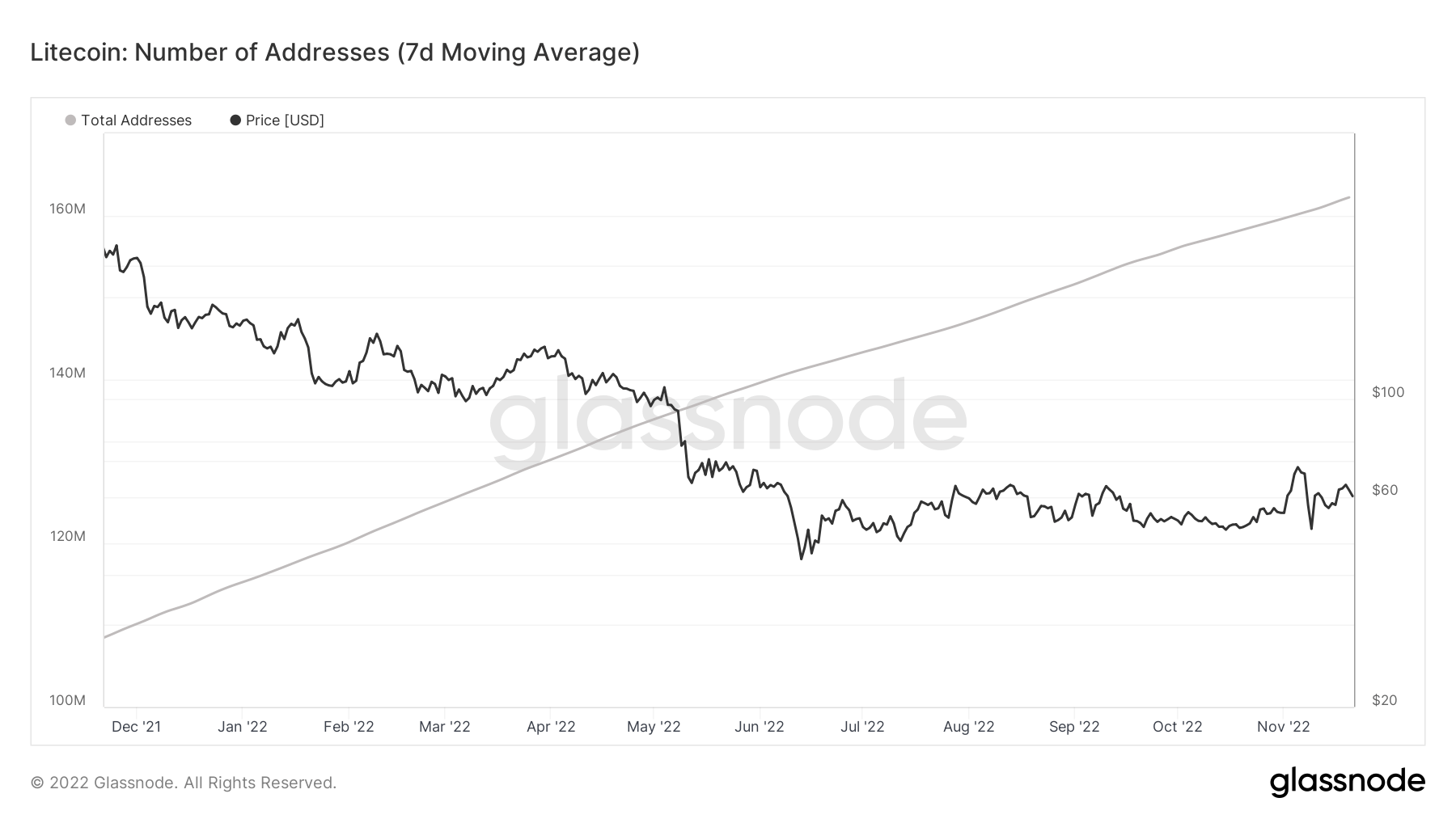

On-chain information reveals the variety of Litecoin pockets addresses continues to develop steadily. At the beginning of the 12 months, the quantity was roughly 117 million wallets. Presently, there are round 162 million LTC wallets.

