The biggest liquidation candle in a month worn out many of the beneficial properties Ethereum posted following the Merge.

Following its transition to a Proof-of-Stake community, ETH touched $1,640 in what many believed can be the start of a rally. Nevertheless, aggressive liquidation pushed its value under $1,500, with ETH standing at round $1,480 as of press time.

Over $60 million in ETH has been liquidated in lower than an hour, creating downward strain on the remainder of the altcoin market. Prior to now 24 hours, liquidations exceeded $150 million.

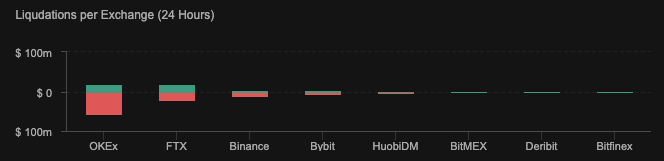

In keeping with knowledge from CoinAnalyze, round $77 million in liquidations occurred on OKEx, whereas FTX stands second with round $40 million in ETH liquidations prior to now 24 hours.

The vast majority of liquidations had been longs — round $98.6 million in longs had been liquidated prior to now 24 hours, whereas the market has seen solely about $48.3 million in shorts liquidated.

The large losses weren’t unique to Ethereum — the remainder of the crypto market took successful, with many large-cap cash going into the pink. However whereas most noticed losses that didn’t exceed a couple of p.c, Ethereum noticed its value lower by over 7.5% in a day.

It’s nonetheless early to inform what prompted the large liquidations. Some consider they might have been a results of hypothesis surrounding the Merge. Others consider that the broader market uncertainty might have prompted them.

The normal market noticed an equally sudden crash prior to now a number of hours, with shares and indexes dropping after days of relative stability. The continuing volatility might be a response to the assembly Russian President Vladimir Putin had with Xi Jinping, the President of China.

The 2 leaders met in Uzbekistan earlier as we speak to debate “international and regional stability” following Russia’s invasion of Ukraine.