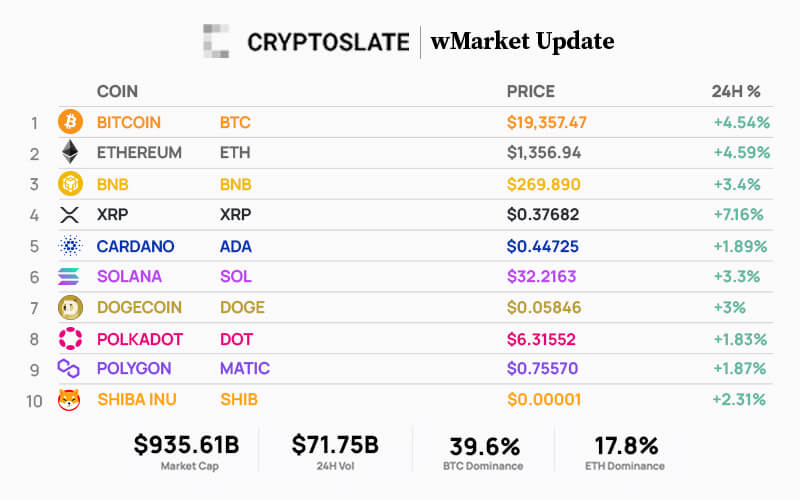

The full cryptocurrency market cap noticed internet inflows totaling $32.1 billion. As of press time, it stood at $935.61 billion, up 3.5% over the weekend.

Bitcoin’s market cap grew 3.6% over the reporting interval to $370.69 billion from $357.68 billion. In the meantime, Ethereum’s market cap was up 4.2% to $166.48 billion from $159.70 billion over the past 24 hours.

After a interval of main promoting, the highest 10 cryptocurrencies all posted good points over the past 24 hours, with XRP main the pack at 7.2%. In the meantime, Polkadot introduced up the rear with a 1.8% achieve.

The market cap of the highest three stablecoins — Tether (USDT), USD Coin (USDC), and BinanceUSD (BUSD) — remained flat over the previous 24 hours, standing at $67.93 billion, $50.12 billion and $20.51 billion, respectively.

