DefiYield, the DeFi investing and yield farming platform, tracks exploited tasks throughout the DeFi ecosystem by means of its REKT database. Since January 2022, it has tracked over $60 billion in misplaced or stolen funds throughout 1,195 occasions, together with Terra Luna. Ronin, Nomad, and the Wormhole bridge.

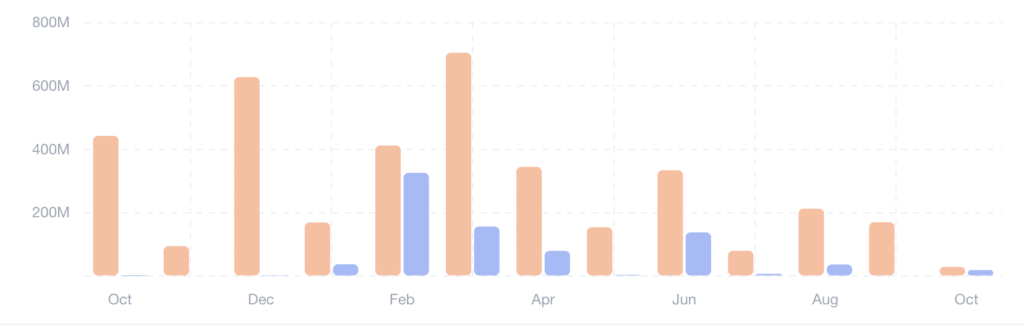

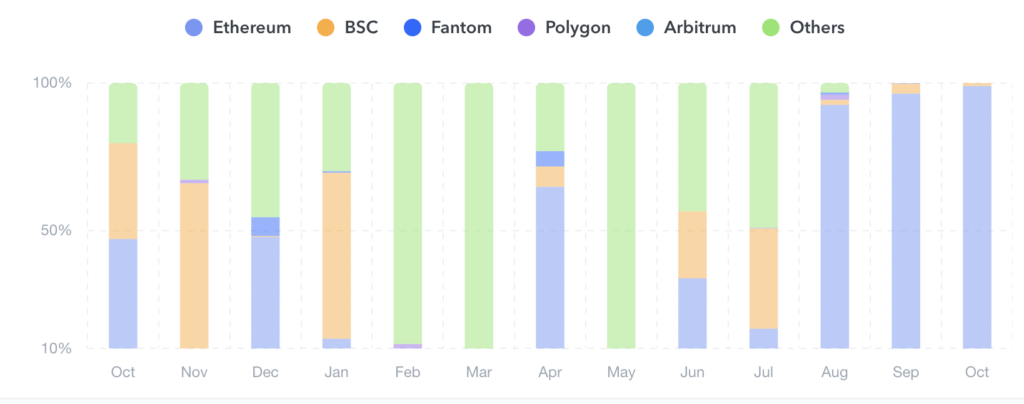

Roughly $2.4 billion has been recovered all through the identical interval, just below 5% of the whole loss. Till August, nearly all of exploits occurred exterior of the Ethereum ecosystem. Nevertheless, as proven within the chart under, for the reason that begin of August, over 90% of funds misplaced occurred throughout the Ethereum community.

