As a result of chain response of occasions following the FTX collapse, the main trade Coinbase felt the necessity to make clear that it has a ‘sturdy capital place’ amid market turmoil, and has zero publicity to Genesis.

2/ We gained’t touch upon each occasion in crypto, however for the sake of readability: Coinbase has zero publicity to Genesis Buying and selling.

— Coinbase (@coinbase) November 16, 2022

The trade Tweeted its doc explaining its strategy to transparency, danger administration, and client safety to remind its precautions in opposition to implosions. It mentioned that its precedence is to advertise a secure, accountable crypto economic system and shield its prospects.

Genesis

Just like the Terra-Luna collapse, FTX’s implosion led to a sequence of occasions that additionally affected the crypto trade Gemini and the crypto-lending platform Genesis.

On Nov. 16, the crypto lender introduced that its halting all withdrawals because of the FTX’s collapse.

Genesis had already taken successful after the collapse of Three Arrows Capital (3AC) following the Terra-Luna crash. The collapse of FTX pushed the lender to the purpose of halting withdrawals.

Coinbase’s strategy

Coinbase revealed its doc on Nov. 8 and posted it on Twitter on Nov. 16.

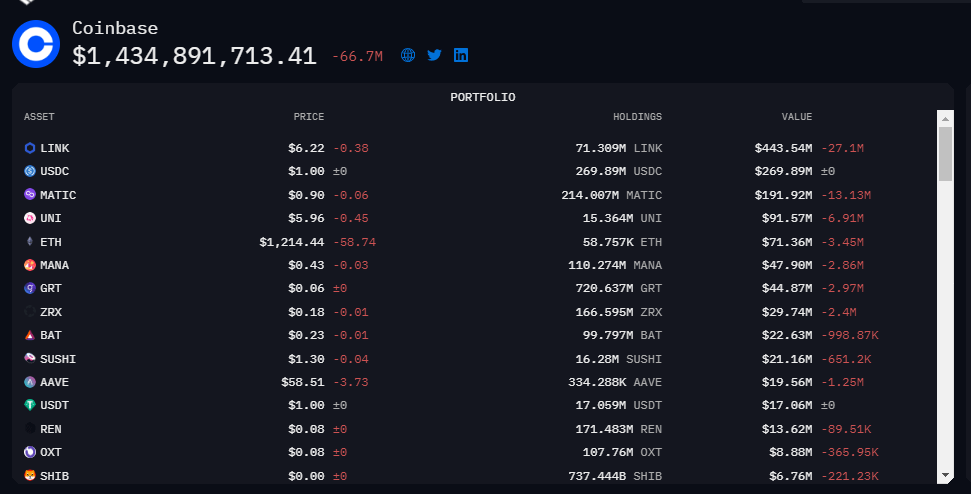

The doc explains why there can’t be a “run on the financial institution” at Coinbase, lays out its capital place, and offers particulars on its danger crew. Coinbase says that it avoids the chance of illiquidity by holding buyer belongings 1:1 and backing all institutional lending by collateral.

By way of its capital, Coinbase at present has $1.5 billion of belongings, half of which is on chainlink. The remaining quantity is held as Bitcoins (BTC).

As well as, Coinbase states that its danger administration crew has many years of expertise within the subject, and prioritizes wholesome liquidity administration, credit score, and counterparty danger.