The largest information within the cryptoverse for Nov. 14 contains Crypto.com CEO saying his trade unintentionally transferred 320,000 ETH to Gate.io; Kraken, Coinbase, and Gate.io publishing full proof-of-reserves with liabilities, and Binance launching a restoration fund for robust tasks caught up within the FTX collapse.

CryptoSlate Prime Tales

Crypto.com turns into newest financial institution run sufferer, however CEO says it’s enterprise as regular

Considerations over Crypto.com’s 320,000 ETH switch to Gate.io, and sluggish withdrawal course of raised speculations that Crypto.com could also be on the verge of a collapse.

Nevertheless, the trade CEO Kris Marszalek in a latest AMA stated that the insolvency rumors had been false, including that enterprise actions had been going usually. In keeping with Marszalek, Crypto.com’s soon-to-be-published audited proof-of-reserve will confirm that the platform is solvent.

Crypto.com transferred practically 85% of ETH reserves to Gate.io in October, CEO assures it was unintended

On-chain information revealed that Crypto.com transferred 320,000 ETH to Gate.io, shortly earlier than Gate.io printed its proof-of-reserves on Oct. 28.

Within the wake of the FTX collapse, the crypto neighborhood has raised issues that the crypto exchanges might have deliberately inflated their reserve holdings.

In his protection, Crypto.com CEO Kris Marszalek stated that the funds had been mistakenly despatched to Gate.io, however was returned instantly.

Huobi addresses issues raised surrounding faux reserves ‘snapshot’

Huobi World printed its proof-of-reserve on Oct. 13, which confirmed it held 14,858 ETH within the Huobi 34 pockets. Nevertheless, shortly after the snapshot was printed, WuBlockchain identified that 10,000 ETH left the pockets, elevating issues over a “faux reserve snapshot.”

In keeping with Huobi, the recent pockets normally sees inflows and outflows often. As such, the ten,000 ETH outflow was not supposed to inflate the reserve.

Kraken, Coinbase and Gate.io publish proof of reserves with liabilities

Crypto exchanges Kraken, Coinbase, and Gate.io has moved to publish a complete proof-of-reserve to guarantee clients of their liquidity.

The proof-of-reserve of the three exchanges disclosed their complete liabilities, alongside property holdings.

President of El Salvador says ‘FTX is the other of Bitcoin’

Bitcoin maximalist and El Salvador President Nayib Bukele labeled the FTX empire a Ponzi scheme, that was sure to fail. He referred to as out Sam Bankman-Fried (SBF) for secretly transferring clients’ funds to Alameda Analysis.

Nevertheless, he proclaimed that Bitcoin was designed to stop Ponzi schemes as transactions are open-source for public verification.

New Huo Know-how unit will get $14M mortgage from ex-Huobi CEO Leon Li to cowl shopper funds caught on FTX

Former Huobi CEO Leon Li has provided to subject a $14 million mortgage to assist a subsidiary of New Huo Know-how (Hbit Restricted) cowl all funds locked up within the bankrupt FTX.

Hbit reportedly has about $$13.2 million of shoppers’ property and $4.9 million of its asset locked up in FTX. The $14 million mortgage from Leon Li will assist the trade compensate all affected customers in full.

Binance to launch ‘restoration fund’ for robust tasks with liquidity disaster

Within the wake of the widespread market contagion attributable to the FTX collapse, Binance CEO Changpeng ‘CZ’ Zhao stated that his trade would launch an business restoration fund to assist robust tasks dealing with monetary misery.

Business consultants together with Tron (TRX)founder Justin Solar and investor Simon Dixon stated they’d contribute to the initiative to assist good builders and builders get better from the disaster.

Congressman Brad Sherman claims FTX ‘deterred laws’ with cash

FTX executives together with Sam Bakman-Fried, Ryan Salame, and Nishad Singh reportedly spent over $68 million to assist U.S politicians of their election bids.

Following the FTX collapse, U.S. Congressman Brad Sherman stated that the donations had been a sinister plan to affect crypto regulation to FTX’s favor.

Sherman referred to as on the SEC to take decisive actions and proffer a transparent regulatory framework to stop shady offers within the crypto business.

