The occasions of the previous week have led to important promote stress throughout the crypto market. Since FTX insolvency rumors broke on Nov. 6, peak outflows noticed $270 billion depart the market.

Regardless of the bearish market situations, on-chain information analyzed by CryptoSlate confirmed all Bitcoin cohorts have flipped into accumulation mode, with whales shopping for most aggressively.

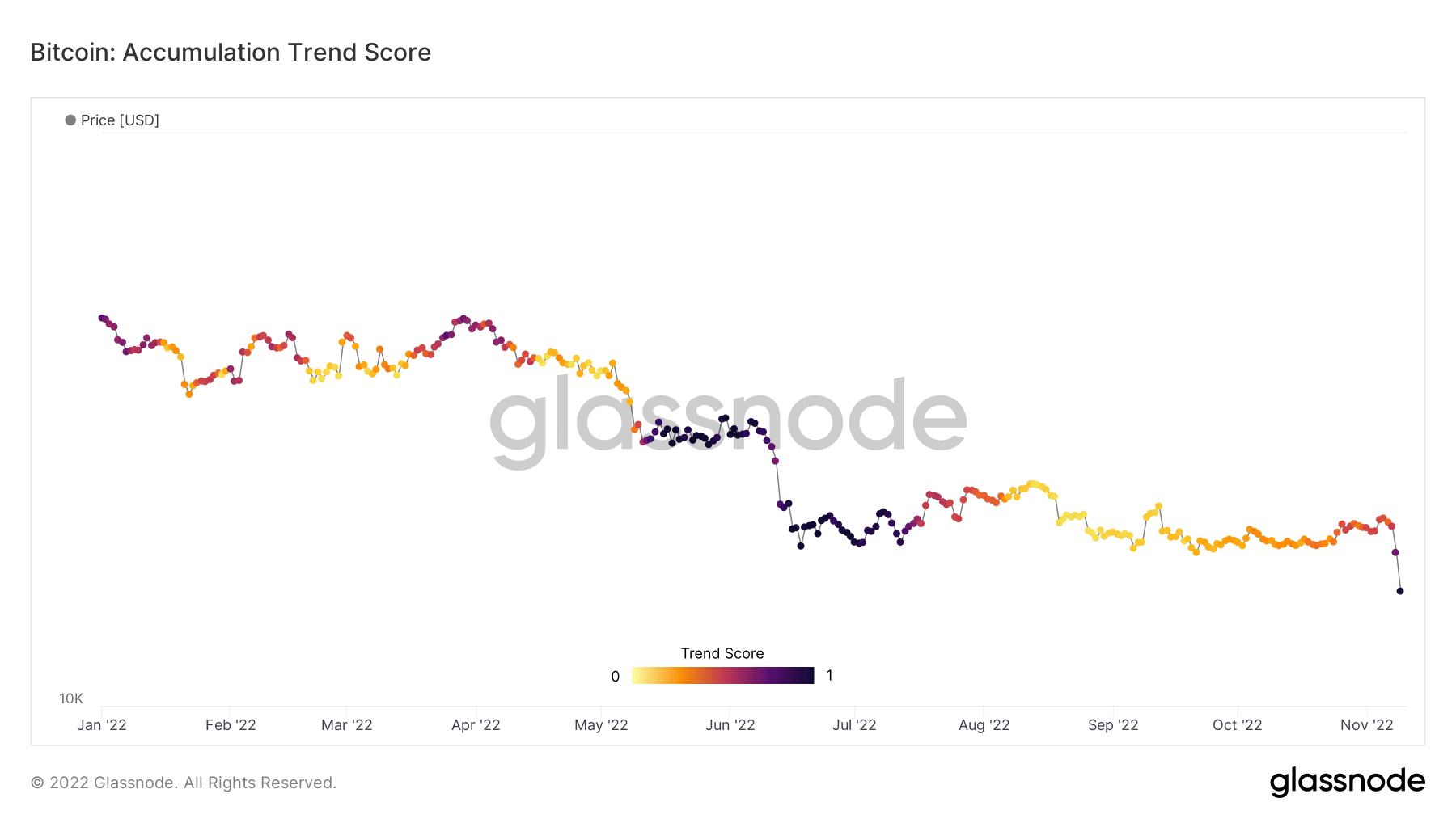

Bitcoin Accumulation Pattern Rating

The Accumulation Pattern Rating (ATS) appears on the relative measurement of entities which might be actively accumulating, or distributing, in relation to their Bitcoin holdings.

