Introduction

Since its inception in 2010, Bitcoin has seen its worth and recognition rise exponentially, creating the muse of a market that reached $1 trillion in worth in a decade. Cryptocurrencies have seen elevated adoption within the wake of broader macroeconomic turmoil, with hundreds of thousands of latest customers onboarding the decentralized world of cryptocurrencies as a hedge towards conventional finance.

Regardless of its present development, some imagine the crypto business can have a restricted life. Its critics count on the rise to plateau and reduce as regulatory pressures and inner market struggles create extra consumer losses.

Nonetheless, many count on the novel expertise to observe the identical adoption curve because the web and telephones did earlier than it.

This report examines the components that might contribute to Bitcoin’s development and assist the crypto business attain 1 billion customers by 2025.

The diffusion of improvements

The diffusion of innovation concept greatest describes the speed at which new applied sciences are adopted and unfold. It explains how the adoption of any new expertise follows a bell curve — a small group of innovators and early adopters at the start make approach for a bigger group of early majority adopters, adopted by a fair bigger group of late majority adopters. Lastly, the bell curve ends with a small group of late adopters.

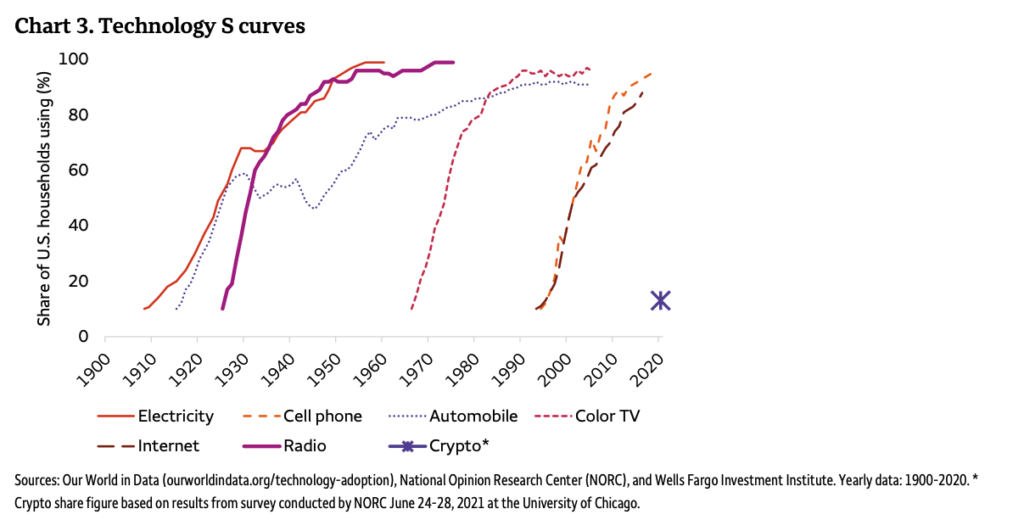

The ever present bell curve graph has been utilized to every part from steam engines to telephones, exhibiting how briskly the applied sciences have been adopted by broader society.

Making use of the dimensions to Bitcoin exhibits that the crypto market remains to be in its early days. A 2022 report from Wells Fargo calculated that cryptocurrencies nonetheless haven’t reached an adoption inflection level, evaluating them to the recognition of the web within the mid-to-late Nineties.