FTX post-mortem triggers Hoskinson-Schwartz feud over allegations of SEC corruption

John E. Deaton that the SEC Chairman Gary Gensler’s relationship with FTX might have influenced the fee from issuing clear tips to manage the crypto business.

Deaton went on to argue that former SEC Director William Hinman’s foul play with Ethereum has roped in Ripple with the SEC. Hoskinson moved to dismiss Deaton’s argument stating {that a} “free move” on Ethereum’s standing has no impact on Ripple’s lawsuit.

In response, Ripple CTO Joel Schwartz stated that the SEC’s transfer to categorise Ethereum as a commodity and XRP as a safety was unfair.

New FTX CEO Ray pronounces steps taken to staunch bleeding cashflow

FTX CEO and Chief Restructuring Officer John Ray stated that in efforts to restructure the bankrupt crypto trade, it’s going to take away all buying and selling and withdrawal capabilities from the platform, and transfer all out there crypto property to a brand new chilly pockets.

Was FTX hacked? Deep dive reveals “backdoor” constructed into accounting software program

Founding father of the bankrupt FTX empire Sam Bankman-Fried (SBF) reportedly leveraged a secret code in its accounting software program to switch some $10 billion to Alameda Analysis notifying anybody of the transaction.

When questioned concerning the lacking funds, SBF didn’t present any clear rationalization.

CZ says business is in ache nevertheless it’s enterprise as regular at Binance

Binance CEO Binance CEO Changpeng Zhao throughout an AMA on Twitter Areas stated his trade was not adversely affected by the FTX collapse. He added that Binance including was working to assist some robust tasks to get better their losses.

On the best way ahead, CZ stated Binance will work with Vitalik Buterin on his proposed Proof-of-Reserves protocol and set up a worldwide affiliation of key gamers to cater to the event of the crypto business.

DEX buying and selling volumes spike as customers go away CEXs en masse

Market information analyzed by CryptoSlate signifies a shift of asset holdings from centralized exchanges to decentralized exchanges.

In keeping with Bitcoinity information, bitcoin buying and selling volumes throughout 10 main centralized exchanges decreased from 182,000 BTC per day on Nov. 9 to 38,000 BTC on Nov. 13.

In distinction, decentralized exchanges noticed a spike in buying and selling quantity from roughly $2.9 billion on Nov. 7 to $12 billion on Nov. 10.