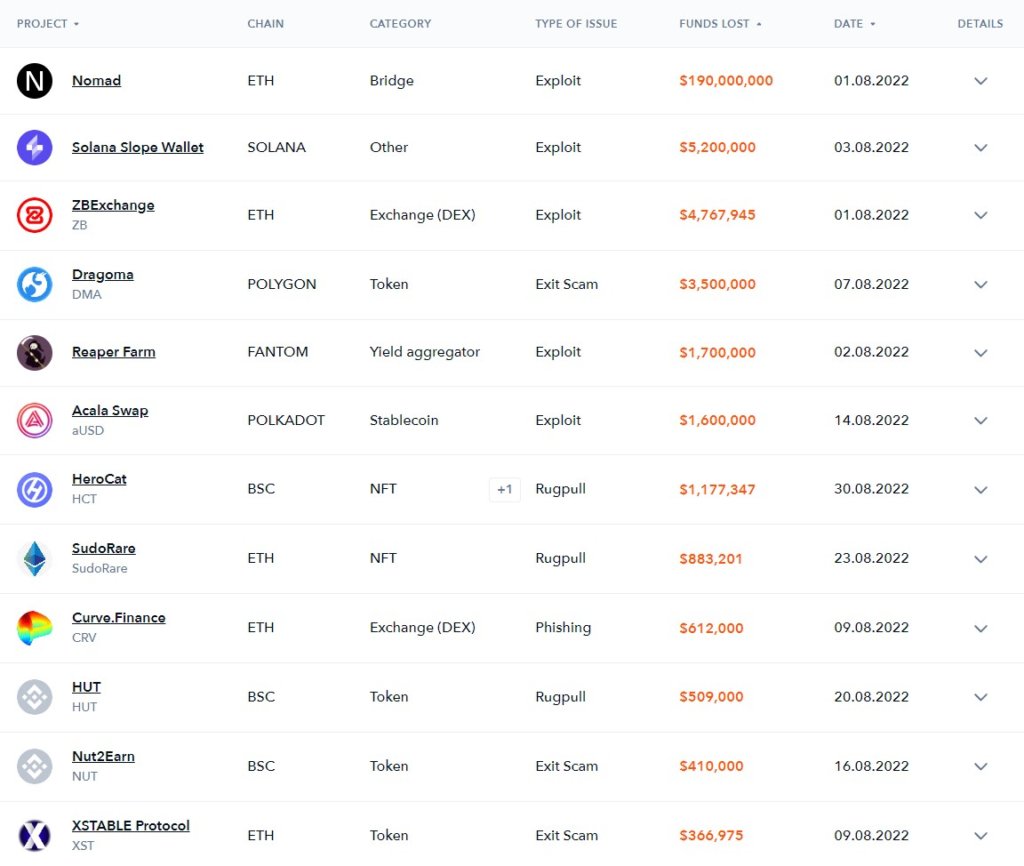

A staggering $212,927,092 was misplaced in August, with the Nomad bridge exploit accounting for $190 million. Different exploits included the Solana Slope pockets incident, ZBExchange, Reaper Farm, and Acala Swap. Probably the most distinguished exit rip-off in August totaled $3.5 million from Dragoma. A number of high-value rug pulls had been additionally from two NFT platforms, HeroCat and SudoRare.

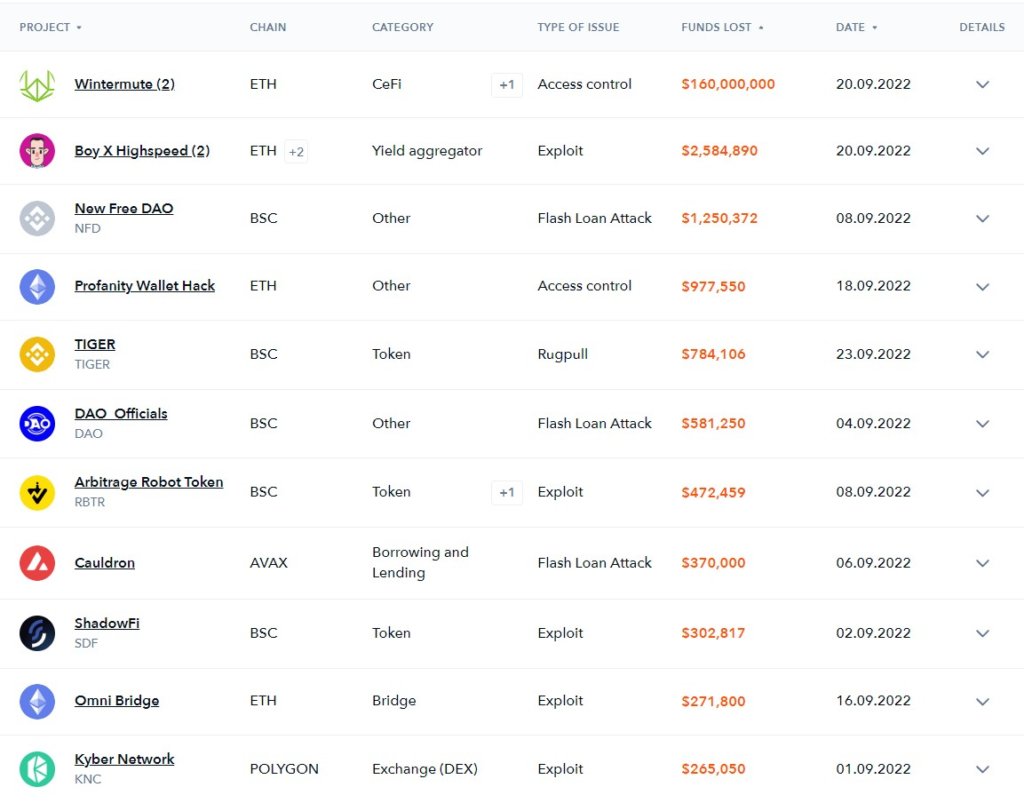

September noticed an 18% lower in stolen or misplaced funds, but $170 million was nonetheless ripped from the DeFi ecosystem by means of exploits and hacks. The Wintermute hack made up many of the misplaced funds at $160 million. An additional $977,550 was misplaced by means of the identical Profanity self-importance deal with exploit, which DefiYield has categorized as an “entry management” situation.

In contrast to different exploits, such because the Boy X Highspeed exploit, which took benefit of points with the venture’s good contract, the Wintermute/Profanity exploit resulted from poor account administration.

Wintermute used a flawed instrument to generate an arrogance Ethereum deal with with lowered cryptographic safety, prioritizing fuel charge optimization over safety. The Boy x Highspeed exploit was the second largest in September at $2,584,890.

Three flash mortgage assaults had been current within the prime 10 exploits of September. New Free DAO, DAO Officers, and Cauldron all suffered flash mortgage assaults for $2,001,622.

Many exploits noticed funds transferred to Twister Money, doubtlessly tainting the stolen funds by interacting with the sanctioned platform. Nevertheless, a number of extra important hacks, together with Wintermute, noticed funds stay managed by the hacker’s pockets.

Thus far in October, a mean of $5.9 million per day has been misplaced in lower than every week. Ought to the development proceed, October would break the downtrend.

The most important exploit in October was the Transit Swap good contract hack which got here to $29 million. Nevertheless, $18.9 million has already been recovered, bringing DeFi’s web loss for October to only $10.1 million.

The chart under tracks the downtrend in DeFi losses all through 2022. Whereas each August and September noticed nine-figure losses, these months mark two of the bottom on report for the 12 months.