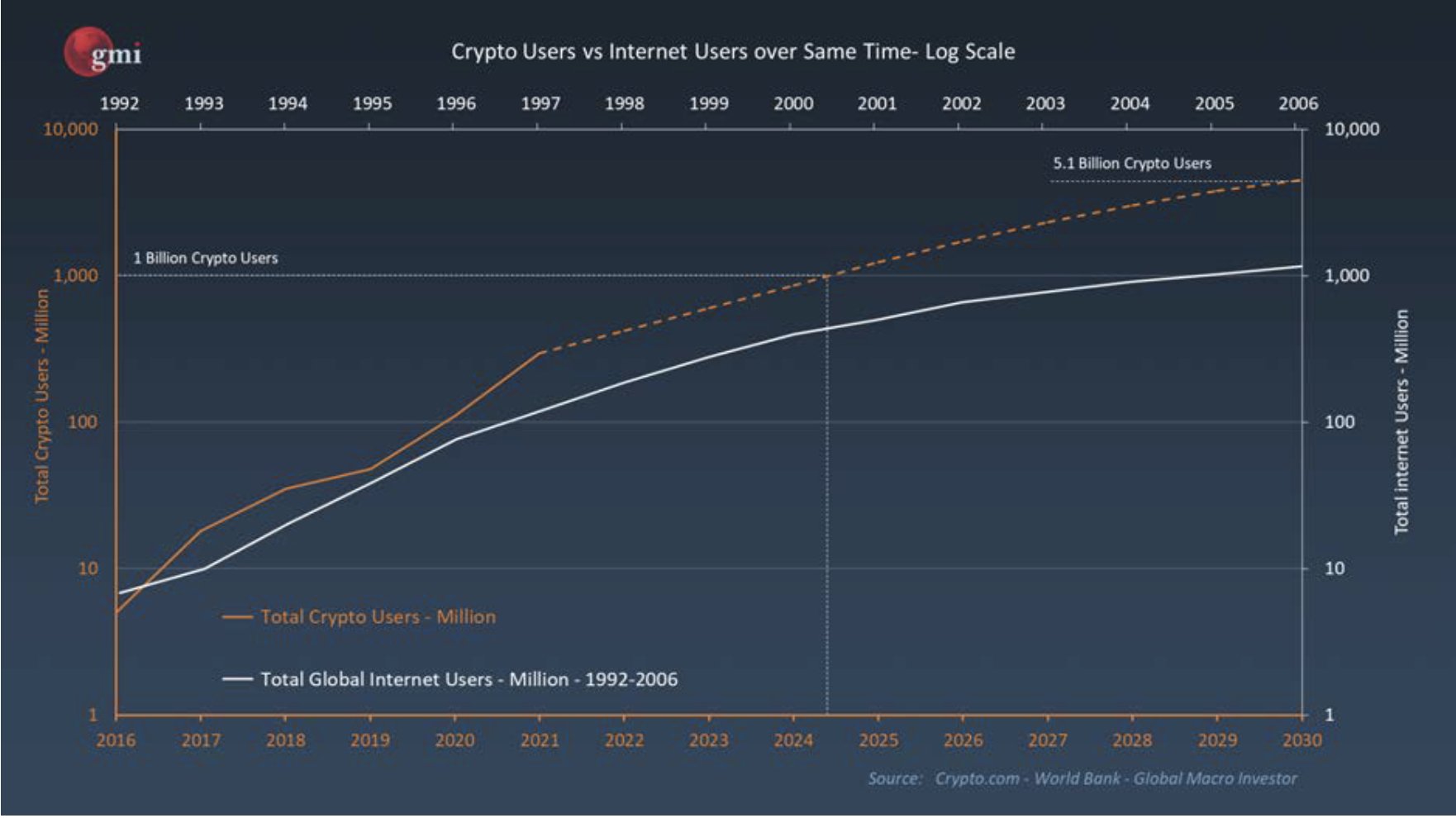

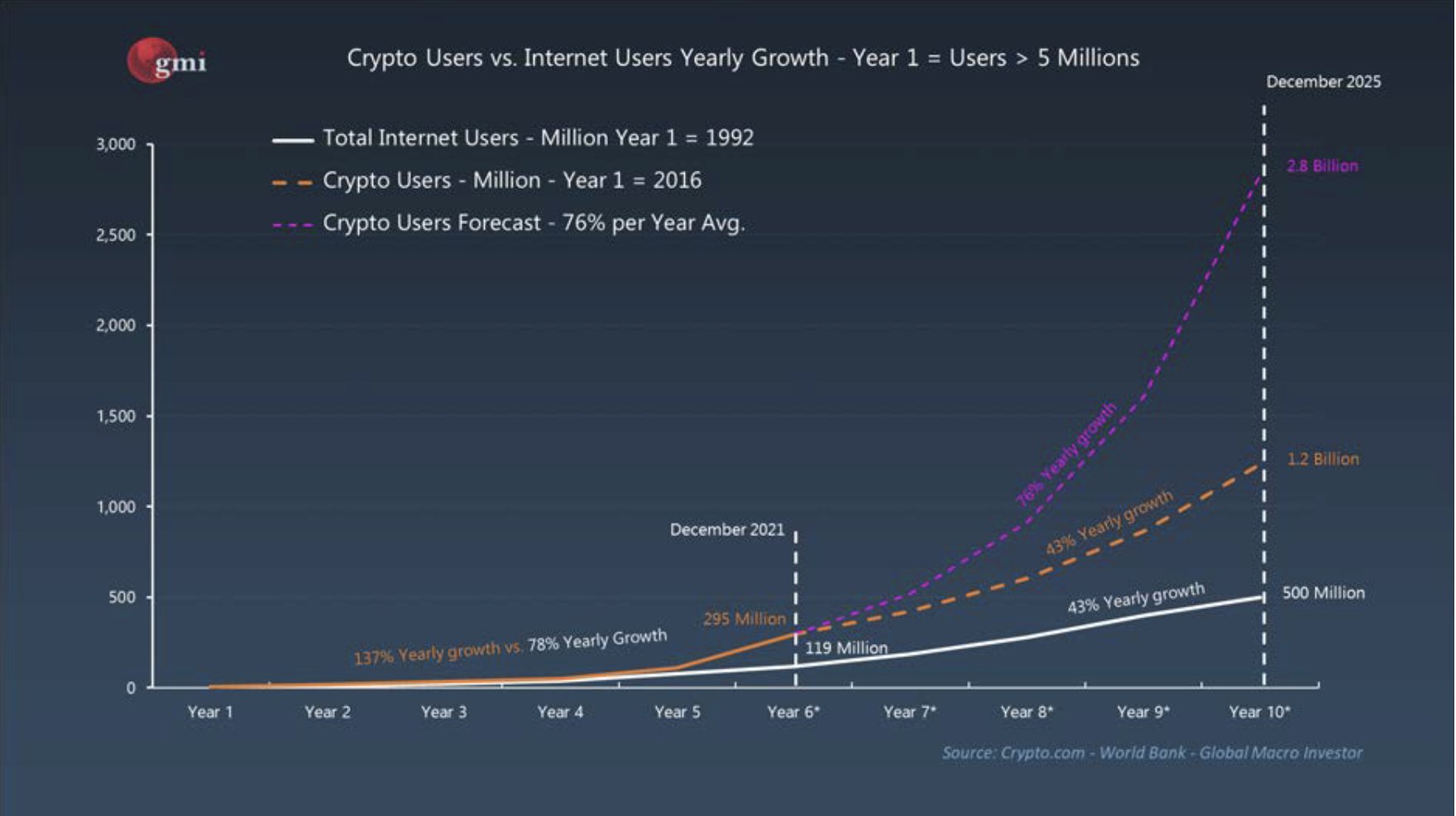

Evaluating Bitcoin to the web has develop into the go-to case examine for these rooting for the success of the crypto business. Information from World Macro Investor discovered that cryptocurrencies have seen the quickest adoption charge of any charge expertise in historical past, recording a 137% development each year.

Except for the exponential development each the web and Bitcoin skilled of their early years, the 2 applied sciences bear many different similarities. Each noticed their reputation rise after a small group of tech-savvy customers introduced them to the mainstream. Each struggled with attracting a wider viewers as a result of technical information required to make use of it. Each skilled regulatory strain as authorities companies struggled with policing the expertise.

The issue with defining Bitcoin adoption

Calculating crypto adoption is very difficult. In contrast to the web, which requires wanting on the variety of individuals with direct entry to an web connection, cryptocurrencies and their adoption are a lot tougher to quantify.

Adoption might be measured by means of the quantity of capital flowing into the market. Whereas this technique actually places the worth of the market into perspective, it tells little in regards to the precise variety of energetic customers.

It can be measured by means of transaction quantity and the variety of transactions on a given community.