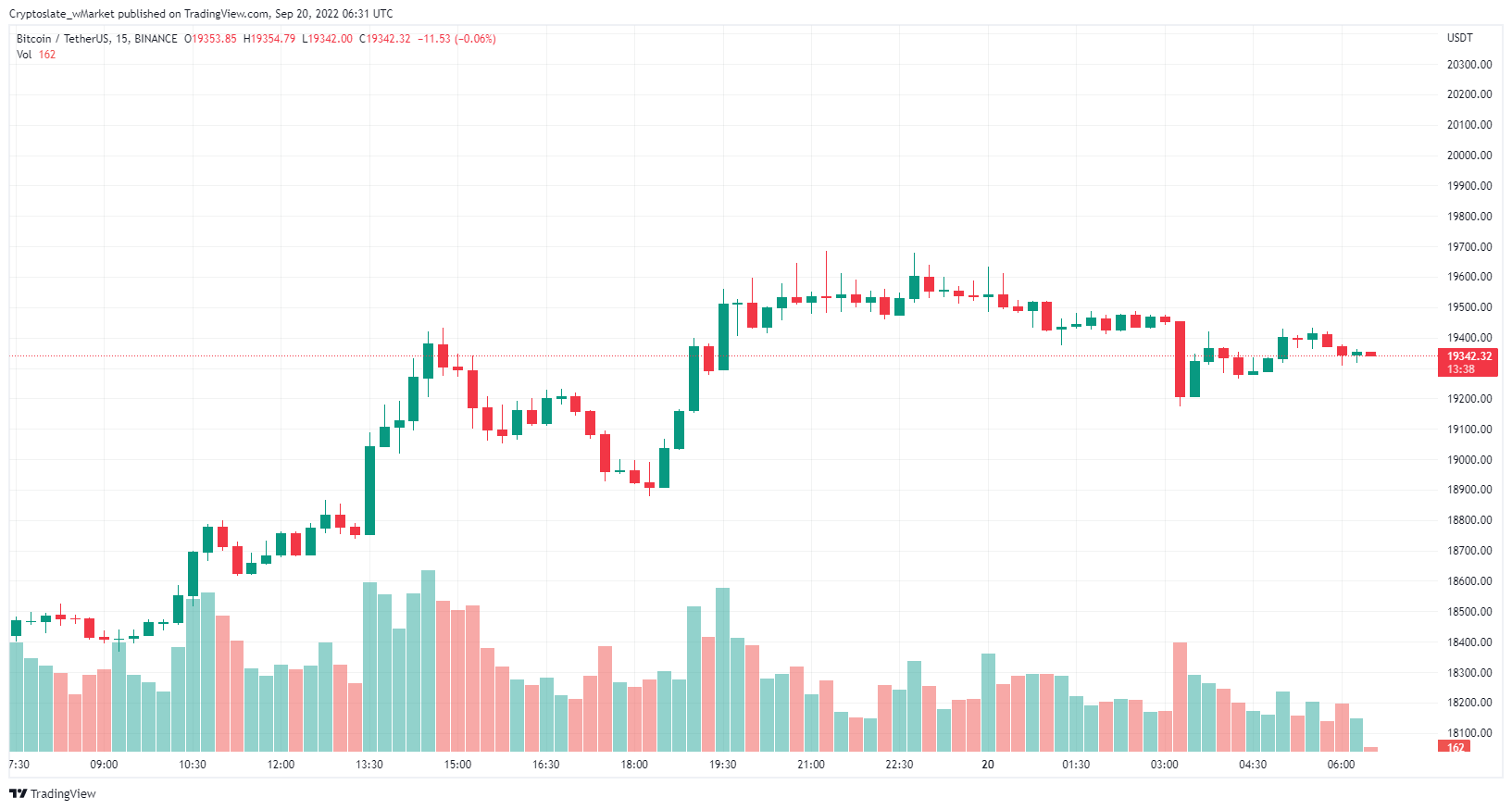

Bitcoin

Over the past 24 hours, Bitcoin was up 5% to commerce at $19,400 as of press time. Market dominance rose barely from 39.5% to 39.6% over the interval.

A weekend sell-off spilled into Monday, dropping BTC to as little as $18,200. This was attributed to the market pricing in an anticipated 75-100 foundation level hike by the Fed this week. The market chief bounced again at lunchtime (UTC) to recuperate Monday’s losses.

