Constancy’s spot Bitcoin (BTC) exchange-traded fund (ETF) swiftly secured its place because the second ETF supplier to surpass $1 billion in property below administration (AUM) inside per week of its launch.

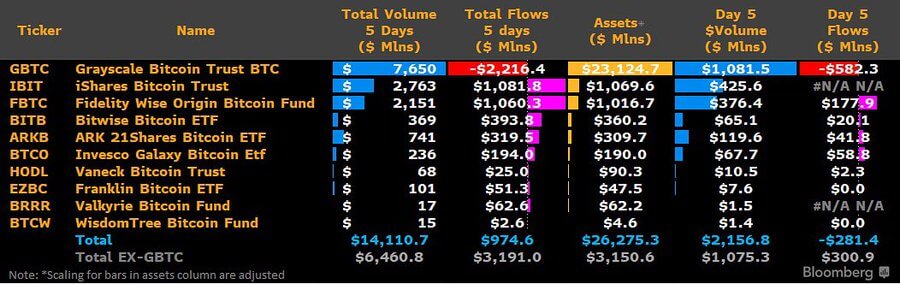

Knowledge from Bloomberg exhibits that Constancy’s Sensible Origin Bitcoin Belief achieved this milestone on its fifth day of buying and selling, recording flows that reached $1.01 billion in AUM. BlackRock’s iShares Bitcoin Belief (IBIT) had reached the identical milestone a day earlier, and its AUM presently stands at $1.06 billion.

This achievement is noteworthy given the transient period because the ETF’s launch, highlighting a speedy ascent among the many not too long ago permitted issuers. The expedited development displays the substantial investor curiosity in these merchandise regardless of the ETF’s earlier challenges in securing approval from the U.S. Securities and Trade Fee (SEC).

Market observers emphasize the importance of attaining $1 billion in AUM inside a brief timeframe, noting that this accomplishment is notable for any ETF. Furthermore, the inflows into these ETFs inside only one week signify a strong demand from buyers for publicity to Bitcoin by means of regulated funding autos.

Notably, a CryptoSlate Perception famous that the substantial inflows into these ETFs have elevated BTC to the place of the second-largest commodity within the U.S. by AUM, surpassing silver. This shift exhibits cryptocurrency merchandise’ rising acceptance and integration into conventional funding portfolios.

GBTC outflows cross $2B

In the meantime, the general outflow from Grayscale’s GBTC has now reached a considerable $2 billion.

This vital outflow continues a constant pattern because the fund’s launch, with a notable $582 million outflow recorded on its fifth day available in the market.

GBTC’s low cost has elevated to roughly 96 foundation factors alongside the outflow. Analysts recommend that this low cost adjustment might reply to the market’s present promoting stress.

Buying and selling exercise stays robust.

Regardless of their transient one-week existence, Bloomberg ETF analyst Eric Balchunas highlighted the exceptional development in buying and selling actions for the “New child 9” ETFs.

Notably, the buying and selling quantity for these ETFs surged by 34% between the fourth and fifth buying and selling days, defying the everyday post-launch decline noticed in hyped-up launches.

“Usually with a hyped-up launch, you see quantity steadily lower every day post-launch; [it’s] uncommon to see it reverse again up. All however one noticed a soar too, however GBTC [remained] flat, so it wasn’t a volatility factor,” Balchunas added.