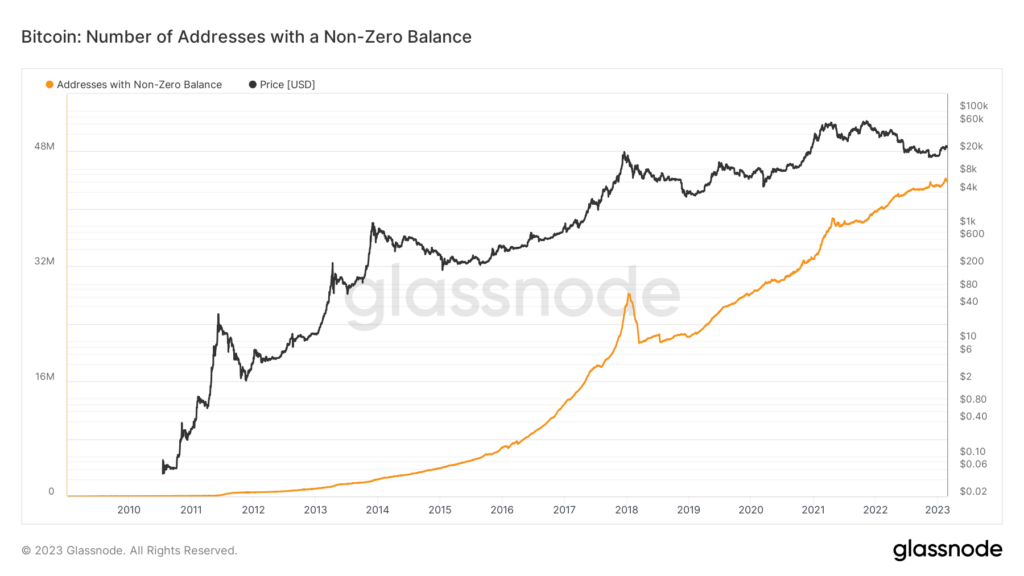

One other, extra dependable approach of measuring adoption is calculating the variety of customers. Nonetheless, this presents one other set of issues as a result of pseudonymous nature of blockchain expertise. Merely counting crypto addresses gained’t present a dependable consequence, as one handle doesn’t equal one consumer.

For this report, an increase in non-zero Bitcoin addresses and the variety of energetic customers on centralized exchanges are an indication of accelerating adoption.

Calculating crypto adoption

The variety of customers on centralized exchanges can be utilized as a proxy for broader crypto adoption.

Take, for instance, Coinbase. In 2021, round 25% of the whole crypto market used the U.S.-based alternate, making it probably the most standard cryptocurrency providers on the planet. As of February 2023, the alternate has round 110 million verified customers.

With a mean year-on-year development in customers of 92%, Coinbase outpaces the web with a mean YoY development of 43%. If the alternate continues to extend its consumer base on the web’s 43% conservative estimate, it might see its consumer base triple by 2025.

Evaluating the dimensions of the crypto consumer base to the web additional confirms the business’s potential for development.

Some consultants imagine that the present state of the crypto business is on par with the web in 1999. On the time, the brand new expertise slowly made approach for what is going to later be often known as the dot-com growth and had round 248 million customers. The web took six extra years earlier than it reached 1 billion customers in 2005.

Some estimates present that the crypto business might have round 605 million customers in 2023. Making use of the 43% YoY development common the web noticed to cryptocurrencies exhibits that the sector might attain 1.2 billion customers by 2025.

Even on the 17% YoY development common the web skilled between 2002 and 2006, the crypto business might see over 900 million customers in 2025.

In response to the diffusion of innovation mannequin, a expertise is in its early part even when it reaches 13.5% of the market.

Provided that the 605 million crypto customers in 2023 characterize 7.5% of the world inhabitants, we will safely say that the business remains to be in its early part. The 605 million customers are nonetheless thought of early adopters, as crypto would take one other 700 million customers to achieve the early majority.

Conclusion

Whereas cryptocurrencies and the web are inherently totally different applied sciences, they bear many similarities on account of their transformative potential.

Making use of essentially the most conservative adoption charge the web has seen to cryptocurrencies exhibits that not solely might the business attain 1 billion customers, however it might attain it a lot faster than some other expertise in historical past.

An increase in mistrust within the conventional monetary system fueled by macroeconomic turmoil makes cryptocurrencies, particularly Bitcoin, a particularly helpful proposition for hundreds of thousands. Because the expertise continues to develop and its use instances enhance, we might see this adoption charge pace up.

Nonetheless, it’s vital to notice that these are crude estimates. Any variety of black swan occasions might influence this adoption charge and set the business again a number of years. A tectonic shift in regulatory method might render cryptocurrencies primarily unusable in lots of components of the world.

Nonetheless, placing the crypto business’s development into perspective exhibits that it’s nonetheless in its early phases, ready for its full potential.