Fast Take

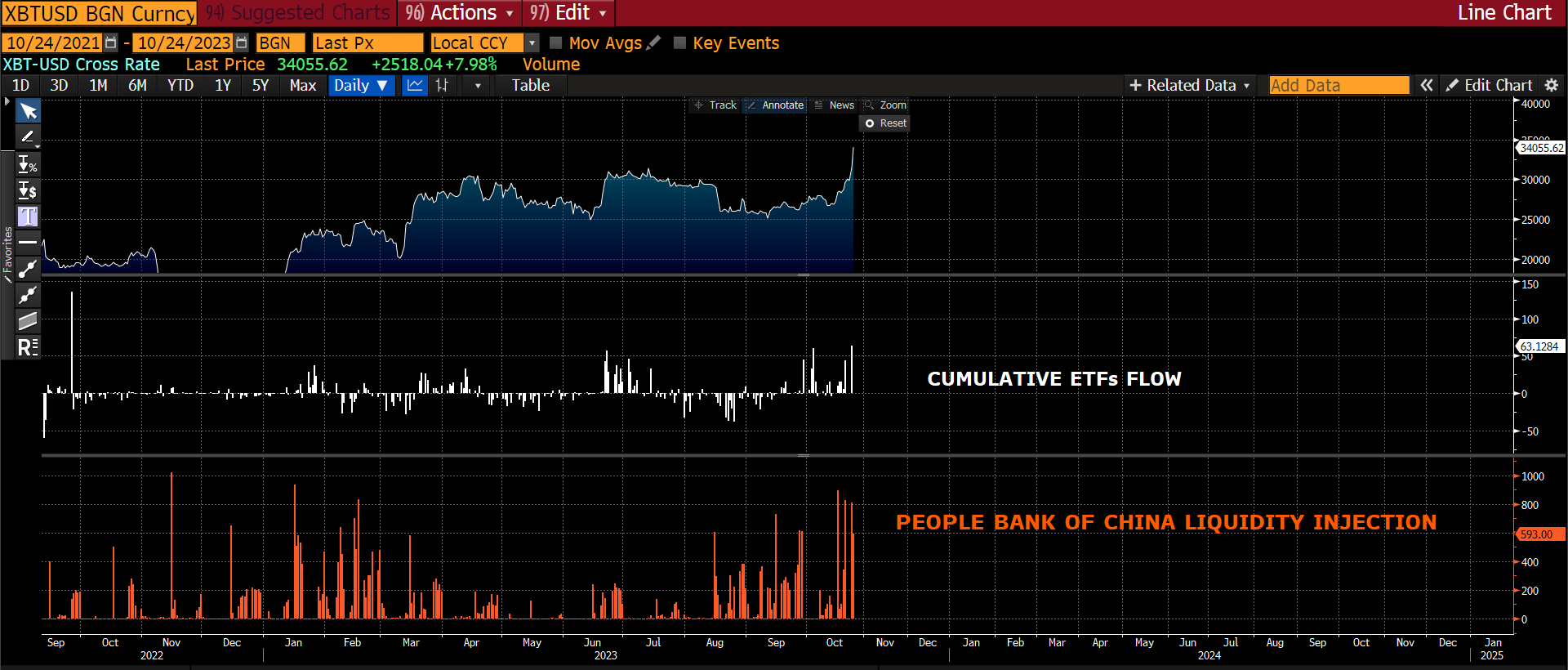

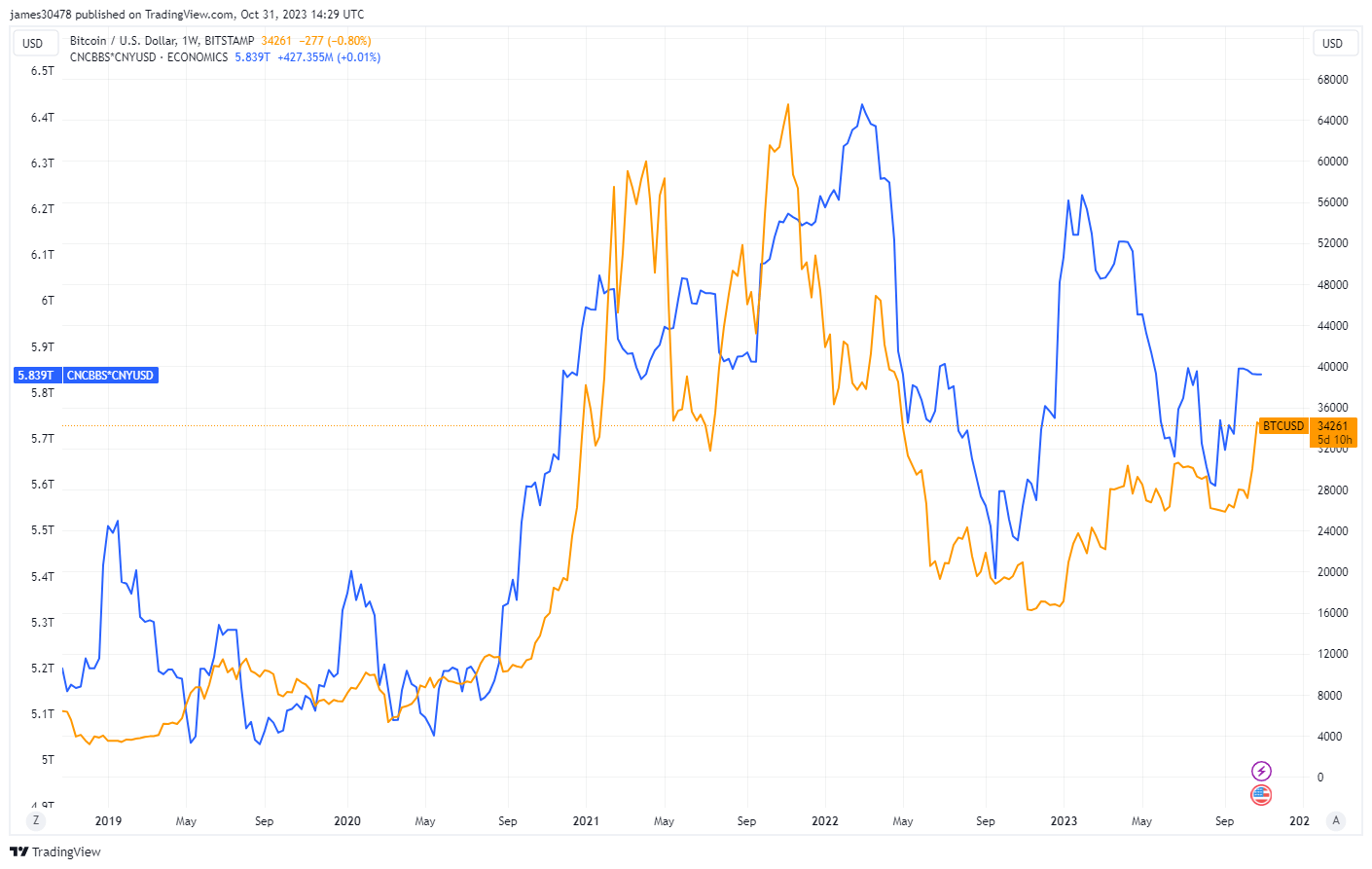

The Folks’s Financial institution of China’s (PBoC) continued liquidity injections into the market have been noticed to coincide with important actions in Bitcoin’s worth.

As an example, analyst Alessio City famous on Oct. 24 that because the PBoC’s liquidity injections surged, Bitcoin concurrently broke above the $30,000 mark. An analogous sample was famous earlier this 12 months, with a major enhance in PBoC’s liquidity that was adopted by an increase in Bitcoin’s worth. This enlargement coincides with Bitcoin’s current success, which isn’t solely attributed to liquidity injections but in addition to ETF inflows, as famous by City.

Nevertheless, it’s essential to know that this isn’t a direct correlation however moderately one of many many elements contributing to Bitcoin’s worth motion, as Bitcoin is a world liquidity indicator.

In a 12 months, the PBoC has expanded its stability sheet by over 7%; the stability sheet equates to roughly 5.84 trillion in Chinese language Yuan. This multifaceted dynamic illustrates the intricate relationship between conventional monetary methods and the evolving digital foreign money surroundings.

The submit Correlation noticed between PBoC liquidity injections and worth of Bitcoin appeared first on CryptoSlate.