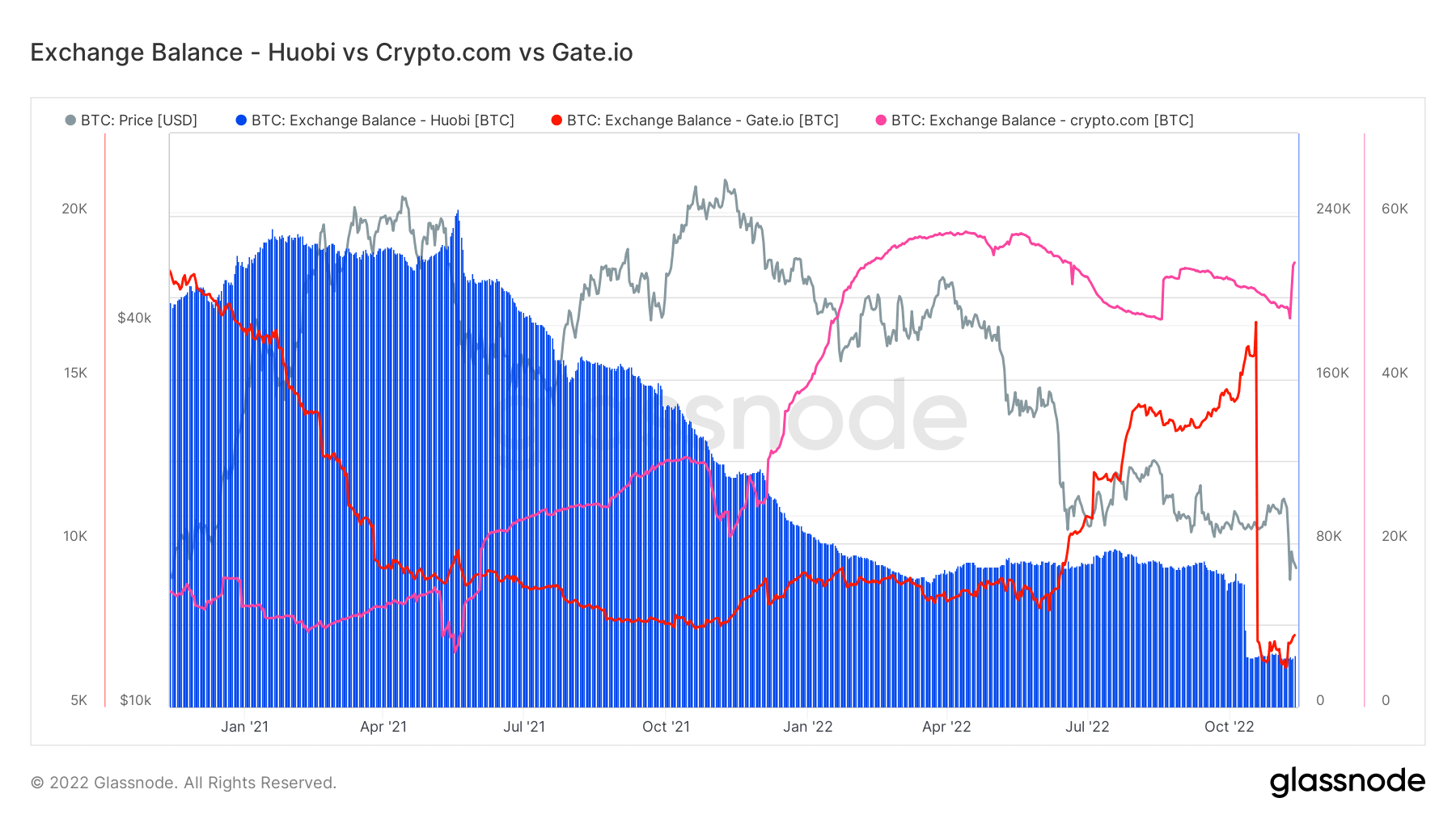

Huobi, Gate.io, Crypto.com see spikes in movement to FTX

On-chain information reveals that Huobi, Gate.io, and Crypto.com noticed most of their Bitcoin balances movement into FTX, within the months previous the FTX collapse.

Originally of October, Bitcoin flows from Huobi to FTX tripled, whereas Gate.io noticed a surge from late October into November earlier than the contagion began.

Retail merchants massively withdraw their BTC from exchanges

To curtail insolvency danger taking part in out on centralized exchanges might retail buyers have moved their Bitcoin for self-custody on chilly wallets.

In keeping with CryptoSlate evaluation, the whole BTC steadiness throughout exchanges has declined by 72,900 BTC within the final seven days. As well as, over 1 million ETH has additionally gone into chilly wallets, following the FTX fallout.

Analysis Spotlight

FTX implosion results in aggressive Bitcoin accumulation for buyers

Bitcoin’s latest fall to $15,682 led to aggressive accumulation for buyers of all courses.

On-chain information analyzed by CryptoSlate reveals that Shrimps (buyers with lower than 1 BTC) took benefit of the worth crash to extend their positions, to a brand new excessive of 1 million BTC, whereas Crabs (buyers holding between 1 BTC to 10 BTC) noticed their complete holdings surge as much as 2.8 million.

Sharks (holders of between 10 BTC to 1000 BTC) maximized the FTX-led market crash to build up Bitcoin aggressively, making their complete holdings attain a brand new all-time excessive of 6.9 million.

BTC Whale who maintain greater than 1000 BTC additionally took benefit of a budget BTC value to extend their holdings, although not as a lot because the Shrimps, Crabs, and Sharks.

Information from across the CryptoVerse

Alameda Analysis purchased crypto tokens earlier than listings on FTX

On-chain information from blockchain analytics agency Argus revealed that Sam Bankman-Fried’s Alameda Analysis collected crypto tokens earlier than they had been listed on FTX for buying and selling.

Alameda was reportedly holding about $60 million value of 18 tokens that had been to be listed on FTX between January 2021 and March 2022.

Nike groups up with Polygon

Main vogue model Nike has partnered with Polygon Community to create digital collectibles for its neighborhood.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased by over 0.04% to commerce at $16,342, whereas Ethereum (ETH) elevated barely by 0.92% to commerce at $1,221.