The ATS operates on a scale of 0 to 1. A studying near 0 signifies distribution or promoting. Whereas a studying near 1 signifies accumulation or shopping for.

The chart beneath exhibits whales amassed for the primary time since August. The present studying is available in at 0.97, indicating an aggressive price of accumulation and the best since 2019. For comparability, the day prior to this’s ATS studying flashed 0.74.

Regardless of jitters ensuing from the collapse of FTX, the market sees worth in Bitcoin priced within the teenagers.

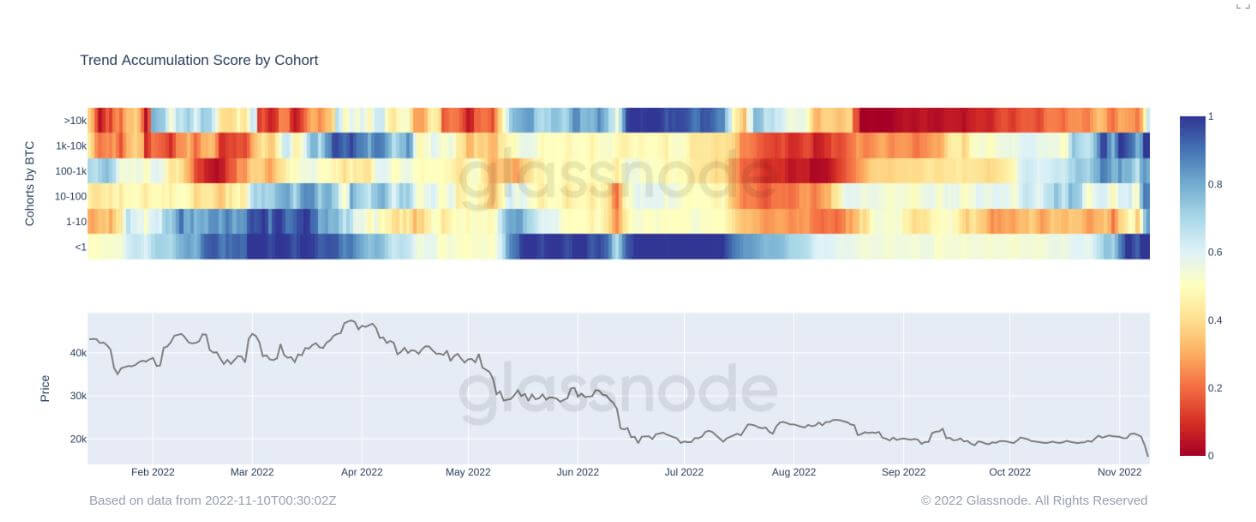

Cohort evaluation

Entities holding between 1,000 and 9,999 Bitcoin are categorized as whales. Whereas 10,000+ BTC holdings seek advice from tremendous whale standing.

In latest days, all cohorts have flashed mild blue or darker blue, indicating all cohorts are accumulating in unison — an unprecedented sample in 2022.

Whales and minnows — entities holding lower than 1 BTC — specifically are the cohorts accumulating most aggressively.