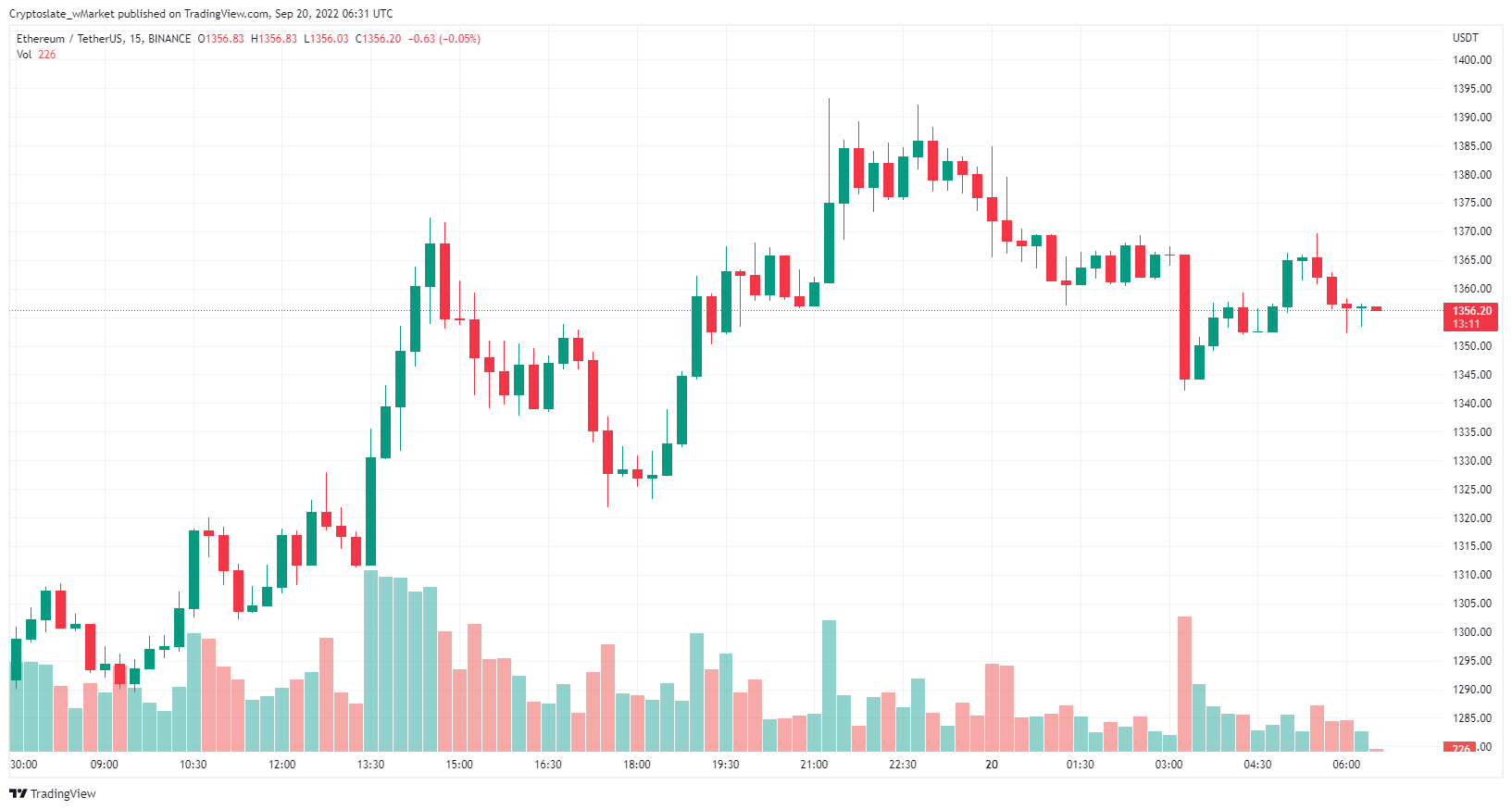

Ethereum

Ethereum grew 5% over the past 24 hours to commerce at $1,357 as press time. Market dominance elevated barely from 17.5% to 17.8%.

ETH bulls introduced some respite from the continuous slide seen post-Merge. Worth motion largely mirrored that of Bitcoin, with $1,290 offering a number of continuous situations of help on the hourly chart earlier than a restoration set in on the morning of September 19.

High 5 gainers

Pundi X

PUNDIX leads the highest gainers over the past 24 hours, buying and selling round $0.59042 as of press time — up 28% over the interval. The token spiked as excessive as $1.06 on September 13, adopted by an excessive sell-off since. Its market cap stood at $152.62 million.

Voyager Token

VGX recorded 21.94% good points over the previous 24 hours to commerce at round $0.73217 at press time. The token has appreciated over 160% over the past 30 days amid rumors of a purchaser taking up the bankrupt platform. Its market cap stood at $203.9 million.

TerraUSD

USTC grew 16.51% over the previous 24 hours and was buying and selling at round $0.03444 on the time of publishing. The rebranded UST stablecoin, on the coronary heart of the Terra implosion, remains to be but to re-peg, regardless of right this moment’s good points. Its market cap stood at $338.08 million.

ConstitutionDAO

PEOPLE is up 14% over the past 24 hours to commerce at $0.02218 on the time of publishing. The mission supposed to buy the unique U.S Structure at Sotheby’s however misplaced out to Citadel CEO Ken Griffin. It’s unclear why PEOPLE spiked right this moment. Its market cap stood at $112.23 million.

Injective Protocol

INJ is up 12% for the reason that final wMarket replace to commerce at $1.62234 at press time. The self-described layer 2 DEX is down 81% over a 12 months. Its market cap stood at $118.44 million on the time of writing.

High 5 losers

Fruits

FRTS is right this moment’s greatest loser falling 9.75% over the previous 24 hours to commerce at round $0.01205 as of press time. The worldwide charity initiative is down 98% from a 12 months in the past. Its market cap stood at $253.89 million.

Reef

REFF sunk 7.4% over the previous 24 hours to $0.00471 at press time. The mission suffered controversy involving Alameda Analysis in March 2021, and its value has but to recapture its former glories pre-controversy. Its market cap stood at $94.54 million.

Toncoin

TON plunged 5.58% in worth over the reporting interval to commerce at $1.47837. After being sued by the SEC, the Telegram mission was handed over to the group. The token is down 78% over a 12 months. Its market cap stood at $1.81 billion.

Chain

XCN 2.68% over the previous 24 hours to round $0.06198 as of press time. The clod-based monetary protocol continues sliding, down 29% over the past 30 days. Its market cap stood at $10.74 million.