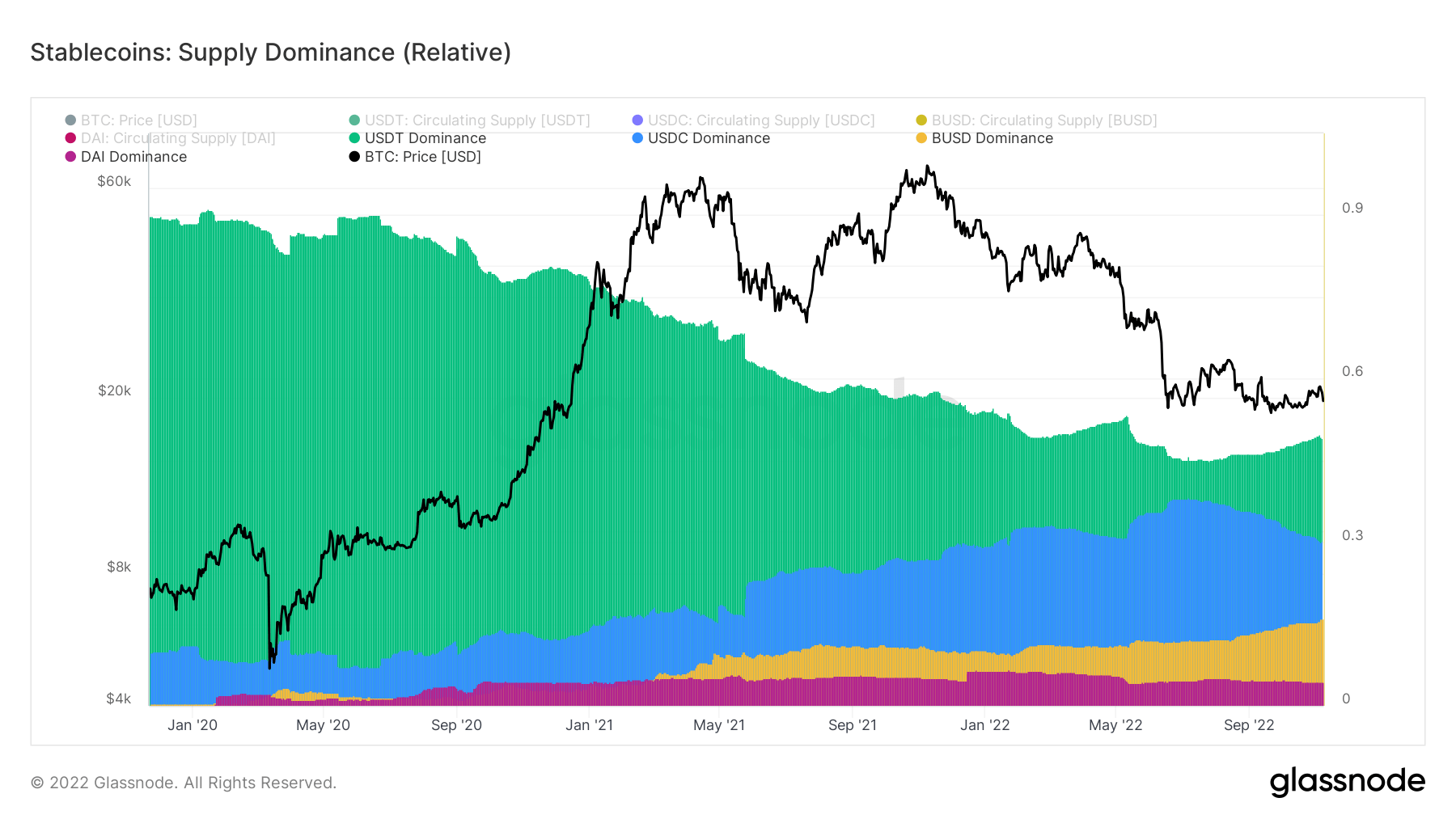

Binance USD (BUSD) is the best-performing stablecoin among the many high three stablecoins, as its provide dominance elevated by 6% on the year-to-date metrics to 16%.

The Binance-backed stablecoin has seen its provide develop from $18 billion at the beginning of the yr to $22 billion as of press time. Its progress was largely pushed by Binance’s choice to transform the USDC stability of its customers into BUSD.

Tether provide dominance drops

Glassnode information, as analyzed by CryptoSlate, confirmed that Tether’s USDT noticed its dominance lower to 50% from 54%. Tether’s market cap began the yr at over $78 billion, peaking at $84 billion in early Might.

Terra’s UST implosion throughout this era severely impacted belief in different stablecoins and the broader crypto market.

Throughout this era, USDT skilled a mini financial institution run that noticed it honor about $10 billion in redemptions over two weeks. The stablecoin additionally briefly misplaced its peg as many questions had been being requested about its reserves.

Whereas Tether has strongly recovered from this era, rising its provide from a low of$62.17billion to $69 billion, it’s nonetheless down from its Might peak of over $84 billion.

USDC stay unchanged

The second largest stablecoin by market cap, USD Coin (USDC), noticed its dominance stay unchanged at 30% on the year-to-date metric.

USDC survived the Terra route unscathed and briefly ate into Tether’s dominance as its provide grew from $42 billion recorded originally of the yr to a peak of $55.90 billion in July

Nevertheless, its provide has shrunk by $10 billion from that peak to $43 billion following Binance’s choice to convert its customers’ stability in USDC, TUSD, and USDP to its native stablecoin BUSD.

In the meantime, USDC’s issuer Circle has continued to make a number of strikes to regain its former glory. Circle introduced its euro coin (EUROC) stablecoin can be supported on the Solana blockchain by 2023. Aside from that, it additionally began transferring USDC reserves right into a Blackrock-managed fund.