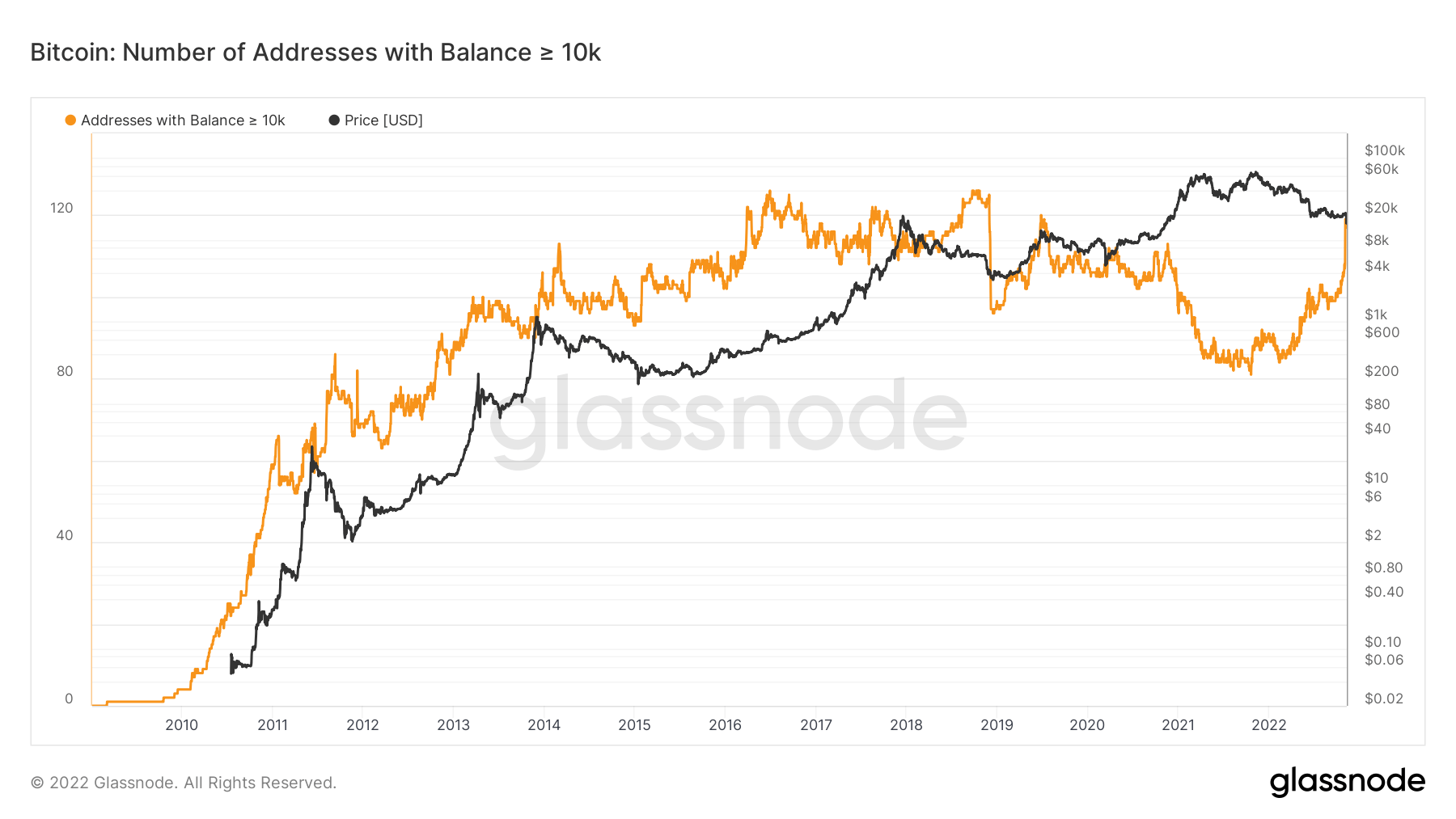

On-chain information exhibits the variety of addresses (as much as whale standing,) bottomed at roughly the time of the $69,000 market prime. Since then, an uptrend over 2022 has culminated in a pointy uptick in latest days.