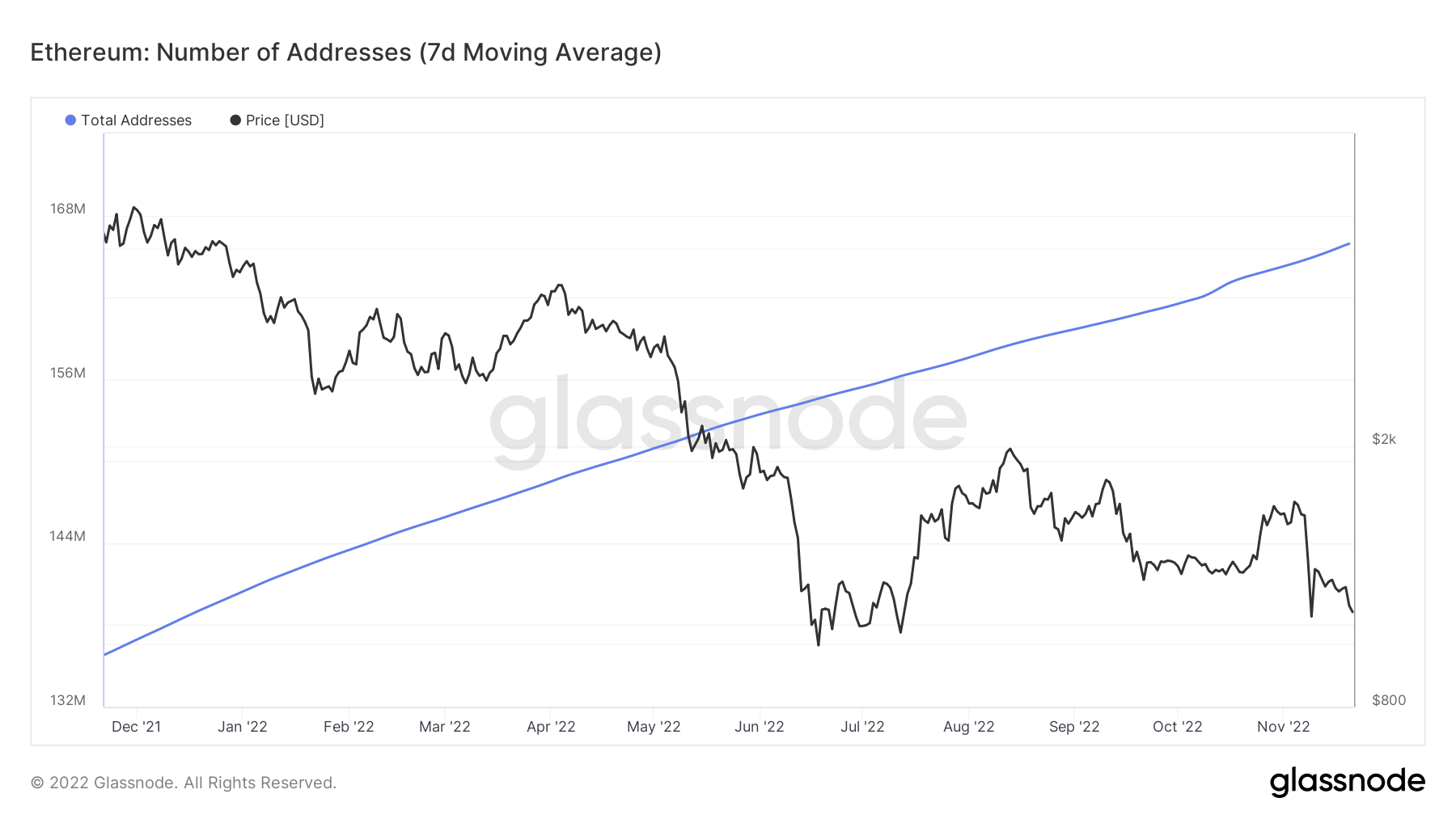

In the meantime, the variety of Ethereum wallets initially of 2022 was round 140 million wallets. Presently, the determine is 166 million.

If this development continues, the variety of Litecoin wallets will exceed Ethereum wallets by the top of the 12 months.