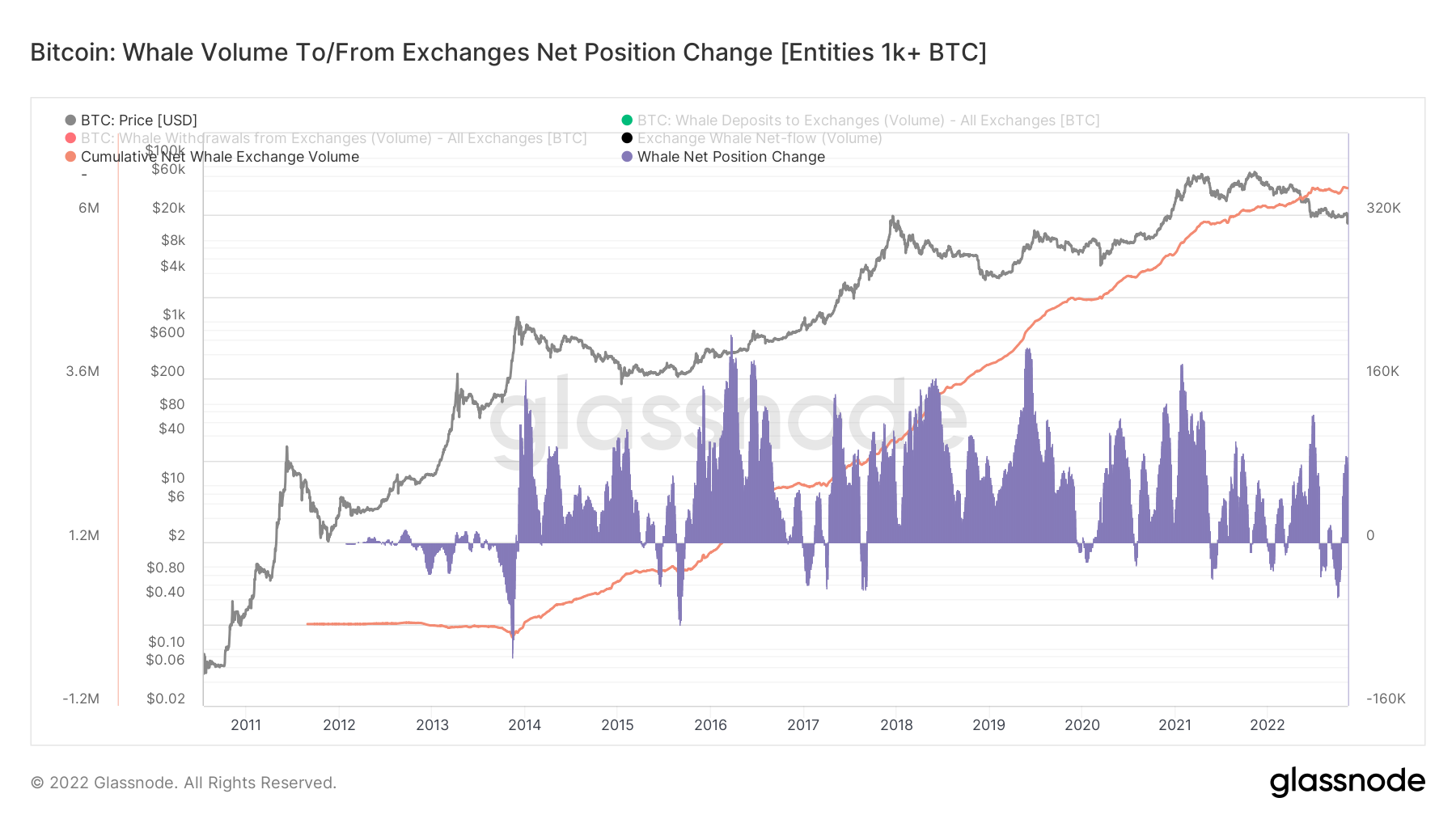

Whale Trade Internet Place Change

Trade Internet Place Change exhibits the 30-day change within the Bitcoin provide from change wallets. Readings above 0 point out inflows into change wallets, whereas beneath 0 present BTC leaving change wallets.

The chart beneath exhibits this information for whales and tremendous whales. Latest days present change whale and tremendous whale holdings have spiked increased. The final time this occurred, to a comparable diploma of significance, was throughout August.

Though the first purpose entities ship tokens to exchanges is to money out. The Cumulative Internet Whale Trade Quantity exhibits a macro enhance over time, indicating this isn’t the case for whale holders.